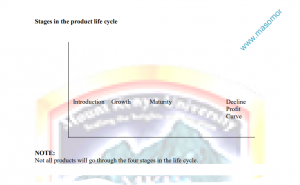

For the purpose of this chapter, PLC will be taken to mean product life cycle, and product and service will be used interchangeably. Many will be familiar with this timeless model which not only describes the stages in the sales pattern of a product or product category, but also offers some strategic directions for each stage. This model is concerned with the sales pattern & strategic directions for each stage of a product‘s life cycle. It is important to differentiate between a product’s life cycle (home loans), a product category’s life cycle (variable, fixed, no-frill) and a brand’s life cycle (Westpac, St. George‘s, BankWest, ANZ). With matured markets, the life cycle model, for strategic planning, is appropriate at the product category level where one normally finds different categories/variants at different stages of the cycle.

APPLICATION OF THE MODEL

The model can be used for analysis as well as for strategy formulation. We shall examine the former first. The PLC concept attempts to provide managers with an understanding of the characteristics of each stage of the life cycle and, therefore, can be used to predict future sales and profit patterns. Underlying the PLC concept is the theory of diffusion of innovation, which identifies categories of buyers (adopters) of the innovation. By understanding these buyers, marketers can plan for the appropriate target market strategies. The early buyers of a new product are called innovators. The numbers are very small because the new product has to prove itself. If the product is satisfactory, it will attract the next category of buyers, early adopters. Later, mainstream buyers, early and late majority, will start adopting the product. Over time, the market becomes saturated and sales come mainly from product replacements. Eventually, sales decline as new products appear and the original product becomes obsolete. This phenomenon gives rise to the distinct S-shaped pattern of a typical product life cycle.

The PLC concept provides a framework for developing marketing strategies in each stage of the product life cycle. Bear in mind that these strategies are appropriate for market leaders whose behaviour parallel the industry. Lesser competitors may need different strategies to compete. In some ways, the PLC model can be used as a forecasting or predictive tool. It can enable marketers to forecast the market characteristics of subsequent stages as well as predict the strategies of the leading competitors. This, of course, assumes that the life cycle exhibits the traditional pattern. Later, we will realise that many life cycle patterns are more than traditional, and the stages are of varying duration.

In the following section, we shall examine the use of the PLC model both as an analytical tool and as a planning tool. These will be divided into characteristics, objectives, and strategies for each stage of the PLC.

STAGE Characteristics

When the new product is first commercialised, it enters the introduction stage of the life cycle. This stage is characterised by a slow sales growth and profits are usually negative because of the high costs of marketing associated with the introduction. Many buyers are unaware of the product and sales are limited to a category of buyers known as innovators. These buyers tend to be more affluent, venturesome and from upper social classes. Mobile phone innovators include company chief executives, sales representative, and tradespersons. These adopt the product for business use while others may buy it as a status symbol. Regardless, these buyers will be influential. There usually is no or little competition at this stage.

Primary Objectives

The main objective here for the pioneer is market expansion by stimulating primary demand, i.e., demand for the product category. For example, Apple has taken upon itself to market its innovative personal MP3 player. Sony did likewise with its personal

stereo, the Walkman, in the late 1970s. The marketing objective at this stage is, therefore, to create product awareness and encourage trial.

Strategic Emphases

With innovators as the target market, the pioneering company would emphasise customer education/trial through advertising and sales promotion; and ―push‖ for trade acceptance (distribution support). The product design and function are usually very basic because of the new technology involved. Price is often cost-based and tends to be very high reflecting the ―newness‖ of the innovation and its associated R&D and marketing costs. Potential competitors, meanwhile, monitor the market closely for signs of customer acceptance.

GROWTH

Characteristics

This stage is characterised by rapidly rising sales as the product receives wide acceptance amongst the early adopters. The innovators, as opinion leaders, serve to ―legitimise‖ the innovation through product use and social interactions. The arrival of major competitors and their combined marketing strategies fuel sales growth and industry profit rises. These events necessitate different marketing objectives.

Primary Objectives

Facing competition, perhaps for the first time, the pioneering company and other leaders will need to maximize their market shares by emphasizing selective demand, i.e., demand for a particular brand. Here, the brand‘s product features and performance are

stressed by extensive promotion to both the trade and customers. Stability of market shares of mainstream brands is a characteristic of the next stage, maturity. Therefore, the size of the market share gained in the growth stage will tend to persist in the maturity stage, the longest and most competitive stage of the life cycle. A brand with a small share at the end of the growth stage will find it hard to survive in the next phase.

Strategic Emphases

The competing brands are priced to penetrate the now mainstream market, both to secure intensive distribution and build customer preference. The target market is broader in demographic terms and the product range, therefore, has to be expanded to cater to the

diverse needs of the market. The companies that enter at this stage of the PLC are often large and formidable competitors with similar access to the core/basic technology. Technological advancement is pursued vigorously for product superiority. This leads to improvements to a product‘s form and function, i.e., the physical attributes of a product that can be evaluated objectively. Examples include frost-free refrigerators, digital mobile phones, ABS brakes and stereo video cassette recorders.

MATURITY STAGE

Characteristics

This is, perhaps, the most important turning point of a market. Its potential indefinite duration, together with its dynamism, makes this stage the most difficult to predict or plan for. Consider the digital camera market. In the early days, they were targeted as a computer multi-media accessory and as a status symbol. Today, they are marketed as a replacement of the conventional film-camera for anyone and everyone. Is the market now still growing or reaching maturity? Technically, a product matures when the market

has been saturated and further sales are mainly from replacements. In other words, most potential customers already have one. Who are these potential customers? Some indicators of maturity may be helpful to analyze the market:

Sales growth and market saturation — maturity is evident when sales growth declines because the number of potential first-time buyers is decreasing. The market is said to be saturated, or fully penetrated, and sales level is maintained mainly because of replacement purchases.

Lower prices and profitability — oversupply and intense competition force pricesto fall resulting in lower industry profitability.

Technological maturity and product parity — the core technology used has matured and this leads to mainstream brands all having similar product form and functions. There are very little physical differences among the competing products‘ key features. Products are usually differentiated on brand name, image and perceived quality, i.e., subjective dimensions. Buyer knowledge — over time, buyers gain experience in the use and evaluation of the product. They may eventually accept the reality of product parity and will buy on price or convenience (economic-driven buyers) or simply on brand name (status-driven).

Primary Objectives

The main objective for most competitors is market share protection. Because the industry does not recognize the notion of a given market share starting point for each competitor, any marketing strategies can be construed as either offensive or defensive. In

a sense, market share protection is a misnomer. An aggressive competitor can claim that it is merely rebuilding lost market share (on the defence) where, in fact, it could had lost share previously by letting its guard down. Also, pro-competitive legislation may prevent businesses from having too high a market share especially through corporate takeovers. These quasi-monopolists or monopolists will always be under the scrutiny of the Trade Practices Commission because of their ability to control the market.

Strategic Emphases

For the reasons mentioned above, it would be difficult to generalize marketing strategies especially for the early maturity stage. The marketing mix strategies adopted in the growth stage tend to persist in the early maturity stage but with greater intensity.

However, product strategies would usually involve multi-branding and an increased number of product variants/models to appeal to an even broader market. The intention is to revitalize or prolong the maturity stage through product quality improvements, functional

improvements, or style/design improvements. Recall that this stage can last indefinitely. Strategies in the late maturity/decline stages will be presented in the next section.

DECLINE STAGE

Characteristics

This stage is characterized by declining sales and profits. However, the contributing factors need to be identified and analyzed so that the business can decide on the best course of action. It is important to note that we are not concerned here with the decline stage of a brand‘s life cycle. A brand may decline due to poor marketing, etc. Rather, we are concerned with the fate of the product category‘s decline such as those evident in the case of dialup internet connections, floppy disks, CD players, CRT TV sets, etc. These products and others have declined because of obsolescence. There are even products or models with planned obsolescence, being replaced with new models. Products become obsolete because of substitutes and forward-planning companies are usually prepared for with these product substitutes. Buyers of these products are known as laggards. They tend to be older, more conservative and from lower socio-economic backgrounds. Their numbers are usually very small. Competition is less intense as some players are quick to exit the market (industry shake-out).

Primary Objective

Since many businesses may have a sizeable infrastructure investment in the product, e.g., plant and machinery, a quick exit may not be the best solution. The more usual move is to reduce expenditure and milk (harvest) the product. Therefore, the primary objective is to maximize cash or profit generation as quickly as possible. Another option is to maintain in, and dominate, the market when others are exiting—―a big fish in a small pond‖. There are also situations where a business can attempt to revitalize the market to create growth.

Strategic Emphases

Some options are available at this stage. Exiting the market involves either selling the business (divestment) or liquidating existing

assets such as plant and equipment. Sometimes there could be ready overseas buyers for outdated equipment especially for third world or developing countries. This should be seen as a last resort especially when milking or harvesting is not feasible. Harvesting attempts to milk the business of all available profits or cash. This is usually possible when there is still a loyal, but small, group of buyers (laggards) to maintain sufficient sales to generate profits. All marketing and overhead expenses are kept at a bare minimum in order to manage profitability and cash flow. The marketing of Typewriters is a classic example.

If exit barriers exist, the business may be motivated to continue business-as-usual. This suggests allowing enough investment to maintain the business and sending a message to the competitors of its determination. An industry shake-out, typical at this stage, will

allow the surviving businesses to reap additional market share and profits from the industry. Of course, depending on the nature of the decline stage, this strategy may not be durable.

Finally, a more positive strategy would be to revitalize the market. This can be achieved by creating new uses for the product (Teflon in paints), targeting new markets (baby shampoo for adults) and product modifications/variants (breakfast cereal redeveloped and repackaged as snack bars).

CRITIQUE OF THE MODEL

The model is not without its critics. The major criticisms of the concept can be summarized as follows:

External versus internal impact on the life cycle

The model assumes that the pattern of a product or brand‘s life cycle is influenced by the chosen strategies (internal) of the business. There is enough empirical evidence to suggest that many companies fail miserably in meeting forecast sales. We can only conclude that environmental forces (external) can play an important role in shaping the sales pattern of the product or brand.

Consider this. An unexpected turn in the environment may, in the short term, cause the sales of a product to decline. Adhering to the PLC concept a manager may misread it as the decline stage of the product‘s life cycle and act accordingly. Marketing support gets

withdrawn and this will surely kill off the product. This creates a self-fulfilling prophecy that the brand is at the end of its life. It is, therefore, not clear how much influence a firm‘s strategy has on the life cycle. One way of resolving this argument is to consider whether pattern follows strategy or strategy follows pattern. The former assumes that the chosen strategy is the primary influence on the life cycle pattern. This is typical of proactive companies, which attempt to prolong both the growth and maturity stages through some of the aggressive marketing strategies discussed earlier.

Lesser competitors tend to be more reactive by accepting the pattern as given. They have lesser control over environmental and competitive forces. They respond by adopting strategies appropriate for each stage. In this case, strategy follows pattern. Other PLC patterns Not all products or brands exhibit the traditional S-shaped pattern. Styles are common in clothing, home design and passenger cars. A style such as blue jeans may last for decades, going in and out of vogue. Fads come as quickly as they decline. They have a steep introduction stage followed by a rapid decline and are found in toys and paraphernalia associated with hit movies.

Scalloped or staircase life cycles exhibit a series of upward growth-maturity stages. This occurs when new applications of the product are found, as in nylon, Teflon, and Scotch Guard.

Varying duration

So far it is not surprising to learn that life cycles do not have a fixed pattern and that the duration of each stage varies. Also, it is not always evident when the turning point (from one stage to the next) occurs. Only a sales history can provide the evidence. By then, it may be too late for strategy development. Within a product category life cycle, the product form and brand life cycles can exhibit contrasting patterns. Brands tend to have the shortest life cycle with the exception of ―classics‖ such as Levi‘s, Colgate, Coca-cola, Hill‘s hoist, Speedo, etc. Product forms are prone to style patterns. Moreover, there may be no clear delineation among product

forms, which could result in a strategic planning nightmare. For example, should prebrush mouth rinses be separate from traditional mouthwashes for analysis and strategy formulation? Should product forms of passenger cars be based on price range, engine

capacity (1.5 litres), body style (sedans), or body types (sports)? Despite these limitations, the PLC model remains one of the most widely used (and misused or abused) strategic tools. The concept is simple and many of its limitations can be minimised or totally avoided through proper market definition, understanding of key environmental forces, and careful dealing of exceptions. After all, there is no known model that can predict the dynamic and erratic marketing environment.