TUESDAY: 5 April 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

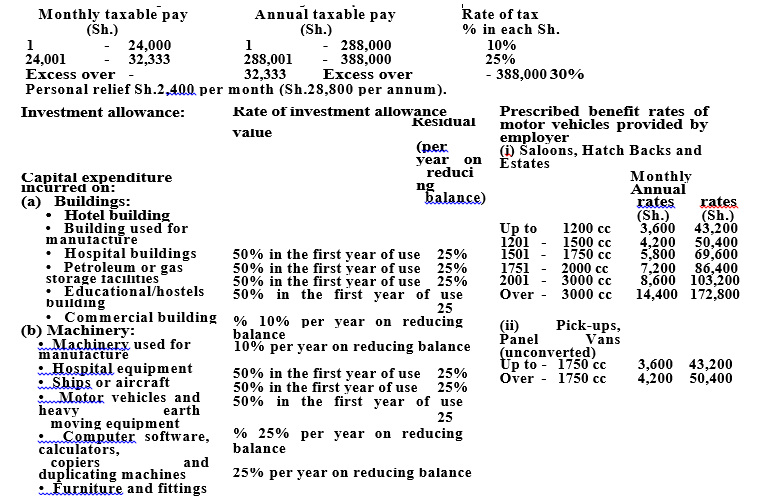

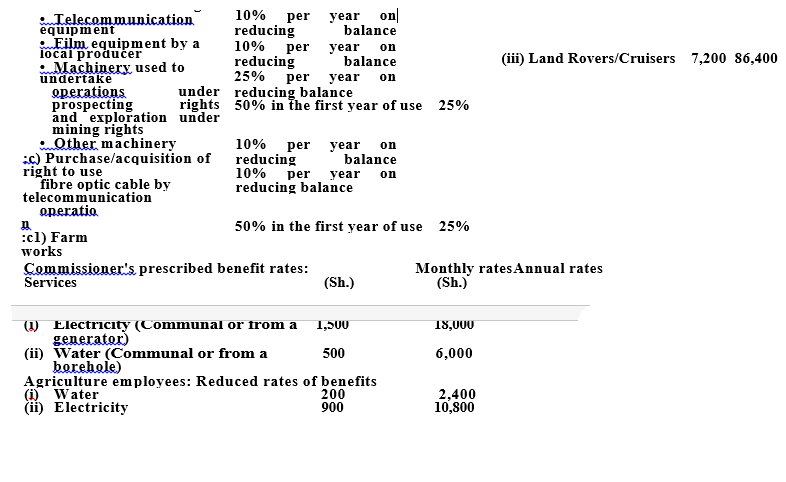

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2021.

Assume that the following rates of tax applied throughout the year of income 2021:

QUESTION ONE

Highlight four reasons for introduction of withholding taxes in most developing countries. (4 marks)

Outline four registration requirements for personal identification number (PIN) for a non-Kenyan employee residing in Kenya other than a refugee. (4 marks)

Kelvin Baraka is employed by Hakika Ltd. as a sales manager. During the year ended 31 December 2021, he presented the following information for income tax purposes:

- He received a basic monthly salary of Sh.350,500. The company deducted Sh.96,950 from his monthly salary as PAYE.

- He received sales commission during the year amounting to Sh.1,200,000.

- He received one month basic salary as bonus in the month of December 2021.

- He lives in a rented house near the company where he pays a monthly rent of Sh.40,000. The company reimburses him the rental cost incurred.

- The company provided him with a 1500cc saloon car and fuel for his travelling. The vehicle had been acquired at Sh.2,500,000. During the year, the company incurred Sh.320,000 as motor vehicle running costs.

- During the year, the company reimbursed him the following expenses:

Sh.

Telephone bills 120,000

Professional membership fees 180,000

Official expenses 145,000

- He attended a 5 day seminar during the month of December where he was paid daily allowance of Sh.6,000 for his accommodation.

- The company provided him with food items worth Sh.25,000 during the year.

- He contributed Sh.12,000 per month to an approved pension scheme while the employer contributed a similar amount.

Required:

Taxable income of Kelvin Balaka for the year ended 31 December 2021. (9 marks]

Tax payable (if any) from the income computed in (c) (i) above. (3 marks)

(Total: 20 marks)

QUESTION TWO

- Distinguish between “bonded warehouse” and “custom warehouse” as used in Customs and Excise Act. (4 marks)

- Describe four categories of goods that are subject to customs control. (4 marks)

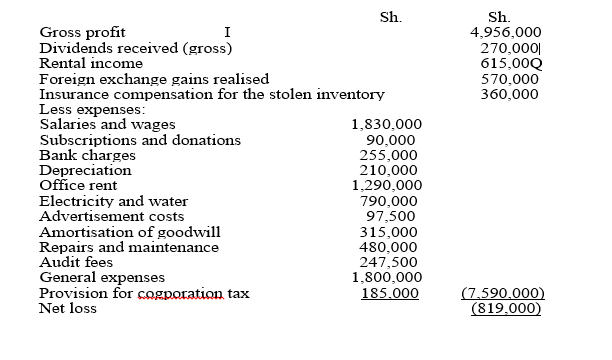

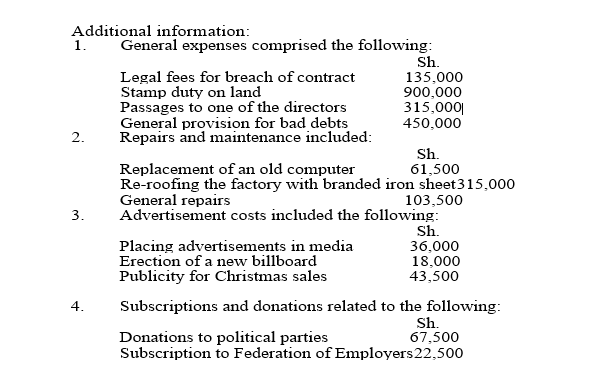

- Darubini Ltd. provided the following statement of profit or loss for the year ended 31 December 2021:

Required:

Adjusted taxable profit or loss of Darubini Ltd. for the year ended 31 December 2021. (12 marks)

(Total: 20 marks)

QUESTION THREE

1. Summarise four contents of a notice of default assessment made by the commissioner to a taxpayer as provided under Tax Procedures Act, 2015. (4 marks)

2. Argue four cases against value added tax (VAT) levied in most countries. (4 marks)

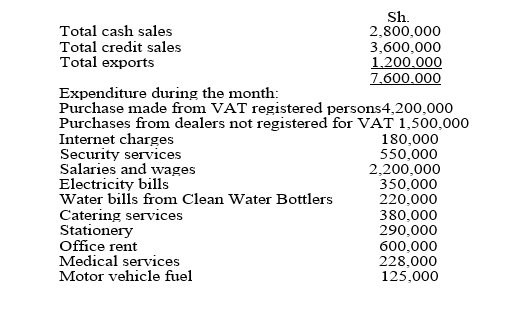

3.Mapema Ltd. deals in a wide variety of vatable goods and is registered for value added tax (VAT) purposes. The following information was extracted from its records for the month of January 2022.

All transactions are exclusive of VAT at the rate of 16% where applicable.

Required:

A value added tax (VAT) account for the month of January 2022. (12 months)

(Total: 20 marks)

QUESTION FOUR

1. A taxation system can be classified based on the base, incidence or the rate. With reference to the above statement, explain four classifications of taxes based on the tax rate. (8 marks)

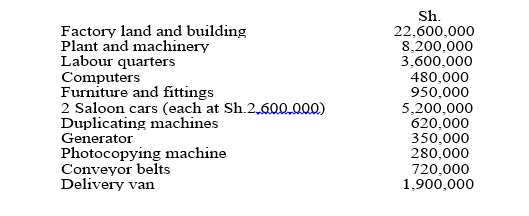

2. Bancy Ltd. is a private company engaged in the business of manufacturing and selling toys. The company started operations in February 2021 after incurring the following costs:

Additional information:

- A godown was constructed and utilised with effect from 1 October 2021. The total construction cost was Sh.1,200,000.

- Factory land and building included Sh.10,000,000 as the cost of laid.

- On 1 October 2021, the following assets were acquired:

Sh.

Laptop 180,000

Heavy duty forklift 1,400,000

Trailer for the tractor 460,000

Required:

Investment allowances due to Bancy Ltd. for the year ended 31 December 2021. (12 marks)

(Total: 20 marks)

QUESTION FIVE

1. Distinguish between the term “tax evasion” and “tax avoidance”. (4 marks)

2. Propose four taxable services under the Digital Service Tax (DST) regulation. (4 marks)

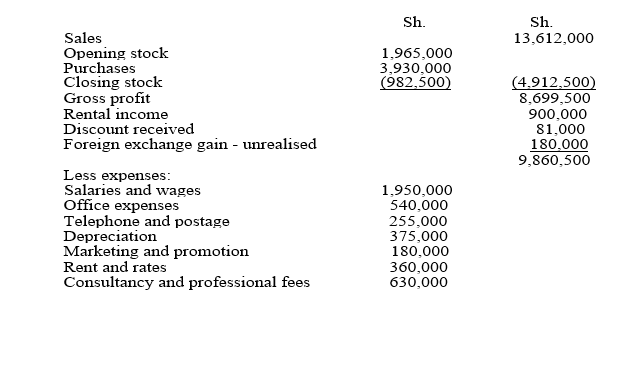

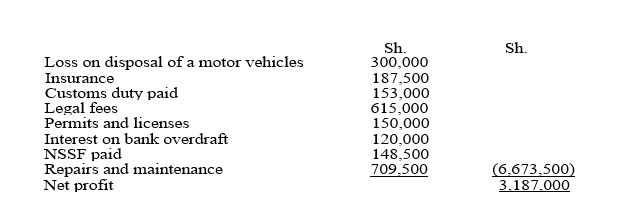

3.Mwenda and Musyoka have been trading as Mwema Traders and sharing profits and losses equally. They have provided the following statement of profit or loss for the year ended 31 December 2021:

Additional information:

- Salaries and wages include salaries to partners of Sh.675,000 and Sh.525,000 for Mwenda and Musyoka respectively.

- Marketing and promotion expenses represent the cost of putting up huge billboard in a conspicuous location of the central business district.

- Consultancy and professional fees include Sh.525,000 paid to a tax law expert to defend the partnership in a tax dispute.

- Included in the rent and rates is Sh.135,000 for stamp duty in relation to lease of the rental premises. The lease is for a period of less than 100 years.

- Investment allowances was agreed with the Commissioner of Domestic Taxes at Sh.1,312,500.

- Rent and rates relates to rental income from commercial properties owned or leased by the partners.

Required:

Adjusted total taxable profit or loss for Mwema Traders for the year ended 31 December 2021. (10 marks)

Allocation of taxable profit or loss in (c) (i) above to the partners. (2 marks)

(Total: 20 marks)