THURSDAY: 16 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated.

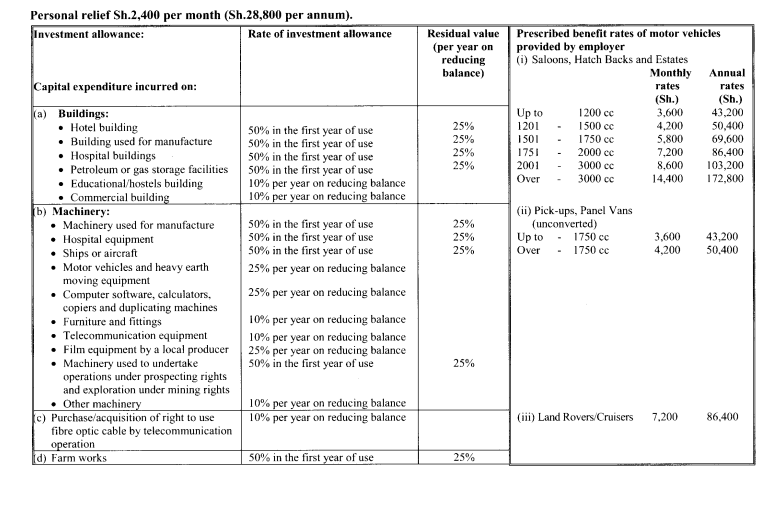

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

Assume that the following rates of tax applied throughout the year of income 2020:

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 24,000 1 – 288,000 10%

24,001 40,667 288,001 – 488,000 15%

40,668 57,334 488,001 – 688,000 20%

Excess over 57,334 Excess over – 688,000 25%

QUESTION ONE

1. Explain the “accruals concept” as applied in accounting. (2 marks)

2. Describe four users of accounting information citing their information needs. (8 marks)

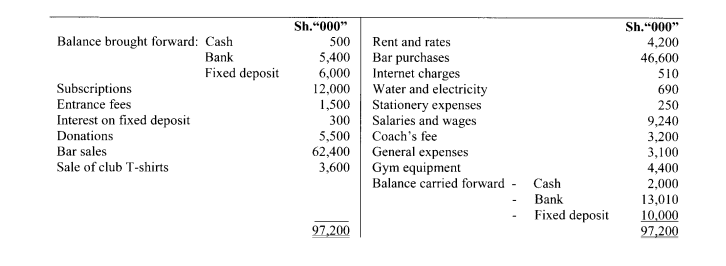

3. The following is the receipts and payments account of Rocket Sports Club for the year ended 30 June 2021:

Additional information:

- On 30 June 2020, the values of non-current assets were as follows:

Sh.”000″

Sports pavilion (cost) 70,000

Fixtures and fittings (cost) 16,000

Sports equipment (net book value) 11,200

- Depreciation is to be provided as follows:

Asset Rate per annum

Sports pavilion 2% on cost

Fixtures and fittings 10% on cost

Sports equipment 20% on reducing balance

- The following balances were available:

30 June 2020 30 June 2021

Sh.”000″ Sh.”000″

Subscriptions in arrears 400 480

Rates due 350 410

Rent prepaid 400 500

Bar payables 1,500 2,200

- As at 30 June 2021, the cost of club T-shirts was included in general expenses.

- The bar inventory was valued at Sh.950,000 as at 30 June 2020 and Sh.1,200,000 as at 30 June 2021.

- The new gym equipment was purchased during the year ended 30 June 2021 at a cost of Sh.5,000,000. The difference between the actual cost and the amount reflected in the receipts and payments account is a trade- in-value of Sh.600,000. The old gym equipment which was traded-in for the new gym equipment had been included in the cost of sports equipment at 30 June 2020 at a value of Sh.400,000.

- Depreciation is charged for a full year irrespective of the date of purchase. No depreciation is charged in the year of disposal.

Required:

Bar income statement for the year ended 30 June 2021. (2 marks)

Income and expenditure account for the year ended 30 June 2021. (8 marks)

(Total: 20 marks)

QUESTION TWO

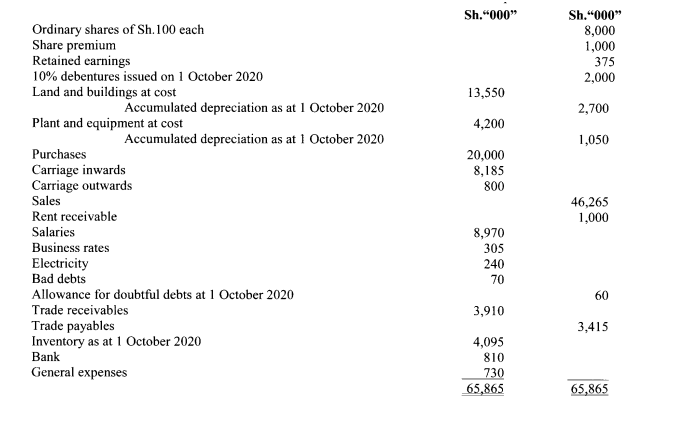

The following trial balance was extracted from the books of Marata Limited as at 30 September 2021:

Additional information:

- As at 30 September 2021, inventory was valued at Sh.4,715,000.

- As at 30 September 2021, salaries accrued amounted to Sh.90,000.

- Business rates paid in advance at 30 September 2021 amounted to Sh.35,000.

- The allowance for doubtful debts is to be increased to Sh.75,000.

- A depreciation charge is to be made on buildings of Sh.1,250,000 and plant and equipment at 20% on cost.

- The directors proposed the following:

- To pay dividends of Sh.1,000,000

- To transfer Sh.1,000,000 to general reserves

- A trade debtor who owed Sh.225,000 was declared bankrupt. The directors decided to write off his debt.

- 10% debenture interest was paid on 1 October 2021.

Required:

Statement of profit or loss for the year ended 30 September 2021. (10 marks)

Statement of financial position as at 30 September 2021. (10 marks)

(Total: 20 marks)

QUESTION THREE

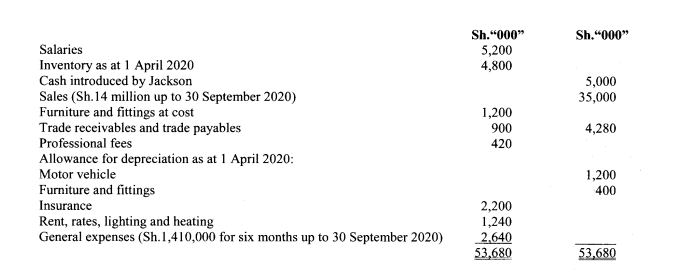

Nelson and Tyson were partners in a retail business sharing profits and losses in the ratio of 2:1 for Nelson and Tyson respectively. Interest on capital is provided at the rate of 6% per annum but no interest is provided on current accounts.

The following were extracted from the partnership books as at 31 March 2021:

Additional information:

- On 30 September 2020, Jackson was admitted as a partner and from that date, profits and losses were to be shared in the ratio of 2:2:1 for Nelson, Tyson and Jackson respectively. For the purposes of these changes the value of goodwill of the firm was agreed at Sh.12,000,000. This goodwill is not to be maintained in the accounts.

- On 1 October 2020, Jackson had introduced Sh.5,000,000 into the firm which it was agreed Sh.3,500,000 should comprise his capital and the balance should be credited to his current account.

- Any apportionment of gross profit was to be made on the basis of sales. Expenses, unless otherwise stated, were to be apportioned on time basis.

- On 31 March 2021, inventory was valued at Sh.5,100,000.

- Allowance for depreciation was to be made on the motor vehicle and furniture and fittings at 20% and 5% per annum respectively on cost.

- Salaries included partners’ drawings as follows: Nelson Sh.600,000; Tyson Sh.480,000 and Jackson Sh.250,000.

- At 31 March 2021, rates paid in advance amounted to Sh.260,000 and an accrual of Sh.600,000 on electricity consumed was required.

- Allowance for doubtful debts as at 30 September 2020 amounted to Sh.120,000 (full provision) and as at 31 March 2021 amounted to Sh.160,000.

Required:

Statement of profit or loss for the year ended 31 March 2021. (10 marks)

Statement of financial position as at 31 March 2021. (10 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the following terms as used in taxation:

Multiple tax system. (2 marks)

Direct taxes. (2 marks)

2. Discuss four factors that could influence tax shifting in your country. (8 marks)

3. In relation to the structure and mandate of the Revenue Authority in your country, propose four benefits that could arise from the integration of functions of various departments. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the following terms as used in relation to custom taxes:

Clean report of finding (CRF). (2 marks)

Import declaration form (IDF). (2 marks)

2. Outline four categories of goods which are subject to customs controls. (4 marks)

3. Tamu Manufacturing Ltd. commenced operations in May 2020 after incurring the following expenditure:

Sh.

Processing machines 22,800,000

Factory building 63,000,000

Delivery van 2,500,000

Computers 1,400,000

Other machinery 1,700,000

Furniture and fittings 1,600,000

Security wall 4,200,000

Computer software 240,000

Office telephone and installation 210,000

Additional information:

- Tamu Manufacturing Ltd. continued expanding and acquired/constructed the following assets which were put into use from 1 September 2020:

Sh.

Additional processing machinery 6,400,000

Labour quarters 4,800,000

Heavy duty fork lifts 2,600,000

Parking bay 1,800,000

Bar code readers 280,000

Factory shop 2,700,000

Showroom 3,600,000

Staff clinic 5,720,000

Go-down 4,600,000

- The delivery van developed a mechanical problem and was traded in for a new one costing Sh.2,800,000 in June 2020. The old van was valued at Sh.1,950,000 and the balance was paid in cash.

- The company constructed a borehole at a cost of Sh.4,500,000 which was put into use on 1 September 2020.

- The company acquired a ship at a cost of Sh.400 million on 1 October 2020 for use in importation of raw materials and exporting finished goods.

Required:

Investment allowances due to Tamu Manufacturing Ltd. for the year ended 31 December 2020. (12 marks)

(Total: 20 marks)