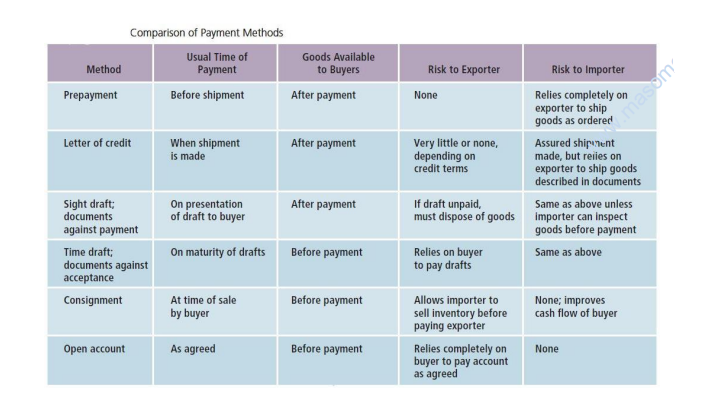

In general, five basic methods of payment are used to settle international transactions, each with a different degree of risk to the exporter and importer:

- Prepayment

- Letters of credit

- Drafts (sight /time)

- Consignment

- Open account

Prepayment

Under the prepayment method, the exporter will not ship the goods until the buyer has remitted payment to the exporter. Payment is usually made in the form of an international wire transfer to the exporter‘s bank account or foreign bank draft. As technology progresses, electronic commerce will allow firms engaged in international trade to make electronic credits and debits through an intermediary bank. This method affords the supplier the greatest degree of protection, and it is normally requested of first-time buyers whose creditworthiness is unknown or whose countries are in financial difficulty. Most buyers, however, are not willing to bear all the risk by prepaying an order.

Letters of Credit (L /C) (expounded on earlier in the chapter)

Drafts (expounded on earlier in the chapter)

Consignment

Under a consignment arrangement, the exporter ships the goods to the importer while still retaining actual title to the merchandise. The importer has access to the inventory but does not have to pay for the goods until they have been sold to a third party. The ex- porter is trusting the importer to remit payment for the goods sold at that time. If the importer fails to pay, the exporter has limited recourse because no draft is involved and the goods have already been sold.

As a result of the high risk, consignments are seldom used except by affiliated and subsidiary companies trading with the parent company. Some equipment suppliers allow importers to hold some equipment on the sales floor as demonstrator models. Once the models are sold or after a specified period, payment is sent to the supplier.

Open Account

The opposite of prepayment is the open account transaction in which the exporter ships the merchandise and expects the buyer to remit payment according to the agreed-upon terms. The exporter is relying fully upon the financial creditworthiness, integrity, and reputation of the buyer. As might be expected, this method is used when the seller and buyer have mutual trust and a great deal of experience with each other. Despite the risks, open account transactions are widely utilized, particularly among the industrialized countries in North America and Europe.

When buying abroad there are a number of payment methods that can be used. What must be remembered is that, when buying abroad, the seller may not wish to release the goods until payment has been made and similarly the buyer may not wish to pay until the goods have been received. Examples of payment methods include:

Open account: The supplier agrees to operate an open account with an approved buyer. Depending on the nature and value of the goods, it may be possible to pay by this method, i.e. usually 30 days after receipt of the goods

Payment in advance: This entails payment of goods and services before receiving them from the overseas suppliers.

Stage or partial payments: This method is usually associated with the purchase of capital equipment. It entails payment of goods in small portions.

Documentary credits-Letter of credit: The buyer instructs a bank in his own country (the issuing bank) to open a credit with a bank in the seller‘s country (the advising bank) in favour of the seller, specifying the documents which the seller has to deliver to the bank for him to receive payment.

Bill of exchange: This is an unconditional order in writing, addressed by one person (the drawer) to another (the drawee), signed by the person giving it (the drawer), requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a certain sum in money to or to the order of a specified person or to the bearer (the payee).