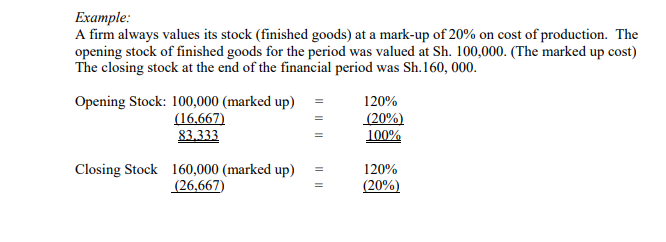

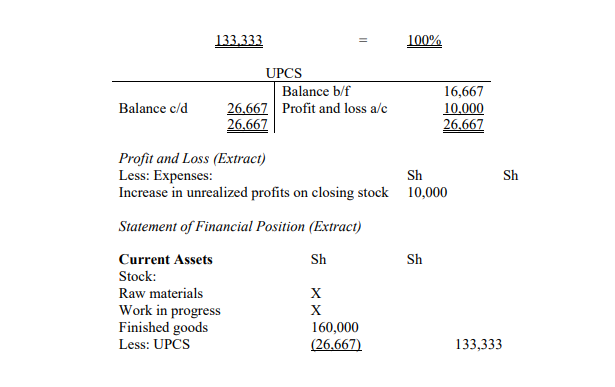

In most cases where business transfers finished goods at a profit to the selling department and the goods are reflected in the balance sheet at the transfer price, then the closing stock includes a profit that has not been earned or realised. If the mark up profit (the profit based on cost of production is always uniform, then any changes in the value of closing stock will result in a reduction or an increase in the unrealised profits.

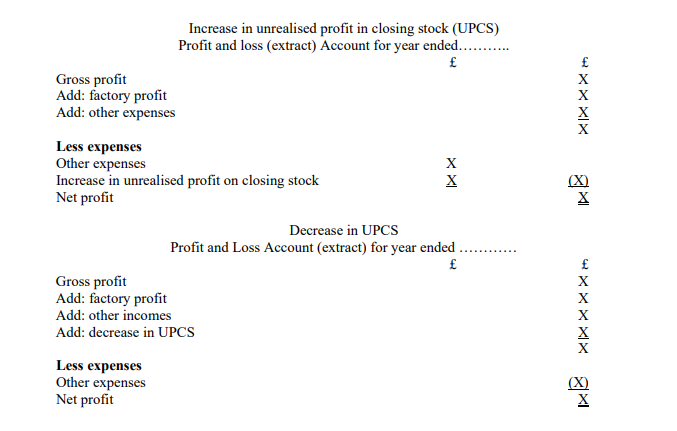

If there is an increase on unrealised profit on the closing stock, then this increase will be reduced from the gross profit from our profit and loss account and if there is a reduction in unrealised profits, then this reduction will be added to the gross profit in our profit and loss account. Any unrealised profit of closing stock should be deducted from the closing stock in the balance sheet. The slight change in the format of the Profit and Loss Account and Balance Sheet will be as follows