These are expenses of a firm incurred during production process. Costs consist of payments to factors of production and therefore closely linked to the theory of production. Costs are derived from the production function. Costs are divided into two:

- Implicit costs: These are basically social costs. They are costs that cannot be included in the computation of the firm’s profits. This is because such costs cannot easily be monetised. They include noise, time wasted, and opportunity cost.

- Explicit costs: These are costs for items for which the firm can make specific payments on. It is the actual expenditure of a firm incurred when purchasing the input factors.

These include costs of raw materials, labour, transport, energy and many others. They include both fixed and variable costs.

14.1.2: Short run costs of the firm

Short run is a period in which the firm cannot change its plant, equipment and the scale of operations. To meet increased demand, it can only raise output by hiring more labour and raw materials or asking the existing labour force to work overtime. The short- run total costs are divided into: i. Total fixed costs (TFC). ii. Total Variable costs (TVC).

14.1.2.1 Total fixed costs (TFC)

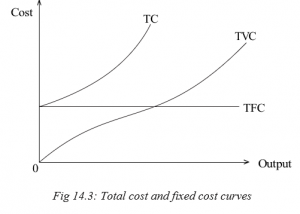

These are costs that do not change as output changes. They include payment for rent, interest on borrowed money, insurance charges, wages and salaries of permanent staff and maintenance expenditure. They are also called overhead costs, supplementary costs and indirect costs. The total fixed cost curve is therefore horizontal and parallel to the X- axis.

Total variable costs (TVC)

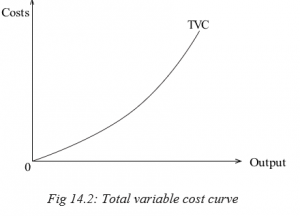

These are costs which change directly with output. They include expenses on raw materials, power, taxes, and advertising. They are also known as direct costs, prime costs or operating costs.

The total cost (TC)

This is the total sum of the total fixed costs and the total variable costs in the business.

TC = TFC + TVC

When output is equal to zero, total cost will equal fixed costs since variable costs will be zero. When production begins to increase, total costs will continue to rise as variable costs increase since variable costs must increase as output expands.

Hypothetical Total Cost (TC), Variable Cost (VC) and

Fixed Cost (FC) Schedule

| Output (Q) | Total fixed costs (FRW) | Total variable costs (FRW) | Total costs

(FRW) |

| 0 | 50 | 0 | 50 |

| 1 | 50 | 20 | 70 |

| 2 | 50 | 30 | 80 |

| 3 | 50 | 35 | 85 |

| 4 | 50 | 45 | 95 |

| 5 | 50 | 65 | 115 |

The total cost curve cuts the vertical axis at a point above the origin and rises continuously from left to right. This is because even when no output is produced the firm has to incur fixed costs. The TVC curve starts from the origin (0) because when output is zero, the variable costs are also zero. They increase as output increases.

14.1.3: Variation of costs in the short run

Activity 14.3

Basing your discussion on the schedule in Activity 14.2, in your groups, create same table like the above but with additional columns of; average fixed cost, average variable cost, average total cost and marginal cost. Carry out research on average fixed costs (AFC), average variable costs (AVC), average total costs (ATC) and marginal costs (MC) from the library, internet regarding their meaning and calculation. Make the notes on the same.

In your groups, discuss the meaning of average fixed costs, average variable costs, average total costs and marginal costs and show how they are calculated. Fill in the columns you created.

As an individual, what is the relationship between the average costs named above?

In the short run analysis average costs are more important than total costs. The units of output that a firm produces do not cost the same amount to the firm, but they must be sold at the same price. Therefore the firm must know per unit cost or the average cost.

The short run average costs of a firm are the average variable cost (AVC), the average fixed cost (AFC) and the average total cost (ATC).

14.1.3.1 The average fixed cost (AFC)

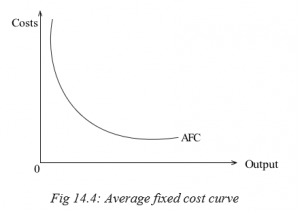

This is the total fixed cost at each level of output divided by number of units produced. That is:

AFC = TFC

Q

The average fixed cost diminishes continuously as output increases. This is because when a constant figure such as the TFC is divided by a continuously increasing unit of output, the result is a continuously diminishing average fixed cost, thus the AFC curve is down ward slopping but does not cross the quantity or output axis because if it did then, AFC would be zero in which case TFC would be zero which cannot be the case.

14.1.3.2 The average variable costs (AVC)

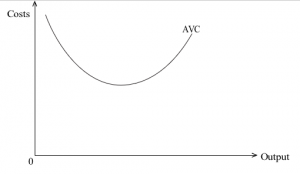

This is the total variable cost at each level of output divided by the number of units produced. That is:

AVC = TVC

Q

The curve is U- shaped because of the law of diminishing marginal returns. The AVC first declines with the rise of output as larger quantities of variable factors are applied to fixed factors but eventually they begin to rise due to the law of diminishing marginal returns.

14.1.3.3 The average total cost (ATC)

This is the average cost of producing any given output.

ATC = TC = TFC + TVC = TFC + TVC

Q Q Q Q

ATC = AFC + AVC

14.1.3.4 The marginal cost (MC)

A fundamental concept for the determination of the exact level of output of a firm is the marginal cost (MC). Marginal cost is an additional cost that is incurred to produce an extra unit of output.

MC = ΔTC

ΔQ

1 Long run average cost curves (LAC)

The Long-run Average Curve (LAC) of a firm shows the minimum average cost of producing various levels of output from all possible short run average cost curves (SAC), thus the LAC is derived from the SAC curves that is the LAC can be viewed as a series of alternative short run situations into any one of which the firm can move.

Each Short-run Average Curve (SAC) curve represents a plant of a particular size which is suitable for a particular range of output. The firm will therefore make use of the various plants up to that level where the short run average costs fall with an increase in output. The firm will not produce beyond the minimum short run of producing various outputs from all the plants used together.

14.1.4.2 Deriving the long run average cost curve (LAC)

The long run average cost curve is shown as smooth curve fitted to the short run average cost curves so that it is tangent to each of them at some point as shown in the illustration below:

Let us assume that we have five plants represented by their short run average cost curves SAC1, SAC2, SAC3 up to SAC5 where each curve represents the scale of the firm.

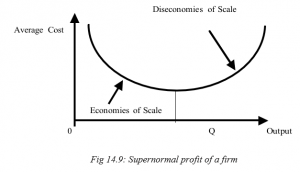

The LAC is U- shaped due to economies and diseconomies of scale. These are the advantages and disadvantages of producing on a large scale respectively. The LAC curve can be divided into three parts.

Part I shows that the costs of the firm are falling while output is increasing. In this region there are increasing returns to scale. In part II LAC is constant but output is increasing, there are constant returns to scale in this region. The factor inputs increase by the same proportion as the increase in factor output.

In part III output is increasing at increasing costs and this is due to the diseconomies of scale thus there are diminishing returns to scale in this region.

14.2: SCALE OF PRODUCTION

Activity 14.6

Case Study

In Kibuye City there are different business persons carrying out their businesses. For example Nadege, Manasse and Nazou are among the prominent business people in this city. They deal in domestic products all of them. Nadege’s business has been doing well until she has opened another branch in Gasarende City. She gets many customers than Manasse and Nazou. Manasse’s and Nazou’s businesses are not doing well and they cannot clear some of their bills like rent, electricity, water and cannot hire employees to help them. They lose customers to Nadege who had better services as compared to them.

Manasse and Nazou decided to dissolve their individual businesses and form a partnership between two of them. They gave it the name Manazou Enterprises. After one year of operation, they started getting many customers and they could now pay all their bills as well as employ people to help them. They opened up other branches in other cities like Gikongoro.

- In your own assessment why do you think Nadege’s business was doing well than Manasse’s and Nazou’s?

- In pairs, discuss the benefits that firms experience when they come together and continue with the production activities.

It’s every firm’s goal to achieve the set objectives. One of the objectives of every firm is to grow and open up to many markets in the country and even outside the country. Some firms can achieve this on their own while others cannot and they have to come together so that they can expand and compete effectively with big firms in the market.

14.2.1: Growth of firms

The steady physical increase in a firm’s productive capacity which is identifiable by a sustained increase in a firm’s real output of goods and services over time is what is called Growth of the Firm.

Remember!!! Did you know that: “Growth depends upon activity? There is no development physically or intellectually without effort, and effort means work.”Now you know.

Firms grow so that they can realise their goals and objectives such as increasing sales, profit maximisation, expanding the market share. This growth may either be natural growth or internal expansion and external growth or mergers.

Natural growth

Natural growth is related to the increase in output which leads to the increase in profits and later expansion or increase in size of the firm.

To grow naturally, a firm will need to retain enough profits in order for it to purchase new assets and new technology. As time goes on, the total of a firm’s resources will increase which provides collateral security to enable it to borrow to fund further projects for expansion.

14.2.2: External growth/ merging

Another way in which a firm can grow is to integrate with other firms through mutual agreement or through acquisitions.

14.2.2.1 Mergers

A merger refers to the amalgamation/coming together of firms to form an entirely new firm for different economic objectives. Mergers are of the following types:

1. Vertical merger

This refers to a type of merger where firms at different stages of production integrate. A vertical merger can either be forward merger or backward merger.

- Backward merger: This is where a firm at a higher stage of production decides to merge with a firm at a lower stage of production. This can take place for the following reasons:

- To control supply of raw materials.

- Ensure quality and quantity of supplies.

- Establish a monopoly by controlling the source of raw materials.

- Forward merger: This is where a firm at a lower stage of production decides to merge with a firm at a higher stage of production. For example a business making furniture merge with a retail outlet selling the furniture. Reasons for such a merger include:

- Control of the market by eliminating middlemen.

- To realise economies of scale.

- Accelerating development of new discoveries.

- Controlling the quality and quantity of output.

2. Horizontal merger

This is where firms at the same stage of production and producing the similar products decide to integrate. For example two hair dresses join together. The reasons for such a merger include:

- Elimination of competition.

- Rationalisation of capacity.

- Increase specialisation.

- Realisation of internal economies of scale.

3. Conglomerate merger

This is where firms which produce commodities which are not related integrate. Such a merger is also known as a diversifying merger. The major reason for such integration is insurance against risks in case a firm anticipates a decline in future.

4. Lateral merger

This is where a business merges with another business who makes similar goods to it but who are not in competition with each other. For example when a sugar manufacturing company merges with a sweet manufacturing company.

Advantages and disadvantages of mergers

Activity 14.7

Through debates, as a class divide yourself into two groups. Basing your discussions on the case study of Nadege, Manasse and Nazou in Activity

14.6;

- Discuss the benefits Manasse and Nazou got when they came together as partners.

- What problems do you think are associated with the coming together of firms? Explain.

There are some benefits that firms cannot enjoy when operating alone. These can only be enjoyed when they come up together and work as one in their production activities. These benefits include:

- International competition: Mergers can help firms become more competitive and able to face the threat of multinational companies and compete on an international level.

- Economies of scale: Mergers enjoy economies of scale since it increases their capacity. The merged firms are able to enjoy marketing economies. They can purchase in large quantities and enjoy discounts among others.

- Research and development: Mergers are able to invest in research and development and therefore improve on the methods of production, thereby leading to development of new products.

- Increased efficiency: When firms merge they are able to combine their capabilities in terms of expertise, technical knowhow all of which result into increase efficiency.

- Rationalisation: Merging results into rationalisation in those parts of a business that are inefficient or unprofitable are eliminated after merging.

- Diversification: Conglomerate mergers in which firms producing unrelated products integrate results into diversification of their production activities increasing their scope of business activities and therefore hedging against risks.

When two or more firms come together to produce a given product, there are different problems that they may experience. These problems sometimes are not experienced by the firms that operate alone. These problems may include:

- Diseconomies of scale: Merging results into diseconomies of scale where after merging the firm experiences problems of coordination and control resulting into increase in the costs of production and reduction in profits.

- Limited variety to consumers: As a result of merging firms which were competing become one and this limits consumer’s choice since consumers will be exposed to products of one firm as opposed to the situation before merging.

- Higher prices: After merging the firm is likely to sell its products at high prices since there is reduced competition hence leading to exploitation of consumers.

- Monopoly: Merged firms may have more monopoly power which may allow them to dictate terms to suppliers and customers such as offering low prices to the suppliers.

- Low output: Mergers may result into a reduction in output leading to shortage of goods on the market which is a disadvantage to the consumer.

- Layoffs: Merging of two businesses often leads to a reduction in labour force required. This leads to unemployment.

- Leadership issues: Merging may lead to a discontent over leadership of the newly formed company. One may have a feeling that their company has been taken over rather than merged as an equal partner. This can lead to corporate infighting and talent drain as people leave the company.

Warning!!! The key is to keep company/business only with people who uplift you, whose presence calls forth your best.

14.2.2.2 Factors limiting merging

To maximise profits, firms tend to amalgamate so as to improve on the output and sales volume. Some firms wish to merge but are discouraged by a number of factors while others are unwilling to do the same. The factors that limit amalgamation of firms are:

- Fear of diseconomies: Most firms prefer to remain independent due to fear of disadvantages of large scale production which may arise with merging.

- Fear of complexity of management: Merging may create complex managerial problems due to combining different groups originally from different firms operating under different situations.

- Fear of losing clients: Firms may not merge due to fear of losing close touch with clients of the firm.

- Fear of losing independence: Firms may not merge due to fear of losing independence by the small firms as a result of being dominated by the large firm.

- Market limitation: Firms may not merge if the market potential favours competition rather than quasi monopoly hence preferring independence.

- Fear of unemployment: Merging results into rationalisation of capacity where some workers may be laid off therefore discouraging merging.

- Fear of high taxes: As a result of merging, a single large scale firm faces more taxes as compared to several small scale firms hence discouraging merging.

- Unrelated fields: Firms may not merge if they are operating in unrelated fields requiring different fields of specialisation.

- Fear of heavy losses: Merging may increase the losses for a single large scale firm as compared a small scale firm which merging of firms.

- Government legislation: Firms may not merge if the government prohibits merging in order to control creation of monopolies.

- Fear of risks: Firms may not merge due to fear of risks associated with large scale production.

14.2.3 Economies and diseconomies of scale

Activity 14.8

Azam industry a firm that a few years in Rwanda has been producing wheat. It started production process with only one branch. It has recently expanded its scale of production by venturing into production of other products including beverages like juice and mineral water and many others. It has also expanded its branch network in all cities in Rwanda. During the expansion process, Azam Industries encountered different benefits as well as problems.

- In pairs, think of some of the benefits a firm may enjoy as it tries to expand its production.

- As a class, discuss the problems that you think may be encountered by firms that expand.

- In your own opinion, is it profitable when a firm expands or when it remains small? Explain.

As firms grow, they experience different problems (disadvantages) and benefits (advantages). These advantages are referred to as economies of scale. The disadvantages are called diseconomies of scale. These are discussed as below:

In the short-run, the firm may make super-normal profits as shown below.

Economies of scale

For relatively small levels of production, a firm tends to experience economies of scale and increasing returns to scale. These result because an increase in the scale of operations (a proportional increase in all inputs under the control of the firm) causes a decrease in average cost. The advantages/ benefits enjoyed by a firm due to expansion resulting into a fall in average costs of production are referred to as economies of scale. Economies of scale can be categorised into internal and external economies.

(a) Internal economies

These are benefits experienced by a single firm as a result of increasing its scale of production. These benefits are not shared with other firms in the industry. Internal economies of scale occur to a firm that has increased its level of output. It consists of the following:

- Technical economies: As a result of expansion a firm becomes more efficient due to specialisation of both labour and capital, ability to use superior equipments, ability to increase dimensions and ability to link processes in production.

- Managerial economies: As a result of expansion a firm can afford better and more elaborate management which a small firm cannot afford. It can employ managers, engineers, accountants and many others. Therefore, functional specialisation at managerial level results into more efficiency and lower costs.

- Marketing economies: When a firm expands it realises advantages in buying and selling its products. For example a firm can employ specialised procurement officers who buy the right quality at the right time and right price. It can also employ marketers to promote sales of its products hence lower costs and higher profits.

- Financial economies: A large firm has more access to finance as compared to a small firm. It can easily secure loans, it has access to the stock exchange market, can easily sell its shares and debentures which give it financial advantages.

- Risk and survival economies: Due to expansion, a firm is in a better position to handle risks as compared to a small firm. It can also reduce risks in business through hedging and by acquiring insurance policies.

- Research and development economies: When a firm expands it can raise to undertake research, develop new designs, invent new products and undertake trade missions which cannot be afforded by a small scale firm.

- Social and welfare economies: As a firm expands its scale of production, it is in position to provide fringe benefits to its workers like better housing, medical insurance and recreation which improve the efficiency of labour.

(b) External economies

These are advantages/benefits enjoyed by a firm as a result of the expansion or growth of the industry. The external economies of scale are shared with other firms operating within the industry. These benefits include:

- Labour economies: When an industry expands, labour with various skills is attracted to that particular area creating more access to such labour by the firms at lower costs.

- Economies of co-operation: Due to expansion of an industry there are more co-operations between firms which enable them to establish common services like research centers, organisation of trade fairs among others.

- Development of commercial facilities: When an industry expands, commercial facilities like banking, insurance, transport and advertising are developed which helps small firms to survive in the long run.

- Development of social and economic infrastructure: The expansion of an industry results in development of infrastructures like roads, communication facilities etc. which help to reduce the average costs of production.

- Economies of information: An industry is in a better position to establish research centers and disseminate the research findings in form of new inventions to the member firms through scientific journals thereby increasing the production efficiency of individual firms and a reduction in cost of production.

- Economies of concentration: Due to concentration of an industry in a particular area, all member firms realise common economies, for instance skilled labour will b available to all firms, transport and communication network, insurance and banking companies are attracted to the area among others.

- Economies of specialisation: Due to the expansion of the industry, individual firms start specialising in different processes and in the end the industry benefits as a whole.

- Transport economies: When the industry expands, individual firms may benefit from the infrastructure net works set up by other firms or by the state.

14.2.3.2 Diseconomies of scale

For relatively large levels of production, a firm tends to experience diseconomies of scale and decreasing returns to scale. These result because an increase in the scale of operations causes an increase in average cost. The disadvantages realised by a firm as a result of expansion leading to higher average costs of production or a fall in the level of output is referred to as diseconomies of scale. They are also divided into internal and external diseconomies.

(a) Internal diseconomies

These are the disadvantages or problems faced by a firm which has increased its scale of production. These problems are only experienced by a single firm and they are not shared by other firms in the industry. They include:

- Managerial diseconomies: When a firm expands it faces the problem of supervision, coordination, control and communication of decisions, bureaucracy increases, time wastage and rigidity also increases which results into higher costs per unit of output.

- Technical diseconomies: A large firm realises disadvantages of specialisation and incurs high costs of maintaining complicated machines and buying raw materials hence higher average costs of production.

- Financial diseconomies: A large firm may face financial disadvantages especially if funds are not secured in time which delays production and limits expansion of the firm.

- Risk bearing diseconomies: Due to expansion a firm faces more disadvantages in case of uninsurable risks like a war since it loses on a very large scale.

- Marketing diseconomies: A large firm faces the problem of scarcity of raw materials, changes in tastes and preferences of consumers, declining demand for its products etc. which may result into higher costs and more losses.

(b) External diseconomies

These are disadvantages realised by a firm from outside due to expansion of the industry. These problems are shared by the firms operating within the industry. They include:

- Labour diseconomies: As an industry expands it becomes more difficult to secure labour with the appropriate skills resulting into higher wages for labour and higher costs of production.

- Marketing diseconomies: As a result of expansion of an industry, competition for markets increases resulting into higher marketing costs and lower profits.

- High demand for raw materials: The expansion of an industry results into higher demand for raw materials hence higher costs of production.

- Scarcity of land: Expansion of an industry creates scarcity of land for expansion for individual firms which increase rent, congestion and transport costs hence higher average costs of production.

- Factor prices: When an industry expands, firms will be challenged by the shortage of infrastructure facilities and social amenities. This will mean that the cost of transport and communication will be very high hence leading to high cost of production.

- Pollution diseconomies: The localisation of industries in a particular place or region pollutes environment. The polluted environment acts as a health hazard for the laboratories.

Unit Summary

- Costs were defined as the expenses by a firm to acquire the different production inputs used by the firm.

- Costs were classified into Implicit and explicit costs. Implicit costs are basically social costs that cannot be included in the computation of the firm’s profits like opportunity, time wasted among others.

- Explicit costs is the actual expenditure of a firm that is incurred when purchasing the input factors like cost of raw materials, labour, transport, energy and many others.

- Production periods were discussed that is the short run and the long run. Short run was defined as a period in which a firm cannot change its plant equipment and the scale of operation. In this period some factors are fixed while others are variable.

- Long run on the other hand is the period when all the factors of production are variable.

- Short run costs of the firm were identified as fixed and variable costs where by fixed costs are those which do not vary with the level of output while variable costs are those that vary with the level of output.

- Short run costs are varied to get average fixed costs, average variable costs, marginal costs as well as average total costs.

- The growth of firms was also discussed where by firms can either grow naturally or externally through mergers where two or more firms come together to form a new firm.

- Two types of mergers were identified; horizontal and vertical mergers. A vertical merger occurs when firms at different stages of production integrate while horizontal merger occurs when firms at the same stage of production integrate.

- Advantages of merging were identified which include, economies of scale enjoyed by the merged firms; increased efficiency, ability to undertake research and development, increased competitiveness of merged firms, rationalisation and diversification among others.

- The disadvantages of merging include; diseconomies of scale, low output, limited variety to consumers, high prices among others.

- Factors limiting merging were also discussed and they include; fear of diseconomies, market limitation, fear of risks, and fear of losing clients among others.

- Economies and diseconomies of scale were also discussed. Economies of scale are the advantages enjoyed by a firm as a result of expansion and they can either be internal economies or external economies.

- Internal economies are the advantages enjoyed by a firm due to its expansion while external economies are the advantages enjoyed by a firm due to expansion of the industry.

- Internal economies include; technical economies, managerial economies, marketing economies, financial economies, research and development economies among others while external economies include; labour economies, economies of corporation, development of social and economic infrastructure, development of commercial facilities.

- Diseconomies of scale were defined as the disadvantages realised by a firm as a result of expansion and they include; managerial diseconomies, technical diseconomies, risk bearing diseconomies, financial diseconomies, marketing diseconomies among others.

Unit Assessment 14

- (a) Distinguish between the long run and the short run periods of

- Define the following short run average costs of the firm; fixed costs, variable costs, average costs, total costs and marginal

- (a) Distinguish between implicit and explicit costs.

- Why is the long run cost curve flatter than the short run cost curve?

- (a) Distinguish between horizontal and vertical merging.

- Explain the advantages and disadvantages of merging.

- (a) What are economies of scale?

- Explain the different economies of scale clearly indicating whether they are internal economies or external economies.