This is the only Accounting/Taxation paper for CS candidates in the whole CS syllabus.

It is therefore expected that candidates will invest time and effort in grasping the fundamental requirements of this paper. Whereas a few candidates demonstrated an acceptable level of preparedness in this paper, quite a number fell short of the required standards.

Some candidates did not perform well in the following questions:

Question No. 1 (c)

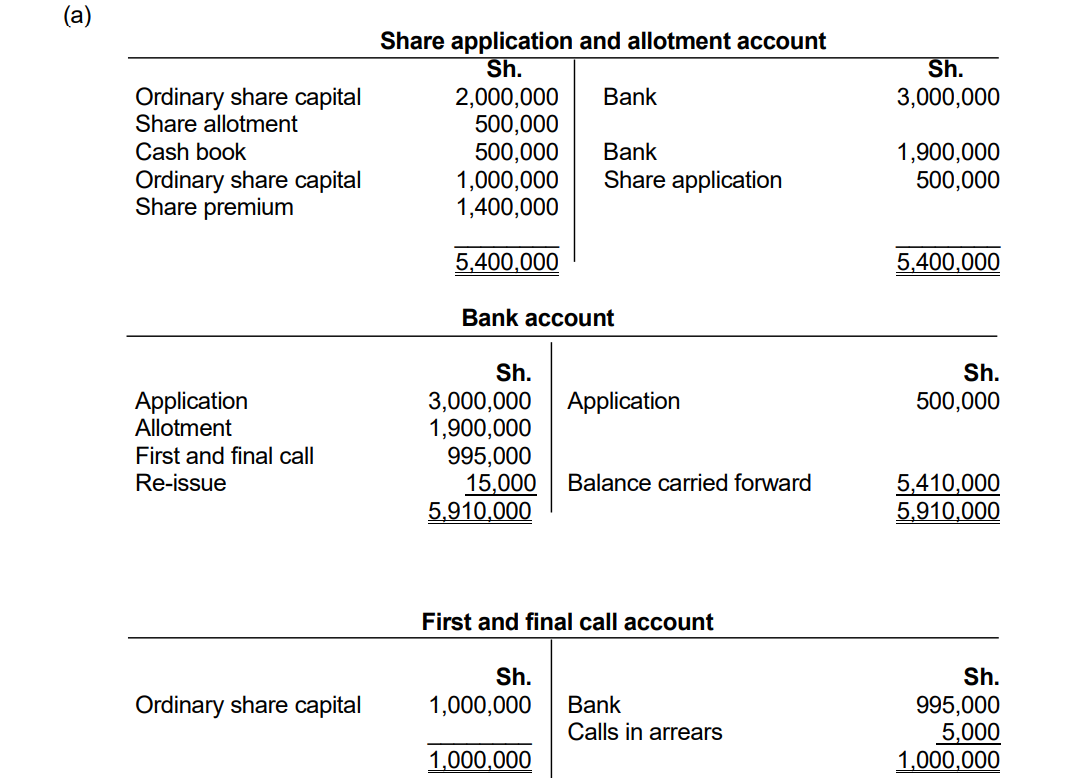

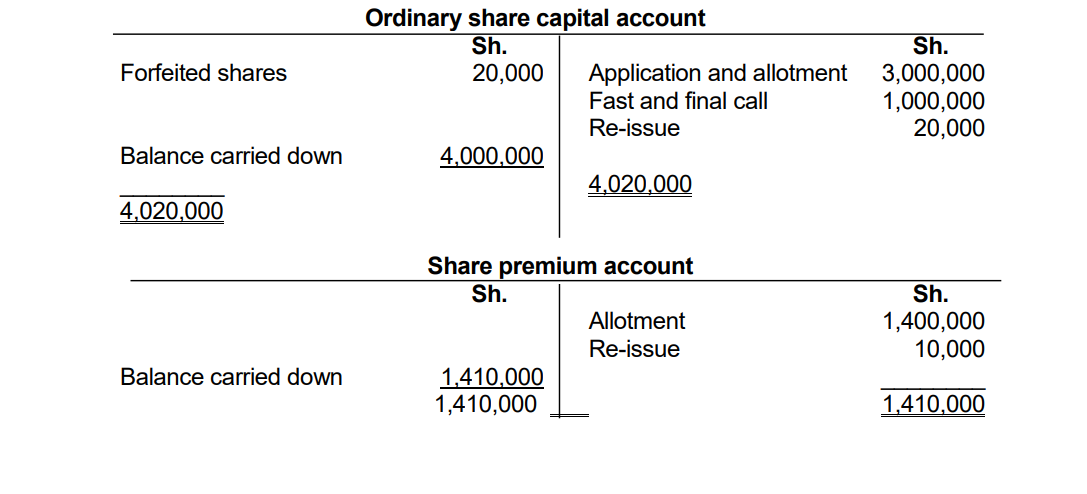

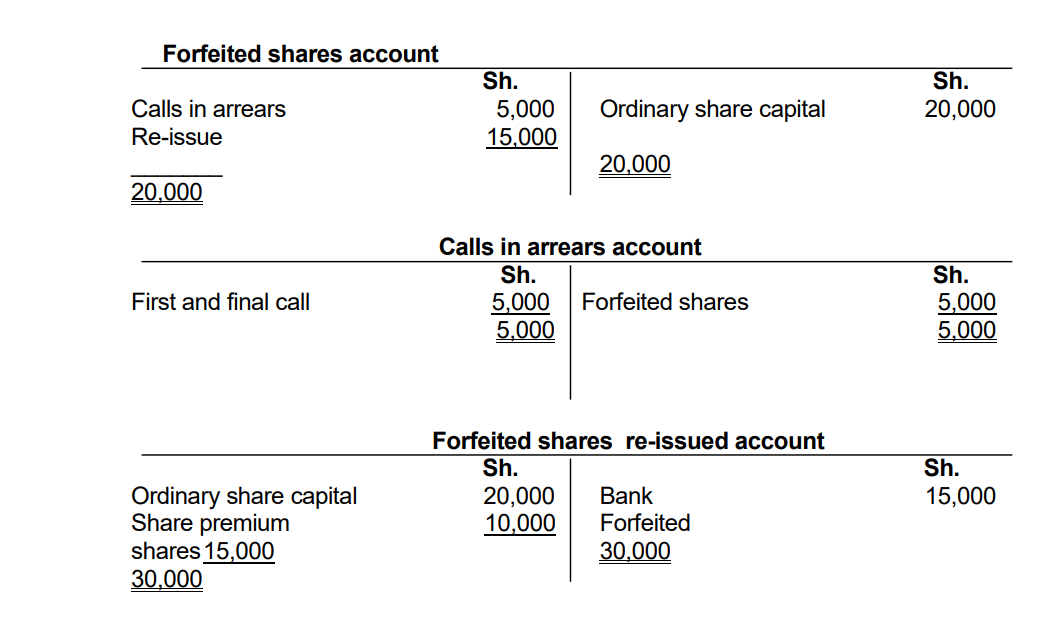

which required candidates to record transactions in ledger accounts in the context of a company issuing shares. Some candidates were unable to make entries in the relevant T accounts which included the share application and allotment

account, the bank account, the first and final call account, the ordinary share capital account, the share premium account, the forfeited shares account, the calls in arrears account and the forfeited shares re-issued account.

The following were the expected ledger accounts to record the transactions:

Question No. 2 (a)

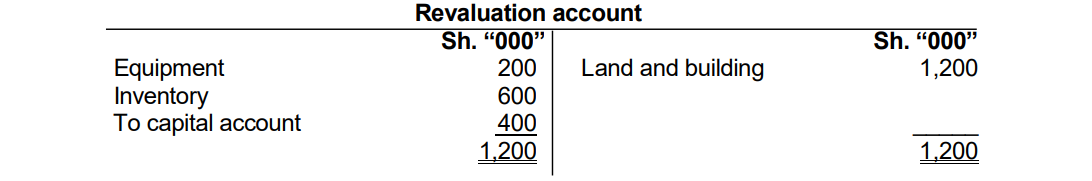

In which candidates were provided with information about a partnership business which was admitting a new partner. Candidates were required to use the given information to prepare a revaluation account, the partners’ capital account,

the partners’ current account and the statement of financial position after admission of the partner. In particular, most candidates were unable to prepare the revaluation account.

The examiner expected the revaluation account to be prepared as follows:

Question No. 5 (b)

In which candidates were required to Identify FOUR documents or instruments that are exempted from stamp duty

The following were among the expected responses.

Documents or instruments that are exempted from stamp duty:

- Instruments of divorce.

- Letter of allotment of shares.

- Affidavit.

- Acknowledgement of debt.

- Reward certificate.

- Court orders.

- Cautions.

- Caveats.

- Wills