TUESDAY: 6 December 2022. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

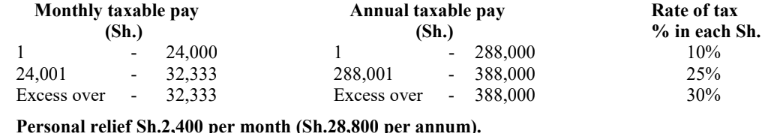

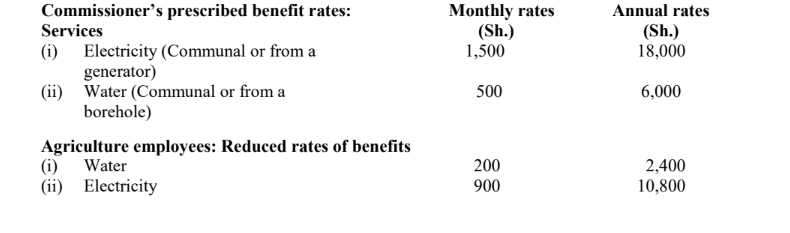

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax).

Year of income 2021.

Assume that the following rates of tax applied throughout the year of income 2021:

QUESTION ONE

1. Identify the financial information needs of the following users of financial statements:

Lenders. (2 marks)

Investors. (2 marks)

2. With respect to public sector accounting, outline THREE accounting techniques adopted by the public sector entities. (6 marks)

3. Kisima Holding Ltd. (KHL) has an authorised share capital of Sh.5,000,000 divided into 500,000 shares of Sh.10 each.

On 1 January 2022, the company decided to issue 400,000 additional shares at Sh.13.5 each (face value Sh.10 each.

The shares were payable in three instalments as follows:

On application Sh.5 each

On allotment Sh.6 each (including premium)

On first and final call Sh.2.5 each

Additional information:

1. Application for 600,000 shares were received by 31 January 2022.

2. The applicants were vetted and applicants for 100,000 shares were rejected and refunded their application money.

3. The remaining applicants were allotted 400,000 shares on prorata basis (allotted 4 shares for every 5 shares applied for).

4. The allotment monies were received by 28 February 2022.

5. The allottees were allowed to use their excess application monies on shares not allotted to reduce the amount payable on allotment.

6. The first and final call was made on 15 March 2022 notifying allottees to pay the final instalment by 31 March 2022.

7. The first and final call monies were received from all allottees on due date except applicants of 2,000 shares who failed to pay on due date.

8. These calls in arrears were later forfeited and reissued to another shareholder for Sh.7.5 per share as full paid on 31 March 2022.

Required:

Ledger accounts to record the above transactions. (10 marks)

(Total: 20 marks)

QUESTION TWO

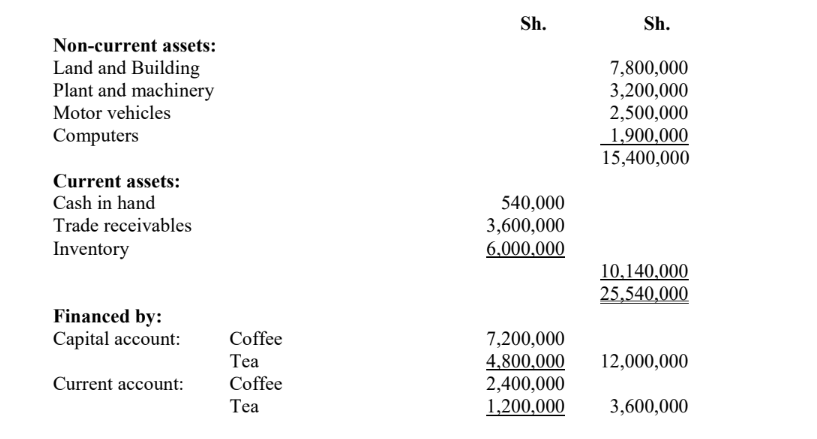

Coffee and Tea are partners in a firm sharing profit and loss in the ratio 3:2.

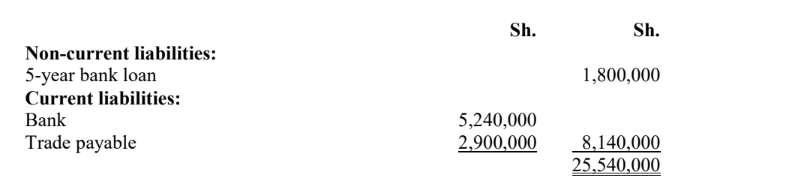

Their statement of financial position as at 30 April 2022 was as follows:

On 1 May 2022 they admitted Cocoa as a partner on the following terms:

Additional information:

1. The new profit sharing ratio of Coffee, Tea and Cocoa was agreed at 5:3:2.

2. Goodwill was to be valued at Sh.1,200,000 and was to be written off.

3. The provision of doubtful debts is to be provided at 10% of trade receivables balance.

4. Land and building was revalued to Sh.9,000,000 and plant and equipment was reduced by Sh.200,000.

5. The inventory was revalued at Sh.5,400,000.

6. Cocoa was to contribute cash in order to make her capital and current accounts equal to 1/5 of the combined adjusted capital and current accounts of Tea and Coffee.

Required:

Prepare the following accounts:

1. Revaluation account. (4 marks)

2. Partners’ capital account. (5 marks)

3. Partners’ current account. (3 marks)

4. Prepare a statement of financial position as at 1 May 2022 after admission of Cocoa. (8 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the term “share premium”. (2 marks)

State FOUR purposes that the share premium may be applied for by a company. (4 marks)

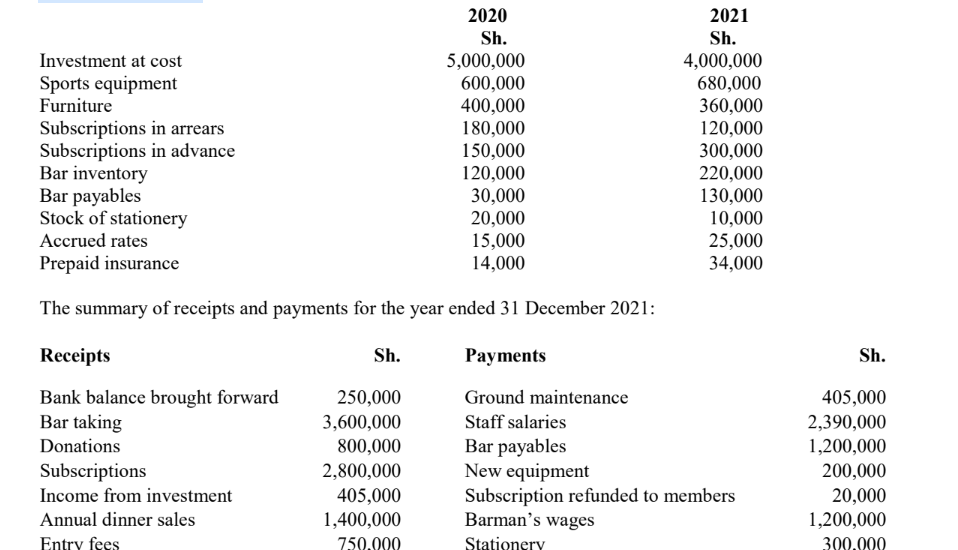

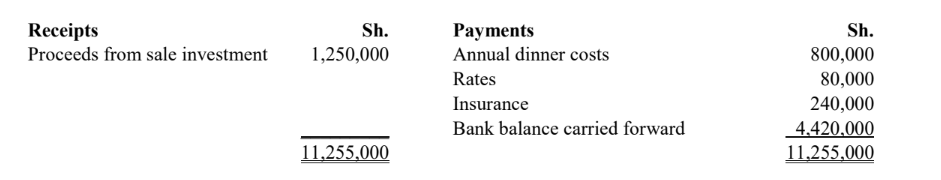

2. The following assets and liabilities were extracted from the books of Jikaze sports club as at 31 December 2020 and 31 December 2021.

Additional information:

1. Included in the subscriptions received in the year 2021 is Sh.150,000 being arrears for the year ended 31 December 2020. It is the policy of the club to write off subscriptions arrears owing for more than twelve months.

2. During the year an investment which cost Sh.1,000,000 was sold for Sh.1,250,000. The club accountant recorded only the receipt of proceeds from sale of investment in the books of account.

Required:

Bar income statement for the year ended 31 December 2021 (4 marks)

Subscriptions account. (4 marks)

Income and expenditure account for the year ended 31 December 2021. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the following terms as used in customs and excise taxes:

Customs area. (2 marks)

Duty free shop. (2 marks)

Ad valorem duty. (2 marks)

2. Propose FOUR ways in which an individual or firm could engage in tax avoidance. (8 marks)

3. Discuss the following principles of an optimal tax system:

Diversity. (2 marks)

Productivity. (2 marks)

Flexibility. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Outline FOUR benefits a country could derive from adopting a multiple tax system. (4 marks)

2. Identify FOUR documents or instruments that are exempted from stamp duty. (4 marks)

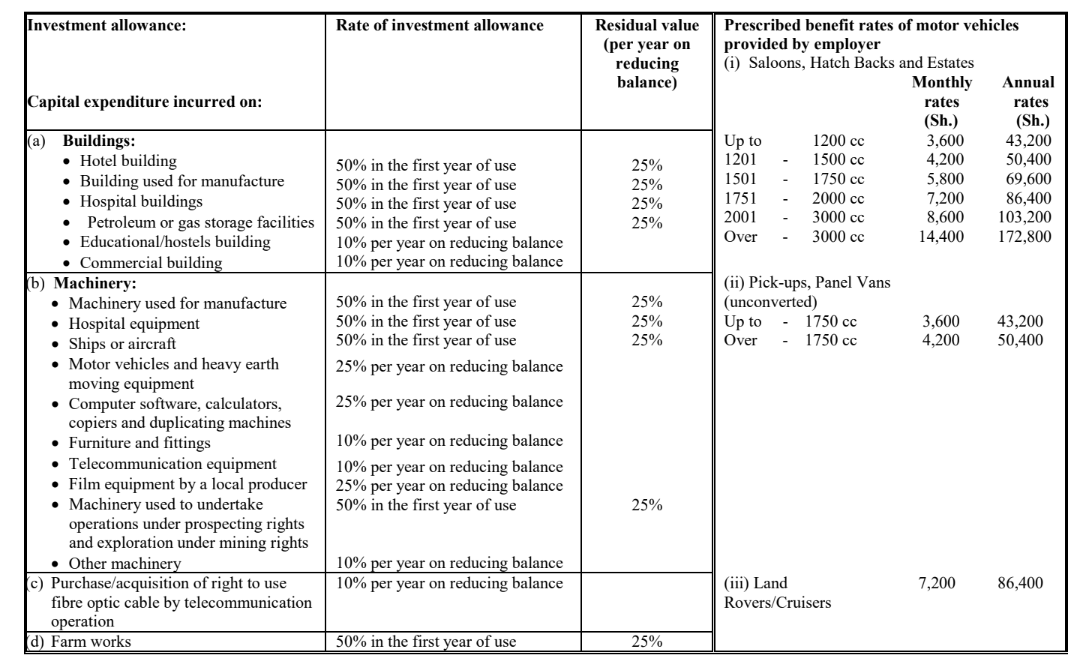

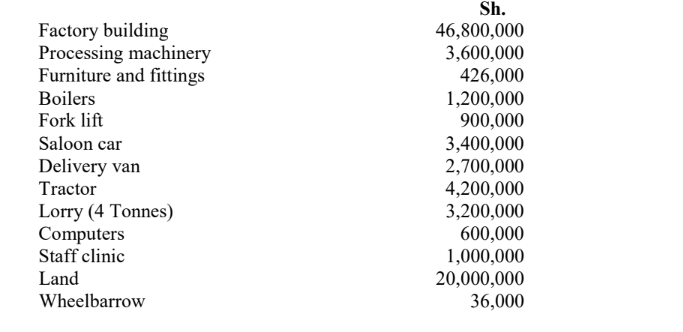

3. Nadia Shoe Manufacturing company commenced its operations in 1 January 2021 after incurring the following expenditure:

Additional information:

1. Factory building includes the cost of a showroom Sh.600,000 a retail shop Sh.500,000 and staff canteen Sh.720,000.

2. A perimeter wall was constructed at a cost of Sh.1,100,000 and completed on 1 April 2021.

3. A go-down and staff quarters were constructed during the year at a cost of Sh.1,200,000 and Sh.1,040,000 respectively

and put into use on 1 October 2021.

4. Included in the land is Sh.2,000,000 being legal fee paid to lawyer involved in acquiring the land.

5. A warehouse was constructed at a cost of Sh.940,000 and put into use on 1 September 2021.

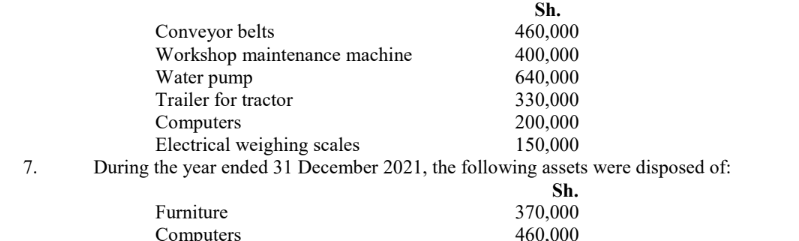

6. On 1 October 2021 the following assets were acquired:

8. During the year the saloon car was sold for Sh.2,000,000 and a new one was purchased at a cost of Sh.3,700,000.

9. On 1 July 2021, a television set was purchased at a cost of Sh.64,000 and placed at the reception area.

Required:

Compute investment allowance for Nadia Shoe Manufacturing Company for the year ended 31 December 2021. (12 marks)

(Total: 20 marks)