WEDNESDAY: 19 May 2021.

Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated.

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

Assume that the following rates of tax applied throughout the year of income 2020:

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 – 24,000 1 – 288,000 10%

24,001 – 40,667 288,001 – 488,000 15%

40,668 – 57,334 488,001 – 688,000 20%

Excess over – 57,334 Excess over – 688,000 25%

QUESTION ONE

1. Summarise four functions of the National Assembly budget committee as per the Public Finance Management Act, 2012. (4 marks)

2. In managing the national government public finances, the National Treasury or such state organ in your country enforces certain fiscal responsibility principles in accordance with the Constitution and the Public Finance Management Act.

In relation to the above statement, explain four fiscal responsibility principles. (8 marks)

3. Citing their information needs, identify four users of the Consolidated Fund reports. (4 marks)

4. Highlight four responsibilities of a County Treasury with respect to county public funds. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Outline six functions of a disposal committee as provided under the Public Procurement and Asset Disposal Act 2015. (6 marks)

2. In a tax seminar, one of the facilitators noted. that “Most revenue authorities in developing countries are embarking on. tax base expansion programme to raise more revenue through identification of new taxpayers”.

With reference to the above statement, highlight four sources of information in regard to identification of new taxpayers. (4 marks)

3. The following summary of transactions were obtained from the books of Zawadi Ltd., a company registered for value added tax (VAT) for the month of October 2020:

Sh.

Sales at standard rate 1,480,000

Exports to a foreign country 364,000

Audit fees ‘7.8,300

Electricity bills 36,400

Imported raw materials 320,000

Purchases at standard rate 624,500

Exempt supplies 700,000

Catering services 94,000

Entertainment services 120,000

Telephone bills 28,000

Car parking services 50,000

Bottled drinking water for staff 64,000

Zero rated supplies (exports) 240,000

Repairs of motor vehicles – 76,200

Additional information:

- Sales at standard rate include goods valued at Sh.280,000 purchased at standard rate and sold at the same state.

- Imported raw materials was exclusive of freight charges of Sh.80,000 and insurance premium of Sh.40,000. Import duty rate was at 20%.

- A debtor was issued with a credit note for goods valued at Sh.48,000 and this had not been passed through the relevant daybook.

- The company issued debit notes valued at Sh.164,000 in respect to under invoicing of some customers.

- Repairs of motor vehicles include Sh.20,000 for fuels and oils supplied to the company.

Transactions are exclusive of VAT at the rate of 14% where applicable.

Required:

The VAT payable by or refundable to Zawadi Ltd. for the month of October 2020. (10 marks)

(Total: 20 marks)

QUESTION THREE

1. Propose four measures that the revenue collection agency in your country could employ to reduce instances of tax evasion. (4 marks)

2. Explain four grounds under which the commissioner might suspend or cancel a licence to manufacture excisable goods. (4 marks)

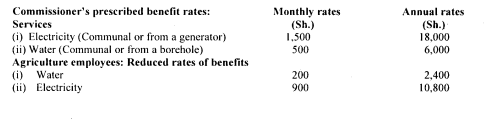

3.Benson Kapila is the manager for Daity Ltd., a company incorporated in Kenya. He has approached you to assist him in filing income tax returns for the year of income 2020. He has provided the following details relating to his income during the year:

- Basic salary per month (Net of PAYE of Sh.I 8,600 per month) Sh.61,400.

- He was provided with a house by the employer which was furnished at a cost of Sh.200,000.

- He is a member of a registered retirement pension scheme. His monthly contribution was Sh.30,000. The employer contributed Sh.32,000 per month.

- He was provided with a company car of 2000 cc whose cost as at 1 January 2019 was Sh.800,000.

- He was given per diem of Sh.10,000 for five days he was out of work station on official duties in the month of June 2020.

- He is a pensioner and received a monthly pension of Sh.35,000.

- He is a member of home ownership savings plan (HOSP) where he contributed Sh.16,000 per month up to 30 September 2020.

- On 1 October 2020, he moved to his own house which he acquired through a 12% mortgage loan of Sh.3,600,000.

- He has an education insurance policy for his children where he pays premiums of Sh.7,000 per month.

- He enjoyed free company products during the year whose value was estimated at Sh.56,000.

- The company gave him a 5% loan of Sh.2,000,000 on 1 December 2020 to assist in off-setting the mortgage loan. The market interest rate was at 12% per annum.

- The company paid him monthly telephone allowance of Sh.5,000.

- His other incomes included:

- Farming loss of Sh.140,000.

- Rental income (commercial building) Sh.96,000.

- Dividends (net of tax) of Sh.47,600 from Hazita Cooperative Society.

- Professional fees Sh.78,000.

Required:

Total taxable income for Benson Kapila for the year ended .31 December 2020. (10 marks)

Tax payable (if any) from the income computed under (i) above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

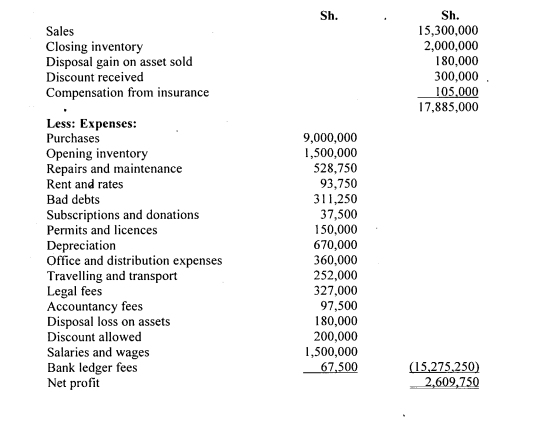

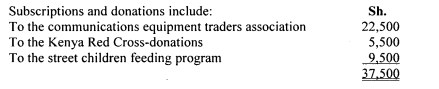

1. Excel Communications Ltd. is the regional dealer and distributor of communications equipment. They have provided you with the following statement of profit or loss for the year ended 31 December 2020:

Additional information:

- Insurance compensation is in relation to communications equipment stolen during the year while being shipped to a client.

- Office and distribution expenses comprise of the following: Sh.

Club membership fee subscriptions for employees 135,000

Private expenditure of directors 102,000

- 10% of the rent and rates relates to directors’ private residences.

- Legal fees include the following: Sh.

Renewal of lease — 100 years 45,000

Staff employment contracts 60,000

Counterfeit equipment suit in the High Court 87,000

Debt collection 50,000

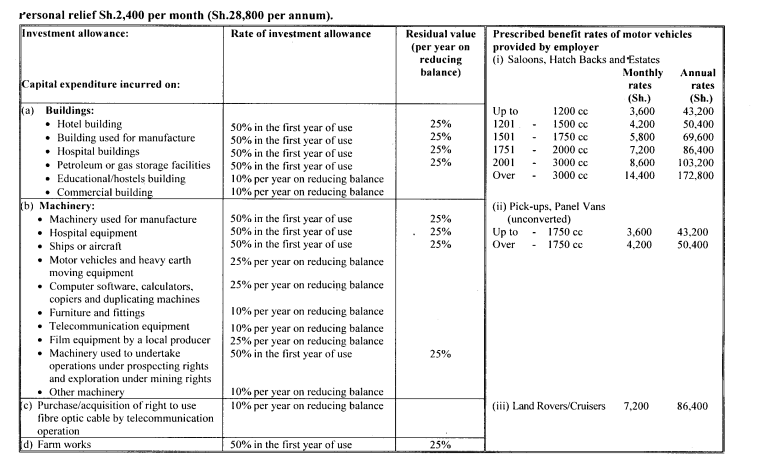

- Capital deductions have been agreed at Sh.645,000 with the Commissioner of Domestic Taxes.

- Bad debts include an increase in general provision for bad debts of Sh.21,250.

- Salaries and wages include directors emoluments of Sh.500,000.

- Repairs and maintenance includes the cost of erecting a signboard outside the dealership shop of Sh.28,750.

Required:

Excel Communications Ltd. taxable profit or loss for the year ended 31 December 2020. (9 marks)

The tax payable (if any) on the profit or loss computed in (i) above. (1 mark)

2. Plasticom Ltd. is a company established in year 2020 to manufacture plastic products. Before commencing its operations on 1 May 2020, the company incurred a total of Sh.8,760,000 in construction of a factory building which included:

Cost (Sh.) Date of first use

Godown 320,000 1 July 2020

Showroom 240,000 1 September 2020

Administration offices 680,000 1 October 2020

Additional information:

- The following assets were constructed or purchased and utilised with effect from 1 July 2020:

Cost (Sh.)

Water pump 540,000

Labour quarters 920,000

Processing machinery 2,600,000

Tractor 1,800,000

Scanners 320,000

Two saloon cars 7,000,000

Mobile forklift 1,500,000

Computers 250,000

Power transformer 820,000

Office cabinets 180,000

Boilers 960,000

Bridge (connecting the factory to main road) 1,200,000 –

- The following costs were incurred by the company on 1 September 2020:

Cost (Sh.)

Sinking a borehole 720,000

Construction of a parking bay 630,000

- One of the computers traded in on 10 November 2020 for a new one costing Sh.68,000. The trade in value was Sh.40,000 and the balance was settled in cash.

- The company constructed a Sports Pavilion and additional staff quarters during the year at the cost of Sh.890,000 and Sh.1,200,000 respectively.

These structures were utilised from 1 October 2020.

Required:

Investment allowances due to Plasticom Ltd. for the year ended 31 December 2020. (10 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain four reasons for the declining trend in tax revenue in most developing countries. (4 marks)

2. Summarise four objectivessof fiscal policies in your country. (4 marks)

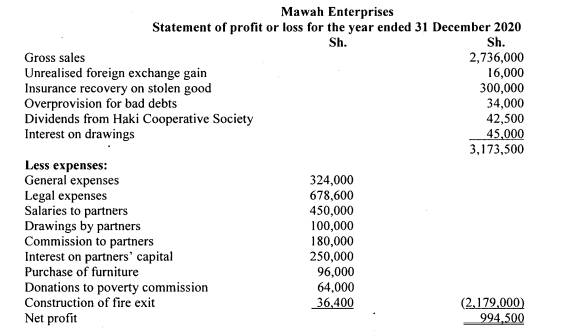

3. Mark and Wanguh are in a trading partnership operating as Mawah Enterprises and sharing profits or losses in the ratio of 2:3 respectively.

The following statement of profit or loss was prepared by the business for the year ended 31 December 2020:

Additional information:

- Gross sales include VAT at 14%. In addition, 10% of sales before VAT represents closing stock. The stock had been overstated by 20%.

- The amounts due to partners are to be apportioned according to profit or loss sharing ratios.

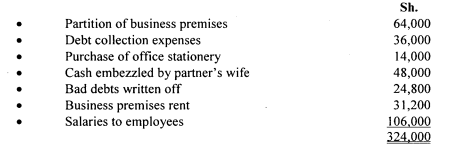

- General expenses comprise:

- Legal expenses include: Sh.

- Acquisition of patent rights 24,800

- Drafting of sales agreement 34,200

- Negotiating sales contract 60,000

- Defending the business against trade dispute 42,600

- Mortgage interest for Mark 140,000

- Defending partners against wrong tax assessment 94,600

- Conveyance fees for business premises 125,800

- Tax consultancy fees 72,500

- The purchases represent 40% of the gross sales figure Sh.2,736,000. The purchases had been understated by 25% and were omitted from the income statement.

Required:

Adjusted partnership statement of profit or loss for the year ended 31 December 2020. (8 marks)

The allocation of profit or loss computed in (i) above to each partner. (4 marks)

(Total: 20 marks)