WEDNESDAY: 1 September 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated.

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

Assume that the following rates of tax applied throughout the year of income 2020:

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 24,000 1 – 288,000 10%

24,001 40,667 288,001 – 488,000 15%

40,668 57,334 488,001 – 688,000 20%

Excess over 57,334 Excess over – 688,000 25%

Personal relief Sh.2,400 per month (Sh.28,800 per annum).

QUESTION ONE

1. Public funds established by the Constitution are usually managed by the National and County governments.

Required:

Identify three types of funds managed by the national government. (3 marks)

Identify two types of funds managed by the county government. (2 marks)

2. Outline four functions of a County Treasury as provided in the Public Finance Management Act. (8 marks)

3. Citing seven reasons, justify why an accounting officer of a procuring entity might, at any time, prior to notification of tender award, terminate or cancel procurement or asset disposal proceedings without entering into contract as provided under the Public Procurement and Asset Disposal Act. (7 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following attributes that must be considered when preparing a national budget:

Periodicity. (2 marks)

Predictability. (2 marks)

Comprehensiveness. (2 marks)

2. Identify four types of reports that the Controller of Budget is required to prepare in relation to Public Finance Management. (4 marks)

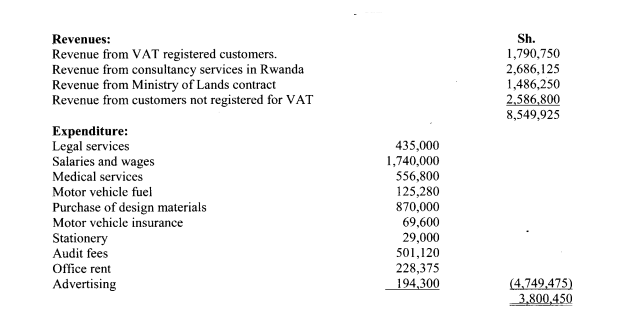

3. S and M Associates is a firm of Surveyors registered for value added tax (VAT) purposes.

In the month of March 2021 the firm made the following transactions:

Additional information:

- VAT withheld by withholding VAT agents was Sh.120,000 during the month.

- Motor vehicle insurance relates to the motor vehicle’s annual premiums for comprehensive insurance.

- Transactions are inclusive of VAT at the rate of 16% where applicable.

Required:

Prepare a VAT account for the month of March 2021 showing the VAT payable or refundable. (10 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain three activities that constitute tax evasion in your country. (6 marks)

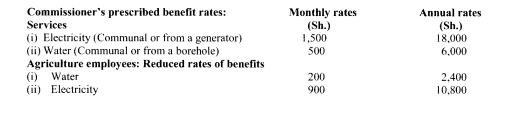

2. Maxwel Bewa was employed as an accountant by Okoa Micro-finance Ltd. on a three-year contract commencing on 1 April 2020.

He has provided the following information relating to his employment income for the year ended 31 December 2020.

- Basic salary of Sh.175,000 per month (PAYE Sh.48,000 per month)

- He enjoyed free medical treatment under a senior employees medical scheme operated by the company, which was assessed at Sh.250,000 during the year.

- He received goods worth Sh.140,000 from the company for personal use.

- He was provided with a company car which had cost Sh.1,750,000. The car had a cc rating of 2,000 and it was under a maintenance plan where the company paid all operating costs of Sh.220,000 during the year.

- He was provided with a furnished house in Alpha Estate where rent for similar houses was Sh.45,000 per month. The house had been furnished at a cost of Sh.850,000.

- He was sponsored for a seminar on Accountancy by the employer at Sh.180,000, 10% of this cost was for private entertainment.

- He contributes 5% of his basic pay to a registered pension scheme while the employer contributes an equal amount for him.

- He employed a night watchman on 1 August 2020 at a monthly salary of Sh.25,000. The employer pays half of the monthly salary.

- The employer paid Sh.320,000 as school fees for his children studying abroad on commencement of his employment contract. This amount was recovered from Bewa’s income during the year.

- He was nominated for an award of the employee of the year on 31 December 2020. This award carried a cash

- gift of Sh.250,000 and a bonus of Sh.180,000.

- Life insurance premium paid for him by the employer for the period 1 April 2020 to 31 December 2020 was Sh.80,000.

- As part of the terms of his employment, he was paid a holiday allowance of Sh.120,000 for his holiday to a foreign destination and back home.

Required:

Total taxable income of Maxwel Bewa for the year ended 31 December 2020. (12 marks)

Tax liability (if any) from the income computed in (b) (i) above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. The Finance Act, 2020 introduced a tax known as minimum tax which shall be payable regardless of whether a taxpayer will have taxable profits or not.

With reference to the above statement, identify four types of income that are not subject to minimum tax. (4 marks)

2. Explain two ways in which the Revenue Authority in your country might prevent loss of tax revenue from imports. (4 marks)

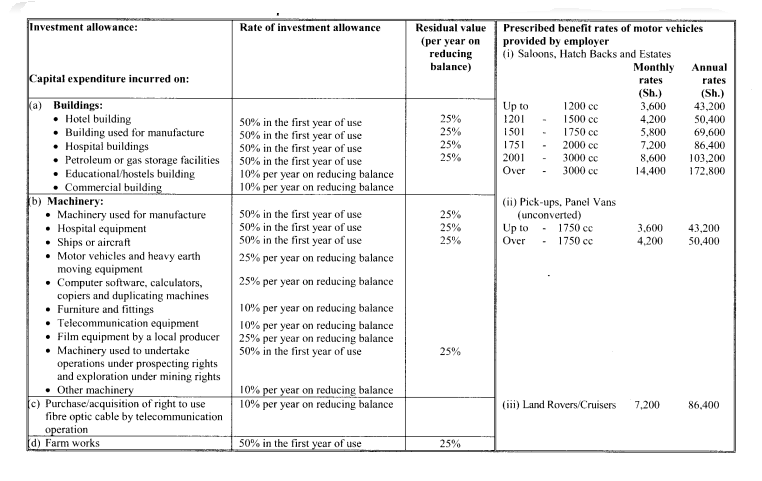

3. Lulu Ltd. commenced manufacturing operations on 1 May 2020 after having incurred the following capital expenditure:

Sh.

Factory building (note 1) 20,600,000

Processing machinery 4,800,000

Factory parking bay 1,640,000

Sewerage system 560,000

Industrial effluent treatment plant 2,400,000

Additional information:

- Factory building included the following: Sh.

- Cost of land 4,400,000

- Godown 800,000

- Showroom 520,000

- Offices 600,000

- Retail shop 400,000

- On 1 July 2020, the following capital expenditures were incurred:

Sh.

Photocopier 60,000

Computers 150,000

Motorbike 96,000

Saloon car 3,400,000

Forklift 720,000

Furniture 240,000

Pick-up 920,000

Scanners 56,000

Tractor 1,700,000

Carpets 36,000

- The company imported a portable weighting machine on 1 September 2020 at a cost of Sh.480,000 inclusive of duty of Sh.20,000. The duty was waived by the government.

Required:

Investment allowances due to the company for the year ended 31 December 2020. (12 marks)

(Total: 20 marks)

QUESTION FIVE

1. Discuss four ways in which taxation could be applied to achieve fiscal policy objectives of a developing economy. (8 marks)

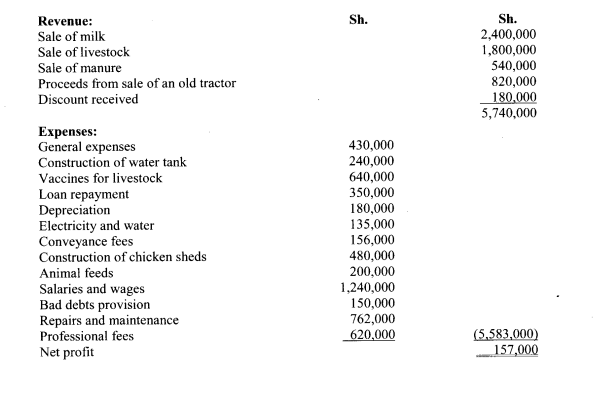

2. Mazao Ranch Ltd. practices mixed farming and milk processing.

The following is the company’s statement of profit or loss for the year ended 31 December 2020:

Additional information:

- Farm works acquired on 1 July 2020 comprised the following:

Sh.

Granary 420,000

Labour quarters 1,200,000

Cowshed 160,000

- General expenses include: Sh.

Subscriptions to Farmers Association 96,000

Acquisition of a 50 year lease 180,000

Staff Christmas party 25,000

Parking fines 129,000

- Repairs and maintenance comprise: Sh.

Provision for fencing expenditure 145,000

Repairs to machinery 240,000

Other repairs 377,000

- Professional fees include Sh.500,000 paid with regard to pursuing a dispute with the Revenue Authority’s VAT department.

- Assume the corporate tax rate during the year was 25%.

Required:

Adjusted taxable profit or loss of Mazao Ranch Ltd. for the year ended 31 December 2020. (10 marks)

Tax payable (if any) on the profit or loss in (b) (i) above. (2 marks)

(Total: 20 marks)