TUESDAY: 5 April 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

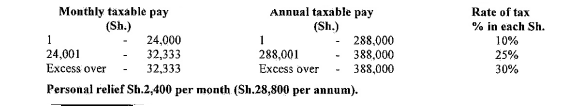

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2021.

Assume that the following rates of tax applied throughout the year of income 2021:

QUESTION ONE

1. Identify six books of original entry. (6 marks)

2. On 1 October 2021, Victory Ltd. offered for sale to the public 50,000 ordinary shares (Sh.100 par value) for Sh.125 each payable as follows:

- Sh.25 on application.

- Sh.50 on allotment (including premium)

- Sh.25 on first call.

- Sh.25 on second and final call.

By 31. October 2021 applications were received for 60,000 shares. An application for 10,000 shares was rejected. Allotment money due was received, first call was made after one month and second call after two months.

All monies due on first call and second call were received except for 1,000 shares. These shares were forfeited after three months, and then re-issued at Sh.70 each as fully paid.

Required:

Ledger accounts to record the above transactions. (14 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following accounting concepts:

Matching concept. (2 marks)

Conservatism concept. (2 marks)

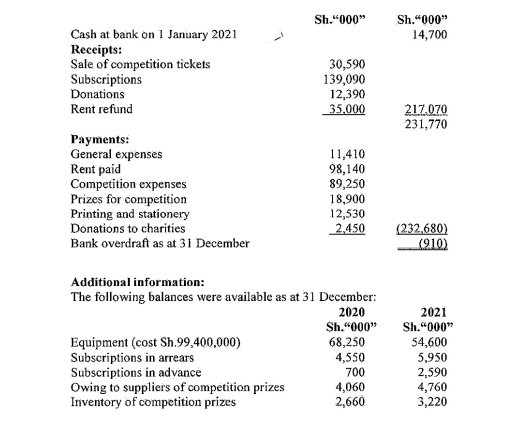

2. The following information was obtained from the books of Vazi Club at 31 December 2021:

Required:

Competition income statement for the year ended 31 December 2021. (4 marks)

Income and expenditure account for the year ended 31 December 2021. (6 marks)

Statement of financial position as at 31 December 2021. (6 marks)

(Total: 20 marks)

QUESTION THREE

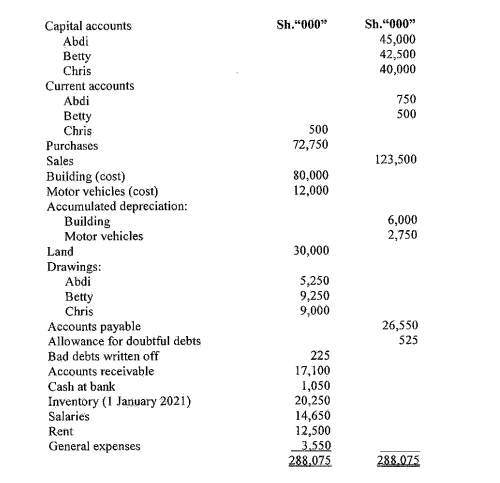

Abdi, Betty and Chris have been in a partnership trading as ABC partnership. They shared profits and losses in the. ratio 1/2: 3/10 : 2/10 respectively. The partnership deed provides for interest on capital at annual rate of 4%.

On 30 June 2021, Abdi retired from the partnership while the other partners continued in partnership sharing profits equally. The following trial balance was extracted from the partnership’s books as at 31 December 2021:

Additional information:

- On retirement of Abdi, goodwill was valued at Sh.5,000,000. This is to be written off on the same date, land was valued upward by Sh.10,000,000.

- Profits for the partnership are assumed to accrue evenly throughout the year.

- As at 31 Decernber 2021, inventory was valued at Sh.12,500,000.

- Allowance for doubtful debts is to be increased to Sh.750,000.

- As at 31 December 2021, rent prepaid amounted to Sh.1,251,000 and general expenses accrued amounted to Sh.1,100,000.

- Depreciation is to be provided per annum as follows:

Asset Rate

Building 4% on cost

Motor vehicles 10% on reducing balance

- The balance due to Abdi is to remain in the partnership as a loan for the next five years.

Required:

Statement of profit orloss and appropriation account for the year ended 31 December 2021. (10 marks)

Partners’ current accounts. (4 marks)

Statement of financial position as at 31 December 2021. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Discuss four principles of an optimal tax system as provided by Adam Smith. (8 marks)

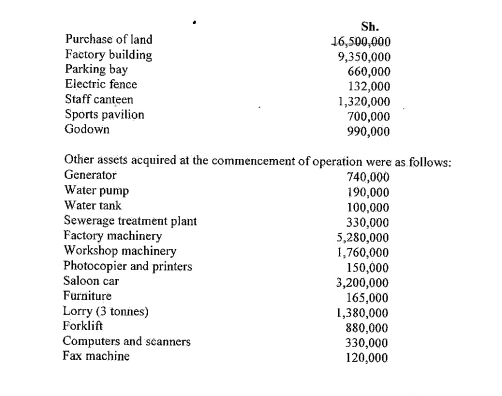

2. Rolling Ltd. is a manufacturing company that commenced its operations on 1 January 2021 after incurring the following expenditures:

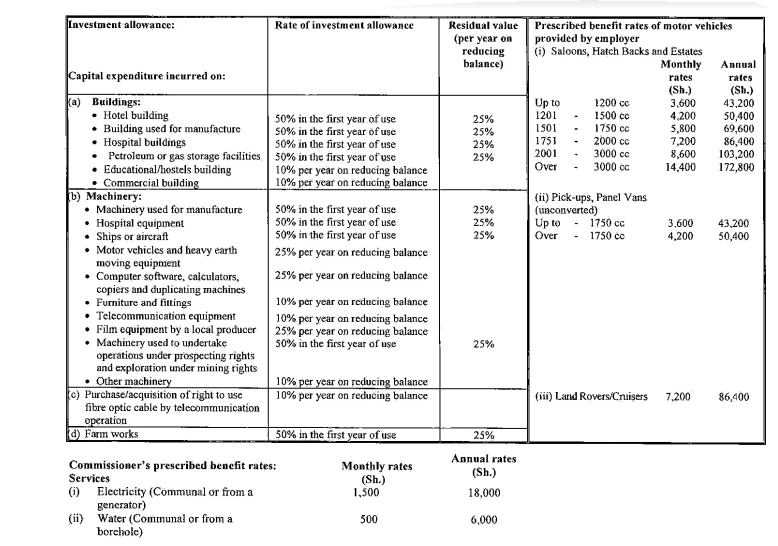

Additional information:

- Rolling Ltd. sunk a borehole at a cost of Sh.1,375,000 which was put in use on 1 September 2021.

- The factory building includes a showroom and an office block constructed at a cost of Sh.660,000 and Sh.440,000 respectively.

- The .company constructed a factory extension at a. cost of Sh.2,400,000 and installed processing machinery costing Sh.1,600,000 on 1 June 2021.

- The company disposed of the following assets on 1 October 2021:

Sh.

- Lorry 900,000

- Fax machine 50,000

- Scanners 80,000

- The saloon car was involved in an accident on 1 July 2021. The company received Sh.1,200,000 as compensation for the loss in the same year

Required:

Investment allowances due to Rolling Ltd. for the year ended 31 December 2021. (12 marks)

(Total: 20 marks)

QUESTION FIVE

1. With reference to pre-shipment inspection:

Explain three purposes of pre-shipment inspection. (6 marks)

State four goods exempted from pre-shipment exemption. (4 marks)

2. Discuss five objectives of levying taxes by a government. (10 marks)

(Total: 20 marks)