OBJECTIVE

The objective of IAS 37 is to ensure that appropriate recognition criteria and measurement bases are applied to provisions, contingent liabilities and contingent assets and that sufficient information is disclosed in the notes to the financial statements to enable users to understand their nature, timing and amount.

. PROVISIONS

The IASB recognised the need for detailing specific rules regarding the creation of provisions. Without such rules, it would be possible for entities to mislead the users of accounts, whether unintentionally or deliberately.

For example, an entity might engage in profit-smoothing. It might create a provision in years where profits are high (thereby artificially reducing profits) and subsequently reverse those provisions in years where profits are low (thereby artificially increasing profits).

Thus, IAS 37 states that provisions can only be made where there are valid grounds for their creation.

DEFINITIONS

A provision is a liability of uncertain timing or amount.

A liability is a present obligation arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.

Provisions differ from other liabilities because of their uncertainty.

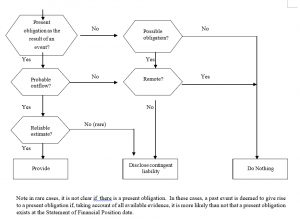

In order for a provision to be recognised in the financial statements, all the following conditions must be met:

There is a present obligation as a result of a past event. [This obligation can be legal or constructive.]

It is probable that a transfer of economic benefits will be required to settle the obligation.

A reliable estimate can be made of the obligation.

If all three conditions are met, then a provision can be created. Generally this is done by:

Dr Expense (in Statement of Comprehensive Income)

Cr Provision (liability in the Statement of Financial Position)

When the obligation is discharged in the future, the liability is removed from the Statement of Financial Position, or indeed, more information may become available requiring the provision to be adjusted.

It is necessary to take a closer look at the conditions for creating a provision, and in particular the terminology used.

Firstly, an obligation is a past event that creates a legal or constructive obligation that results in an enterprise having no realistic alternative to settling that obligation.

The absence of a realistic alternative is critical in determining the validity of the provision.

As stated above, the obligation can be legal or constructive.

A legal obligation is an obligation that derives from:

- A contract

- Legislation

- Other operation of law

A constructive obligation is one that derives from an entity’s actions where:

- By an established pattern of past practice, published policies or a sufficiently current statement, the entity has indicated to other parties that it will accept certain responsibilities; and

- As a result, the entity has created a valid expectation on the part of those other parties that it will discharge those responsibilities.

In relation to the transfer of economic benefits, such a transfer is considered probable if it is more likely than not to occur, i.e. there is a greater than 50% chance of such a transfer will arise.

IAS 37 states that the amount recognised as a provision should be the best estimate of the expenditure required to settle the present obligation at the Statement of Financial Position date.

Such estimates are determined by the judgement of management, who will use their experience of similar transactions and, if necessary, reports from independent experts.

In cases where there is a range of possible outcomes, management can use the “expected value” statistical method.

Risks and uncertainties surrounding events and circumstances should be considered in arriving at the best estimate of a provision.

- If a group of items is being measured, it is the “expected value”.

- If a single obligation is being measured, it is the “most likely outcome”.

RESTRUCTURING

If the entity is to embark on a restructuring programme (for example, closure of business locations, sale of a business division, changes in management structure) expected future costs of that restructuring can be provided for if the entity:

- Has a detailed formal plan

- Has communicated the plan to those affected by it, thus creating a valid expectation that the restructuring will be carried out.

This plan should outline at least:

- The business or part of the business being restructured

- The principal locations affected by the restructuring

- The location, function and approximate number of employees who will be compensated for terminating their employment

- When the plan will be implemented

- The expenditure that will be undertaken.

ONEROUS CONTRACT

An onerous contract is a contract in which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received under it.

The unavoidable costs are the lower of the cost of fulfilling the contract and any penalties arising from failure to fulfil it.

Onerous contracts should be recognised and treated as a provision.

CONTINGENT LIABILITIES

A contingent liability is:

- A possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity or

- A present obligation that arises from past events but is not recognised because:

- It is not probable that a transfer of economic benefits will be required to settle the obligation; or

- The amount of the obligation cannot be measured reliably.

An entity should not recognise a contingent liability in the financial statements. However, it should disclose the following:

- Description of the contingent liability

- An estimate of its financial effect

- An indication of the uncertainties relating to the amount or timing of the liability

- The possibility of any reimbursement

However, the position of a contingent liability is often fluid. Thus the entity should continually assess the situation to determine if the status of the contingency should be changed to a provision or removed altogether from the notes to the financial statements.

. CONTINGENT ASSETS

A contingent asset is a possible asset that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity.

An example of a contingent asset is a claim that the entity is pursuing through the courts, where the outcome is uncertain.

Contingent assets should not be recognised in the financial statements. Furthermore, it is only disclosed in the notes if an inflow of benefits is probable.

However, if the realisation of income is virtually certain, the asset is not a contingent asset any longer and should be recognised.

Again, contingent assets should be continually reviewed and any change in status should be recorded appropriately.

In relation to the disclosure of information surrounding provisions, contingent assets and contingent liabilities, IAS 37 does provide a “let-out” clause.

Paragraph 92 states that where disclosure of such information might seriously prejudice the position of the entity in a dispute with other parties on the subject matter of the provision, contingent asset or contingent liability, then the entity need not disclose the information.

In that case, the entity should disclose the nature of the dispute as well as the fact and reason why the information has not been disclosed.

But Paragraph 92 suggests that such cases will be “extremely rare”.

DISCLOSURES

For each class of provision, the following must be disclosed:

- The carrying amount at the beginning and end of the period

- Additional provisions made in the period

- Amounts used (i.e. incurred and charged against the provision) during the period

- Unused amounts reversed during the period

- The increase during the period in the discounted amount arising from the passage of time and the effect of any change in the discount rate.

Additionally for each class of provision:

- A brief description of the nature of the obligation and the expected timing of any resulting outflows of economic benefits

- An indication of the uncertainties about the amount or timing of those outflows

- The amount of any expected reimbursement

In relation to contingent liabilities, unless the possibility of settlement is remote, the entity must disclose: (a) A brief description of the nature of the contingent liability

- An estimate of its financial effect

- An indication of the uncertainties relating to the amount or timing of the outflow

- The possibility of a reimbursement

In relation to contingent assets, where an inflow is probable, the entity must disclose:

- A brief description of the nature of the contingent asset; and

- Where practicable, an estimate of their financial effect

In extremely rare cases, disclosures required for provisions, contingent liabilities and contingent assets may prejudice seriously the position of the entity in a dispute with other parties on the subject matter of the provision, contingent asset or contingent liability. In such cases, an entity need not disclose the information. Instead, it should disclose the general nature of the dispute, together with the fact that, and the reason why, the information has not been disclosed.