TUESDAY: 22 August 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

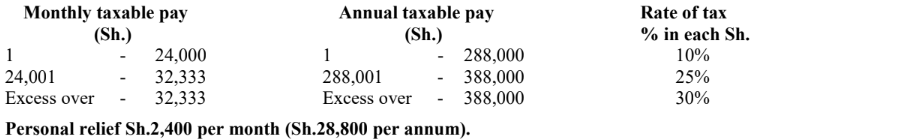

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2022.

QUESTION ONE

1. Explain the following terms as used in public finance management:

Equitable share. (2 marks)

Conditional grants. (2 marks)

Own source revenue. (2 marks)

2. The societal needs of most developing countries are mostly greater than the resources available to the government.

The countries must therefore develop a public financial management framework to act as a tool for guiding formulation and implementation of public policies so as to improve the welfare of the citizens.

In relation to the above statement, outline FOUR principles of public financial management regulations that govern all aspects of public finance in your country. (4 marks)

3. Summarise FOUR roles of the Senate as an oversight function in public finance management. (4 marks)

4. Discuss THREE parameters used by the Commission on Revenue Allocation in sharing revenue among county governments or their equivalent in your country. (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Developing countries face significant challenges in meeting their development objectives and at the same time ensuring that their debt levels remain sustainable. They are therefore, advised by the International Monetary Fund (IMF) and World Bank to develop a framework for Debt Sustainable Analysis that is country specific.

With reference to the above statement, analyse TWO objectives of conducting an annual debt sustainability analysis in your country. (4 marks)

2. According to the Public Procurement and Asset Disposal Act, 2015, the county treasury is required to establish a procurement function.

In relation to the above provision, outline SIX responsibilities of the county government procurement function. (6 marks)

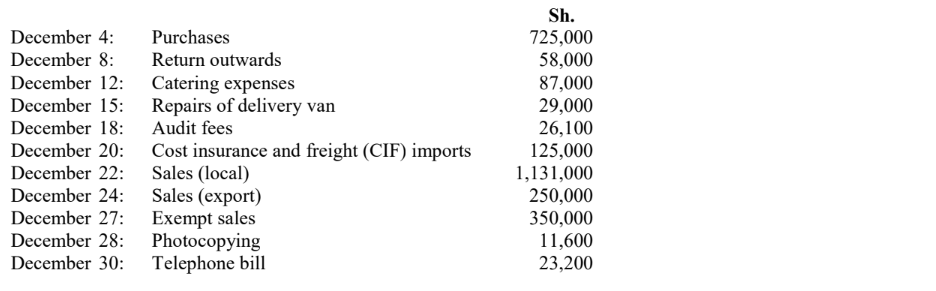

3. Baraka Traders has provided you with the following details in respect of transactions for the month of December 2022:

Additional information:

1. Input tax relating to goods sold as exempt sales could not be directly identified and it was found appropriate to restrict deductible input tax.

2. All transactions are inclusive of value added tax (VAT) at the rate of 16% where applicable.

3. Import duty is at 20% on cost, insurance and freight (CIF) basis.

4. A debtor of goods valued at Sh.50,750 was declared bankrupt on 15 December 2022.

Required:

Compute output tax. (2 marks)

Compute deductible input tax. (4 marks)

Determine VAT payable by or refundable to Baraka Traders. (2 marks)

Advise the management of Baraka Traders on the penalty applicable for late filing and late payment of VAT. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the term “export levy” as used in miscellaneous fees and levies. (2 marks)

2. Summarise FOUR roles that taxation policies of a country play in achieving budgetary objectives. (4 marks)

3. Solomon Chuchuh is employed as the Managing Director of Utamu Millers Ltd. During the year ended 31 December 2022, he presented the following information relating to his income:

1. His basic salary was Sh.120,000 per month net of PAYE of Sh.48,000 per month.

2. He was provided with lunch by the employees from 1 August 2022 of Sh.6,000 per month.

3. He enjoyed a medical allowance from the company which is only available to senior managers. The

allowance was Sh.12,500 per month.

4. The company paid for him Life Insurance premiums of Sh.4,800 per month for each member of his family from 1 September 2022. This included himself, wife and the daughter.

5. During the year, the employer paid a total of Sh.200,000 as school fees for his daughter. This amount was allowed in the company’s income statement.

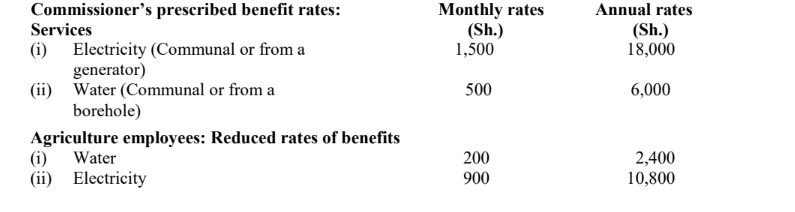

6. He was provided with a fully furnished house with electricity and water. The employer paid monthly rent of Sh.50,000 for the house and deducted 5% of his basic salary for rent. The cost of furniture was Sh.240,000 while the monthly electricity bill and water bill amounted to Sh.1,800 and Sh.1,000 per month respectively.

7. On 1 October 2022, the company provided him with the following:

• A land cruiser which was acquired at a cost of Sh.3,200,000 with an engine capacity of 3000cc.

• A house servant and a night watchman whose monthly salaries were Sh.12,500 and Sh.15,000

respectively. The fair market value was agreed with commissioner at Sh.14,000 per month for each

of them.

8. He contributed 15% of his monthly basic salary towards a registered pension scheme while the employer contributed 10% of his basic salary towards the same scheme.

9. Other incomes for the year include:

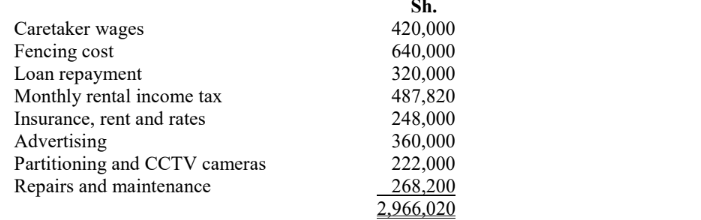

He has invested in the real estate and from his rental houses, he reported a net rental income of Sh.2,400,000 after deducting the following expenditure:

10. Dividend received from United Millers Co-Operative Society was Sh.306,000 net and interest received from Fanaka Bank Ltd. was Sh.240,000 net.

Required:

Compute the total taxable income for Solomon Chuchuh for the year ended 31 December 2022. (12 marks)

Determine tax payable (if any) from the income computed in (c) (i) above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Highlight FOUR factors that have contributed to the growth of Public Private Partnership (PPPs) arrangements in most developing countries. (4 marks)

2. Outline FOUR determinants of taxable capacity in your country. (4 marks)

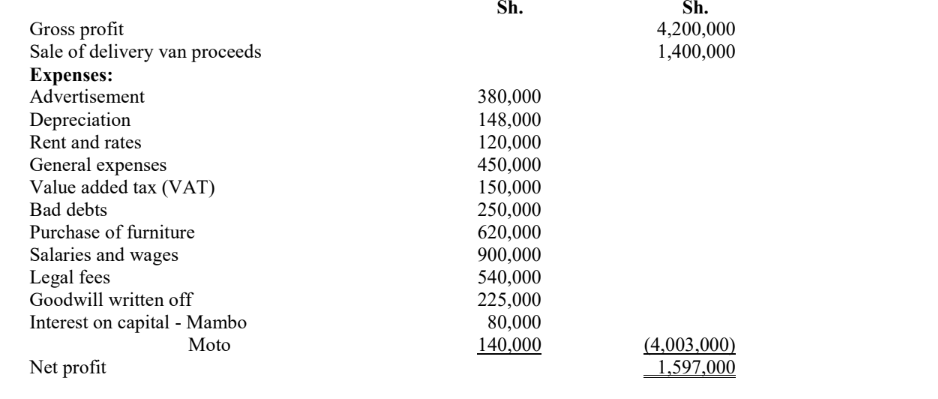

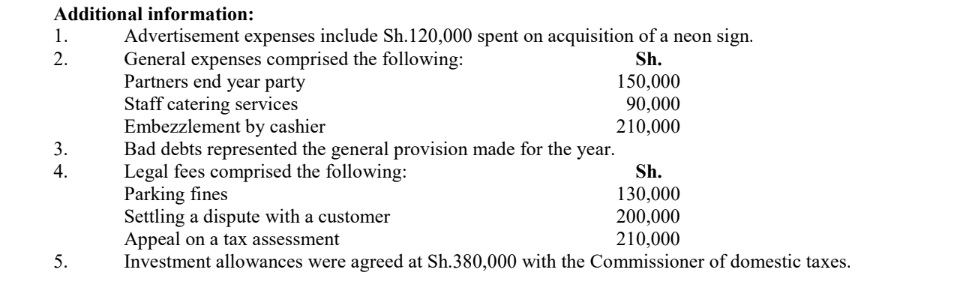

3. Mambo, Moto and Mutokah are in a partnership sharing profits and losses in the ratio of 2:1:1 respectively.

Their statement of profit or loss for the year ended 31 December 2022 was as follows:

Required:

Prepare adjusted taxable profit or loss of the partnership for the year ended 31 December 2022. (7 marks)

The allocation of the taxable profit or loss in (c) (i) above to the partners. (2 marks)

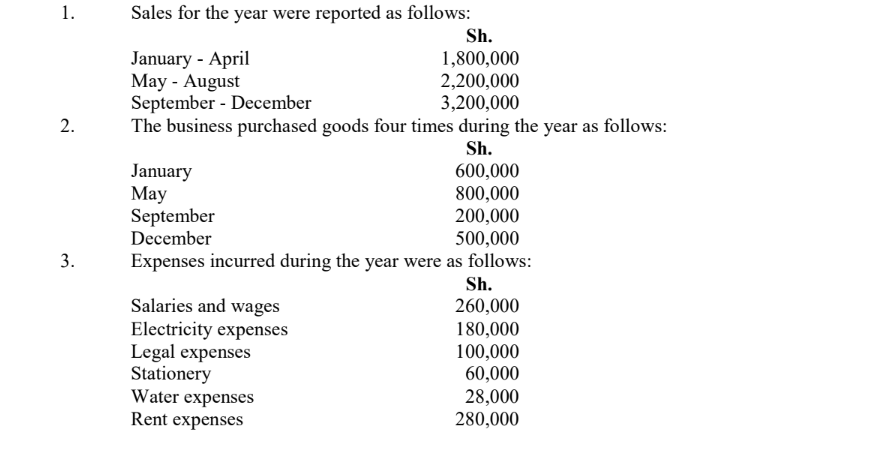

4. Bright Traders is a small business in the Jua Kali sector. The following information has been presented to you for the year ended 31 December 2022:

The proprietor of Bright Traders is not conversant with turnover tax requirements and has approached you to advise him on whether the business is liable to turnover tax and if so, the amount of tax payable for the year ended 31 December 2022.

Required:

Using the information provided above, advise the proprietor of Bright Traders on his turnover tax position and turnover tax liability (if any). (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. Following the convergence of market economies, most business transactions currently take place through the digital market place. Most countries have come up with ways of taxing the digital economy, although some countries continue to struggle in taxation of this economy.

With reference to the above statement, suggest FOUR challenges faced by your country in taxing the digital economy. (4 marks)

2. Section 17 of the Excise Act empowers the commissioner to consider an application for excise license and either grant or refuse to issue the applicant with the license.

Identify THREE instances in which the commissioner may refuse to grant an excise license to the applicant. (3 marks)

3. Sky Rift Growers Ltd. was incorporated in the year 2021, but commenced agribusiness on 1 January 2022.

The statement of profit or loss for the company for the year ended 31 December 2022 was as follows:

Additional information:

1. The company’s main activity is growing flowers for local and export market.

2. The company has leased the land on which it grows flowers from Enkalop Roses Ltd. One of its shareholders,

Enkalop Roses Ltd. owns 25% of the share capital in Sky Rift Growers Ltd.

3. Donations were made to the National Flowers Council to support its activities.

4. The loss on sale of investment relates to sale of shares that Sky Rift Growers Ltd. held in a quoted company.

5. Bad debts comprise: Sh.

General provision 220,000

Specific provision 240,000

6. The surplus from pension scheme arose after an actuarial valuation was carried out by a firm of actuaries.

7. Dividend income was received from Enkalop Roses Ltd.

Required:

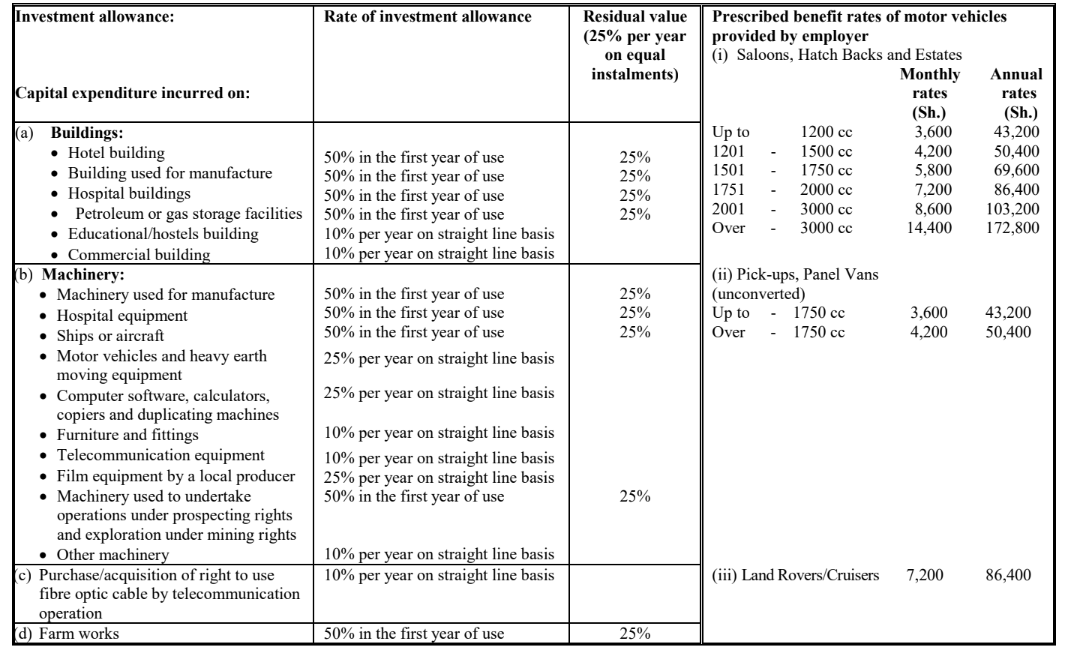

Compute the investment allowances due to Sky Rift Growers Ltd. for the year ended

31 December 2022. (5 marks)

Compute total taxable income for the company for the year ended 31 December 2022.

(7 marks)

Determine the tax liability due to the company for the year ended 31 December 2022. (1 mark)

(Total: 20 marks)