WEDNESDAY: 6 April 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

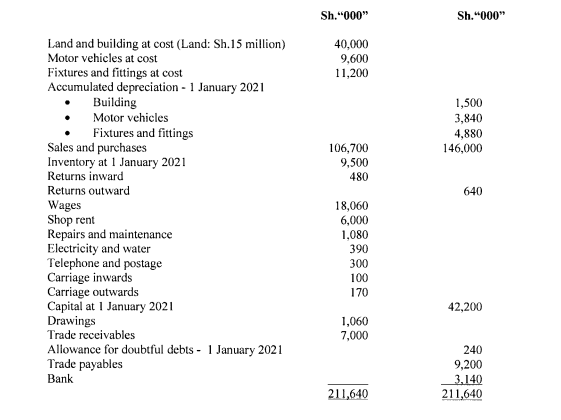

Ezekiel Mbogi, a sole trader operates a retail business dealing in school outfits.

A trial balance as at 31 December 2021 extracted from the accounting records of his business was as shown below:

Additional information:

- Inventory as at 31 December 2021 was valued at Sh.11,400,000.

- On 1 January 2021, Ezekiel Mbogi paid shop rent for 15 months at a monthly rate of Sh.400,000.

- On 31 December 2021, outstanding electricity bills amounted to Sh.60,000.

- An allowance for doubtful debts is to be maintained at the rate of 5% of the trade receivables.

- Depreciation on property, plant and equipment is provided per annum as follows:

- Building – 2% annually, straight-line basis.

- Motor vehicles – Straight-line, assuming a useful economic life of five years with no residual value.

- Fixtures and fittings – 12.5% annually on a reducing balance basis.

Required:

Statement of profit or loss for the year ended 31 December 2021. (12 marks)

Statement of financial position as at 31 December 2021. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following elements of financial statements:

Asset. (2 marks)

Liability. (2 marks)

Income. (2 marks)

Expense. (2 marks)

2. The trial balance of Tausi Limited extracted as at 31 October 2021 failed to balance and the accountant posted the discrepancy to the suspense account.

Upon investigations, the accountant discovered the following errors made in the preparation of the ledger accounts:

- Credit sales amounting to Sh.630,000 made during the year ended 31 October 2021 were altogether omitted from the books of accounts.

- Purchases returns of Sh.12,000 were recorded on the debit side of the sales returns ledger account. A cash payment of Sh.185,000 to a credit supplier had been correctly recorded in the cashbook, but no corresponding entry was made in the payables’ control account.

- Cash purchases of Sh.84,000 had been posted in the relevant ledger accounts as Sh.8,400.

- A credit balance of Sh.64,800 in the commission income account had erroneously been extracted on the list of balances as a debit balance.

- A debit balance of Sh.56,000 on the electricity expense account had been incorrectly extracted on the list of balances as Sh.65,000.

- The book keeper recorded the purchase of a motor vehicle at a cost of Sh.850,000 in the motor expenses account.

- A cheque of Sh.160,000 received from a credit customer had been entered correctly in the cash book, but posted to the wrong side of the receivable’s ledger control account.

Required:

Prepare the relevant journal entries to correct the above errors. (Narrations required). (12 marks)

(Total: 20 marks)

QUESTION THREE

1. Highlight four benefits of preparing a cash book. (4 marks)

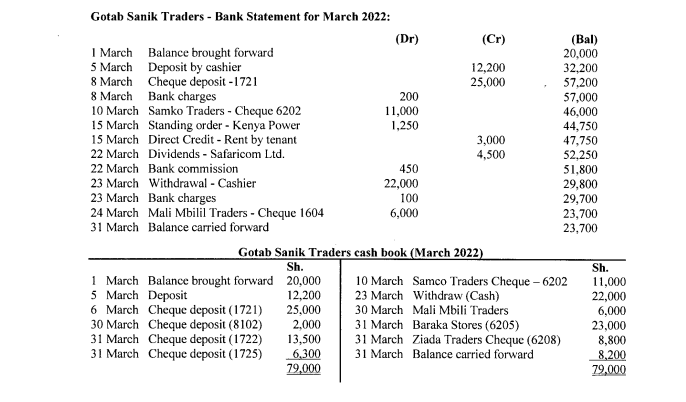

2. The cash book of Gotab Sanik Traders as at 31 March 2022 showed a debit balance of Sh.8,200. The bank statement issued on the same day showed a credit balance of Sh.23,700. The bank statement and cash book are shown below:

Gotab Sanik Traders – Bank Statement for March 2022:

The cheque deposited on 30 March of Sh.2,000 (Cheque number 8102) was dishonoured by the bank.

Required:

Updated cash book for the month of March 2022. (9 marks)

Bank reconciliation statement. (7 marks)

(Total: 20 marks)

QUESTION FOUR

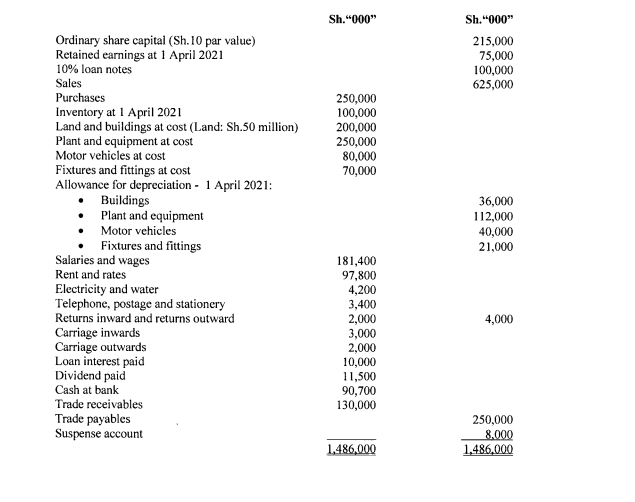

The following trial balance relates to Nyota Limited, a public limited entity as at 31 March 2022:

Additional information:

- As at 31 March 2022, inventory was valued at Sh.96,000,000.

- Accrued rent as at 31 March 2022 amounted to Sh.2,200,000.

- Depreciation on non-current assets is provided as follows:

Asset Rate per annum Basis

Building 2% Straight-line

Plant and equipment 15% Reducing balance

Motor vehicles 25% Straight-line

Fixtures and fittings 10% Straight-line

- Current tax for the year to 31 March 2022 is estimated at Sh.5,000,000.

- The balance on the suspense account represents the proceeds from the issue of 500,000 ordinary shares at a price of Sh.16 per share.

Required:

Statement of profit or loss for the year ended 31 March 2022. (10 marks)

Statement of financial position as at 31 March 2022. (10 marks)

(Total: 20 marks)

QUESTION FIVE

1. Highlight six source documents maintained by entities for the measurement and recording of transactions. (6 marks)

2. Describe three challenges of using computerised accounting systems. (6 marks)

3. List four contents of a partnership agreement. (4 marks)

4. Explain the following terms as used in accounting:

Share capital. (2 marks)

Forfeiture of shares. (2 marks)

(Total: 20 marks)