WEDNESDAY: 6 April 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

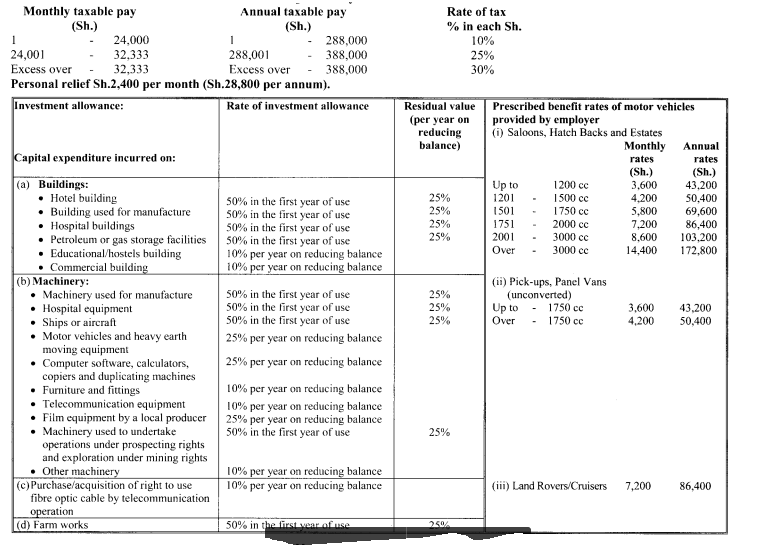

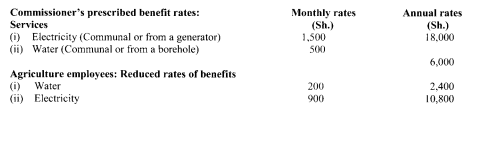

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2021.

Assume that the following rates of tax applied throughout the year of income 2021:

QUESTION ONE

1. Explain the term “consolidated fund” as used in public finance management. (2 marks)

2. Outline six criteria that a person should satisfy to be eligible to bid for a contract in procurement or an asset being disposed, as per the Public Procurement and Asset Disposal Act, 2015. (6 marks)

3. The internal audit function plays a vital role in public governance. In relation to public finance management, evaluate four roles of the internal audit department or similar agency in your country. (4 marks)

4. Citing four benefits, justify the need for Public Private Partnership (PPPs) arrangement in most developing countries. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. With reference to public finance management, distinguish between “planning” and “budgeting”. (4 marks)

2. Summarise five functions of the public debt management office. (5 marks)

3. The following transactions were extracted from the books of Intercity Ltd. for the month of January 2022.

The company is registered for value added tax (VAT) purposes:

Sh.

Sales to the local market 3,400,000

Sales to foreign market 5,000,000

Exempt sales 2,350,000

- Purchases and expenses incurred during the month were as follows: Sh.

Cash purchases 1,300,000

Credit purchases 2,250,000

Salaries and wages 1,800,000

Legal services 650,000

Stationery 720,000

Warehouse rent 400,000

Security services 680,000

Purchase of computers 120,000

- The above transactions are stated exclusive of VAT at the rate of 16%.

Required:

Determine deductible input VAT. (8 marks)

Output VAT. (2 marks)

VAT payable or refundable. (1 mark)

(Total: 20 marks)

QUESTION THREE

1. Explain the following terms as used in taxation:

Import declaration fee. (2 marks)

Catering levy. (2 marks)

2. Outline four items that should be specified in writing in the notification to the taxpayer, when the Commissioner has made an amended assessment. (4 marks)

3. John Wesonga is employed by Fadhili Ltd. as a Finance Manager. During the year of income 2021, he provided the following details relating to his income:

- Basic salary per month of Sh.182,500. Monthly PAYE deducted by the employer was Sh.47,200.

- He lives in a house provided by the employer and Sh.35,000 per month is paid by the employer to the landlord for the house. The employer furnished the house at a cost of Sh.180,000. The employer deducted 5% of his basic monthly salary during the year to cater for the house rent.

- He contributed Sh.15,000 per month to a registered pension scheme while the employer contributed Sh.10,000 for him per month towards the scheme.

- He was reimbursed Sh.250,000 for medical expenses incurred during the year. The medical scheme only covers employees earning more than Sh.100,000 per month.

- He was given Sh.45,000 as per diem for attending a 5-day seminar at Mombasa. This amount was to cater for his accommodation and meals.

- He has an education insurance policy for his children where he pays Sh.15,000 as premiums per month.

- He is entitled to an annual bonus of 5% of his annual basic salary. This bonus was paid in December 2021.

- Benefits provided to him by the employer during the year were as follows:

Sh.

Commuter allowance 180,000

Meals 35,000

Residence telephone bills 60,000

Entertainment allowance 120,000

Required:

Taxable income of John Wesonga for the year ended 31 December 2021. (10 marks)

Tax payable (if any) on the income computed in a (c) (i) above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Propose four ways through which the government might prevent loss of revenue from imports. (4 marks)

2. Outline four instances where the Commission may suspend a license issued under the Excise Duty Act, 2015. (4 marks)

3. Kalebu, Wekesa and Babu are in partnership trading as Kaweba Traders and sharing profit and loss equally.

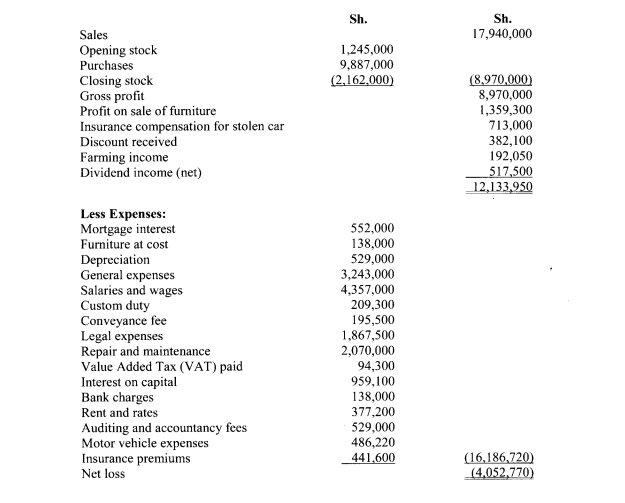

The partners have presented the following statement of profit and loss for the year ended 31 December 2021:

Additional information:

- Mortgage interest related to a partners residential house.

- Insurance premiums include Sh.259,900 paid to insure Wekesa’s private car.

- The investment allowances were agreed with the revenue authority at Sh.1,357,000 during the year ended 31 December 2021.

- The partners took goods for personal use which have recorded as sales which had a cost price of Sh.207,000. The gross profit margin was 20%.

- Salaries and wages included: Sh.

Kalebu 1,035,000

Wekesa 1,380,000

Babu 1,150,000

- Interest on capital comprised: Sh.

Kalebu 374,900

Wekesa 170,200

Babu 414,000

- Legal fees included: Sh.

Preparation of tender document 287,500

Parking fines paid to county government 138,000

Court charges for breach of contract 368,000

Appeal against tax assessment 75,000

Defending a partner in a local committee 216,200

- General expenses included: Sh.

Embezzlement by cashier 678,000

Registration of trademark 337,500

Office partition 510,000

Directors’ christmas party 575,000

- Repairs and maintenance comprised of: Sh.

New office tables 280,000

Laptops and computers 430,000

Fixing broken chairs and tables 116,000

Required:

Adjusted partnership statement of profit and loss for the year ended 31 December 2021. (10 marks)

The allocation of profit or loss computed in (c) (i) above to each partner. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Identify five factors that determines the taxable capacity in your country. (5 marks)

2. Propose five reasons for the failure to achieve tax revenue targets by the Revenue Authority in your country. (5 marks)

3. Elite Manufacturing Ltd. commenced operations on 1 January 2021 after incurring the following expenditures:

Sh.

Factory building 6,600,000

Processing Machinery (cost, insurance and freight) 3,800,000

Delivery van 1,908,000

Tractor 1,448,000

Photocopier 450,000

Generator 720,000

Go-down 1,500,000

Workshop machinery 840,000

Computers 660,000

Saloon car 3,840,000

Fax machine 280,000

Additional information:

- Processing machinery was imported from China and the company received an import duty waiver of 25% on the value of the machinery for duty from Government. The VAT rate was 16%. Factory building include the cost of clinic Sh.420,000, showroom Sh.580,000 and a retail shop Sh.600,000.

- A perimeter wall was constructed at a cost of Sh.540,000 and put into use on 1 September 2021.

- The company sunk a borehole at a cost of Sh.300,000 which was utilised from 1 October 2021. A water pump costing Sh.45,000 was purchased and utilised from the same date.

- On 1 November 2021, the following assets were acquired:

Sh.

Conveyor belts 680,000

Surveillance cameras 120,000

Water tank 150,000

5. A sport pavilion and a staff canteen were constructed at a cost of Sh.780,000 and Sh.1,280,000 respectively and used with effect from 1 December 2021.

6. The Saloon car was disposed of at Sh.1,920,000 in December 2021.

Required:

Investment allowances due to the company for the year ended 31 December 2021. (10 marks)

(Total: 20 marks)