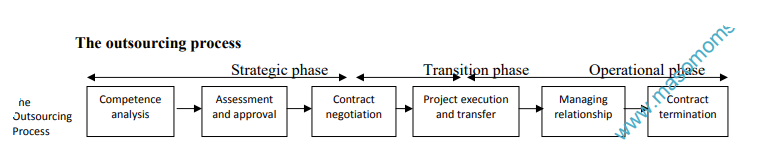

During the strategic phase three essential questions have to be answered:

- The question relates to the objective of the firm with regard to its intent to outsource a certain activity.

- what activities are considered for outsourcing.

- what qualifications a supplier should be able to meet in order to qualify as a potential future partner for providing the activity concerned must be answered. The decision to outsource should support and enable the company’s overall strategy. The motives that are cited most are:

1. Focus on core competence.

2. Focus on cost efficiency/effectiveness and

3. Focus on service

This motives and that strategy of the outsourcing company should be aligned. These three motives and the outsourced activities should contribute to this strategy. The second question relates to what should be outsourced. Two important approaches are used to answer this question;

- The transaction cost approach and

- The core competence approach.

The transaction cost approach is based on the idea of finding a governance structure aimed at arriving at the lowest cost possible for each transaction that is made. Transaction cost is defined as the costs that are associated with an exchange between two parties.

The assumptions of the transaction costs approach is that an exchange with an external party is based upon a contract. The (potential) costs associated with establishing, Monitoring and enforcing the contract, as well as the costs associated with managing the relationship with the external party, are all considered to be part of the transaction costs as well as the costs associated with the

transaction itself. Therefore all of these costs should be taken into account when deciding between make or buy options.

The level of the transaction costs depends upon three important factors. These factors are:

- frequency of the transaction,

- the level of the transaction specific investments and

- the external and internal uncertainty.

The frequency of the transaction is an important factor because the more frequently exchanges occur between partners, the higher the total costs that are involved. The level of the transaction specific investments also determines the level of transaction costs, because transaction-specific investments are investments that are more or less unique to a specific buyer-supplier relationship.

Examples are investments in specific supplier tooling (such as molds and dies) by a large automotive manufacturer and the change costs involved when choosing a new accountant (internal staff need to get accustomed to the new accountant, the new accountant needs to be thoroughly briefed to get acquainted with the company etc.). These examples show that investments are made

in assets as well as in human capital. Obviously the higher these investments are, the higher the transaction cost will be. The last factor that determines the transaction costs is the external and internal uncertainty. Uncertainty is a normal parameter in the decision-making process. It can be defined as the inability to predict contingencies that may occur. The higher these uncertainties, the

more slack a supplier wants to have in presenting his proposal and rates, and the more difficult it will be to make a fixed price or lump sum contract that deals with all uncertainties beforehand.

Therefore, the higher the level of uncertainty, the higher the transaction costs will be. The other approach on which an outsourcing decision can be based is the core competence approach. This theory is based, among others, on the work of Quinn and Hilmer (1994). The core competence approach is based on the assumption that, in order to create a sustainable competitive advantage, a company should concentrate its resources on a set of core competencies where it can achieve definable pre-eminence and provide a unique value for customers … (hence it should) strategically outsource all other activities’ (Quinn and Hilmer, 1994 p43). The important question

to be answered here is what are the firm’s core competence. Characteristics of core competence are;

- Skills or knowledge sets, not products or functions

- Flexible, long term platforms that are capable of adaptation

- Limited in number; generally two or three

- Unique sources of leverage in the value chain

- Areas where the company can dominate

- Elements important to the customer in the long run

- Embedded in the organization’s system

The competencies that satisfy these requirements are the core competencies and provide the firm with its long-term competitive advantage. These competencies must be closely protected and are not to be outsourced. All other activities should be procured from the markets if these markets are totally reliable and efficient.

Long and Vickers-Koch (1992) distinguish five categories of a firm’s activities, instead of two categories, core or non-core, (Quinn and Hilmer 1994). These five categories are;

- Cutting edge activities. The activities that determine the competitiveness of the organization from a long term perspective.

- Core activities. The activities that create the foundation and main process for the organization and its possible competitive advantages.

- Support activities. Those activities that are directly connected to the core competences.

- Separate activities. The activities that are part of the main process, but easily separated from that process and not related to the core competences.

- Peripheral activities. The activities that do not concern the main process. Anorld (2000) also makes a further distinction in a firms activities. He distinguishes between:

- Company core activities. Activities that are directly to the core activities.

- Close-core activities. The activities that are directly related to the core activities.

- Core distinct activities. The supporting activities.

- Disposable activities. Activities with general availability.

Both studies imply that the outsourcing decision framework based upon the work of Quinn and Hilmer (1994) needs adjustment. Anold (2000) has developed a general model for whom the function should be outsourced. After the decision to outsource has it is essential that the right supplier is chosen. A suppler has to be selected who has the necessary technical and managerial

capabilities to deliver the expected and required level of performance. Also the supplier should be able to understand and be committed to these requirements.

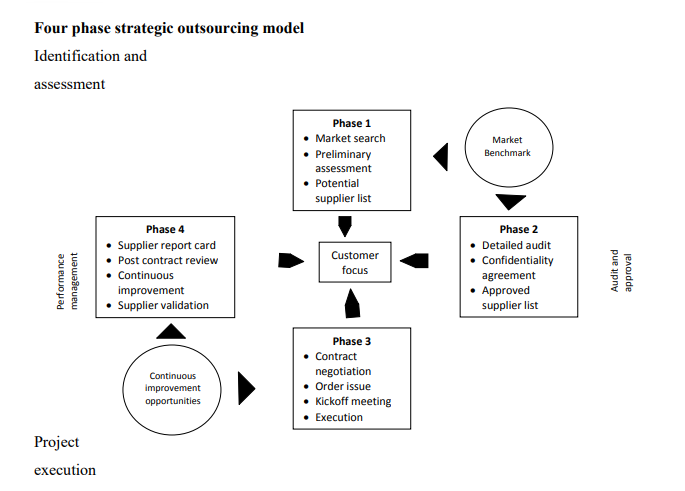

The supplier selection process is key to the success of the buyer-supplier relationship. Companies that make extensive use of supplier selection and monitoring practices in supplier partnership seem to be more successful than the companies. An adequate supplier selection model is crucial for the success of the outsourcing decision. Momme and Hvolby (2002) present a four-phase model (figure below). This model gives guidance on how to identify, evaluate and select outsourcing candidates and therefore is an appropriate tool

to use in the strategic phase . it also gives a brief guidance for the transition (phase 2 and 3) and the operational phase (phase 4), but needs to be elaborated for that purpose.

After the strategic phase in which the outsourced activities and supplier have been identified, the transmission phase starts. The transition consists of the contract negotiation and the project execution and transfer. The most important issue in the contract negotiation in an outsourcing agreement is often the start of a long term relationship, so not only the contractual issues should be

dealt with but the people issues and the importance of a sound and cooperative relationship should be covered as well.

The contract is the legal basis for the relationship and is therefore the key document in the outsourcing process. It allows both organizations to maximize the rewards of the relationship, while minimizing the risk. This makes the outsourcing contact key success factor for the establishment of a strategic outsourcing relationship. The contract and the type of contract should reflect the business plan (the goal of the cooperation) the two parties have and should be seasonable for both parties.

There are different types of contracts. The type chosen depends on the characteristics and the scope of the contract and the functions or activities that are outsourced. After the transition phase has successfully ended, the operational phase of the outsourcing process

starts. This operational phase consists of two processes namely:

- Managing the relationship and

- Contract termination.

Managing the buyer-supplier relationship management is one of the, if not the critical stage in the outsourcing relationship. Achieving the goals of the outsourcing relationship is impossible without close cooperation. When the relationship is not properly managed the conditions for close cooperation will not be present and the outcome of the outsourcing relationship will be far from optimal.

The true value of outsourcing comes after the relationship has had time to develop and additional synergies have emerged. Creating a sustaining, long relationship with a supplier is exciting: it’s where the win-win is really beginning to show.

Many researchers have written on the characteristics of a successful buyer-supplier relationship.

The top five include

- the factors trust,

- flexibility,

- team approach,

- shared objectives and

- open communication.

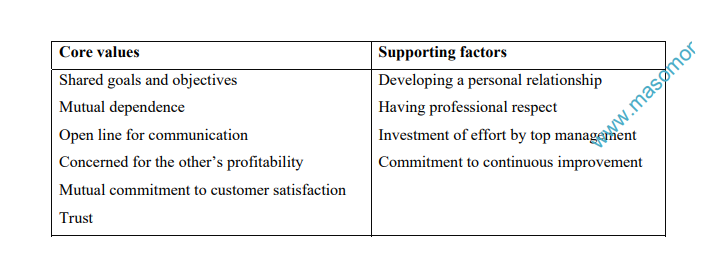

The factors found by McQuiston to be core to a successful outsourcing relationship are presented in the table below.