WEDNESDAY: 19 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. As at I January 2019, Peter Pamba, a sole trader had an opening balance of Sh.1.547,000 on his accounts receivable account and Sh.77,350 on his allowance for doubtful debts account.

Additional information:

- During the year ended 31 December 2019, the business made credit sales of Sh.8,053.500 and collected cash from receivables of Sh.7.735,000.

- On 31 December 2019. Peter Pamba reviewed his receivables listing and acknowledged that he was unlikely to receive debts totalling Sh.45,500. These amounts are to be written alas irrecoverable.

- The allowance for doubtful debts was at the rate of 5% on the outstanding balance as at 31 December 2019.

- During the year ended 31 December 2020. credit sales amounted to Sh.8,916.000, sales returns of Sh.149.000 were made and collection from customers amounted to Sh.8,468,000.

- The amount of Sh.45.500 written off in 2019. was recovered in full and cash received during the year ended 31 December 2020.

- As at 31 December 2020, the allowance for doubtful debts was to be maintained at 5% on the outstanding balance.

Required:

For the years ended 31 December 2019 and 31 December 2020:

Trade receivables account. (4 marks)

Allowance for doubtful debts account. (2 marks)

Bad debts account. (1 mark)

Bad debts recovered account. ( 1 mark)

2. Upon extracting a trial balance of Linen Traders on 31 December 2020, the accountant, discovered a suspense account with a debit balance of Sh.172,000. She also discovered that the debit entries exceeded the credit entries by Sh.143,920. She posted this difference to the suspense account pending investigations.

After carrying out investigations, she discovered the following:

- A payment of Sh.80,000 to a credit supplier had been correctly posted in the cash book, but no entry had been made in the payables control account.

- The bookkeeper debited the suspense account and credited the bank account with an amount of Sh.252,000. This amount was equipment purchased during the year ended 31 December 2020.

- A cash receipt of Sh.10,000 from a credit customer had been correctly posted to the receivables control account, but had been entered in the cash book as Sh.100,000.

- A debit balance of Sh.12,000 on the telephone expense account had been incorrectly extracted on the list of balances as Sh.120,000.

- A credit balance of Sh.12,960 in the investment income account had been incorrectly extracted on the list of balances as a debit balance.

- No entry has been made for a cheque of Sh.19,200 received from a credit customer.

- The bookkeeper credited an amount of Sh.80,000 received from the owner’s bank account to the suspense account.

- Cash sales of Sh.8,000 had been posted in the ledger accounts as Sh.800.

Required:

Journal entries to correct the above errors. (Narrations not required). (8 marks)

Suspense account duly balanced as at 31 December 2020. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. In the context of public sector accounting. explain the following terms:

Commitment accounting. (2 marks)

Fund accounting. (2 marks)

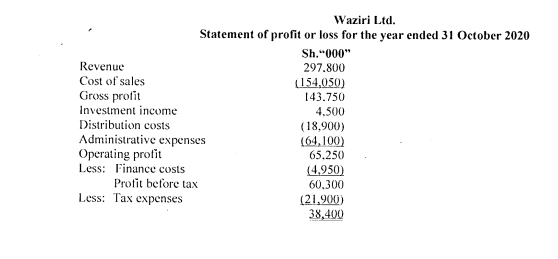

2. The financial statements of Waziri Ltd. for the year ended 31 October 2020 were as follows:

Additional information:

- The expenses on depreciation, impairment of goodwill and amortisation are included in the administrative expenses.

- During the year ended 31 October 2020, acquisition of non-current assets was as follows:

Asset Cost

Sh.”000″

Production machinery 10,500

Motor vehicle 4,500

- During the year ended 31 October 2020, a motor vehicle whose net book value was Sh.7,500,000 was disposed off at a loss of Sh.600,000.

- The revaluation reserve relates to the revaluation of freehold land.

Required:

Statement of cash flows in accordance with International Accounting Standard (lAS) 7 “Statement of cash flows” for the year ended 31 October 2020. (16 marks)

(Total: 20 marks)

QUESTION THREE

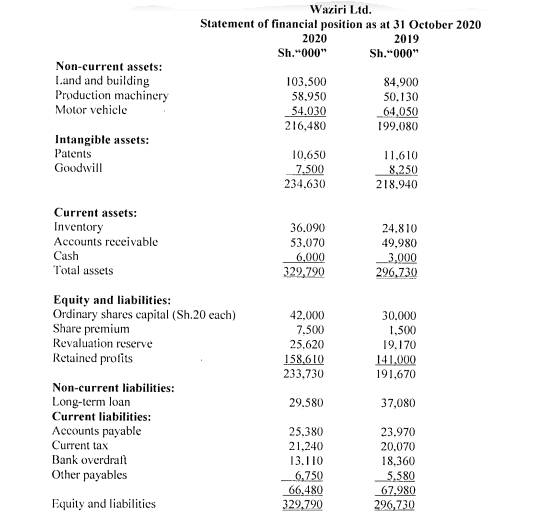

Mkoba Ltd. is a company that manufactures various types of bags. The following trial balance was extracted from the books of the company for the year ended 31 December 2020:

Additional information:

- The finished goods are transferred to the sales department at a factory profit of 20% on cost. Roth the opening and closing inventory of finished goods are valued at the transfer price.

- As at 31 December 2020, inventory was valued as follows:

Sh.”000″

- Raw materials 14.500

- Work-in-progress 7.500

- Finished goods 6,000

- As at 31 December 2020, accrued expenses were as follows:

Sh.”000″

- Office salaries 500

- General expenses 1.400

- The allowance for doubtful debts is to be maintained at 5% of the accounts receivable.

- General expenses and electricity expenses are to be apportioned as follows:

- 1/5 – Office

- 4/5 – Factory

- Factory royalty expenses amounting to Sh.2 million were omitted from the records.

- Depreciation is to be provided as follows:

- Plant and machinery – 5% per annum on cost

- Motor vehicle – 200/O per annum on cost

- The directors agreed to revalue land to Sh.250 million on I January 2020.

- Tax rate is 30% per annum.

- Final ordinary dividend of sh.4 million is proposed and final preference dividend is declared.

Required:

1. Manufacturing statement of profit or loss for the year ended 31 December 2020. (14 marks)

2. Statement of financial position as at 31 December 2020. (6 marks)

(Total: 20 marks)

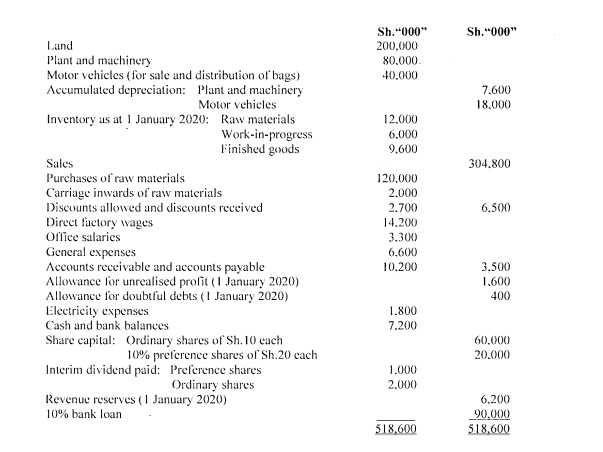

QUESTION FOUR

1. Highlight live benefits of using a computerised accounting system. (5 marks)

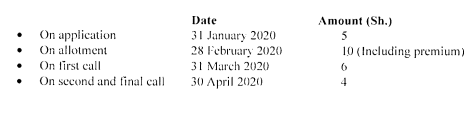

2. HNW Ltd. I las authorised share capital of Sh.200 million divided into 10 million ordinary shares of Sh.20 each. The company has 2 million shares already issued and fully paid up. On I January 2020, the directors of the company offered 4 million shares for sale to the public, payable as follows:

Additional information:

- I. Applications fir 5 million shares were received and allotment done on a pro-rata basis on 2 March

- Excess money on application was utilised to meet part of the money due on allotment.

- The balance on amounts due on allotment. first call and second and final calls were received on the due dates.

- However. one allotee for 50.000 shares failed to pay both calls. while another, who was allotted 30.000 shares did not pay (Or the second and final call.

- The 80.000 shares were subsequently forfeited and reissued at Sh.14 per share. This amount was received on 25 May 2020.

Required:

Ordinary share capital account. (3 marks)

Application account. ( 1 mark)

Allotment account. ( 1 mark)

First call account. ( 1 mark)

Second call account. ( 1 mark)

Share premium account. (1 mark)

Calls in arrears account. ( 1 mark)

Forfeiture account. (2 marks)

Re-issue of forfeiture account. ( 1 mark)

Bank account. (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. In relation to not-for-profit organisations:

Define the term -life membership fund”. (2 marks)

Explain how life membership should be treated in the books of account. (2 marks)

2. Describe six types of errors that cannot be disclosed by the trial balance. (6 marks)

3. In preparing the accounts of your company for the year ended 31 October 2020, you discover the following information:

As at 31 October 2020, an amount is outstanding in respect of salaries.

One of the directors of the company has invested his drawings in some corporate bonds and shares.

Although the sales have not yet actually taken place. some reliable customers of the company have placed several large orders that are likely to be extremely profitable.

4. The long term future success of the company is extremely uncertain.

5. The Chief Executive Officer would like the company’s good industrial relations to be reflected in the accounts.

Required:

Explain the accounting concepts that could be applied in dealing with each of the above cases. (10 marks)

(Total: 20 marks)