1.1 The Sponsor(s)

- Sponsors background

- Full name (and age – where applicable_

- Marital Status

- Residence

- Educational, Entrepreneurial, Management Skills, Training, Experience and Professional qualification

- Relevant business experience

- Plans to acquire necessary experience

- Amount to be invested in the business. Amount to be borrowed from a specified source

- Sponsor Roles and Contributions to the business

1.2 The Business

- State the name of your proposed business

- When to the business

- Whether it will be operated as a sole proprietorship, partnership or a company

- The major activities of your business

- Other activities of your business

- Activities involved and nature of product/services

- Hour (s) of operation, week or season

- The principal customers of your business

1.3 Justification of the Business

- SWOT analysis versus competitors

- Specific needs business to satisfy

- Contribution of the business to the community

- Personal, resource and environmental factors

- Sustainability of the business

1.4 Business status/form/type of ownership

Businesses can be at difference stages e.g.

Start ups: a business start-up means creating a new business, which stands alone, and is not tied to other organizations, except in the normal course of trading. It does not mean the idea is necessarily new, only that the vehicle which is set up to exploit it is.

Franchise: a franchise is a method for starting a new business within the frame work of an existing, larger business entity. it is a legally separate enterprise operating in some way under the umbrella of another organization . Buying an existing business

Outright purchase: this involves buying an existing business from somebody else; although there is a new business owner, the business does not start from scratch but is already trading in some way.

Buy-out: a buy-out is buying an existing business from within, rather than from the outside recently, this has become an increasingly popular form, as larger corporations have sold off parts of their corporation to the existing management team , same buy –outs , such as National freight , are large enough not to be classified as small business at all.

Buy-in: this occurs when the existing owners accept a new partner, or shareholder, who buys into a small firm which already exists

Forms of business

Sole proprietorship: This is a type of business owned and managed by one person called a sole proprietor.

Capital for a sole proprietorship can be raised from:

- Borrowing from friends, relatives or financial institutions.

- Inheritance.

- Donations

- Credit buying or hire purchase

- Profits ploughed back

- Leasing and renting out property.

- Personal savings

Characteristics

- It is owned and managed by one person

- The owner of the business provides all the capital required and is responsible for all the debts of the business

- The owner may or may not employ some people to assist in operations of the business

- The law does not distinguish the owner of the business from the business.

- The owner has unlimited liability .therefore, if the business owes debts which it is unable to pay, the owner of the business will be required to pay the debt from personal sources. Personal property may have to be sold to pay the debts.

- All the profits of the business belong to the owner.

- All business decisions are made by the owner, who does not have to consult with any one else.

- When the business makes losses, the owner bears them all. This means losing part or all of the capital infested in the business

- Most sole proprietorships tend to stay small in size due to limited capital business resources.

Advantages

The following are some of the advantages of sole proprietorship:

- Few legal requirements to start.

- Decision making and implementation is fast.

- The owner exercises direct personal control.

- The trader has close and personal contact with customers.

- Trader is accountable to him/herself

- The trader can maintain top secrets of the business.

- The owner enjoys all the profits alone.

- Can get assistance from family members.

- capital required to start and sustain the business is relatively small.

Disadvantages

Some of the disadvantages of the sole proprietorship are as follows:

- Has unlimited liability

- Limited amount of capital

- The proprietor work for long hours with little time for recreation.

- The business may experience management difficulties if the owner falls sick.

- May not benefit from economies of large scale operations

- Death of the owner may lead to dissolution of the business.

- May perform poorly due to lack of specialization.

Dissolution of a sole proprietorship

Dissolution means termination of a business. For a sole proprietorship, thus may arise as a result of:

- Decision by the owner to dissolve the business

- Death, insanity or bankruptcy of the owner.

- If the business is involved in unlawful practices.

- Court order.

Partnership

This is a business unit owned by two or more people called partners.

Characteristics

- Formed by two to twenty members (partners) except for a professional partnership that may have a maximum of 50 members.

- Managed by members who may share the responsibilities according to their skills .where this is not possible they may employ skilled man power to manage there business.

- The partners contribute capital to the business according to the agreed proportions.

- Can either be a general partnership (liability of all the partners are unlimited) or a limited partnership however, there should be at least one member whose liability is unlimited.

- A partnership can be either permanent or temporary. A temporary partnership is also called a joint venture.

Partnership agreement

During the formation of the partnership the partners prepare an agreement which would govern the operations of a partnership. The agreement can be either oral or written .A written agreement is referred to as a Partnership deed. The contents of the partnership

agreement may include:

Name of the business and address of the head office.

- Capital to be contributed by each partner.

- Rate of interest on capital.

- Profit and loss sharing ratio.

- Salaries and commissions to be paid to partners.

- Rate of interest on drawings by partners.

- Objectives of the business

- Rate of interest on loans by partners to the firm.

Where a partnership agreement is missing or where it is ambiguous, the Partnership Act applies in case of a dispute:

- All partners are entitled to equal contribution of capital.

- No salaries allowances or commissions to any partner.

- No interest on capital.

- NO interest on drawings.

- Profits and losses are shared equally

- Each partner who incurs personal expenditure or loss while executing the duties of the business should be compensated.

Types of partners

The following are some various types of partners:

- Active partner: one who takes active part in the running of the business.

- Dormant (sleeping) partner: one who does not take active part in running the business.

- General (unlimited liability) partner: one whose liabilities are not limited.

- Limited partner: one whose liabilities are limited.

- Minor partner: one who is under eighteen years.

- Major partner: one who has attained the age of majority.(eighteen years)

- Real partner: one who has actually contributed capital into the business.

- Nominal partner: A person who is not a real partner but appears as one.

Advantages of a partnership

Some of the advantages of a partnership are:

- A partnership is able to raise more money than a sole proprietorship.

- Different talents are combined.

- Work is distributed among the partners.

- Losses and liabilities are shared.

- Fewer legal requirements than in a limited liability company.

Disadvantages of a partnership

Some of the disadvantages of a partnership are as follows:

- Liabilities of some or all the members are unlimited.

- Continued disagreements among members can lead to dissolution.

- Decision making may take long.

- Mistake made by one partner may result into losses that are shared by all the partners.

- A partnership that h3avily relies on one partner may be adversely affected on retirement or death of a partner.

- A hard working partner may not be equitably rewarded.

- A partnership may have limited access to wid3e source of capital and managerial skills compared to a limited liability company.

Dissolution of a partnership

Dissolution of a partnership may arise from:

- Mutual agreement by all the partners to dissolve the business.

- Death, insanity or bankruptcy of a partner.

- Completion of the intended purpose or on the expiry of the agreed period, if the partnership was temporary.

- Court order.

- Written request by a partner to dissolve the business.

- If the partnership is engaged in unlawful practices.

- Retirement or admission of a partner.

- Continued disagreements among the partners.

Sources of capital for a partnership

All the partners of a partnership are jointly responsible for raising capital for the business. The capital may be raised from various sources which include the following:

- Personal savings

- Loans friends

- Loams from financial institutions

- Trade credit

- Hire purchase

- Profit from the business

Limited liability Company

This is an association of persons, called share holders who contribute capital to carry out business together with a view of making profit. A company is however a legal entity separate from the shareholders.

Formation of a limited liability company

The people who decided to form a company are referred to as promoters’ .During the formation; the promoters prepare the following documents:

1. Memorandum of association

This document defines the relationship of the proposed business with the outsiders. The following are some of the clauses it contains:

- Name clause

- Objects clause

- Situation clause

- Liability clause

- Capital clause

- declaration

2. Articles of association

This document governs the internal operations of the proposed company. it also contains rules and regulations relating the shareholders to the company and the relationship among shareholders themselves. Some of its other contents are:

- Rights of each type of shareholder.

- Methods of calling and conducting meetings.

- Rules governing the election of officials.

- Rules governing preparation and auditing of accounts.

- Powers, duties and rights of directors.

3. List of directors

This contains the names of the directors, their addresses, occupations shares subscribed by each of them and their acceptance to serve as directors.

4. Directors statement of agreement

The directors sign in this document to indicate their acceptance to act as directors.

5. Declaration

This is a document in which the promoters declare that all legal requirements have been complied with .Once the above documents are ready, they are lodged with the registrar of companies and business names who issues a certificate of incorporation. (Registration)

Sources of capital for Limited Liability Company

1. Shares

A share is a unit of capital in a company. Members contribute to the company by buying shares .There are two types of shares: Ordinary (equity) shares and preference shares .Some of the characteristics of ordinary shares are:

- Have voting rights,

- No fixed rate of interest

- Have a claim to dividends after the preference shares.

- Are paid lastly if the company is winding up.

Some of the characteristics of preference shares are:

- Have a fixed rate of dividends.

- Have a prior claim to dividends over the ordinary shares.

- No voting rights.

- Can be either redeemable or irredeemable.

- Can be cumulative or non cumulative

- Can be convertible into ordinary shares.

2. Debentures

Debentures are loans from the public to the company. They therefore carry interest at fixed rates which is payable whether profits are made or not. Debentures can be redeemable or irredeemable. They can also be secured (mortgaged) or unsecured

(naked).

3. Loans from banks and other financial institutions.

4. Profits ploughed back.

5. Bank overdrafts.

6. Leasing and renting of property.

7. Credit and hire purchase buying.

Types of limited companies

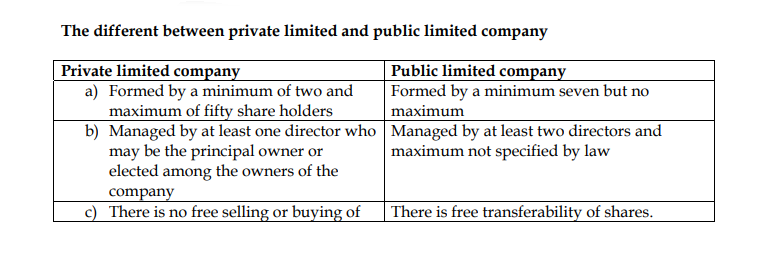

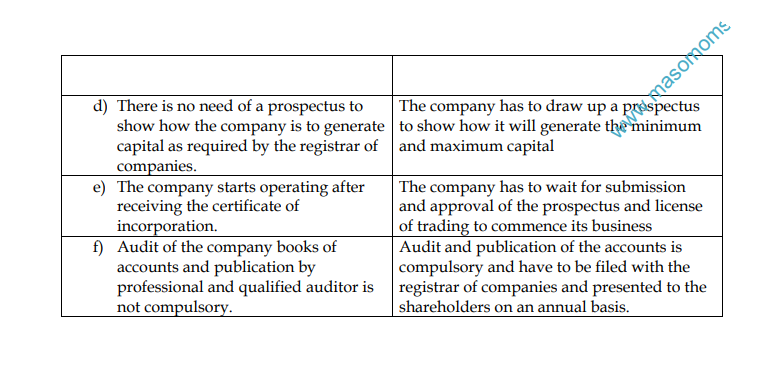

Limited liability companies may be classified into either private or public limited company:

1. Private companies.

A private limited company may be identified by the following characteristics:

- Can be formed by two to fifty members.

- Does not invite subscription for shares and debentures from the public.

- Restricts the transfer of shares and debentures.

- Can be managed by at least one director.

- Can start business immediately after receiving a certificate of incorporation.

2. Public limited companies

A public limited company may be identified by the following characteristics:

- Formed by a minimum of seven members and no maximum.

- Cannot start business before it receives a certificate of trading.

- Accounts are required to be published.

- Shares and debentures are freely transferable.

- Invite the public to subscribe for shares and debentures.

Advantages of a limited liability company

The following are some of the advantages of a public limited company:

- Wide range of sources of capital.

- Limited liability.

- Can afford specialized management.

- Not affected by death, insanity or bankruptcy of a share holder.

- Enjoys economies of scale.

- Enjoy legal personality status.

- Can afford to put in place schemes meant to motivate employees.

Disadvantages of a limited liability company

The following are some of the disadvantages of a limited liability company:

- High cost and long procedures of formation.

- Operations are inflexible and rigid.

- Alienation of members from the business.

- Lack of secrecy.

- Directors’ personal interest might conflict with those of the company.

- Decision making might take long.

- May suffer from diseconomies of large scale.

- Taxation on profits and also on dividends results into double taxation.

Dissolution of public limited companies

A company may be liquidated under the following circumstances:

- Bankruptcy.

- Decision by share holders to dissolves the business

- If the company acts contrary to the provisions of the objects clause of the memorandum of association (Ultra-vires).

- Court order.

- Amalgamation /absorption.

1.5 Business location and contact

1.5 Business location and contact

Business Location: This explains where the business is going to be located. To be included Here are:

- The town

- The street

- Lane, building or floor where the business is going to be situated

- Choice of business location

- Area size, population and infrastructure

- Features of the location and its worthiness

- Choice of store/building/premises and suitability

- Compatibility with other business adjacent

- Contract/communication modes

1.6 The Industry

- Identify the industry

- Describe the size of the industry of your business Industry size

- Which industry does your proposed business belong to?

- How large is the industry?

- What is the industry’s sale in shillings per year?

- How profitable is the industry?

Industry Trends

The following questions should be asked and answered and sought

- It is industry growing, declining or stable?

- What were the sales figures last year compared to two years ago?

- Compared to five years ago? Etc.

- Is there any significant differences in the number of competitors between last year and 2, 5 or 10 years ago?

Industry outlook

Try to find out what is expected to happen within the industry in the future. Are the sales, profits and competitors expected to increase, decrease or stabilize? Show figures. What new product or new production methods are expected? Will the industry become more or less competitive with other industries?

Proprietary position

- Do your products and/or services have any competitive advantage because of patents, copyrights, trademarks, franchise or dealership rights and the like? If so, explain the advantages and state how long this proprietary position is likely to last.

- State any other factors that give you a competitive advantage.

Industry Characteristics

- Determine the important characteristics of the industry and list those that are relevant to your business.

List those characteristics which could have an impact upon your business, beneficially or adversely. Some characteristics that you might wish to consider are:- - Capital requirements

- Distribution channels

- Technology to use- modern, outdated sophiscated or simple Whether it is capital or labour intensive

- Competition from imports

- Market segmentation and size of competitors

- Describe the seasonal factors that are experienced in the industry.

Industrial trends and prospect

- Describe the trends and prospect of sales in the industries – indicate sign of growth, stability or decline.

- Describe the trends and prospects of technological development in the industry

- Competitive trend in the industry and what future holds for the industry e.g product innovations

1.7 The Product / Service

Describe the products of service of your business:

List and describe the products or services you sell. For each business offering, cover the main points, including what the product or service is, how much it costs, what sorts of customers make purchases, and why. What customer need does each product or service line fill? You might not want or need to include every product or service in the list, but at least consider the main sales lines.

It is always a good idea to think in terms of customer needs and customer benefits as you define your product offerings, rather than thinking of your side of the equation–how much the product or service costs, and how you deliver it to the customer. As you list and describe your sales lines, you may run into one of the serendipitous benefits of good business planning, which is generating new ideas. Describe your product offerings in terms of customer types and customer needs, and you’ll often discover new needs and new kinds of customers to cover. This describes;

- Main product/services and their subsidiaries (brands)

- Main features of proposed products/services indicate colour, shape, texture, quality and packaging of the product(s).

- Benefits of products to customers and the customers needs, Indicate the performance,

- Convenience, economy, comfort, durability, usage flexibility, service and warranties of the product(s) or service(s).

- Competitive advantage of your services/products and uniqueness

- Why customers should buy your products/services

- Packaging strategy

- Trade marks or other proprietary features

Strategic formulation and implementation

Once the business unit has developed its principal strategies, it must work out details supporting programmes .even the unit has decided to attain technological leadership, it must plan programmes to strengthen its Research & Development department, gathers

technological evidence, develop leading –edge products, train the technical sales force, and develop advertisements to communicate its technological leadership.

1.8 Entry and growth strategy

- Explain acceptance of your products/services in the market

- Indicate superior pricing, advertising, distribution or promotion

- Measures to sustain your business in the market

- Plans for growth and development of opportunities

- Trends which signal growth and opportunities

- Taking advantages of opportunities

Strategic alliance. Small businesses can also form strategic alliances with other small firms in ways that enhance mutual competitive strength. statistics suggests that about a half of all small businesses maintain one or more strategic alliances with businesses that are

smaller or equal in size , especially when it comes to outside contractors , licensing partners , import /export operations , marketing agreements and shared manufacturing .

Strategic alliances allow business firms to combine their resources without compromising their independent legal status. Strategic alliance match makers can help small businesses find suitable alliance partners, entrepreneurs can improve their chances of creating and maintaining a successful alliance by establishing productive connections, identifying the best person to contact being prepared to confirm benefits of that alliance learning to speak the partner-s “language”, and monitoring the progress of the alliance.

Marketing alliances

Many strategic alliances take the form of marketing alliances they fall into four categories ,

1. Product or service alliance: one company licenses another to produce its product, or two companies jointly market their complementary products or new products –two service business—have also joined together in a marketing alliance.

2. Promotional alliances: one company agrees to carry out a promotion for another company’s product or service. Mc Donald’s, for example, has often teamed with Disney to offer products related to current Disney films t people buying its food.

3. Logistics alliances: one company offers logistical services for another company’s products.

4. Pricing collaborations: one or more companies join in a special pricing collaboration. it is common for hotel and car companies to offer mutual price discounts

Companies need to give creative thought to finding partners that might compliment their strengths and offset their weaknesses. Well – managed alliances allow companies to obtain a greater sales impact at less cost. To keep their strategic alliances thriving, corporations have begun to develop organizational structures to support them and have come to view their ability to form and manage partnerships as core skills in and of themselves (called Partner Relationship Management, PRM) companies can designate a core group in charge of partnerships, even if it is not formal, to manage and monitor alliances. Goals indicate what a business unit wants to achieve, strategy is a game plan to getting there. Every business must design a strategy for achieving its goal consisting of a marketing strategy compatible with technology strategy and sourcing strategies.