This refers to the market structure dominates by large few firms. The number of sellers (firms) is small enough for other sellers to take account of each other i.e. if one seller changes his prices or uses non- price strategies his/her rivals would react. This is called

oligopolistic dependency.

Characteristics

1. Contains few firms who produce goods that are substitute but need to be perfect substitutes.

2 Lies somewhere between extreme of perfect competition are monopoly.

3 There are barriers to the entry.

4 Decision of the firms are strictly interdependent

5 Sellers agrees on the price or the market share

Forms of oligopoly

- Duopoly where market is dominated by two firms

- Pure oligopoly where the products of the few sellers are identical.

- Differentiated oligopoly where products are differentiated in term of quality packaging etc.

- Collusive oligopoly where the few sellers in the market come together and make decisions to control the prices, quality and quantity to be produced.

- Non collusive oligopoly where the few sellers determine their prices, quality and quantity without colluding.

Kinked Demand Curve

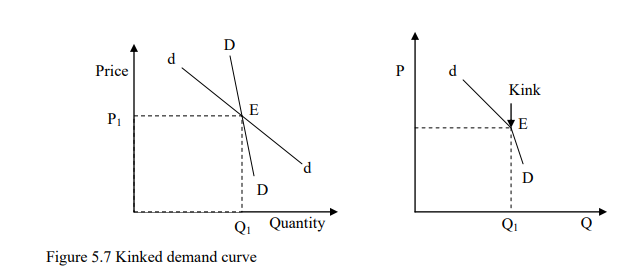

The interdependence in oligopolistic firms explains the price rigidity among the firms. The theory of kinked demanded curve suggests that firms in oligopoly face two sets of demand curves.

- Price increase

- Price reduction which is slightly inelastic

For price increases the firm is an elastic demand curve dd. For price decreases it is on the inelastic demand curve DD. This means the actual demand curve for firms is represented by dED. The demand is said to have a kink at point E associated with the price P1 and

quantity Q1. All firms in the industry are assumed to be in a similar position which implies that if a firm raises its prices and its competitor fails to follow suits then, it will loss large sales of revenue.

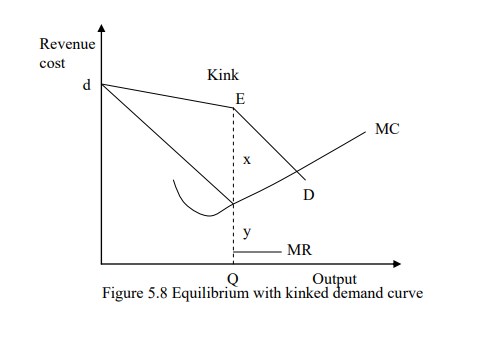

This firms is on the elastic portion of the demand curve If one firm reduces prices then, its competitors will have to reduce their price by at least a much or even more to retain the market share. When the price is lower each firm has the same market share which implies that the firms are on the inelastic portion of the demand curve. Collusion will take the form of agreeing the prices for each market share. This is done in order for the oligopolistic firms to maximize their joint profits and reduce uncertainty. A form of open collision is known as a cartel whereby firms produce differently but act like determinants of price and output. Figure 5.8 shows the

Equilibrium of an oligopolistic firm facing kinked demand curve.

The marginal revenue is discontinuous at the output level where there is a kink in the demand curve. The kink in the demand curve explains the nature of the marginal revenue curve. Where at point E and output Q the marginal revenue curve falls vertically since at

the higher price the marginal revenue curve correspond to less elastic demand curve. The firm maximizes its profit where the marginal cost is equal to marginal revenue. Its is very likely that the marginal cost curve will cut the marginal revenue curve between point X

and Y which corresponds to the discontinuous part of marginal revenue curve.