FRIDAY: 17 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Explain the following accounting concepts:

Consistency concept. (2 marks)

Going concern concept. (2 marks)

Prudence concept. (2 marks)

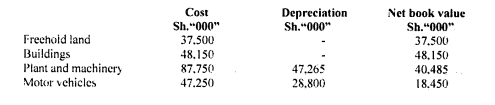

2. The property. plant and equipment balances of I3ahati Ltd. as at 1 January 2020 were as follows:

The company uses the straight line method of depreciation on assets as follows:

- 10% per annum for plant and machinery.

- 20% per annum for motor vehicles.

Additional information:

- It is the company’s policy to make a depreciation charge proportionate to the period of usage of the asset.

- An item of machinery bought on 1 July 2015 for Sh.12,600.000 was sold on 1 January 2020 at Sh.7.500.000.

- From the year ended 31 December 2020. the management of the company’ decided to charge depreciation on buildings at a rate of 2.5% per annum. The buildings were all completed on 1 July 2016.

- On I January 2020. a vehicle purchased on I May’ 2017 for Sh.I5.750.000 was traded in at a value of Sh.9.150,000 in part exchange for a new vehicle costing Sh.22.500.000.

- Included in machinery is an old machine which originally cost Sh.16.875.000 and which was already fully depreciated and not expected to yield any material amount on either use or resale.

- On 30 June 2020. a machine costing Sh.16.875.000 was purchased, from a vendor who had used it for three years. The vendor had bought the machine at Sh.22.500.000. Another machine costing Sh.13.125.000 was purchased on 3 i August 2020.

Required:

Non-current asset movement schedule for the year ended 31 December 2020. (14 marks)

(Total: 20 marks)

QUESTION TWO

1. Summarise the live steps in the accounting process. (5 marks)

2. Highlight five benefits of preparing manufacturing accounts. (5 marks)

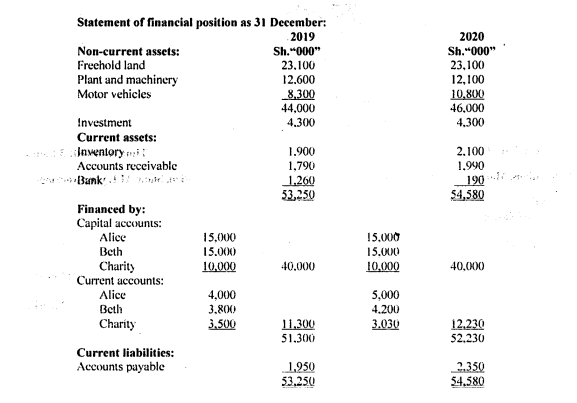

3. The following are the summarised accounts for ABC partnership for the years ended 31 December 2019 and 31 December 2020:

Required:

The following ratios for the years ended 31 December 2019 and 31 December 2020:

Return on capital employed. (2 marks)

Debtors turnover. (2 marks)

Current ratio. (2 marks)

Quick ratio. (2 marks)

Gross profit margin. (2 marks)

(Total: 20 marks)

QUESTION THREE

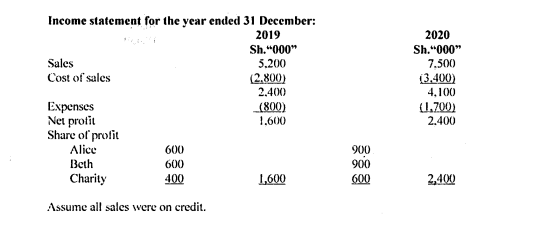

Daisy and Ian are in partnership sharing profits and losses in the ratio 60% to 400/0 respectively after charging annual salaries of Sh.3.000.000 each. On 1 July 2020. they admitted Milly as a partner and agreed to share profits in the ratio 2:2:1 for Daisy. Ian and Milly respectively. They also agreed to change the interest on capital from 10% per annum to 5% per annum. The salaries credited to Daisy and Ian ceased from 1 July 2020.

The following trial balance as at 31 December 2020 relate to the partnership:

Additional information:

- Closing inventory as at 31 December 2020 was valued at Sh.20,000,000.

- Debts amounting to Sh.1.600,000 are to be written off and the allowance for doubtful debts increased by Sh.1,000,000.

- Provision is to be made lOr staff bonuses totalling to Sh.1.200.000.

- Milly introduced Sh.10,000.0(K) as capital and Sh.4.000.000 paid for a 20% share of goodwill of the partnership. The goodwill payment was to be treated in the capital accounts of the partners concerned. No goodwill is to he maintained in the accounts.

- It was agreed that the freehold land should be revalued upwards on 30 June 2020 prior to the admission of Milly from Sh.20.000.000 to Sh.28.000.000.

- Daisy’s loan carries an interest at the rate of 10% per annum and was advanced to the partnership some years ago.

Depreciation is provided as follows:

Building 2% on cost

Plant and equipment 10% on cost

- Profits are accrued evenly throughout the year.

Required:

1. Statement of profit or loss and appropriation account for the year ended 31 December 2020. (12 marks)

2. Statement of financial position as at 31 December 2020. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. In the context of public sector accounting. explain the following:

Budgetary accounting. (2 marks)

Accrual accounting. (2 marks)

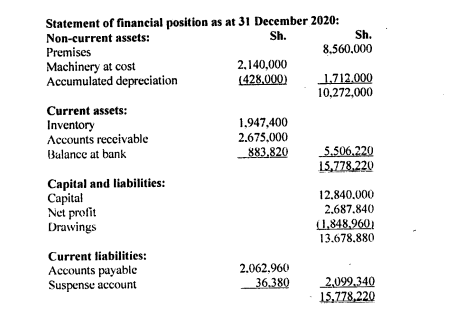

2. Richard Dua retired from employment and started a business. He has not employed an accountant. He prepared a trial balance for the year ended 31 December 2020 which failed to balance. The difference was transferred to a suspense account. He went on to prepare the following statement of financial position as at 31 December 2020:

Richard Dua engaged an accountant to prepare his final accounts. The accountant’s investigations revealed the following:

- Purchase of machinery during the year at Sh.1.000.000,by cheque was recorded correctly in the cash book, but was entered in the purchases account. Richard Dua provides depreciation on machinery at 20% per annum on cost.

- A payment made to John, a creditor for Sh.14.980 had been entered in the cash book only.

- Sale of goods on credit to Susan for Sh.19,260 had been entered in both accounts as Sh.23.112.

- Rent expense account was overcast by Sh.8.560.

- Sales account was undercast by Sh.42.800.

Required:

Journal entries to correct the above errors. (6 marks)

Suspense account duly balanced. (2 marks)

Statement of corrected net profit for year ended 31 December 2020. (3 marks)

Corrected statement of financial position as at 31 December 2020. (5 marks)

(Total: 20 marks)

QUESTION FIVE

1. Highlight four accounting software packages. (4 marks)

2. Distinguish between direct costs” and “indirect costs” in manufacturing accounts. (4 marks)

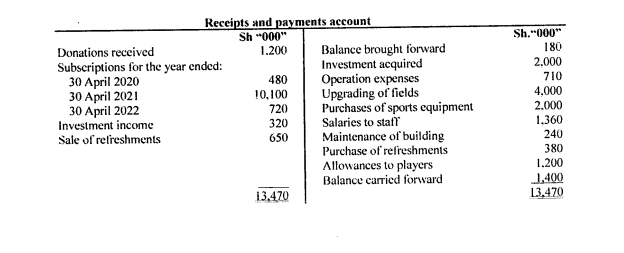

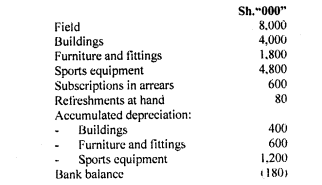

3. The following information relates to Morning Star Football Club for the year ended 30 April 2021:

Additional information:

- As at 30 April 2021, the subscriptions in arrears amounted to Sh.480,000 while those outstanding as at 1 May 2020 amounted to Sh.600,000. The policy of the club is to write-off any subscription outstanding after 12 months.

- The committee agreed to capitalise the cost of upgrading the field.

- As at 30 April 2021, outstanding operating expenses amounted to Sh.290,000.

- The following balances were extracted from the books of the club as at 1 May 2020:

- Sports equipment which had cost Sh.1.21 1080?)000 with an accumulated depreciation of Sh.600.000 was disposed of for Sh.800,000 cash, during the year.

- Depreciation is provided for as follows:

Building 5% per annum on reducing balance

Furniture and fittings 10% per annum on cost

Sports equipment 15% per annum on cost.

- The committee agreed to capitalise the donations received in order to purchase a club bus.

Required:

Income and expenditure account for the year ended 30 April 2021. (6 marks)

Statement of financial position as at 30 April 2021. (6 marks)

(Total: 20 marks)