TUESDAY: 2 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

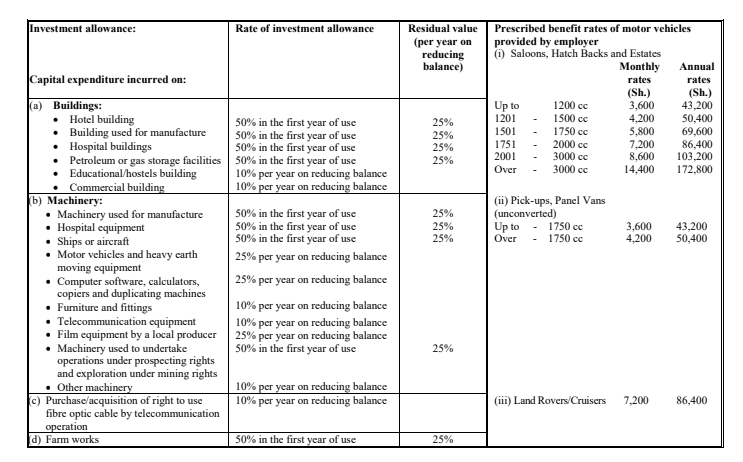

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2021.

Assume that the following rates of tax applied throughout the year of income 2021:

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 – 24,000 1 – 288,000 10%

24,001 – 32,333 288,001 – 388,000 25%

Excess over – 32,333 Excess over – 388,000 30%

Personal relief Sh.2,400 per month (Sh.28,800 per annum).

QUESTION ONE

1. Outline four roles of an employer in relation to the operation of the Pay As You Earn (PAYE). (4 marks)

2. Distinguish between “restricted goods” and “prohibited goods” as used under Customs and Excise Act. (4 marks)

3. Tobias Osoro is an employee of Mayfarm Ltd. He has provided the following information relating to his income for the year ended 31 December 2021:

- Basic salary Sh.140,000 per month (PAYE Sh.54,950 per month).

- He was provided with a saloon car of 2000cc which had an initial cost of Sh.1,950,000.

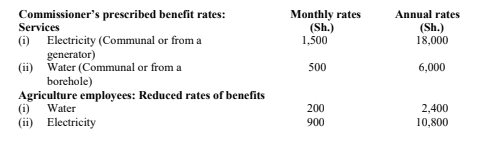

- He was provided with a free house, water, electricity, furniture and telephone. The market value of the rental house was Sh.50,000 per month and he contributed Sh.10,000 per month to cater for the rent. The cost of the furniture to the employer was Sh.315,000.

- During the year, the employer settled his bills as follows; electricity Sh.18,000, telephone Sh.15,000 and water Sh.14,400.

- His employer’s contribution to a registered pension scheme was 5% of the basic salary and he contributed a similar amount.

- He was entitled to leave pay equal to one month’s basic salary.

- He enjoyed free medical treatment during the year valued at Sh.128,000 under the medical cover operated by the company for all staff.

- During the year, the employer paid Sh.72,000 for his life insurance policy.

- He was issued 2,000 shares by the company at a price of Sh.70 each. The market price per share was Sh.120.

- The company paid Sh.138,000 during the year for his daughter’s school fees. This amount was recorded in the company’s books as an expense.

- His wife was given free goods worth Sh.80,000 by the company during the year.

- He contributed Sh.7,000 per month towards home ownership savings plan.

Required:

The taxable income for Tobias Osoro for the year ended 31 December 2021. (10 marks)

Tax payable (if any) on the income computed in 3 (i) above. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Discuss four measures that the government could put in place to prevent tax evasion. (8 marks)

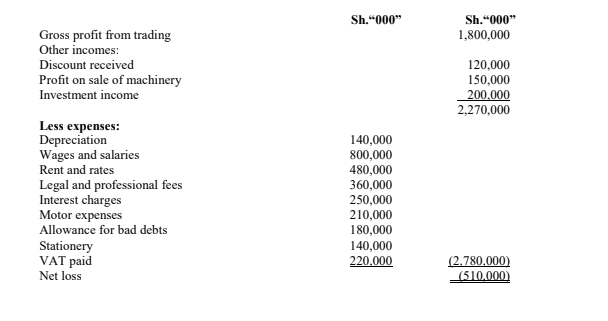

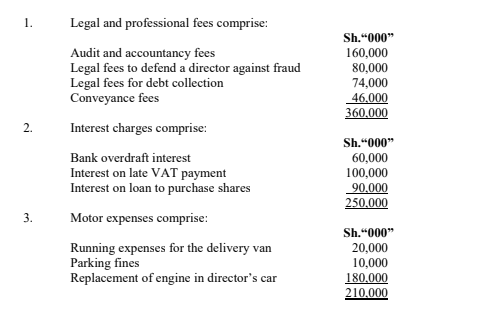

2. Bahati Ltd. presented the following income statement for the year ended 31 December 2021:

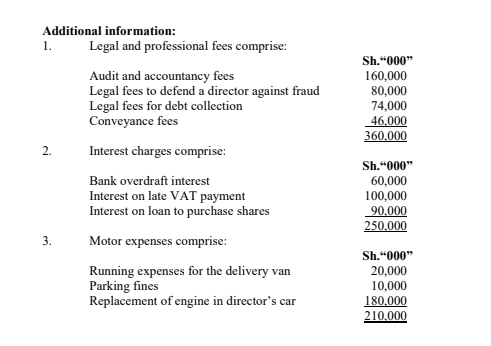

Additional information:

Required:

Adjusted taxable profit or loss for Bahati Ltd. for the year ended 31 December 2021. (10 marks)

Tax payable (if any) on the profit or loss in 2 (i) above. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the following terms as used in taxation:

Petroleum levy. (2 marks)

Airport tax. (2 marks)

2. Propose four reasons why a difference may arise between the accounting profit and the taxable profit. (4 marks)

3. Tembek Ltd. is a company dealing in a variety of value added tax (VAT) designated goods. The following transactions were recorded for the month of May 2022:

May 1: Sold goods to Jakah Ltd. Sh.1,399,975 on credit.

May 5: Purchased goods on cash Sh.759,800 from Alpha Holdings.

May 8: Imported goods valued at Sh.1,200,000 from China being cost insurance and freight excluding import duty and VAT. Import duty rate was 20% during the month.

May 9: Purchased a pick-up for Sh.1,199,875 from general motors for business use.

May 11: Bought stationeries for Sh.72,000 from Edu Bookshop.

May 13: Paid accountancy and audit fee to Kibuchi Associates Sh.79,750 by cheque.

May 15: Paid Sh.69,600 to Perfect Garage for the repair of the pickup.

May 17: Sold goods on credit to Ministry of Education Sh.809,825.

May 18: Sold goods amounting to Sh.2,088,000 and allowed a discount of 5% to Watermark Ltd.

May 19: Sold goods to Kalama Traders a company based in Tanzania for Sh.510,000.

May 21: Purchased goods from Limuru Ltd. Sh.259,550 and paid cash.

May 23: Paid electricity expenses Sh.14,500 and telephone expenses Sh.8,700.

May 27: Paid for catering expenses Sh. 23,000 to Furaha Caterers.

May 29: Paid for legal fees Sh.71,775 to Jopo Advocates.

May 30: Closing stock was valued at Sh.800,000.

All transactions were inclusive of VAT at the rate of 16% where applicable unless otherwise stated.

Required:

The VAT account for Tembek Ltd. for the month of May 2022. (12 marks)

(Total: 20 marks)

QUESTION FOUR

1. Outline two requirements that need to be fulfilled for a notice of objection to be treated as validly lodged by a taxpayer under Section 51(2) of the Tax Procedures Act, 2015. (4 marks)

2. Summarise four obligations of the user of a register as provided under the Value Added Tax (Electronic Tax Invoices) Regulations, 2020. (4 marks)

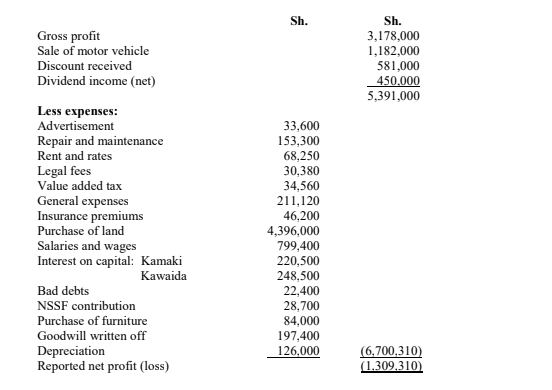

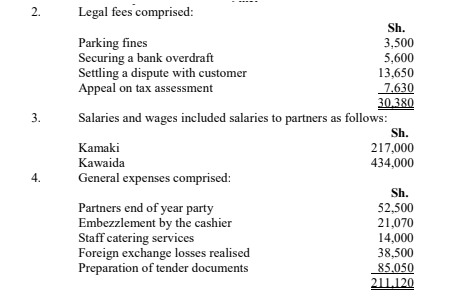

3. Kamaki and Kawaida are partners trading as Kamaki Traders and sharing profits and losses in the ratio of 2:1 respectively. The following is an extract of income statement for the year ended 31 December 2021:

Additional information:

- Insurance premiums expenses included Sh.22,050 paid to insure Kawaida’s private house.

- Legal fees comprised:

- Bad debts represented the general provision as at the end of the year.

- Half of the rent and rates paid related to the amount paid to Kamaki for letting part of the building to the partnership.

- The capital allowances were agreed with the revenue authority at Sh.882,000 during the year ended 31 December 2021.

Required:

Adjusted total taxable profit or loss for Kamaki Traders for the year ended 31 December 2021. (9 marks)

Allocation of taxable profit or loss calculated in (3 (i) above to the partners. (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. Citing an example, explain the difference between “tax impact” and “tax incidence”. (4 marks)

2. Penalties are imposed by Revenue Authority to enforce tax laws and regulations among other objectives.

In relation to the above statement, propose four circumstances under which the imposition of penalties might not achieve the intended objectives. (4 marks)

3. Best Industries Ltd. a manufacturer of clothes was established in December 2020. The company commenced its operations on 1 January 2021 after incurring the following expenditure:

Sh.

Factory building 14,200,000

Warehouse 900,000

Staff canteen 780,000

Drainage system 400,000

Computers 500,000

Delivery van 1,800,000

Conveyor belts 680,000

Office furniture 250,000

Generator 350,000

Tractor 4,200,000

Processing machinery 3,800,000

Additional information:

- A godown was constructed and utilised with effect from 1 October 2021. The total cost of construction was Sh.850,000.

- A Sports Pavilion and labour quarters were constructed at a cost of Sh.650,000 and Sh.1,300,000 respectively. Both were utilised with effect from 1 June 2021.

- A parking bay was constructed and completed on 1 November 2021 at a cost of Sh.580,000.

- The factory building comprised of the following:

Sh.

Retail shop 720,000

Dwelling house 600,000

Office block 280,000

Land 4,200,000

Required:

Investment allowances due to Best Industries Ltd. for the year ended 31 December 2021. (12 marks)

(Total: 20 marks)