December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated.

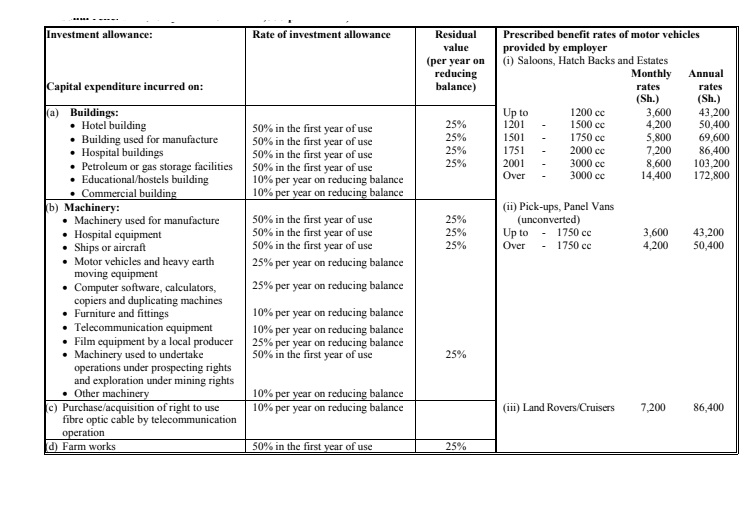

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

Assume that the following rates of tax applied throughout the year of income 2020:

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 – 24,000 1 – 288,000 10%

24,001 – 40,667 288,001 – 488,000 15%

40,668 – 57,334 488,001 – 688,000 20%

Excess over – 57,334 Excess over – 688,000 25%

Personal relief Sh.2,400 per month (Sh.28,800 per annum).

QUESTION ONE

1. The public Finance Management Act requires that, no later than 30 August in each year, the Cabinet Secretary shall issue to all National government entities a circular setting out guidelines on the budget process to be followed by them. With reference to the above provision, outline four contents of the circular. (4 marks)

2. Discuss four responsibilities of the National Treasury in the administration of the consolidated Fund. (8 marks)

3. Explain four fiscal responsibility principles enforced by the National Treasury in Managing National Government Public Finance. (8 marks)

(Total: 20 marks)

QUESTION TWO

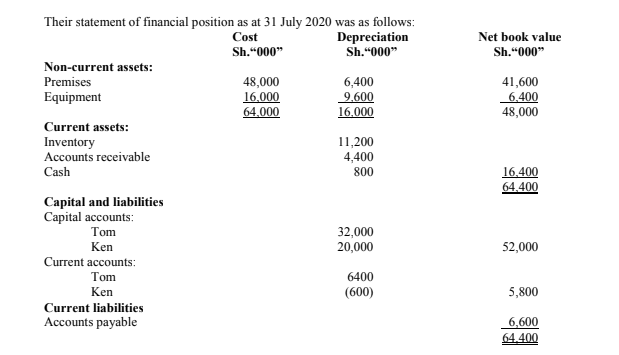

Tom and Ken are partners sharing profits and losses in the ratio of 3:2 respectively. The partnership agreement provides for Ken to receive a salary of Ksh. 8 million per annum. Interest on capital allowed at the rate of 5% per annum.

Additional Information;

- On 1 November 2020, Jude was admitted to the partnership. The terms of her admission were as follows: Interest on capital was raised from 5% per annum to 6% per annum for all partners. Jude introduced Sh. 24 million in cash as capital into the partnership. Jude received a salary of Sh.12 million per annum. Ken’s salary was raised to Sh.12 million per annum. The profit-sharing ratio for Tom, Ken and Jude was adjusted to 4:2:1 respectively.

- The profit for the year ended 31 July 2021 was Sh.111,570,000

- As at 31 July 2021, the working capital of the partnership was as follows:

Sh.“000”

Inventory 25,110

Accounts receivable 7,000

Cash 17,260

Accounts payable and accrual 6,960

- Partners drawings for the year ended 31 July 2021 were as follows:

Sh.“000”

Tom 51,410

Ken 39,050

Jude 16,500

- The non-current assets are to be depreciated as follows:

Asset Rate per annum

Premises 5% on cost

Equipment 10% on cost

Required:

1. Statement of profit or loss and appropriation account for the year ended 31 July 2021. (10 marks)

2. Partners current accounts. (4 marks)

3. Statement of financial position as at 31 July 2021. (6 marks)

(Total: 20 marks)

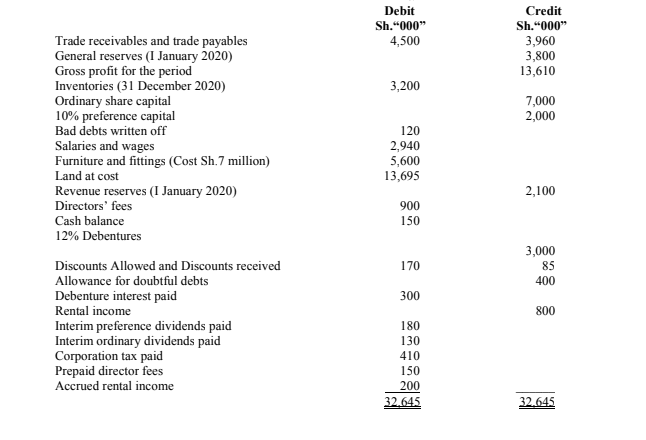

QUESTION THREE

The following balances were extracted from the books of Hesabu Ltd. as at 31 December 2020:

Additional Information

- Provisions as at 31 December 2020 are to be made as follows

Audit fees Sh.360,000

Outstanding debenture interest

- Included in the salaries and wages is Sh. 140,000 which relates to the month of January 2019.

- Allowances for doubtful debts are to be made at 10% of net trade receivables.

- Furniture and fittings are to be depreciated at 10% per annum on the net book values

- The directors have recommended that

Sh.700,000 be transferred to general reserves

Outstanding preference dividends and a 5 % ordinary dividend be paid for the whole year.

Required:

1. Income statement for the year ended 31 December 2020. (12 marks)

2. Statement of financial position as at 31 December 2020. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the treatment of the following in taxation:

Tax losses. (2 marks)

Capital losses. (2 marks)

2. Explain two distinguishing features between tax evasion and tax avoidance. (4 marks)

3. ABC Commenced a manufacturing operation on 1 May 2020 having incurred the following capital expenditure:

Sh.“000”

Factory buildings (Note 1) 20,600

Processing machinery 4,800

Factory parking bay 1,640

Sewerage system 560,000

Industrial effluent treatment plant 2,400

Additional Information:

- Factory building included the following: Sh.“000”

Cost of land 4,400

Godown 800

Showroom 520

Offices 600

Retail shop 400

- On 1 July 2020, the following capital expenditures were incurred:

Photocopier 60

Computers 150

Motorbike 96

Saloon car 3,400

Fork lift 720

Furniture 240

Pick up 920

Scanners 56

Tractor 1,700

Carpets 36

- The company imported a weighting machine on 1 September 2020 at a cost of Sh.480,000 inclusive of duty of Sh.20,000. The duty was waived by the government.

Required:

Investment allowances due to the company for the year ended 31 December 2020. (12 marks)

(Total: 20 marks)

QUESTION FIVE

1. Highlight two categories of goods liable under customs and excise duty Act. (2 marks)

2. Suggest four types of taxes used by a government in collecting tax revenue. (4 marks)

3. Explain two ways in which the Revenue Authority in your country might prevent loss of tax revenue from Imports (4 marks)

4. Discuss five challenges faced by a tax authority of a developing economy. (10 marks)

(Total: 20 marks)