WEDNESDAY: 1 September 2021.

Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Explain why freehold land is not regarded as a depreciable asset. (2 marks)

2. Highlight four objectives of public sector accounting. (4 marks)

3. Discuss four limitations of computerised accounting systems. (8 marks)

4. According to the cash book of TJ Ltd., the firm had a credit balance at the bank of Sh.8,600,000 on 30 June 2021, but the bank statement revealed an overdraft of Sh.100,000.

An investigation into the difference revealed the following information:

- A standing order for a charitable subscription of Sh.900.000 had been effected by the bank on 29 June 2021, but no entry had been made in the cash book.

- A cheque paid for sales promotion on 15 June 2021 for Sh.2,790,000 had been entered in the cashbook as Sh.2,970,000.

- Cheques for Sh.21,740,000 sent to suppliers on 30 June 2021 were not paid by the bank until 5 July 2021.

- Cheques received from the customers amounting to Sh.34,600,000 were paid into the bank on 30 June 2021, but were not credited by the bank until 2 July 2021.

- On 25 June 2021, a cheque for Sh.3,280,000 was received from a customer on settlement of an invoice for Sh.3,400,000. An entry of Sh.3,400,000 had been made in the cash book.

Required:

Bank reconciliation statement as at 30 June 2021. (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following terms as used in accounting for companies:

Share premium. (2 marks)

Oversubscription of shares. (2 marks)

Forfeiture of shares. (2 marks)

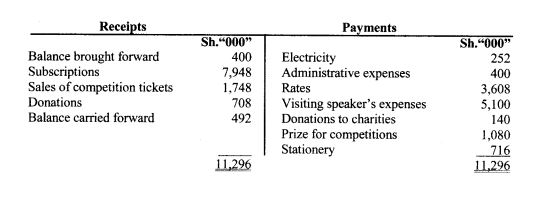

2. The following receipts and payments account was extracted from the books ofJijenge Club for the year ended 31 December 2020:

As at 31 December, the following balances were also provided:

2020 2019

Sh.”000″ Sh.”000″

Equipment (Cost – Sh,4,500,000) 3,120 3,900

Subscriptions in arrears 340 260

Subscriptions in advance 148 40

Owing to suppliers of competition 272 232

Inventory of competition prizes 184 152

Required:

Income and expenditure account for the year ended 31 December 2020. (7 marks)

Statement of financial position as at 31 December 2020. (7 marks)

(Total: 20 marks)

QUESTION THREE

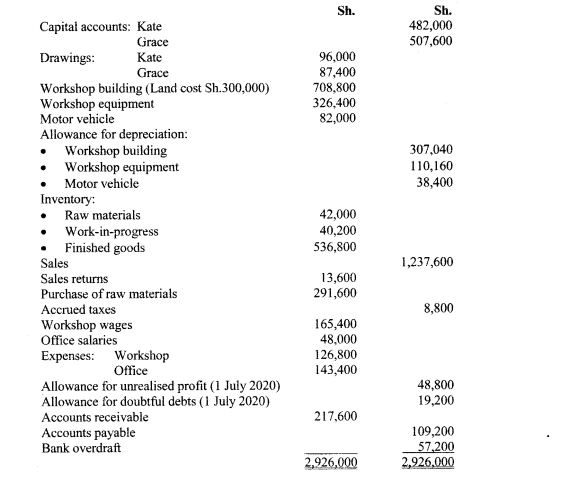

Kate and Grace operate a manufacturing business under the trade name Kare Manufacturers.

The following trial balance was extracted from the books of Kare Manufacturers as at 30 June 2021:

Additional information:

- Manufactured goods were transferred to the finished goods warehouse with a manufacturing profit of Sh.205,184.

- As at 30 June 2021, inventories were valued as follows:

Sh.

- Raw materials 35,000

- Work-in-progress 54,600

- Finished goods 582,500

- Allowance for depreciation is to be provided on cost at the following rates:

Workshop building – 2% per annum

Workshop equipment – 10% per annum

Motor vehicles – 25% per annum

- As at 30 June 2021, accrued expenses were as follows:

Sh.

Office expenses 33,800

Workshop expenses 29,600

- As at 30 June 2021, pre-paid expenses were as follows:

Sh.

Office expenses 2,200

Workshop 2,000

- As at 30 June 2021, there was an allowance for unrealised profit of 15% of the closing inventory of finished goods.

- The allowance for doubtful debt is to be maintained at 10% of the accounts receivable.

- Kate is responsible for the workshop and Grace for sales. Their salaries are computed as follows:

Kate – 25% of the manufacturing profit

Grace – 10% of the trading gross profit

- Kate and Grace share the balance of the net profit equally.

- Capital accounts and drawings do not attract any interest charges.

Required:

1. Manufacturing account for the year ended 30 June 2021. (7 marks)

2. Statement of profit or loss for the year ended 30 June 2021. (7 marks)

3. Statement of financial position as at 30 June 2021. (6 marks)

(Total: 20 marks)

QUESTION FOUR

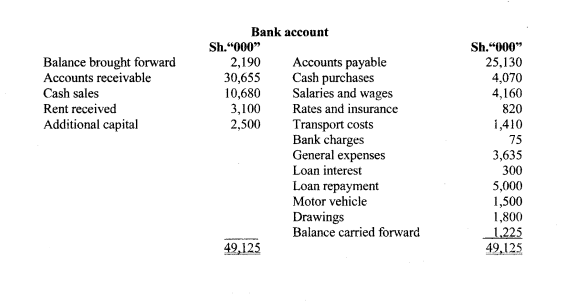

Joseph Moto is a sole trader. He does not maintain records on a double entry system. He has provided the following balances as at 31 December:

2019 2020

Sh.”000″ Sh.”000″

Premises 17,500 17,500

Furniture 3,000 2,650

Motor vehicles 900 ?

Inventory 3,140 3,715

Accounts receivable 1,975 2,035

Accounts payable 3,980 4,650

Bank loan 6,000 ?

Salaries and wages accrued 460 375

Pre-paid rates 125 180

Rent received in advance 200 340

Capital 18,190 ?

Additional information:

- Joseph Moto maintains a cashbook with discount columns and a file of invoices issued and received.

- Discounts allowed during the year ended 31 December 2020 amounted to Sh.615,000 and discounts received amounted to Sh.680,000.

- During the year ended 31 December 2020, Joseph Moto took goods costing Sh.250,000 for his personal use.

- Depreciation on motor vehicles is charged at 20% per annum on book value. A full year’s depreciation is charged in the year of purchase and no depreciation is charged in the year of disposal.

- The motor vehicle was purchased on 1 October 2020.

- Joseph Moto’s bank balance is provided below:

Required:

1. Statement of profit or loss for the year ended 31 December 2020. (12 marks)

2. Statement of financial position as at 31 December 2020. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain two ways in which share premium might be used in a company. (4 marks)

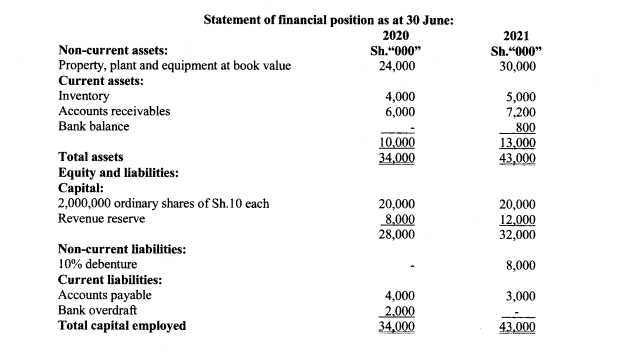

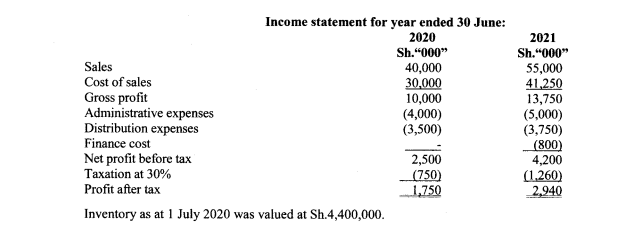

2. The financial statements of Left Ltd. for the years ended 30 June 2020 and 30 June 2021 were as provided below:

Required:

For the years ended 30 June 2020 and 30 June 2021, compute the following ratios:

Gross profit margin. (2 marks)

Inventory turnover ratio. (2 marks)

Acid test ratio. (2 marks)

Current ratio. (2 marks)

Return on assets. (2 marks)

Return on equity. (2 marks)

Earnings per share (EPS). (2 marks)

Return on capital employed (ROCE). (2 marks)

(Total: 20 marks)