TUESDAY: 25 April 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2022.

Personal relief Sh.2,400 per month (Sh.28,800 per annum).

QUESTION ONE:

1. Explain the following terms as used in division and sharing of revenue in relation to the public finance management:

- Vertical (2 marks)

- Horizontal (2 marks)

2. Outline FIVE different entities whose accounts the Auditor General is required to audit and report within six months after the end of each financial year as provided in the constitution of Kenya, (5 marks)

3. Identify FIVE matters that are included in the budget estimates submitted to the County Assemblies by the County Executive Committee members for finance in respect of the budget for every financial (5 marks)

4. In a public finance workshop, one of the facilitators noted that “public debt in most developing countries are at high level and could slowly be approaching distress levels”.

With reference to the above statement, summarise SIX measures that could be taken to mitigate the level of increasing public debts. (6 marks)

(Total: 20 marks)

MASOMO MSINGI PUBLISHERS APP – Click to download and access past paper answers in PDF

QUESTION TWO

1. Explain the term “electronic reverse auction” as used in Public Procurement and Asset Disposal Act, (2 marks)

2. Summarise FOUR benefits of applying e-procurement in the public (4 marks)

3. The Public Private Partnership (PPP) Act establishes the public private partnership project facilitation fund as a mechanism for financing the PPP Highlight FOUR sources of funds deposited into this fund. (4 marks)

4. Hyrax Stores deals in a variety of vatable and non-vatable goods. The following transactions took place during the month of January 2023:

January 2: Sold goods on credit to Kikoi Traders for Sh.800,000.

January 3: Purchased goods on cash basis from Riverroad Traders for Sh.196,000. January 5: Purchased electronic tax register for Sh.150,000 and paid by cheque.

January 7: Kikoi Traders returned goods valued at Sh.60,000 and received a credit note. January 9: Sold goods to JB Ltd., a company based in Uganda for Sh.300,000.

January 12: Paid electricity bills amounting to Sh.16,000.

January 14: Received a debit note of Sh.48,000 from Riverroad Traders. January 18: Purchased office stationery for Sh.36,000

January 20: Supplied goods to Ministry of Trade valued at Sh.1,600,000.

January 21: Imported goods from Dubai for Sh.800,000 exclusive of import duty at the rate of 25% and value added tax at the rate of 16%.

January 24: Purchased fuel for business vehicles for Sh.150,000. January 28: Paid Sh.68,000 for catering services.

January 29: Paid Sh.45,000 for audit services

Transactions are stated exclusive of VAT at the rate of 16% where applicable.

Required:

- A value added tax (VAT) account for the month of January (9 marks)

- Comment on the penalties and interest due where the VAT is not paid by Hyrax Stores on the due date. (1 mark)

(Total: 20 marks)

QUESTION THREE

1. Highlight THREE benefits of the Integrated Customs Management System (ICMS) in the administration of customs (3 marks)

2. Identify THREE activities that require a licence or registration by the commissioner before undertaking as per the excise duty Act (3 marks)

3. Oscar Ebala is employed as an IT Officer by County University. He reported the following details of his income and that of his wife for the year ended 31 December 2022:

-

- He was entitled to a basic salary of 1,200,000 per annum net of PAYE of Sh.250,000 per annum.

- The employer provided him with a motor vehicle of 2600cc that had cost 2,800,000, from 1 August 2022.

- Sitting allowance for attending the university meetings at the head office for the year amounted to 120,000 out of which 30% was in relation to reimbursement of travel costs incurred between the month of January 2022 to July 2022. This amount was paid in January 2023.

- The employer had provided him with a house within the university where he lived up to 30 June 2022. The market rental value of the house was Sh.45,000 per month and he contributed Sh.10,000 per month towards the

- On 1 July 2022, he moved to his residential house which he purchased using his savings from Home Ownership Savings Plan (HOSP) where he was contributing Sh.8,000 per month up to 30 June 2022. He also obtained a mortgage loan from Technology SACCO to top up the savings from For the 6 months up to 31 December 2022 he had paid Sh.360,000 (inclusive of interest Sh.100,000) for the mortgage loan. Half of this amount was reimbursed by the employer at year end.

- Technology SACCO paid him Sh.24,000 net as dividend on his shares and interest of Sh.48,000 gross on his

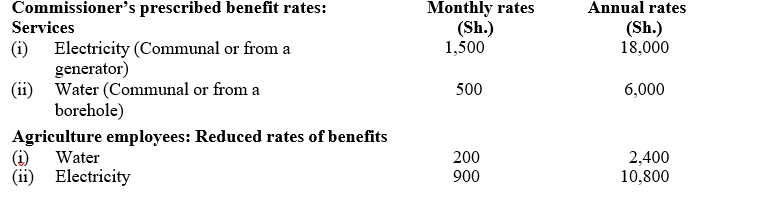

- The following deductions were made from his salary during the year:

Sh.

Family life insurance premiums 48,000

Subscription to ICT Association 16,000 Contribution to registered pension scheme 300,000

- He enrolled for an online Cyber Security Certification course in September 2022 and the employer paid his fee of 60,000.

- His wife Erica Ebala works for an IT Consultancy firm where she received a basic salary of 60,000 per month and other benefits from employment as follows:

- Medical allowance of 15,000 per month. The firm has a medical scheme for all senior employees only.

- She worked out of office for 7 days to install a Human Resource Management Software where she received a subsistence allowance of 7,000 per day.

- She attended a one week training on Artificial Intelligence Master The employer paid Sh.120,000 for the training.

Her other income comprised of:

- Part time IT Consultancy (Sh.120,000)

- Royalties on sale of literature books 95,000 net of tax at source.

- Oscar Ebala and his wife have a tradition of filing tax returns separately to the Revenue

Required:

- Compute the separate taxable income for Oscar Ebala and his wife for the year ended 31 December (10 marks)

- Determine tax payable (if any) on income computed in (c) (i) (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. Distinguish between a “single tax system” and a “multiple tax system”. (4 marks)

2. In a tax seminar, one of the facilitators noted that, “tax evasion has remained a major challenge for revenue authorities in most developing countries, in effort to achieve revenue collection target”.

With reference to the above statement, propose FOUR measures that could be applied to curb tax evasion. (4 marks)

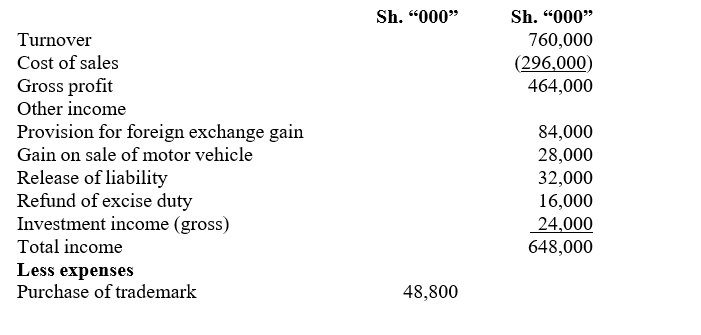

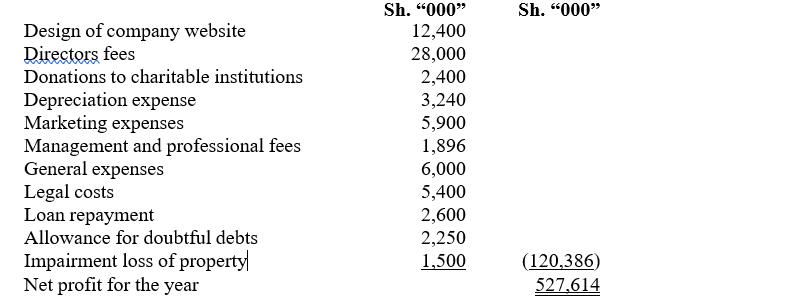

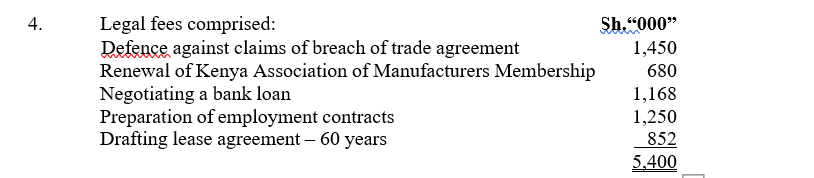

3. Zahari Processors presented the following statement of profit or loss for the year ended 31 December 2022:

Required:

Compute the total taxable profit or loss for Zahari Processors Ltd. for the year ended 31 December 2022. (12 marks)

(Total: 20 marks)

QUESTION FIVE

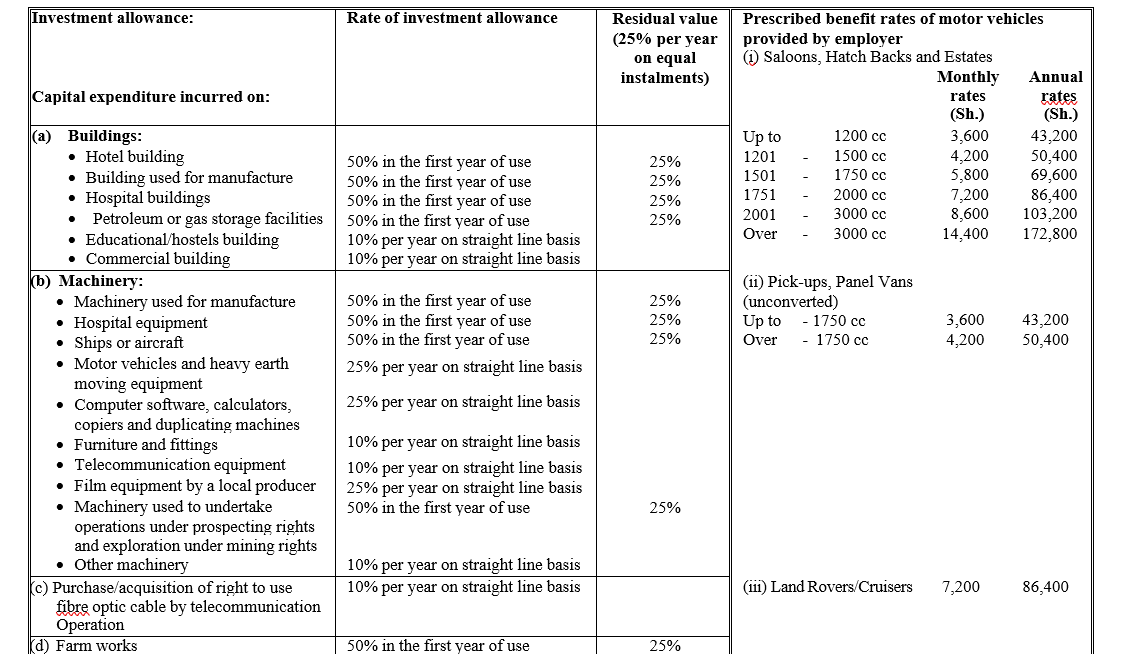

1. Explain the following terms as used in investment allowances:

- Trading (2 marks)

- Balancing (2 marks)

2. Describe THREE instances where a taxpayer is considered to have made self-assessment return, as provided under Section 28 of the Tax Procedures Act, 2015. (6 marks)

3. You have been provided with the following incomes from various sources. You are required to determine how much withholding tax is deductible from each source:

- Withdrawal of Sh.1,800,000 (gross) from a registered pension scheme by a resident who retired early in year 2022 at an age of 49 years after serving for 12 (2 marks)

- Royalties of 760,000 gross received by Janet Nikoye a popular Ugandan musician from sale of ringtone tunes in Kenya. (1 mark)

- Moses Patibhai received 68,000 (net) for placing bets on football from Shinda Pesa, a sports betting house. (1 mark)

4. Shebe Abdallah disposed of his property in September 2022 for Sh.18,500,000. The property consisted of a piece of land he had bought in 2007 for Sh.1,300,000. He had incurred legal costs of Sh.650,000 on its transfer in addition to stamp duty of Sh.13,000. He put up a hotel building at a cost of Sh.9,800,000 and was completed in 2008. A local politician laid claim to the property in Sheba Abdallah filed a suit against her and won having spent legal charges amounting to Sh.3,450,000 on the case.

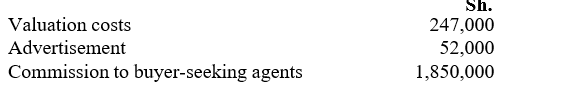

The following costs were incurred to dispose of the property:

Additional information:

- During the existence of the hotel business, the buildings had been allowed investment deductions amounting to Sh.740,000.

- The capital gains tax rate during the year was 5%.

Required:

- Compute the capital gains tax (CGT) if any payable by Shebe Abdallah on the disposal of his (5 marks)

- Citing a reason, identify which of the following forms Shebe will use to file returns on transactions in (d) (i) above

- CGT1

- CGT2P

- CGT3 (1 mark)