A business can be set up in two ways:

- Owner supplying all the resources

- Owner supplying some of the resources and the rest being supplied by outside parties.

The two cases bring out the accounting equation also called book- keeping equation

Case one: owner supplying all the resources

In this case we say thatResources in the business = Resources supplied by the owner…………… (i)

Resources in business are called assets and resources supplied by the owner are called capital

Therefore equation (i) can be re -written as-

ASSETS = CAPITAL

Case two: resources supplied by owner and outside parties

In this case we say that-

Resources in business = Resources supplied by the owner + Resources supplied by

out- side parties……………………………………………… (ii)

The new term in the equation is resources supplied by out side parties, in accounting, we call them liabilities.

Therefore equation (ii) can be re-written as-

ASSETS = CAPITAL + LIABILITIES……………………………………… (ii)

Components of accounting equations

Assets: An asset is a resource controlled by a business entity/firm as a result of past events for which economic benefits are expected to flow to the firm. An example is if a business sells goods on credit then it has an asset called a debtor. The past event is the sale on credit and the resource is a debtor. This debtor is expected to pay so that economic benefits will flow towards the firm i.e. in form of cash once the customers pays.

Assets are classified into two main types:

- Non current assets (formerly called fixed assets).

- Current assets.

Non current assets are acquired by the business to assist in earning revenues and not for resale. They are normally expected to be in business for a period of more than one year.

Major examples include

- Land and buildings

- Plant and machinery

- Fixtures, furniture, fittings and equipment

- Motor vehicles

Current assets are not expected to last for more than one year. They are in most cases directly related to the trading activities of the firm. Examples include:

- Stock of goods – for purpose of selling.

- Trade debtors/accounts receivables – owe the business amounts as a resort of trading.

- Other debtors – owe the firm amounts other than for trading.

- Cash at bank.

- Cash in hand.

Liabilities: These are obligations of a business as a result of past events settlement of which is expected to result to an economic outflow of amounts from the firm. An example is when a business buys goods on credit, then the firm has a liability called

creditor. The past event is the credit purchase and the liability being the creditor the firm will pay cash to the creditor and therefore there is an out flow of cash from the business.

Liabilities are also classified into two main classes.

- Non-current liabilities (or long term liabilities)

- Current liabilities.

Non-current liabilities are expected to last or be paid after one year. This includes long-term loans from banks or other financial institutions. Current liabilities last for a period of less than one year and therefore will be paid within one year.

Capital: This is the residual amount on the owner’s interest in the firm after deducting liabilities from the assets.

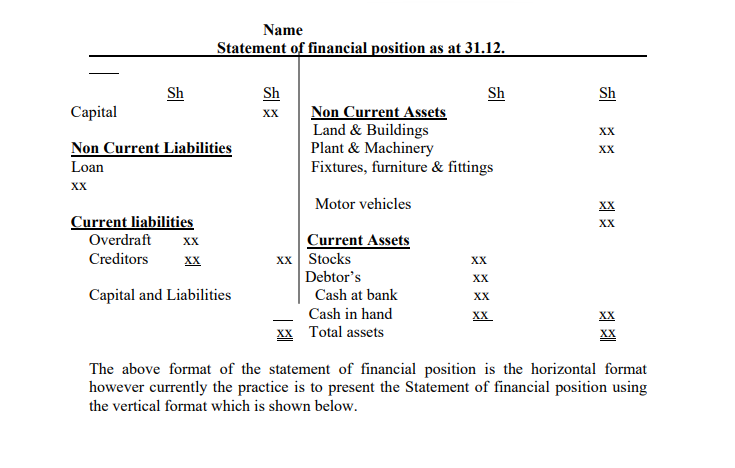

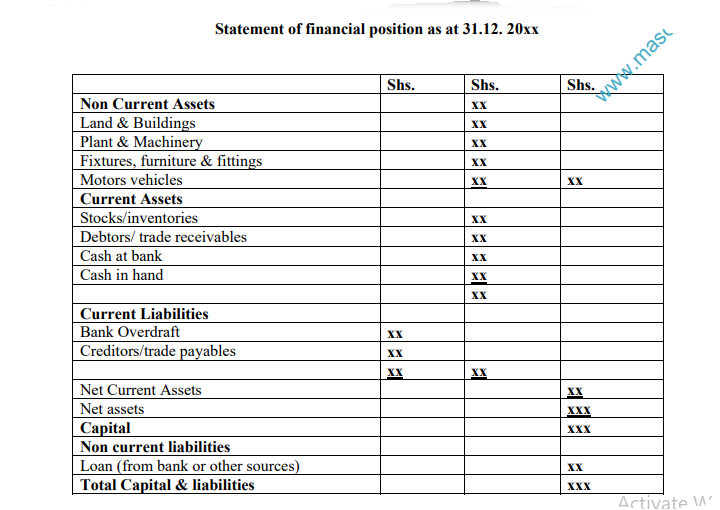

The Accounting equation can be expressed in a simple report called the Statement of financial position (formerly, balance sheet). The basic format is as follows:

Pay attention to the format. The non current assets are listed in order of permanence as shown i.e. from Land and Buildings to motor vehicles. The current assets are listed in order of liquidity i.e. which asset is far from being converted into cash. Example, stock is

not yet sold, (i.e. not yet realised yet) then when it is sold we either get cash or a debtor (if sold on credit). When the debtor pays then the debtor may pay by cheque (cash has to be banked) or cash.

The current liabilities are listed in order of payment i.e. which is due for payment first. Bank overdraft is payable on demand by the bank, then followed by creditors. Note that in the vertical format, current liabilities are deducted from current assets to give net current assets. This is added to Non Current assets, which give us net assets. Net assets should be the same as the total of Capital and Non Current Liabilities.