TUESDAY: 2 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

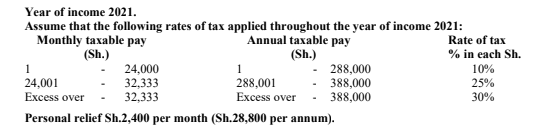

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax).

QUESTION ONE

1. Describe three qualities of useful accounting information. (6 marks)

2. Highlight four characteristics of public sector entities. (4 marks)

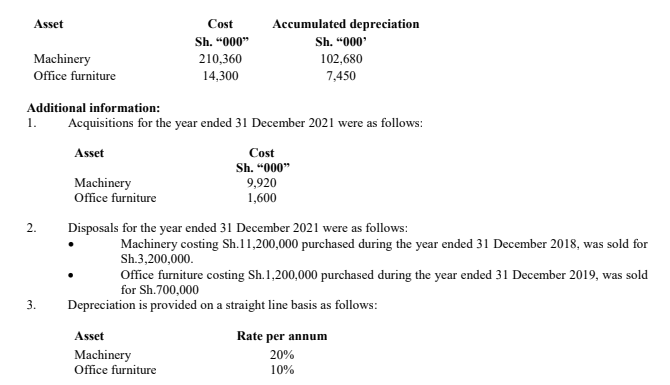

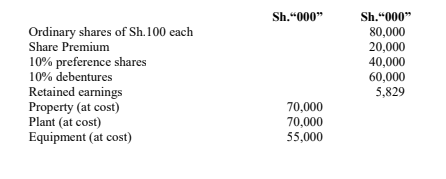

3. Millz Ltd. maintains its property, plant and equipment at cost. The company maintained an accumulated depreciation account for each asset.

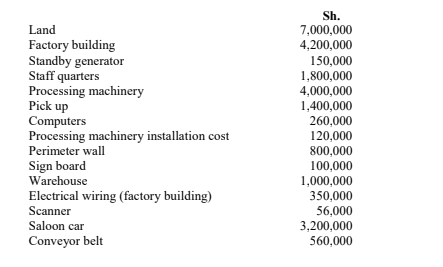

As at 31 December 2020, the asset balances were as follows:

4. The company’s policy is to provide a full year’s depreciation in the year of acquisition and no depreciation charge in the year of disposal.

Required:

Prepare the following accounts as at 31 December 2021:

Machinery account. (2 marks)

Accumulated depreciation on machinery account. (2 marks)

Office furniture account. (2 marks)

Accumulated depreciation on office furniture account. (2 marks)

Machinery disposal account. (1 mark)

Office furniture disposal account. (1 mark)

(Total: 20 marks)

QUESTION TWO

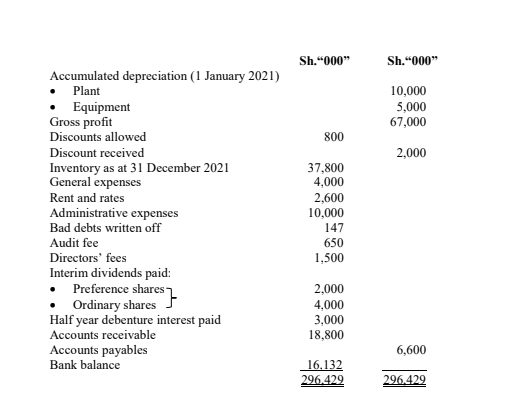

1. The following trial balance was extracted from the books of Taratibu Ltd. as at 31 December 2021;

Additional information:

1. Depreciation is to be provided on cost as follows:

Asset Rate per annum

• Plant 20%

• Equipment 10%

2. The corporation tax for the year amounted to Sh.3,627,000.

3. As at 31 December 2021, rates paid in advance amounted to Sh.500,000, while salaries and wages outstanding amounted to Sh.300,000. Salaries and wages are included in administrative expenses.

4. The directors propose to pay a final dividend of 10% of the issued share capital and pay the remainder of the preference share dividend.

5. An allowance for doubtful debts of 2% of the amount owing as at 31 December 2021 is to be created.

Required:

1. Statement of profit or loss for the year ended 31 December 2021. (10 marks)

2. Statement of financial position as at 31 December 2021. (10 marks)

(Total: 20 marks)

QUESTION THREE

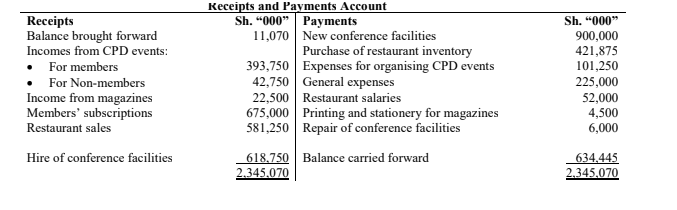

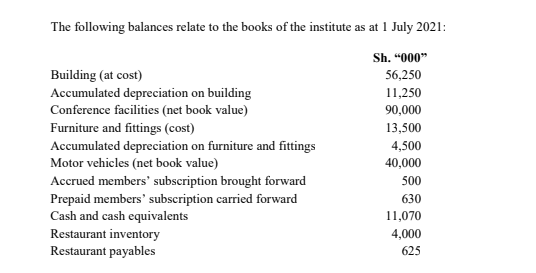

Certified Human Resource Institute (CHRI) is a professional body for human resources. The institute offers training to both members and non-members, organises continuous professional development (CPD) programmes and has conference facilities (inclusive of a restaurant) which it hires out to the public. It also has a magazine where companies place their advertisements. The receipts and payments account for the year ended 30 June 2022 is as follows:

Additional information:

1. Restaurant inventory as at 30 June 2022 was valued at Sh.2,520,000.

2. The following balances were accruing as at 30 June 2022:

Sh. “000”

Restaurant purchases 800

Restaurant salaries 25

Repair of conference facilities 370

3. As at 30 June 2022, outstanding and prepaid members’ subscriptions amounted to Sh.350,000 and Sh.790,000 respectively.

4. Depreciation is to be provided on a reducing balance basis at the following rates per annum:

Asset Rate

Building 2.5%

Conference facilities 10%

Furniture and fittings 10%

Motor vehicles 20%

5. Full year deprecation is provided in the year of acquisition but none in the year of disposal.

Required:

1. Restaurant income statement for the year ended 30 June 2022. (4 marks)

2. Income and expenditure account for the year ended 30 June 2022. (8 marks)

3. Statement of financial position as at 30 June 2022. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. Define the following terms as used in relation to customs taxes:

Dumping. (2 marks)

Bond security. (2 marks)

2. Every package of excisable goods, except motor vehicles and manufactured goods are required to be affixed with an excise stamp.

Explain four purposes of the excise stamp. (4 marks)

3. KR Ltd., a manufacturing company, commenced its operations on 1 January 2021 after incurring the following expenditures:

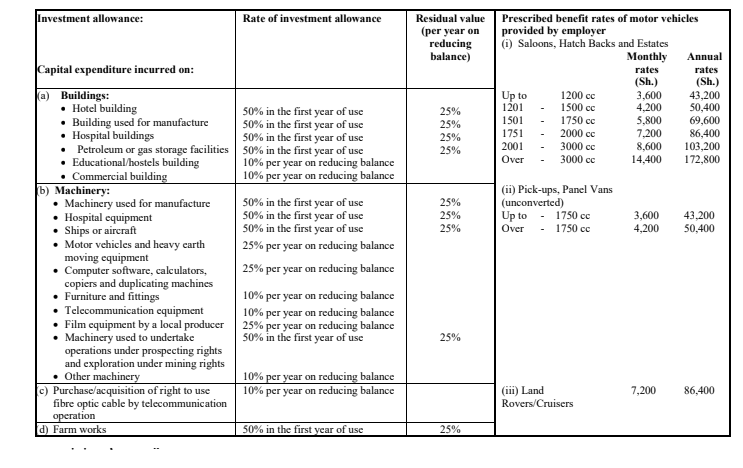

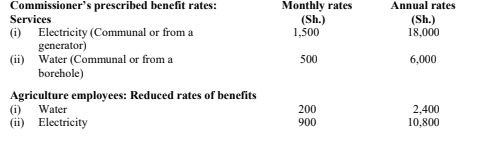

Additional information:

1. The pick-up was traded-in on June 2021 at a cost of Sh.1,200,000 for a prado. The company paid a balance of Sh.2,100,000 in cash.

2. The following buildings were constructed and put into use on 1 July 2021:

Sh.

• Staff social hall 900,000

• Staff canteen 700,000

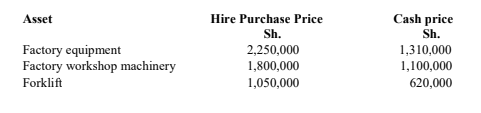

3. In August 2021, the following assets were acquired on hire purchase terms:

Required:

Investment allowances due to KR Ltd. for the year ended 31 December 2021. (12 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the term “taxable capacity”. (2 marks)

Discuss four factors that could influence the taxable capacity in your country. (8 marks)

2. Explain the following terms used in tax shifting:

Forward shifting. (2 marks)

Backward shifting. (2 marks)

3. Mount Zone Milk Limited buys milk from dairy farmers at Sh.45 per litre and after processing sells it at Sh.100 per litre. Tax at the rate of 20% is imposed on every litre of milk sold.

Required:

Demonstrate the effect of the following tax shifts on the cost price and selling price of milk per litre:

No tax shift. (2 marks)

Forward shift. (2 marks)

Backward shift. (2 marks)

(Total: 20 marks)