Definition

Production comprises all activities that provide goods and services which people want and for which they are prepared to pay a price. The composition of the total output can be classified into consumer goods and produce goods and services. Consumer goods are commodities that satisfy human needs directly .They can be:

- Durable consumers’ goods provide a steady stream of satisfaction and their value diminishes slowly through age and usage.

- Non- durable consumer good are consumed and destroyed in the very act of being used e.g. Food, juice, cigarettes.

Producer goods are commodities that do not directly satisfied wants but they are used for the contribution they make to the production of other goods. Example: factories, buildings etc. Services are intangible economic goods e.g. banking, transport, tourism and administration. Services are non transferable i.e. they can not be purchased and then resold at a different price.

Production can be categorized into three:

Extractive industries, examples are farming, fishing and forestry. Primary products result from such industries

Manufacturing industries these include engineering, vehicle manufacture, chemical and food processing.

Distribution industries; these incorporate the activities of wholesaling and retailing.

4.2 Factors of Production

This refers to the inputs or resources from the society that are used in the process of production .They include land, labour, capital and entrepreneurship Land It refers to all natural recourses over which people have power of disposal and which may be used to yield income. It includes farming land, forest, river, lakes, building land, and mineral deposit. The total supply of land in the world is limited although the supply of land for some particular use is not fixed. Thus for example, more maize can be planted at the expense of potatoes. Alternatively, more land can be allocated to buildings at the expense of farming land, drainage, irrigation and fertilizers can increase the area of agricultural land.

Labour refers to the exercise of human mental and physical effort in the production of goods and services. The supply of labour in an economy is measured by the number of hours of work which is offered at a given wage rate at a given period of time. Capital is a manmade input. It can be classified as working capital or circulating capital referring to stocks or raw materials, partly finished goods and goods held by producers.

Alternatively, capital can be classified as fixed capital which consists of equipment used in production such as machinery and buildings. The value of total output required for replacement of won out producer goods every year is referred to as depreciation. The total output of producer goods is referred to as the gross investment and any addition to capital stock is referred to as the net investment.

This implies that: Gross investment – Depreciation = Net investment

Note that in economics, the concept of depreciation is distinct from the concept of depreciation in accounting. Depreciation is considered to be the period allocation of the cost of a fixed asset

Entrepreneurship the organizational of the factors of production with a view to make a profit It involves hiring and combining other production factors making decision on what to produce how and what and where to produce. It in involves risk taking which arises because most production is undertaken in expectation of demand and in most cases the future is uncertain. Entrepreneurs make payments to cover their costs without any certainty that the cost will be covered by revenue.

Mobility of Factors of Production has two main aspects

- Occupational mobility refers to the ease of movement of factors of production from one job or task to another.

- Geographical mobility refers to the movement factors of production from one location to another.

Individual mobility of factors of production

Land is not mobile geographically but has a high degree of occupation mobility i.e. land can be put into different uses of farming building roads etc Capital is mobile in both cases e.g. a vehicle and tools are geographical and occupational mobile. Some capital are immobile e.g. railways. Other form of capital has occupational mobility e.g. a building Labour is mobile both geographical and occupation. However there are barriers to geographical and occupation mobility.

Barriers to Mobility of Labour

1) Reluctance of the family to move

2) Cost involves in labour mobility

3) Language barriers

4) Adverse climatic condition

5) Insecurity and political instability

6) Ignorance of job opportunities

4.3 Specialization

This refers to the concentration of activity in those lines of production where the individual, firm or country has natural or acquired an advantage. Adam Smith drew attention to the importance of division of labour in his book, the wealth of nations. He was fundamentally concerned with division of labour of a particular industry where the manufacture of products was broken down into many specialized activities. Adam Smith observed that the making of pins required 18 distinct operations, estimating that the production per day in the factory was about 5,000 pins per person employed. If however the whole operation was undertaken from first to finish by each employee, Smith estimated that he would have been able to make only a few dozen pins per day. Apart from specialization in particular industries the following other forms of specialization can be identified:

- International specialization – refers to the concentrating of a country of its resources on a specific area of production for example, the concentration by Kenya in the production of coffee and tea or the production of copper by Zambia.

- Regional specialization within a country where factor endowments and economic history have led industries to concentrate in certain areas because it is difficult for competitive plants to be established elsewhere. Thus for example, in Kenya the production of tea is concentrated in the highlands.

- Specialization between Industries since each economy includes many industries an example; it is possible to speak of the motor manufacturing industry, the steel industry and so on.

- Specializations between firms- since industries are composed of firms that can be regarded as units of production. Thus for example different firms can specialize in the manufacture of different components of a product. Thus for example, in the car industry certain firms specialize in the provision of spare parts.

- Specialization within factories which arises because one firm will often control a number of factories, and these are usually referred to as plants and are units of production. For example, a manufacturer might find it economical to build engines in one plant, axles in another, car bodies in a third and so on, and subsequently transport all the parts of another plant for final assembly.

- Specialization within plants can be of two types:

- A particular plant may produce more than one item and plant may thus be regarded as two working side by side.

- Within every plant there is a considerable specialization of labour. In a typical manufacturing firm, some employees will be receiving and storing raw materials and components whereas the majority will be engaged in the manufacturing process, while others will be checking and packing finished product.

The advantages of specialization

1. The fundamental advantage of division of labour is the increased output arising from division of labour.

2. Specialization may lead to boredom or monotony as some workers perform the same operation hundred of times. This monotonous repetion may lead to a greater incidence of accidents and greater absenteeism as a result of low morale. In addition, labour relations between senior management and production workers may deteriorate as communication becomes more difficult.

3. Specialization may be accompanied by decline in craftsmanship as skills are transferred from the hands of the workers to a machine that controls the design, quantity and quality of a given product. It should however be noted that mechanization has produced many craftsmen in occupations that require a high degree of skills.

4. Specialization is associated with an increased risk of unemployment as specialized workers do not have a wide industrial training that would make them adaptable to changes in techniques of production. In the short term such workers are susceptible to unemployment although in the long run the simplification of tasks implied by specialization would mean that jobs in different industries are fairly similar and retraining is relatively easily achieved.

5. Specialization is economically limited by the extend of the market in that methods of production using expensive capital equipment are only worthwhile if there is a potential demand for the mass produced product that keeps the capital equipment fully employed. This mass market may not always exist because of low income levels in a particular country.

6. Specialization especially in cases involving mass production is inevitably associated with standardization of products. This is because of the heavy development costs incurred in launching mass commodities that leave little possibility for the accommodation of tastes and preferences of individual consumer‟s sovereignty is, to some extend, limited by this narrow regard for individual preferences.

4.4 Production Function

This is a technical relationship between the output of good and the input required to make these goods. The function may take the form of an equation, a table or a graph. The relationship between an input and output is a technological relationship which may be the

short run or long run.

Q = f (K, L) where Q-output; K-capital; L – Labour

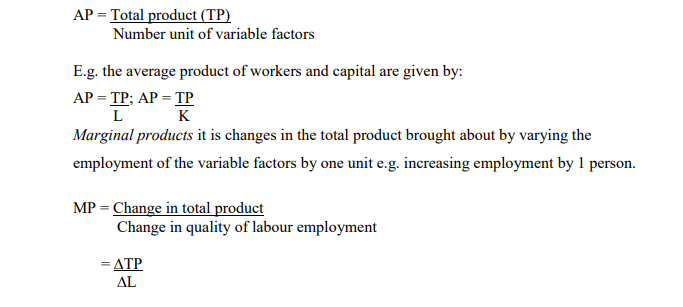

Short run refers to a period of time in which only some variables change. It is an economic process during which supply of certain factors of production e.g. land are fixed and cannot be varied. Long run refers to a period of time in which all variables are able to settle at their equilibrium and all economic processes have time to work in full. Average product (AP) is the output per unit of the variable factors and it’s given by:

Fixed Costs – are costs that do not change as output varies. They are associated with fixed factors of production and include; rent rates, insurance, interest on loans and depreciation. Fixed costs remain the same whether output is one unit or output is 1,000 units. Fixed costs are also referred to as overhead costs or unavoidable costs.

Depreciation, especially in capital intensive industries usually constitute a major item in fixed costs since the life of capital tends to be measured in economic rather than technical terms and machinery, for example, depreciates even when not in use.

Variable Costs- are costs that are related directly to output and include the wages of labour, the costs of raw materials, fuel and power. Variable costs are alternatively known as direct or prime costs.

Total Costs represent the sum of fixed costs (FC) and variable costs (VC).

TC = FC+VC

When output is equal to zero, total costs will be equal fixed costs since variable costs will be zero. When production begins to increase total costs will continue to rise as variable costs increase since output expands.

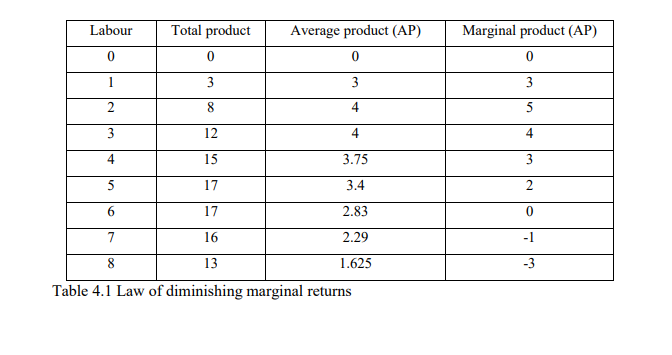

Law of Diminishing Marginal Returns/Law of Variable Proportions

It states that holding other factors constant as additional unit of a variable factor are added to a given quantity of a fixed factors, the total product and the marginal product will initially increase at an increasing rate but beyond a certain level of output it will

increase at a decreasing rate and eventually fall.

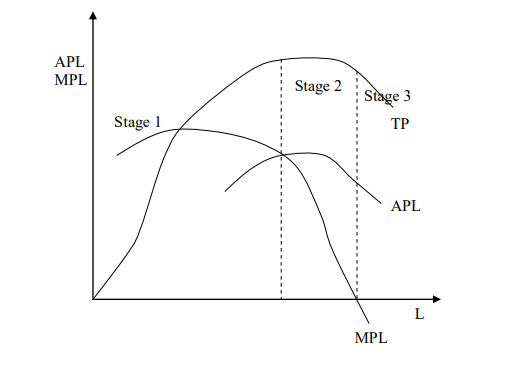

Stage 1

There is increasing returns to the variable factors. In this stage the total product is increasing at an increasing rate while the marginal product and average product are also rising with marginal product higher than average product at any given point. This is an indication of increasing efficiency of the proportion in which the factors are combined since the fixed factors are still under utilized and there is greater scope of specialization.

Stage 2

It represents a decreasing return to the variable factors in that the total product is increasing at a decreasing rate. The marginal product and the average product are positive but they are falling at this stage. The average product is higher than the marginal product and only national production takes place.

Stage 3

This represents a stage of negative return of the variable factors. At this stage the marginal product is negative and as a result the total output is reducing. It represents a stage of extreme inefficiency when factors of production are probably getting into each other‟s way (conflicting). At this stage the producer will not operate even with free labour, since he could also raise the total output by using less labour. The law of diminishing marginal returns is explained by the use of the schedule in Table 4.1

The average product curve raises at first, reaches the maximum and then falls. It remains a positive as long as the total product is positive. The marginal product rises and reaches the maximum before the average product and then declines. The marginal product becomes zero when the total product starts to decline. Therefore the falling portion of marginal product curve illustrates the law of diminishing returns.

Assumptions

1) The state of technology remains unchanged.

2) Successive units of the variable factors are assumed to be equally efficient

3) Production take place in the short run where at least one factor of production is fixed.

4) There is one variable factor of production under consideration.

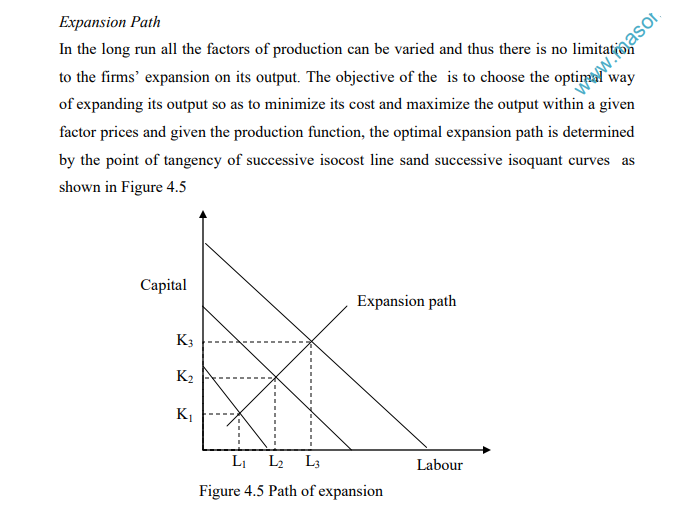

4.5 Long Run Changes in Production

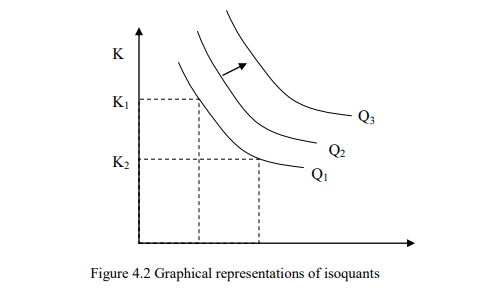

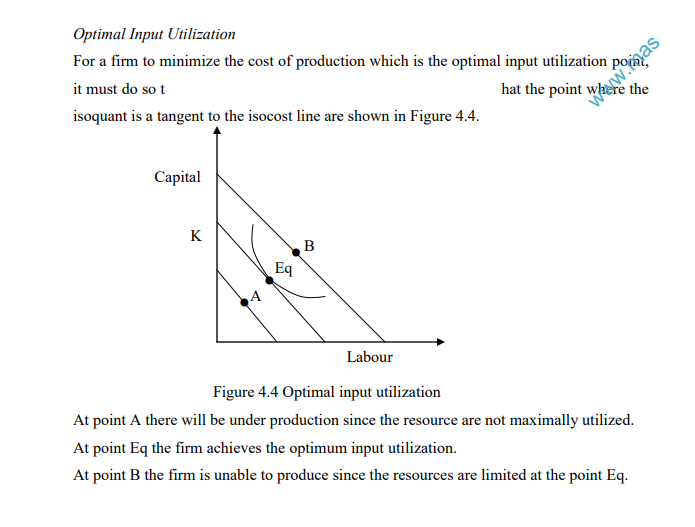

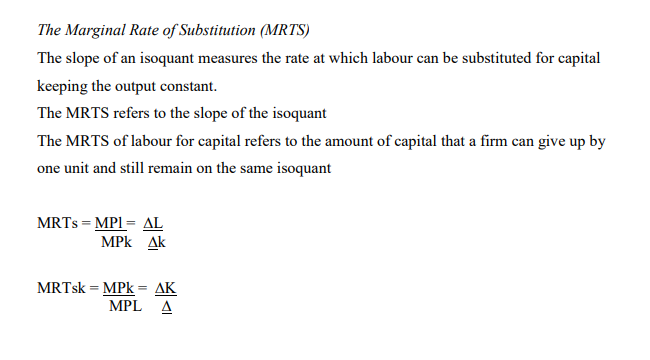

In the long run all factors of production can be varied and thus the firm will chose the input combination which optimize output and at the same time minimize their cost. This is illustrated by the use isoquant and isocost.

Isoquant shows all the difference combination of labour and capital with which a firm can produce a specific quantity of output.

Assumption of Isoquant

1) There are only two factors of production i.e. labour and capital

2) It is possible to substitute labour for capital and vise versa continuously in the production process

A higher isoquant shows a greater level of output (Q3) while a lower isoquant shows lower level of output (Q1). A series of isoquant gives isoquant map series

Properties of Isoquants

1) They are convex to the origin

2) Do not intersect

3) They have a negative slope

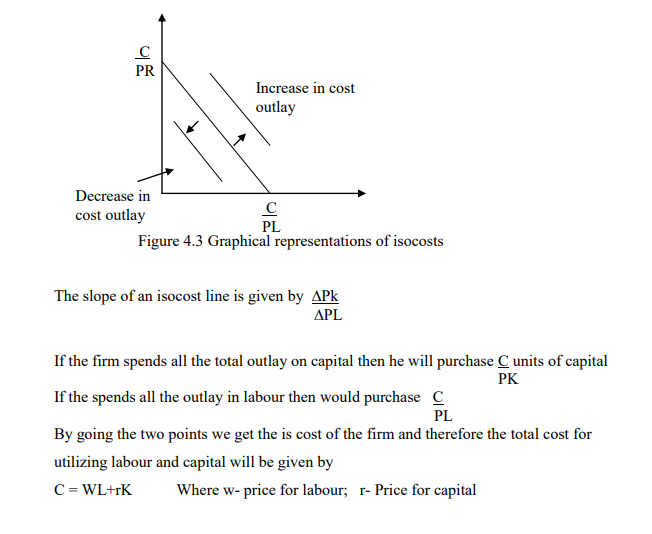

Isocost shows all different combination of labour and capital that a firm can purchase given the total outlay (ability) of the firm and factor prices.

Assumptions

1) The firm takes the input prices as given by the market

2) There are two inputs; there are the labour and the capital.

4.6 The Theory of Cost

It helps in understanding the concept of cost. The following are necessary: Opportunity Cost Assuming full resources allocation and employment in production of good and services increasing the production of any one product involves the sacrifice of an alternation product. The cost of producing a certain product is taken to refer to the forgone value of the alternative product

Private cost and social cost (negative externalities) private cost refers to these costs which relates to an individual producer. They include both explicit and implicit. While social cost refer to these costs which occur to the third party in the production process. Implicitly cost The explicit costs refer to the money paid out made by the firm. This includes payment for resources bought or hired e.g. wages, cost of raw materials, rent etc.

Implicit cost includes the resources owned and used by the firm’s the owner. When the profits are calculated on the bases of explicit and implicit cost we obtain economic profit. When calculated only on basis of explicit cost we obtain financial profit.

Assumptions

- The firms take prices or input as determined by the market forces.

- Firms aim at minimizing the production cost.

Short Run Cost Function

In the short run input levels will depend on output level that the firm wants to achieve. In short run not all factors will be varied. At least one must be fixed and therefore the cost incurred on it will be fixed cost. The total fixed cost will be constant regardless of the

output level e.g. rent for factory building, salaries of office staff etc.

Variable costs are incurred by the firm for its variable input. A firm wishing to increase its out put will require large variable input thus higher variable cost. The variable costs of a firm will increase as the output levels increase e.g. cost of raw materials, cost of direct

labour and other direct running expenses.

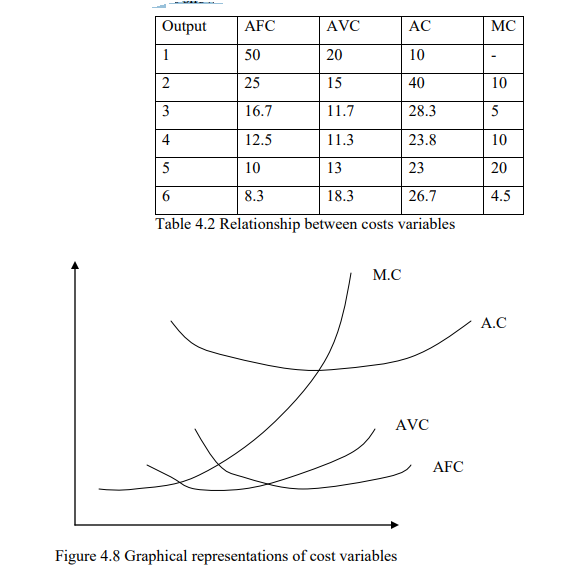

The relationship between average cost and marginal cost In most of case the marginal cost the average cost from below. The average cost must be failing as compared to marginal cost a) Mathematically it can be shown that, if the slope of average cost is less than zero, then the marginal cost will be less than average cost AC<0; MC0 ;MC>AC Since the average cost curve is U- shaped the slope of average cost becomes zero to its minimum and hence marginal cost is equal to costs at this point.

The relationship between average total costs, average fixed cost, average variable cost and marginal cost is shown in Table 4.2.

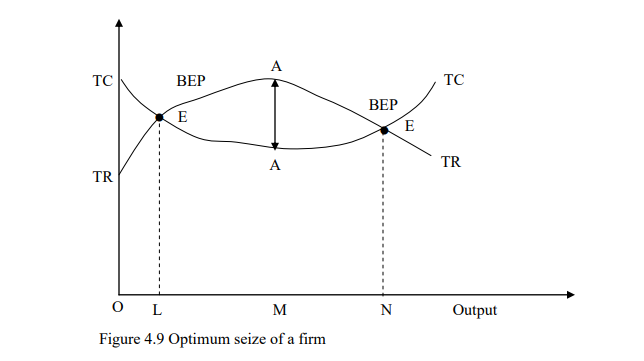

4.8 Optimum Seize of a Firm

This is the level of output at which total profit is at maximum. It is the best or the most efficient size of a firm when the long run average cost of a firm is at minimum. At this point there will be no motive for further expansion since at any other size large or smaller

the firm will be less efficient. This is also attained when the firm cost of production is at its minimum level as illustrated in Figure 4.9

Below OL total cost exceeds total revenue and hence the firm is making loss. At the point EL neither profit nor loss are being made and hence its break even point (BEP) when total revenue is equal to the total cost. The same case applies to the point EN. Maximum profit lies where revenue and total cost difference total in the greater i.e. the point where the vertical distance between the total revenue and the total cost is greatest. In Figure 4.9 the maximum profit is at point M where AA is the largest vertical distance.

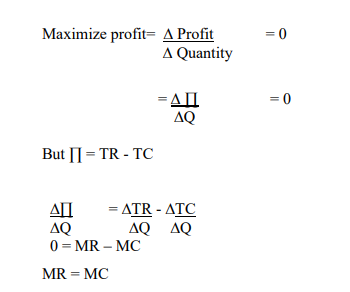

N/B: For profit maximization the following two conditions must be met

1. The necessary conduction – according to this conduction profit are maximized at the levels of output where marginal revenues is equal to marginal cost. To maximize profits profit is symbolized by pie ( ∏

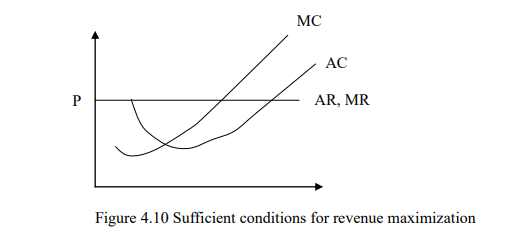

2. The sufficient condition states that the slope of marginal revenue curve must be less than the slope of marginal cost curve at the point where they meet. Meaning that the marginal cost curve cuts the marginal revenue curve from below as shown in Figure 4.10

N/B: Total profit function is maximized as follows

- Taking the first derivative and setting it equal to zero to obtain the critical values.

- Taking the second derivative and evaluating it at the critical values to ascertain if the function is at the relative minimum or maximum.

4.9 Economies of Scale

In the long run, all the input into production processes are variable so the problems associated with diminishing returns to the variable factors do not arise. The law of diminishing returns therefore only applies to short run costs and not on long run costs.

This implies that whereas short term decisions are concerned with diminishing returns given fixed factors of production, long run output decisions are concerned with economies of scale which are based on assumptions that all factor inputs are variable.

Economies of scale are aspects of increasing size which lead to falling long run average costs. Economies of scale assist in explanation of trend towards large production units in some industries. Economies of scale can be classified into internal and external economies of scale. They are the advantages that arise due to expansion in scale of are two categories:

- Internal economies of scale

- External economies of scale

Internal economic of scale are factors which bring to reduction in average cost as the scale of production of individual firm rise. Internal economies of scale are those factors which bring out a reduction in average costs as the scale of production of individual firm

arises, depending on what is happening to other firms. This is attributed to the activities within the firm hence the economics are brought about by various source which include:

1. Marketing economies of scale consists of all the advantages a firm acquires as they approach the market such as

Buying advantage– large firms enjoy buying advantage since they purchase goods in bulk hence receive heavy bulk discounts that reduce cost of production.

Packaging advantage It is easier to package goods in bulk than in small unit with reference to packaging costs.

Transportation advantage due to transporting many units at the same time which reduces transportation cost to a large scale producer compared to a small scale producer.

Selling advantage in terms of advertising whereby the large scale producer will benefit more as he will sell more as compared to a small scale producer due to mass advertisement

2. Technical economic of scale consists of:

Factor indivisibility e.g., certain capital equipment must be of a specific minimum scale or capacity of justify manufactures ability. A small firm will not utilize its equipments in full due to idle capacity arising from the small production capacity. Large scale producer will be advantaged since he will optimally utilize the equipments.

Increased specialization The larger the scale of production the greater the scope of specialization of both labour and machinery leading to high productivity.

Principle of multiples If the production process involves use of different stages and type of machinery the large firms will benefit due to high productivity while smaller ones will be disadvantaged since they produce fewer units.

Research and developments A large firm may be able to support its research and development programs which could result in cost reducing innovations

3. Financial economies Large firms can easily obtain financial resources at lower rates than small firms. Large firms can also produce more security for loans and investments

4. Risk becoming economies a large firm that has diversified into several markets is usually better placed to withstand adverse trading conditions.

5. Managerial and administrative economies Managers and administrators are highly qualified in managements of large firms. This creates division of labour which improves efficiency.

External economies of scale

These are advantages that arise from the growth of industry resulting from simultaneous interaction of a number of industries in the same or various industries as well as the community at large. External economies of scale are those advantages in the form of lower average costs that a firm gains from the growth of the industry. External economies are available to all firms in the industry no matter their size.

These advantages include:

- Employment Due to growth of industries employment opportunities are created to the communities that will help to improve the standard of living.

- Specialization Different firms within the industry will decide to specialize in one area of production which will reduce cost of production and improves quality of the product and reduce prices. The repeated performance of the same actions means that labour can become very skilled. The breaking of the production process into many stages signifies that machines can be designed specifically for each stage. An example is in the motor assemble plant where many of the different stages in the assembly are completed using computer controlled machines.

- Growth of complimentary service Whenever a business is expanding its output, there are some complimentary services that arise e.g. schools medical facilities financial institutions, better roads, etc. that benefit the society.

- Increased co-operation Many firms within the industry can co-operate with one another in terms of research and development hence improve the quality of a product, new techniques in production which lowers the cost of production and

reduction in prices.

Internal diseconomies of scale

Increasing the size of a firm beyond a certain scale can lead to rising average costs. This is because of management difficulties and rising prices of inputs. Management problems arise because:

- As the size of departments in an organization increase, the task of coordination becomes more difficult.

- Despite the existence hierarchy of authority in large firms, the task of control, that is, of ensuring implementation is extremely difficult in practice.

- In the firms of large sized communication may be problematic in that it is difficult to ensure an effective vertical and lateral line of communication. Communication network are generally more complex in large organization with associated greater likelihood of communication breakdown.

- The maintenance of morale is more difficult in large organizations because individual workers in large organizations may feel unimportant the firm and often do not identify with the firm‟s objectives.

- An additional source of internal diseconomies of scale is increase in price of inputs since as the scale of production increases, the firm will increase the demand for inputs likelihood and transport and this may lead to the bidding up of prices of prices of certain inputs.

External diseconomies of scale

May arise because of a shortage of various inputs used in the industry may arise leading to an increase in the cost of those inputs. For example, an increased demand for raw materials may bid up the prices of raw materials and cause their prices to rise. Heavy

localizations of industry may make land for expansion scarce and therefore more expensive to rent and purchase. Increased congestion could also lead to higher transport costs. Others costs include:

- Over production Increase in growth of a firm will lead to overproduction leading to wastage due to lack of a market

- Negative externalities e.g. pollution, poor working condition this will be experienced as many firms expand their output.

- Maintenance of morale Individual workers feel unimportant to the firm and may not identify with the firm objectives

- Government interference Whenever there is increase in output due to increase in growth it‟s led to increase in profit. The government then imposes tax which is a disadvantage to the firm

4.10 Mergers and Acquisitions

Mergers occur where two firms agree mutually to joint their operations together. While an acquisition occurs when a firm called a predator decides to take over another firm referred to as a prey either forcefully of willings. Mergers and acquisitions are driven by

different motives. The following are major types of mergers and acquisitions.

- Vertical integration occurs when merger takes place between firms engaged in different stages of the production process. Thus for example, a tyre manufacturer can acquire rubber plantations. Backward integration is said to take place when the movement is towards the market outlets as, for example in the case of large

oil companies taking control of petrol stations. - Horizontal integration occurs when firms engage in the production of the same kind of good or service brought under unified control. An example would be an amalgamation of several motor manufacturers.

- Diversification occurs when firms that produce goods that are not directly related to each other combine. An example would be the merger of a firm producing fertilizers with a manufacturer of paint. The main aim of diversification or conglomerates is to reduce the risk of trading.

The survival of small firms

Small firms continue to survive for the following reasons:

- Demand for variety that cannot be met by mass production especially in industries like clothing and footwear.

- Many owners of small firms have no ambition to grow large because they do not want to sacrifice their independence and control.

- A personal contact with customers is important in many industries like accountancy and architecture.

- The size of the firm may be limited by the extend of the market since a firm can only grow in size if this is permitted by the market. The market for luxury items for example is limited by income and wealth.

- Firms may want to avoid the rising costs that arise from diseconomies of scale

- There is a tendency for mass production industries to disintegrate into a large number of specialist firms.