TUESDAY: 22 August 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

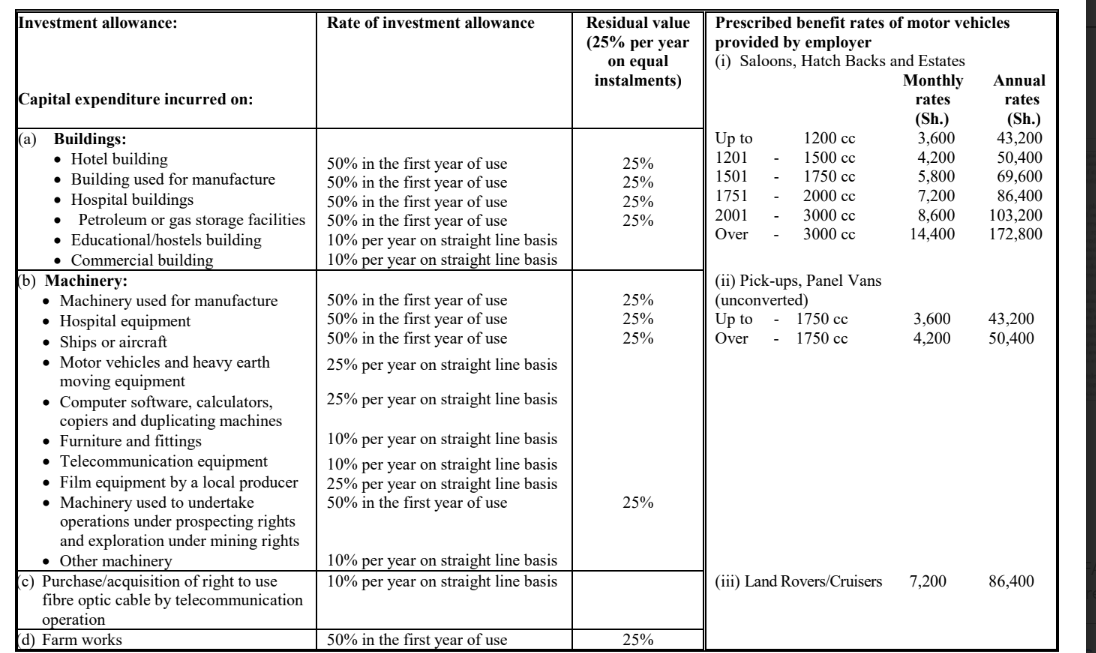

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax).

QUESTION ONE

1. Summarise the information needed by the following users of accounts:

Shareholders. (2 marks)

Governments. (2 marks)

Employees. (2 marks)

2. Outline FOUR objectives of public sector financial statements and International Public Sector Accounting Standards (IPSASs). (4 marks)

3. The property, plant and equipment balances of Highken Ltd. comprised the following as at 1 January 2022:

The company uses the straight line method of depreciation on assets as follows:

• 10% per annum for plant and machinery

• 20% per annum for motor vehicles

Additional information:

1. It is the company’s policy to make a depreciation charge proportionate to the period of the asset.

2. An item of machinery bought on 1 July 2018 for Sh.10,080,000 was sold on April 2022 at Sh.6,000,000.

3. From the year ended 31 December 2022, the management of the company decided to charge depreciation on buildings at a rate of 2.5% per annum. The buildings were all completed on 1 July 2018.

4. On 1 January 2022, a vehicle purchased on 1 May 2018 for Sh.12,600,000 was traded in at a value of

Sh.7,320,000 in part exchange for a new vehicle costing Sh.18,000,000.

5. Included in machinery is an old machine which originally cost Sh.13,500,000 and which was already fully depreciated and not expected to yield any material amount on either use or resale.

6. On 30 June 2022, a machine costing Sh.13,500,000 was purchased from Vector Ltd., and had been used for three years. Vector Ltd. had bought the machine at Sh.18,000,000.

7. Another machine costing Sh.10,500,000 was purchased on 1 August 2022.

Required:

Prepare a schedule showing the movement of property, plant and equipment for the year ended 31 December 2022. (10 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain TWO reasons why a firm should account for depreciation of its non-current assets. (4 marks)

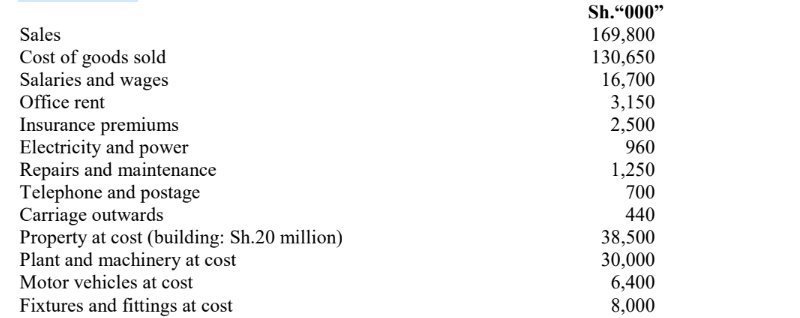

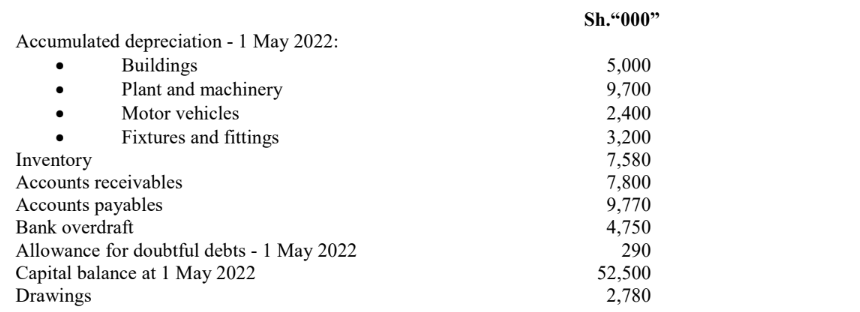

2. The following balances were obtained from the financial records of Junior Enterprises, a sole trader business as at 30 April 2023:

Additional information:

1. Depreciation is to be provided as follows:

• Building 2% annually, straight line basis.

• Plant and machinery, 15% per annum, reducing balance basis.

• Motor vehicles, 25% annually, straight line basis.

• Fixtures and fittings, 10% per annum, straight line basis.

2. Electricity and power accruing at 30 April 2023 amounted to Sh.120,000.

3. Prepaid insurance at 30 April 2023 was Sh.200,000.

4. Allowance for doubtful debts at 30 April 2023 was Sh.475,000.

Required:

Statement of profit or loss for the year ended 30 April 2023. (10 marks)

Statement of financial position as at 30 April 2023. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Describe THREE differences between “receipts and payments account” and “income and expenditure

account”. (6 marks)

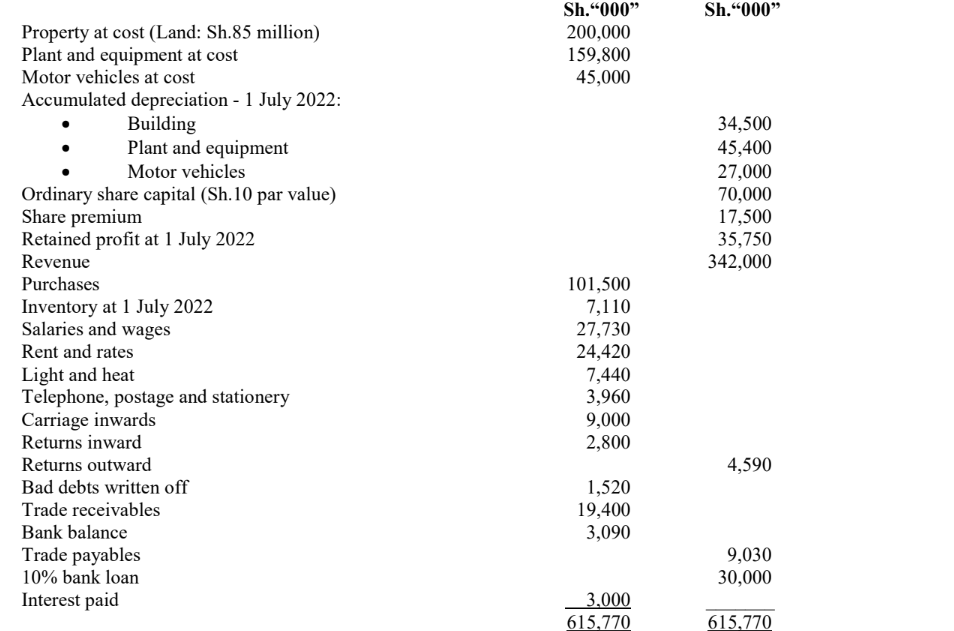

2. The following trial balance as at 30 June 2023 was extracted from the accounting records of Bungeh Limited, a public limited entity:

Additional information:

1. Inventory at 30 June 2023 was valued at a cost of Sh.3,660,000.

2. Prepaid rent as at 30 June 2023 amounted to Sh.2,640,000.

3. Depreciation on non-current assets should be provided as follows:

• Building at 2% per annum on cost.

• Plant and equipment at 15% per annum on net book value.

• Motor vehicles at 20% per annum on cost.

4. The corporate tax for the year ended 30 June 2023 is estimated at Sh.38,600,000.

Required:

Statement of profit or loss for the year ended 30 June 2023. (8 marks)

Statement of financial position as at 30 June 2023. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Outline FOUR disadvantages of direct taxes in your country. (4 marks)

2. Explain the term “set off tax” as used in taxation. (2 marks)

Discuss THREE causes of tax evasion in developing countries. (6 marks)

3. With regards to Customs and Excise Act, highlight FOUR types of goods which are subject to customs control. (4 marks)

4. Warren Korir is a commercial farmer. He incurred the following expenditure during the year ended 31 December 2022:

Required:

Compute his farmworks deductions for the year ended 31 December 2022. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Highlight FOUR circumstances under which duty paid on imported goods may be refundable. (4 marks)

2. State FOUR circumstances under which the commissioner of customs and excise duty may request for fresh securities. (4 marks)

3. Betalite PLC commenced its manufacturing operation on 1 January 2022 after incurring the following capital expenditures:

Additional information:

1. Factory building include; an office Sh.280,000, showroom Sh.420,000, Godown Sh.800,000 and a retail shop Sh.300,000.

2. The processing machine costing Sh.4,200,000 was imported and the amount includes import duty and value added tax of Sh.400,000 and Sh.160,000 respectively which were waived by the government.

3. The borehole was sunk using money raised internally while the balance was borrowed from a bank amounting to Sh.1,000,000 which includes interest on bank loan of Sh.180,000.

4. The saloon car was disposed of for Sh.2,100,000 on December 2022.

5. The company constructed a canopy at the entrance of the factory building at a cost of Sh.570,000 which was completed and utilised from 1 November 2022.

6. Purchased a water pump at a cost of Sh.90,000 and a generator at a cost of Sh.120,000.

Required:

Compute the investment allowance due to Betalite PLC for the year ended 31 December 2022. (12 marks)

(Total: 20 marks)