TUESDAY: 6 December 2022. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

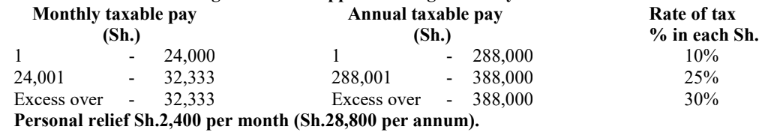

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2021.

Assume that the following rates of tax applied throughout the year of income 2021:

QUESTION ONE

1. Explain the following terms as used in taxation of employment income:

Benefits in kind. (2 marks)

Deemed interest. (2 marks)

2. Outline TWO conditions where an individual is deemed to be resident in Kenya for tax purposes. (4 marks)

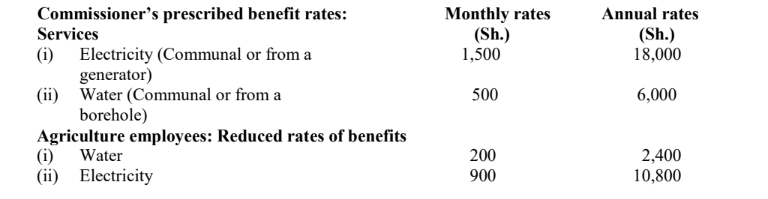

3. Ezekiel Keboi is an employee of Sabuk Ltd. The following information relate to his income for the year ended 31 December 2021:

1. His basic salary was Sh.515,000 per month (PAYE Sh.154,600 per month).

2. He was provided with a company house with electricity, water and telephone.

3. During the year, the employer paid Sh.60,000 for his life insurance policy.

4. He was provided with a 2000cc saloon car which had an initial cost of Sh.2,600,000.

5. During the year, the company settled his bills as follows:

Sh.

Electricity 28,000

Water 12,000

Telephone 32,000

6. During the year, he was reimbursed Sh.180,000 spent on medical bills. The company has a medical cover

for all staff.

7. His employer contributes 3% of his basic salary to a pension scheme while he contributes an equal amount.

8. He spent Sh.20,000 in December 2021 for entertaining the company’s customers which was fully

reimbursed by the company.

9. He received Sh.350,000 as annual bonus which is usually payable to all employees in December each year.

10. He received an overtime allowance of Sh.40,000 in the month of December 2021.

Required:

- Compute the total taxable income for Ezekiel Keboi for the year ended 31 December 2021. (10 marks)

- Determine the tax payable (if any) from the income computed in (c) (i) above. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following terms as used in taxation:

Bond security. (2 marks)

Stamp duty. (2 marks)

2. Identify FOUR documents required by the customs authority when clearing imported goods in Kenya. (4 marks)

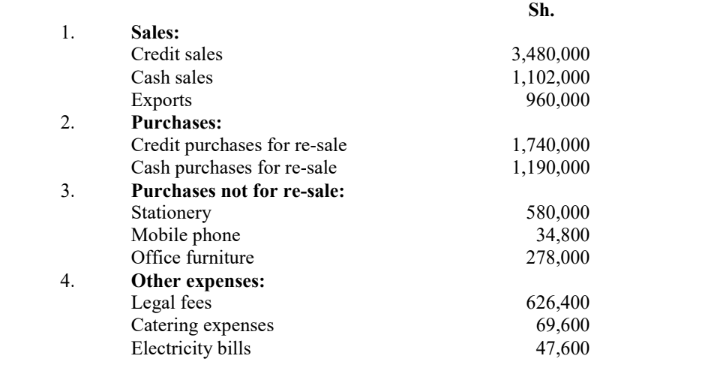

3. Haziki Enterprises is registered for value added tax (VAT) purposes dealing in electrical appliances and accounts for

VAT on monthly basis.

The following information relates to the month of August 2022:

All transactions are inclusive of value added tax (VAT) at the standard rate of 16% or any other applicable rate.

Required:

Determine the VAT payable or refundable to Haziki Enterprises for the month of August 2022. (12 marks)

(Total: 20 marks)

QUESTION THREE

1. Outline FOUR instances when the Commissioner might cancel a personal identification number (PIN) as provided

under the Tax Procedures Act, 2015. (4 marks)

2. Identify SIX items that the Commissioner should specify in writing and notify the taxpayer when he has made an

amended assessment. (6 marks)

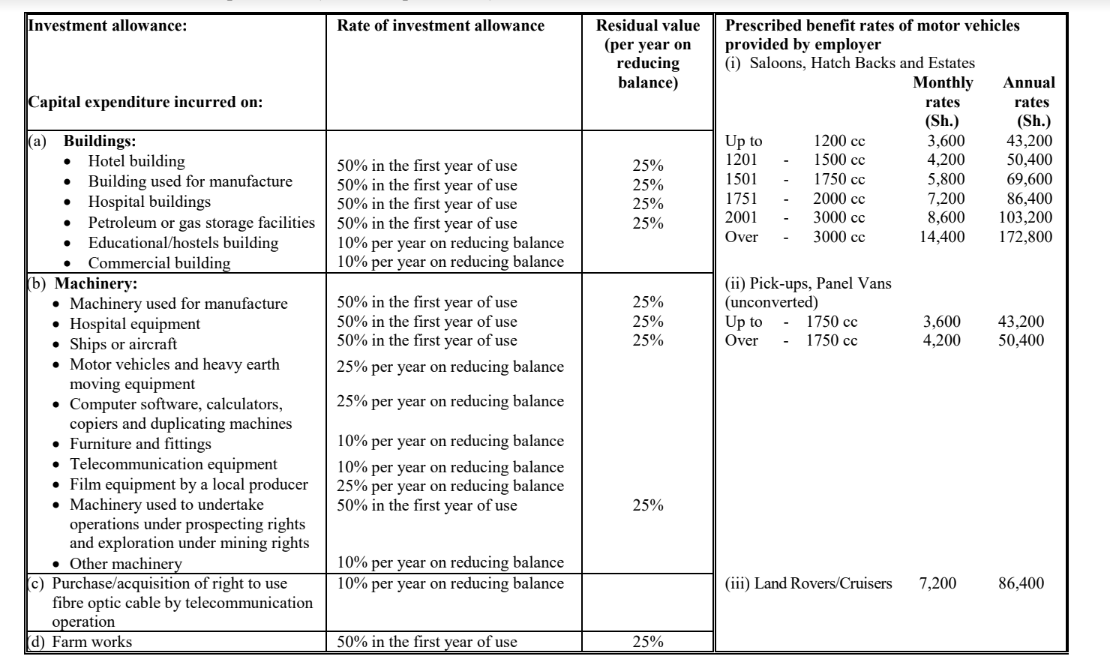

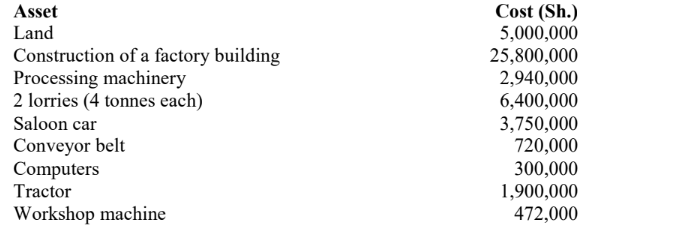

3. Sportsline Manufacturing Ltd. commenced operations on 2 January 2021 as a manufacturer of sports shoes. The

company acquired and constructed the following assets before commencing operations:

Additional information:

1. The cost of land includes Sh.1,800,000 paid for a building on site as at 2 January 2021. The building was constructed by the seller on 1 January 2019 at a cost of Sh.2,000,000. Sportsline Ltd. converted this building into a warehouse with effect from 2 January 2021.

2. The cost of constructing the factory building included Sh.800,000 spent on the construction of administration offices.

3. The following assets were purchased and utilised by the company with effect from 1 June 2021:

4. On 1 July 2021, the company constructed a factory extension at a cost of Sh.2,400,000. Processing machinery costing Sh.840,000 was purchased and installed in the factory extension on 15 August 2021.

5. Saloon car purchased on 2 January 2021 was involved in an accident on 1 September 2021. The company received Sh.2,500,000 as insurance compensation for the vehicle.

6. The following costs were incurred on 1 September 2021:

Required:

Compute the investment allowance due to Sportsline Manufacturing Ltd. for the year ended 31 December 2021. (10 marks)

(Total: 20 marks)

QUESTION FOUR

1. Discuss FOUR principles of taxation as advocated by Adam Smith. (8 marks)

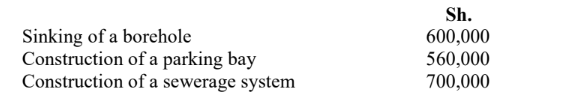

2. Safi Ltd., a company dealing with laundry services has provided the following statement of profit or loss for the year

ended 31 December 2021:

Additional information:

1. Salary and wages includes Sh.6,600 paid to the Revenue Authority as penalties and interests on delayed

submission of PAYE deduction.

2. Hire purchase interest relates to interest on loans obtained to purchase a delivery van Sh.14,600 and the

chairman’s personal car Sh.26,700.

3. The company directors and senior managers are given free laundry services at the company’s laundry. The

cost of cleaning their personal clothing for the year ended 31 December 2021 was Sh.13,300.

4. Legal and professional expenses includes Sh.14,600 incurred while defending the managing director in a

private suit.

5. Repair and maintenance include the cost of acquiring a second hand laundry machines for Sh.16,700.

6. The 10% of bad and doubtful debt relate to general provision for bad debt while the balance relate to

specific provision for bad debts.

7. Subscription and donations comprise:

Sh.

• Subscription to the chamber of commerce 32,350

• Donation of books to Watoto School for the blind 3,500

• Donation to political party 1,250

8. Sundry expenses include Sh.26,300 paid to Heal Africa for the Managing Director’s medical cover. He is

the only one in the company covered by the medical scheme.

9. Investment allowance for the year ended 31 December 2021 has been agreed with the Commissioner at

Sh.432,000.

Required:

Prepare adjusted taxable profit or loss for Safi Ltd. for the year ended 31 December 2021. (12 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the following terms as used in customs and excise Act:

Bill of landing. (2 marks)

Clean Report of Findings (CRF). (2 marks)

2. With reference to Digital Service Tax (DST), explain whether DST is a final tax for a resident and non- resident. (2 marks)

Outline TWO benefits of Digital Service Tax (DST). (2 marks)

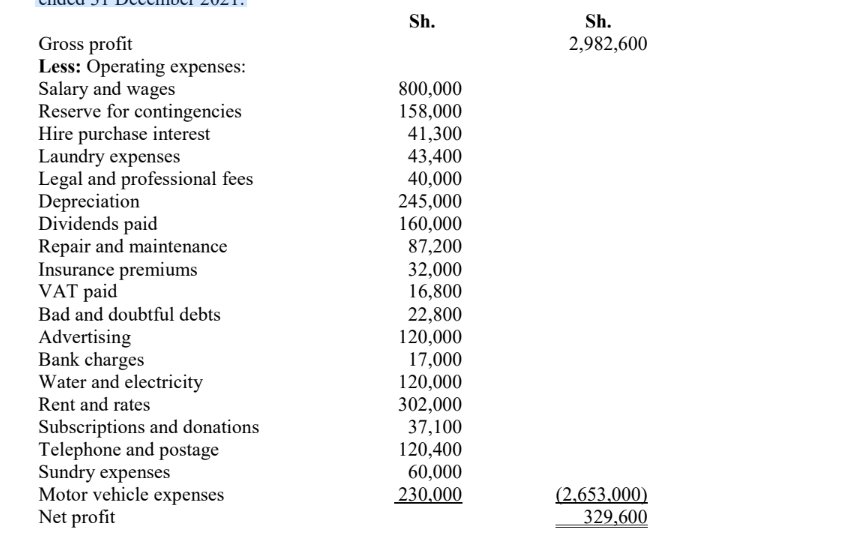

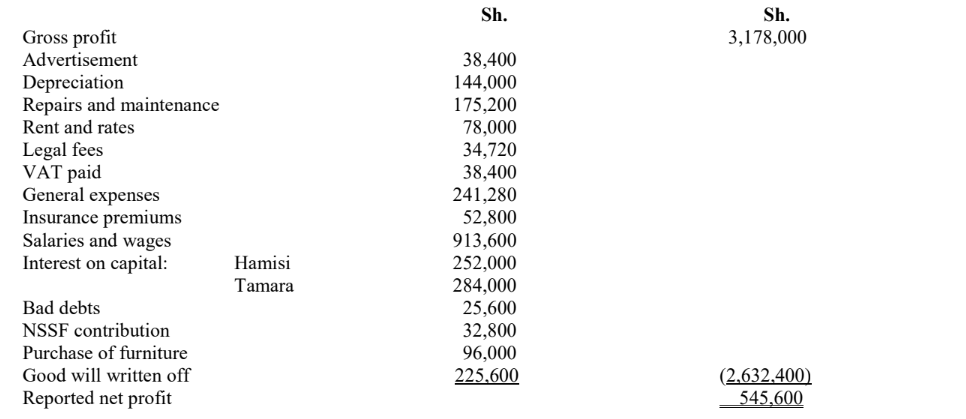

3. Hamisi and Tamara are partners trading as Hatah Traders and sharing profits and losses in the ratio of 2:1 respectively. Their statement of profit or loss for the year ended 31 December 2021 reflected the following:

Additional information:

1. Insurance premium expense included Sh.25,200 paid to insure Hamisi’s private car.

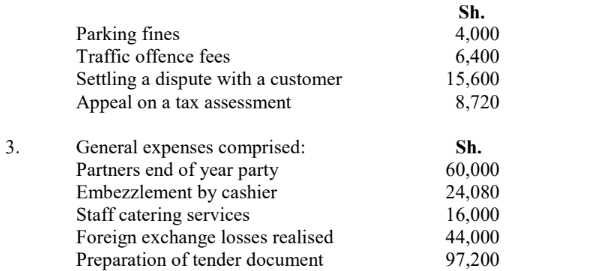

2. Legal fees comprised the following:

4. Salaries and wages included salaries to partners Sh.744,000 according to their ratio of sharing profit and losses.

5. Bad debts represented the general provision as at the end of the year.

6. Capital allowances was agreed with the commissioner at Sh.180,000.

7. Closing stock was valued at Sh.360,000 and had been over valued by 20%.

Required:

1. Compute taxable profit or loss of the partnership for the year ended 31 December 2021. (8 marks)

2. Allocation of the profit or loss in 1 above to the partners. (4 marks)

(Total: 20 marks)