WEDNESDAY: 7 December 2022. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain the term “credit note”. (2 marks)

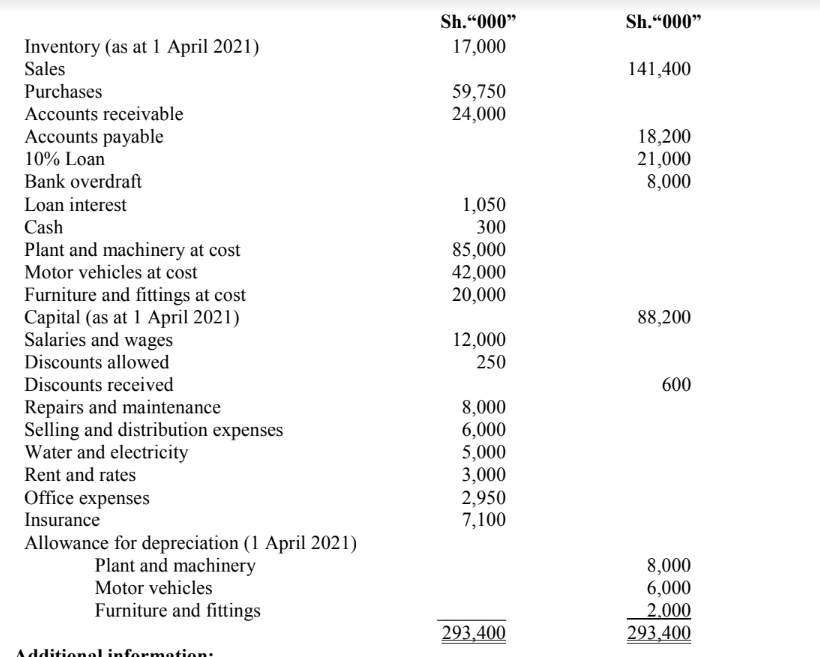

2. The following trial balance relates to Kilifi Traders as at 31 March 2022:

Additional information:

1. Closing inventory as at 31 March 2022 was valued at Sh.16,000,000.

2. As at 31 March 2022, accrued water and electricity expenses amounted to Sh.680,000.

3. As at 31 March 2022, prepaid insurance amounted to Sh.300,000.

4. Interest on loan is charged at 10% per annum.

5. Depreciation on non-current assets is provided on cost per annum as follows:

Asset Rate (%)

Plant and machinery 10

Motor vehicles 20

Furniture and fittings 10

Required:

1. Statement of profit or loss for the year ended 31 March 2022. (10 marks)

2. Statement of financial position as at 31 March 2022. (8 marks)

(Total 20 marks)

QUESTION TWO

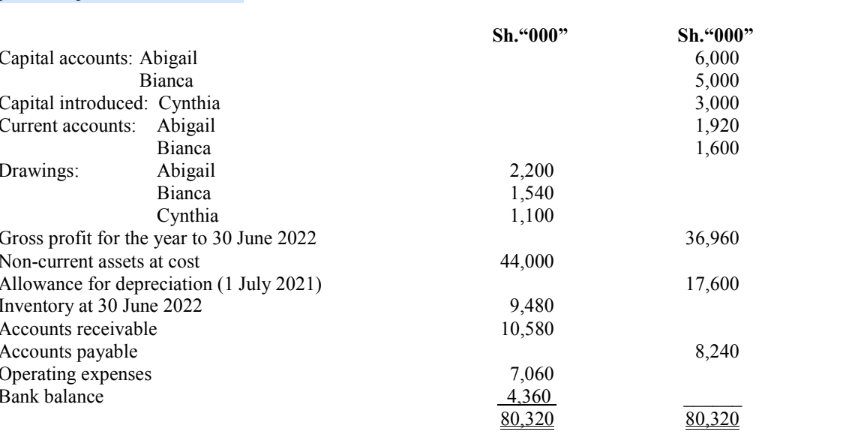

Abigail and Bianca are partners in a partnership sharing profits and losses in the ratio of 3:2 respectively after allowing for

interest on partners’ capital at the rate of 10% per annum. The trial balance below was extracted from the books of the

partnership as at 30 June 2022:

Additional information:

1. On 1 January 2022, Cynthia was admitted to the partnership under the following agreement:

Cynthia was to introduce capital of Sh.3,000,000.

For the purpose of admission of the new partner, goodwill was valued at Sh.6,000,000 and no account for goodwill was to be maintained.

From 1 January 2022, the partners were entitled to annual salaries as follows:

Sh. (per annum)

Bianca 1,620,000

Cynthia 880,000

2. The new profit and loss sharing ratio is 3:2:1 for Abigail, Bianca and Cynthia respectively after allowing for interest on capital at the rate of 10% per annum.

3. The income and expenses accrued evenly throughout the year.

4. Non-current assets are to be depreciated at the rate of 25% per annum based on cost.

Required:

1. Statement of profit or loss and appropriation account for the year ended 30 June 2022. (6 marks)

2. Partners’ capital accounts as at 30 June 2022. (4 marks)

3. Partners’ current accounts as at 30 June 2022. (4 marks)

4. Statement of financial position as at 30 June 2022. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Describe the following accounting concepts as used in the preparation of financial statements:

Materiality. (2 marks)

Substance over form. (2 marks)

2. Highlight FOUR challenges of a computerised system in accounting for business transactions. (4 marks)

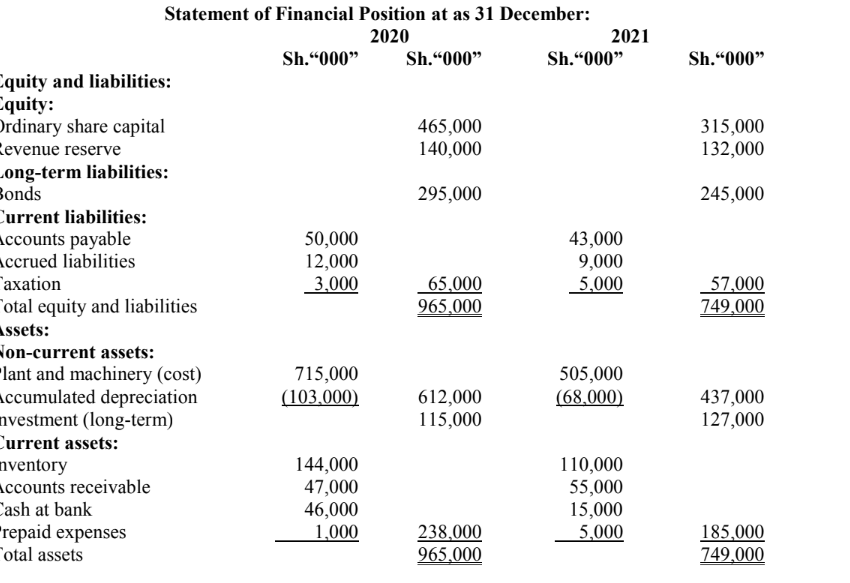

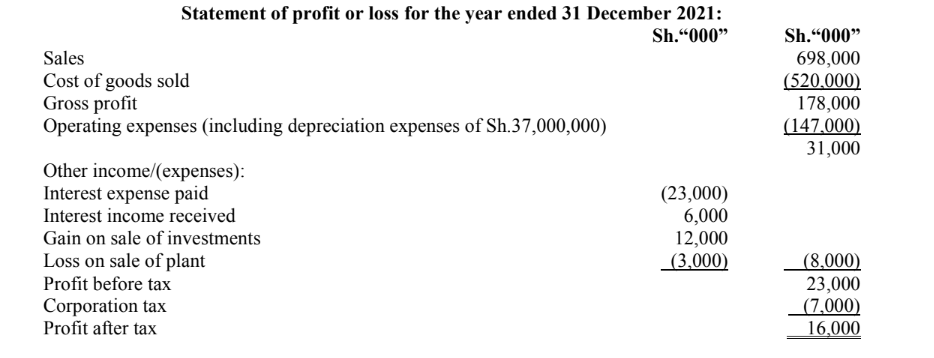

3. The following are summarised financial statements of Sereka Kenya Ltd. for the years ended 31 December 2020

and 31 December 2021:

Additional information:

During the year ended 31 December 2021, Sereka Kenya Ltd.:

1. Purchased investments for Sh.78,000,000.

2. Sold investments for Sh.102,000,000. These investments had cost Sh.90,000,000.

3. Purchased plant and machinery for Sh.120,000,000.

4. Sold two plants that had a total cost of Sh.10,000,000 and an accumulated depreciation of Sh.2,000,000

for Sh.5,000,000.

5. Issued Sh.100,000,000 of bonds at face value in exchange for plant and machinery on 31 December 2021.

6. Repaid Sh.50,000,000 of bonds at face value at maturity.

7. Issued 15,000,000 shares of Sh.10 each for cash.

8. Paid cash dividends of Sh.8,000,000.

Required:

Statement of cash flows in compliance with International Accounting Standard (IAS) 7 “Statement of Cash Flows”

for the year ended 31 December 2021. (12 marks)

(Total: 20 marks)

QUESTION FOUR

1. Describe FOUR users of public sector financial statements. (4 marks)

2. Explain THREE errors that may be committed in the recording of accounting transactions where the trial balance does not agree. (6 marks)

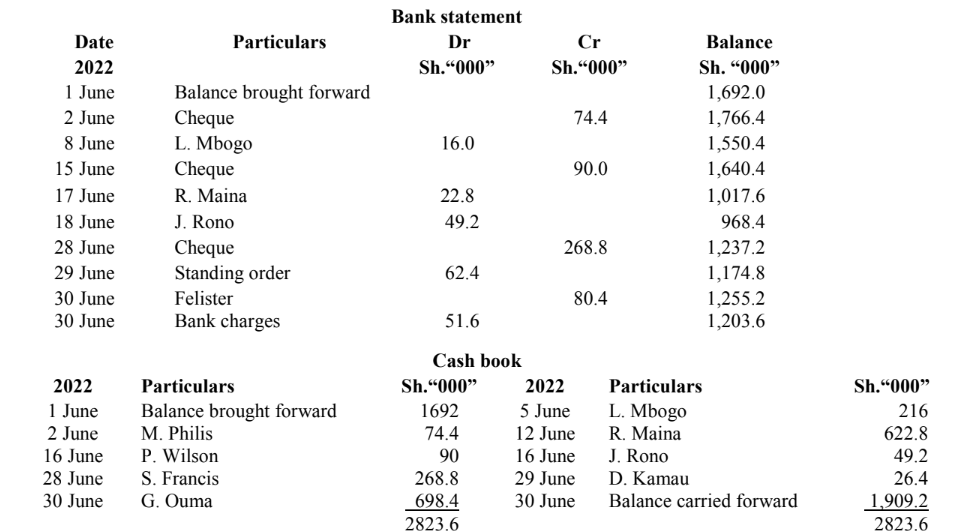

3. The bank column in the cash book for June 2022 and the bank statement for that month for Abbas Traders are as follows:

Required:

1. Updated cash book. (6 marks)

2. Bank reconciliation statement as at 30 June 2022. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. The financial year of Jamii Ltd. ended on 31 December 2021. At 1 January 2021, the company had in use equipment with a total accumulated cost of Sh.13,562,000 which had been depreciated by a total of Sh.8,137,400. During the year ended 31 December 2021, Jamii Ltd. purchased new equipment costing Sh.4,780,000 and sold off equipment which had originally cost Sh.3,600,000 and which had been depreciated by Sh.2,822,400 for Sh.570,000. No further purchase or sale of equipment had been planned for December. It is the policy of the company to depreciate equipment at 40% using the reducing balance method. A full year’s depreciation is provided for on all equipment in use by the company at the end of each year.

Required:

1. The equipment account. (2 marks)

Allowance for depreciation on equipment account. (4 marks)

Equipment disposal account. (4 marks)

2. Highlight FOUR conditions that a company must fulfill when issuing shares at a discount. (4 marks)

3. In one of the seminars you attended, one of the speakers stated that many companies are changing from manual

recording to computerised accounting system.

With reference to the above statement, explain THREE differences between a manual accounting system and a

computerised accounting system. (6 marks)

(Total: 20 marks)