WEDNESDAY: 3 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

1. List five features of a computerised accounting system. (5 marks)

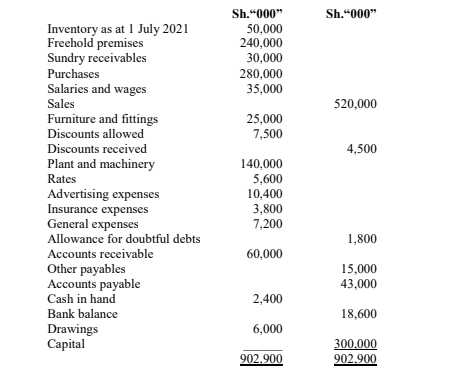

2. The following trial balance relates to Semasema, a sole trader as at 30 June 2022:

Additional information:

1. Depreciation on non-current assets is provided as follows:

Asset Rate per annum Basis

Furniture and fittings 15% Cost

Plant and machinery 10% Cost

2. Allowance for doubtful debts was increased to 4% of the accounts receivable.

3. As at 30 June 2022, prepaid insurance amounted to Sh.500,000 while rates accrued amounted to Sh.400,000.

4. As at 30 June 2022, inventory was valued at Sh.60,000,000.

5. During the year, Semasema took goods costing Sh.2,000,000 for his personal use.

Required:

Statement of profit or loss for the year ended 30 June 2022. (7 marks)

Statement of financial position as at 30 June 2022. (8 marks)

(Total: 20 marks)

QUESTION TWO

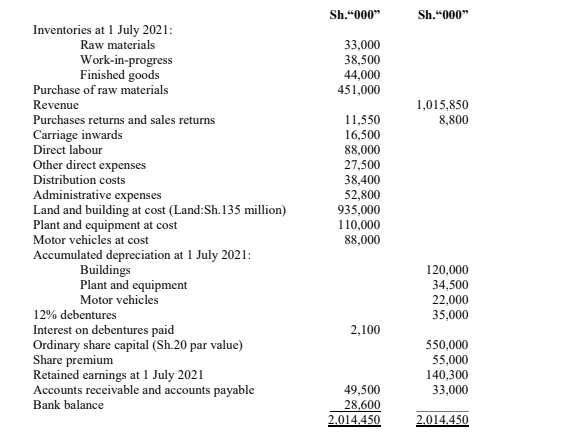

Stark Limited is a company that manufactures and sells water tanks. The trial balance extracted from the books of Stark Limited as at 30 June 2022 was as follows:

Additional information:

1. Inventories as at 30 June 2022 were valued at their cost as follows:

Sh.“000”

Raw materials 39,600

Work-in-progress 11,000

Finished goods 52,250

2. The 12% debentures were issued on 1 October 2021 and are redeemable after five years. Interest on debentures is paid semi-annually on 31 March and 30 September each year.

3. Stark Limited’s policy is to transfer finished goods from production to trading at their production costs.

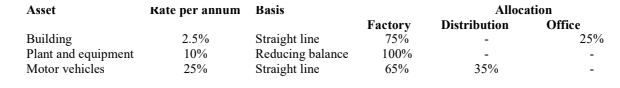

4. Depreciation on non-current assets is charged and allocated as follows:

5. The corporation tax for the year ended 30 June 2022 was estimated at Sh.70,000,000.

Required:

1. Manufacturing account for the year ended 30 June 2022. (6 marks)

2. Statement of profit or loss for the year ended 30 June 2022. (6 marks)

3. Statement of financial position as at 30 June 2022. (8 marks)

(Total: 20 marks)

QUESTION THREE

1. Citing examples of entities in the public sector, briefly evaluate the structure of the public sector. (8 marks)

2. Analyse three possible reasons for maintaining incomplete records and single-entry book-keeping. (6 marks)

3. The following balances were extracted from the books of Jamii Limited as at 30 June 2022:

Sh.

Inventory at 1 July 2021 1,331,400

Purchases (all credit) 8,964,400

Sales turnover (all credit) 9,568,475

Accounts receivable at 30 June 2022 1,048,600

Accounts payable at 30 June 2022 859,600

Inventory at 30 June 2022 1,041,000

Assume a 365-day financial year.

Required:

The cash conversion cycle (CCC) for Jamii Limited for the period ended 30 June 2022. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Distinguish between the “straight-line” and the “reducing balance” methods of providing for depreciation. (4 marks)

2. In the context of the financial statements of not-for-profit organisations, explain two differences between “receipts and payments accounts’ and “income and expenditure accounts”. (4 marks)

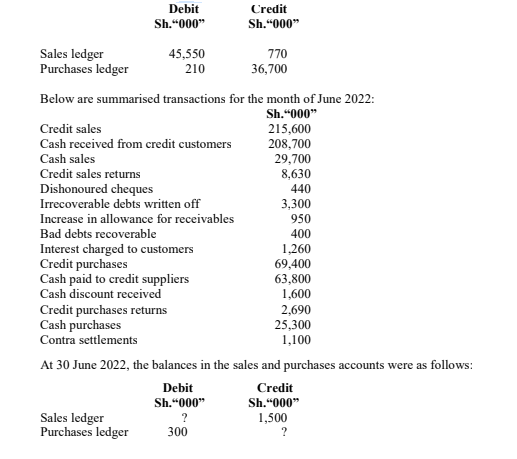

3. Jersey Limited, a private limited company prepares monthly reconciliations of its trade receivables and trade payables.

As at 1 June 2022, the following balances were extracted from the accounting records of the company:

Required:

Sales ledger control account as at 30 June 2022. (6 marks)

Purchases ledger control account as at 30 June 2022. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the meaning of the term “International Financial Reporting Standards” (IFRSs). (2 marks)

Highlight four benefits of adopting (IFRS). (4 marks)

2. Explain the following types of errors:

Error of omission. (2 marks)

Error of commission. (2 marks)

Error of principle. (2 marks)

3. Distinguish between the following terms:

“Share capital” and “reserve”. (4 marks)

“Shares issued at a premium” and “shares issued at a discount”. (4 marks)

(Total: 20 marks)