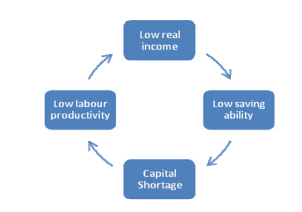

Underdevelopment from the viewpoint of these theories is the result of vicious circles of factors. One example is based on the fact of low real income in developing countries which is the result of low labour productivity. This low labour productivity, in turn, is a consequence of capital shortage which is a result of the population’s low saving ability. As the saving rate is determined by the low real income, the circle is closed. The illustration below summarizes this cycle of factors.

Strategy theories intend to break up this cycle at a certain point which they consider critical and which varies according to the different theories. Thus, they want to initiate development and transform traditional subsistence economy into a modern market economy.

Their main emphasis is on capital formation and investment (investment theories) and, by and large, they prescribe action for overcoming underdevelopment while they contribute little towards explaining the causes of underdevelopment.

Theory of Balanced Growth

This theory sees the main obstacles to development in the narrow market and, thus, in the limited market opportunities. Under these circumstances, only a bundle of complementary investments realized at the same time has the chance of creating mutual demand. The theory requests investments in such sectors which have a high relation between supply, purchasing power, and demand as in consumer goods industry, food production, etc. The real bottleneck in breaking the narrow market is seen here in the shortage of

capital, and, therefore, all potential sources have to be mobilized. If capital is available, investments will be made. However, in order to ensure the balanced growth, there is a need for investment planning by the governments.

Development is seen here as expansion of market and an increase of production including agriculture. The possibility of structural hindrances is not included in the line of thinking, as are market dependencies. The emphasis is on capital investment, not on the ways

and means of achieving capital formation. It is assumed that, in a traditional society, there is ability and willingness for rational

investment decisions along the requirements of the theory. As this will most likely be limited to small sectors of the society, it is not unlikely that this approach will lead to super-imposing a modern sector on the traditional economy, i.e., to economic dualism.

Theory of Unbalanced Growth

Contrary to the theory of balanced growth, in the opinion of this theory, the real bottleneck is not the shortage of capital, but lack of entrepreneurial abilities. Potential entrepreneurs are hindered in their decision-making by institutional factors: either group

considerations play a -great role and hinder the potential entrepreneur, or entrepreneurs aim at personal gains at the cost of others and are thus equally detrimental to development. In view of the lack of entrepreneurial abilities there is a need for a mechanism of incentive and pressure which will automatically result in the required decisions.

According to the theory, not a balanced growth should be aimed at, but rather existing imbalances— whose symptoms are profit and losses—must be maintained. Investments should not be spread evenly but concentrated in such projects in which they cause additional

investments because of their backward and forward linkages without being too demanding on entrepreneurial abilities. Manufacturing industries and import substitutions are relevant examples. These first investments initiate further investments which are made by less qualified entrepreneurs. Thus, the strategy overcomes the bottleneck of entrepreneurial ability. The theory gives no hints as to how the attitude of entrepreneurs and their institutional influence will be changed in time.

Theory of Stages of Growth

This theory tries to explain the long-term processes of economic development from the point of view of economic history by describing five ideal types of stages through which all societies pass:

- ‘Traditional Society Stage’

The ‘traditional society’ has more than 75 per cent of the population engaged in food production, and political power is in the hands of landowners or of a central authority supported by the army and the civil servants.

- ‘Transitional Stage’

The ‘transitional stage’ creates the preconditions for take-off by bringing about radical changes in the non-industrial sectors. Export of raw material gains momentum; a new class of businessmen emerges; and the idea of economic progress coming from outside spreads through the elite.

- ‘Take-off Stage’

The ‘take-off stage’ brings a sharp increase in the rate of investment in the per capita output. This stage of industrial revolution is accompanied by radical changes in the production techniques. Expansion takes place in a small group of leading sectors at first and, on the social side, is accompanied by the domination of the modern section of society over the traditional one.

- ‘Drive to Maturity stage’

The ‘drive to maturity’ brings a spread of growth from the leading to the other sectors and a broader application of modern technology followed by necessary changes in the society at large.

- ‘Stage of High Mass Consumption’

The ‘stage of high mass consumption’ can be reached after attaining a certain level of national income and formulating an economic policy giving priority to increased private consumption. The critical phase for development is the ‘take-off stage’ during which net investment rates have to increase from 5 to 10 per cent of the national product and during which the political, social, and institutional framework has to be built in order to reach a situation of selfsustained growth. The financial resources must be accumulated internally by higher saving rates. Income distribution favoring classes and strata which are willing and able to use capital more productively than others has the same effect.

- ‘Big-push’ Theory

This theory is an investment theory which stresses the conditions of take-off. The argumentation is quite similar to the balanced growth theory but emphasis is put on the need for a big push. The investments should be of a relatively high minimum in order to reap the benefits of external economies. Only investments in big complexes will result in social benefits exceeding social costs. High priority is given to infrastructural development and industry, and this emphasis will lead to governmental development planning and influence.

- Theory of Development Poles

The promotion of regional development centers will serve as focal point and incentive for further development. Such a regional concentration helps to reap the benefits of technological external economies and makes the growth centre attractive to entrepreneurs, thus initiating further development. This theory is a sort of ‘regional unbalanced growth theory’ which uses temporary regional imbalances to initiate development. Little attention is given to the process which is necessary to ensure a spread or linkage from the centers to the hinterland without which the poles may transform the economy of the region into a dual economy.

- Theory of Circular Causation

This theory opposes the strategy of development poles because social systems and economic processes do not develop towards equilibrium but, on the contrary, factors tend to cumulate to positive or negative cycles. In principle, the theory is a negation of the monocausal explanation of problems of developing countries by economic factors alone. Rather, in a comprehensive way, all social relations have to be incorporated.

At national level—different stages of development between regions—as well as international level—trade between industrialized and developing countries—differences tend to increase because of the spread effects in the more developed areas and modern sectors and

backwash effects in backward areas and traditional sectors. For instance, industrial import goods are in competition with traditional crafts; terms of trade deteriorate; capital is being transferred, etc.

The direction of processes depends on the initial situation and the factors causing the change. Under the conditions in developing countries, increased regional dualism often is a consequence of such processes of circular causation.