FRIDAY: 17 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated.

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

Assume that the following rates of tax applied throughout the year of income 2020:

QUESTION ONE

1. Explain the term “pre-qualification procedure” as provided under the Public Procurement and Asset Disposal (PPAD) Act, 2015. (2 marks)

2. Outline six requirements that an accounting officer should set out when preparing an invitation to tender, as provided under the PPAD Act, 2015. (6 marks)

3. Discuss four roles played by the Council of Governors or its equivalent in county financial management. (8 marks)

4. The Public Private Partnership Act provides for the establishment of a fund referred to as public private prgject facilitation fund.

In relation to the above provision, outline four sources of revenue for the fund. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Outline two objectives of the Public Finance Management Act. (2 marks)

2. In a tax seminar, one of the facilitators noted that “most developing countries are currently experiencing escalating debt levels”.

With reference to the above statement, propose four measures that could be adopted to reduce the escalating public debt. (8 marks)

3. The following transactions were extracted from the books of Sabaki Enterprises Ltd. for the month ended 31 August 2021.The company is registered for value added tax (VAT) and deals in electronic appliances.

2 August: Purchased 16 digital television sets from Dubai Ltd. for Sh.58,000 each.

2 August: Sold 4 video cameras to the Ministry of Tourism for Sh.72,500 each.

4 August: Paid audit fees to Hekima and Associates CPA of Sh.34,800.

5 August: Sold 8 digital television sets to Mambo Restaurant in Uganda for Sh.I 30,500 each.

9 August: Purchased 10 slide projectors for Sh.104,400 each from Infor Tech Limited.

10 August: Purchased office stationery for Sh. I 7,400 and paid by cheque.

12 August: Sold 4 flashbulbs that had cost Sh.420,000 for Sh. 116,000 each.

16 August: Mambo Restaurant returned 2 television sets and was issued with a debit note of the equivalent amount.

19 August: Paid electricity bills amounting to Sh.40,600.

21 August: Sold 8 television sets to local customers for Sh.104,400 each.

24 August: Sold slide projectors for Sh.232,000 to Umoja Communications Ltd.

27 August: Paid Sh.58,000 for repairing the director’s motor vehicle.

28 August: Purchased electronic appliances from local suppliers for Sh.1,160,000.

30 August: Paid water bills of Sh.21,600 in cash for water supplied by the county water services board during the month.

The above transactions are stated inclusive of VAT at the rate of 16% where applicable.

Required:

The VAT payable by or refundable to Sabaki Enterprises Ltd. for the month of August 2021. ( 10 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the following tax assessments as provided under the Tax Procedures Act, 2015:

Default assessment. (2 marks)

Advance assessment. (2 marks)

Amendment of assessment. (2 marks)

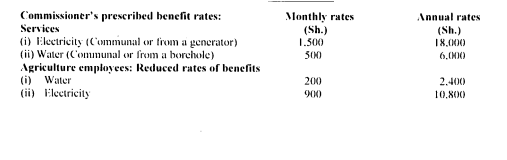

2. Alex Makali is an employee of Pengo Ltd. During the year of income 7020, he provided the following information to you to assist in filing of individual income tax returns:

- Basic salary of Sh.144,600 per month net of PAYE tax of Sh.19,600.

- He was provided with a land cruiser whose accumulated depreciation as at 1 January 2020 was Sh. 130,000 while the net book value was Sh.1,600,000.

- He was provided with a fully furnished house. The cost of the furniture was Sh.250,000. The house had a fixed telephone. The average telephone bill paid by the employer per month was Sh.6,000.

- On I September 2020, he moved into his own house which he had acquired through a 15% mortgage loan of Sh.4,000,000 on I May 2020.

- He is a member of a home ownership saving plan where he had contributed Sh.4,800 per month towards the scheme up to 30 April 2020.

- On 1 July 2020, he obtained a loan of Sh.2,400,000 from his employer at an interest rate of 7% per annum. During this period the Revenue Authority prescribed interest rate was 12% per annum.

- He was out of his workstation in the month of August for 10 days on official duty. The company paid him an out-of-pocket allowance of Sh.4,800 per day.

- His salary was increased with effect from I September 2020 by Sh.8,000 and back dated to I May 2020.

- The employer paid school fees for Alex Makali’s children amounting to S11.148.000. This expense was not taxed on the employer.

- He is a member of a registered retirement pension scheme where he contributed Sh.30,000 per month towards the scheme. The employer contributed a similar amount.

- His other incomes included:

- Dividends from Wali Cooperative net of tax of Sh.85,000.

- Rent income Sh.280,000 net of purchase of furniture Sh.40,000 and cost of advertising vacant houses for Sh.24,000.

- He secured a life insurance cover for his family of Sh.8,000 per month with effect from 1 October, 2020.

Required:

Total taxable income of Alex Makali for the year ended 31 December 2020. (12 marks)

Tax liability (if any) from the income computed in (i) above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Summarise four roles of the Senate Budget Committee in public finance matters as provided under the Public Finance Management Act, 2012. (4 marks)

2. Citing three reasons, justify the need for introduction of integrated customs management system (iCMS) or similar system in your country. (6 marks)

3. Kencoff Company Ltd. is a coffee manufacturing company that was incorporated on 1 January 2020. The company commenced its operations on 2 May 2020 after incurring the following expenditure.

Sh.

Factory land and building 82,000,000

Conveyor belts 6,200,000

Furniture and fittings 350,000

Farm labour quarters 4,800,000

Coffee milling machinery 4,200,000

Irrigation system 1 ,480,000

Borehole 2,360,000

Construction of gabions 1 ,120,000

Lorry (3.5 tonnes) 3,400,000

Fencing of the farm 780,000

Sh.

Farmhouse 2,620,000

Tractor 3,600,000

Godown 1,860,000

Factory perimeter wall 948,000

Delivery van 2,600,000

Trailer for tractor 520,000

Computers 720,000

2 Saloon cars (each costing Sh.3,300,000) 6,600,000

Sports pavilion 1,840,000

Additional information:

Included in the factory land and building is the cost of land valued at Sh.45,000,000.

- One of the saloon cars was disposed of during the year for Sh.2,200,000.

- The following assets were purchased on 1 August 2020:

Sh.

Office curtains 320,000

Fax machine 180,000

Water pump 560,000

Packaging machine 1,720,000

Required:

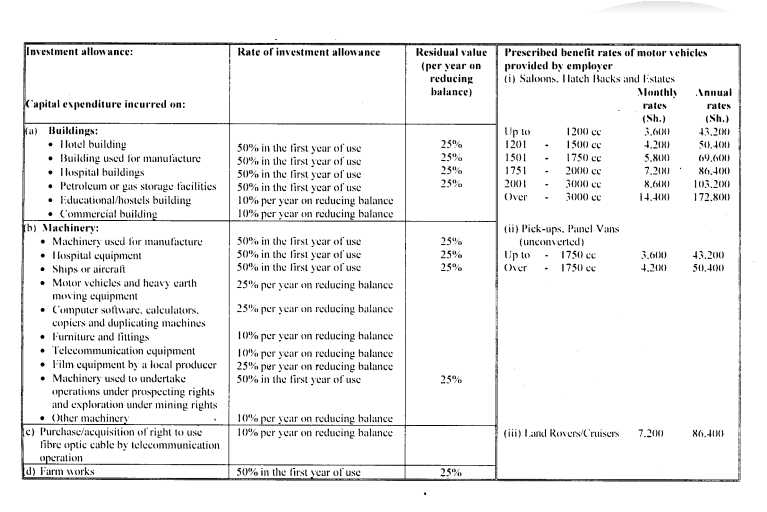

Investment allowances due to Kencoff Company Ltd. for the year ended 31 December 2020. (10 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the term “lottery” as used in taxation. (2 marks)

Explain the tax charges (if any) and the due date in relation to lottery. (2 marks)

2. Propose four ways through which taxpayers could engage in tax avoidance. (4 marks)

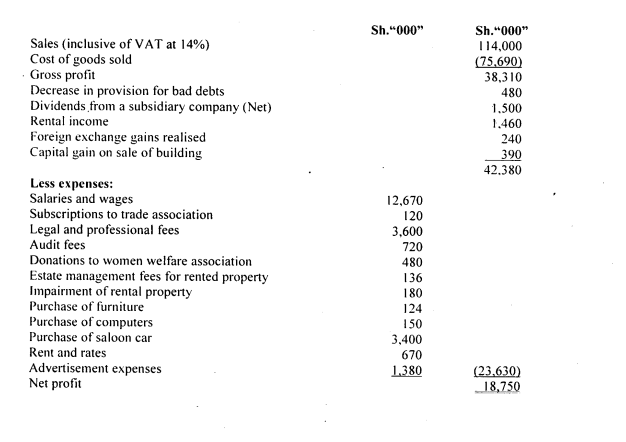

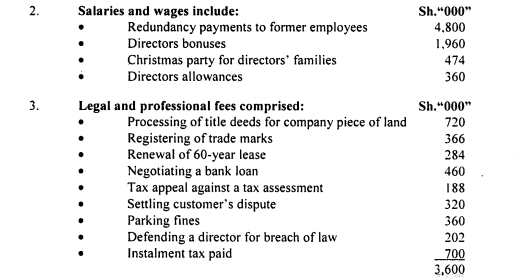

3. Patah Plc started trading on 1 January 2020. The following is the statement of profit or loss for the year ended 31 December 2020:

Additional information:

- Two thirds of the cost of goods sold comprised of purchases, which are overcast by 20%.

- Audit fees include Sh.124,000 for penalties for late filing of tax returns with the Revenue Authority.

- Advertisement expenses comprise; bill board for Sh.380,000, Neon sign Sh.240,000 and Sh.150,000 for hosting the company website.

- Purchases figure includes the cost of a forklift amounting to Sh.720,000 which was also inflated by 20%.

- Investment allowances were agreed with the Commissioner for Revenue Authority at Sh.2,840,000.

- The corporate tax rate during the year was 25%.

Required:

1. A statement of adjusted taxable profit or loss for the year ended 3 I December 2020. (10 marks)

2. Tax liability and amount payable (if any) on or before 30 April 2021. (2 marks)

(Total: 20 marks)