Definitions

According to R.P. Kent, “Money is anything that is commonly used and generally accepted as a medium of exchange, or as a standard of value.”

According to Marshall, “All those things which are (at any time and place) generally accepted without doubt or special enquiry as a means of purchasing commodities and services and defraying expenses are included in the definition of money.”

According to Geoffry Crowther, “Money can be defined as anything that is generally accepted as a means of exchange and at the same time acts as a measure and as a store of value.”

Money is derived from a Latin word, Moneta, which was another name of Goddess Juno in Roman history.

The term money refers to an object that is accepted as a mode for the transaction of goods and services in general and repayment of debts in a particular country or socio- economic framework.

Different Approaches of Money:

Economists have given a number of approaches to explain the concept of money. They have defined the concept of money off on the basis of different aspects of money.

However, in recent time, there has been a controversy on which aspects of money should be included in the definition of money.

The different approaches of money (as shown in Figure-2) are explained below:

1. Conventional Approach:

The conventional approach is considered as one of the oldest approach for defining the concept of money. It takes into consideration only two functions of money, namely, medium of exchange and measure of value. Therefore, as per this approach, any good or service that fulfills these two functions is termed as money, regardless of the fact that money is always a subject of authentication by the government.

According to this approach, commodities that serve the purpose of money are cattle (cow, sheep, horse, and bull), grains (wheat, jowar, and rice), stones and metals (copper, brass, silver, and gold). These commodities considered as money as long as they fulfilled the two conditions of money.

Some of the definitions of money given by economists who support conventional approach are as follows:

According to R.P. Kent, “Money is anything that is commonly used and generally accepted as a medium of exchange, or as a standard of value.”

According to Marshall, “All those things which are (at any time and place) generally accepted without doubt or special enquiry as a means of purchasing commodities and services and defraying expenses are included in the definition of money.”

According to Geoffry Crowther, “Money can be defined as anything that is generally accepted as a means of exchange and at the same time acts as a measure and as a store of value.”

2. Modern Approach:

Over a passage of time, it was realized that conventional approach provides a restrictive definition of money. In addition, the functions of money are not only confined to medium of exchange and measure of value rather it performs a large number of functions.

The modern approach of money is broadly classified into three categories, which are as follows:

- Chicago Approach:

Lays emphasis on extending the definition of money given in conventional approach. This approach was given by Milton Friedman and his associates in Chicago University. They have extended the definition of money given in conventional approach by including three more concepts, namely, currency, checkable demand deposits, and time deposits.

However, economists having conventional viewpoint of money were against the addition of the concept time deposit in the definition of money. According to conventional approach, time deposits are not available easily in liquid form or spent directly; therefore, do not serve the purpose of money. However, the Chicago school of thought has given two points emphasizing the importance of time deposits in the definition of money.

These two points are as follows:

1. Advocated that national income and money are interrelated to each other and this interlink can be more strengthen if time deposits are included in money

2. Propounded that definition of money should include the close substitutes of money and time deposit is one of those substitutes

However, both of the explanations are not strong enough to include time deposits in the definition of money.

3. Gurley-Shaw Approach:

Includes the liabilities of non-banking financial intermediaries in the definition of money. The main contributors of this approach were John G. Gurley and Edward S. Shaw. Gurley and Shaw, while explaining the concept of money, highlighted the substitution relationship among various factors, such as currency, demand deposits, time deposits, and saving bank deposits.

These factors act as the sources for storing value. Therefore, according to Gurley-Shaw, money can be defined as the weighted sum of currency, demand deposits, and other deposits and claims against the financial intermediaries. The weights should be allotted on the basis of substitutability of currency.

However, the practical implication of this approach is not possible as it is difficult to determine the degree of substitutability of deposits and claims against the financial intermediaries. Moreover, assigning weights to measure the money supply is a challenging task.

4. Central Bank Approach:

Constitutes the broader view of the whole concept of money. The function of the central bank is to control and regulate the flow of money in an economy. Therefore, the central bank formulates and implements a monetary policy to achieve its goals and objectives.

For this purpose, it needs to determine all the sources and modes of payment and flow of credit in the economy, which are treated as money. According to the central bank view, currency and all other assets that can be converted into money (realizable assets) are included in the money supply.

Radcliffe Committee of United States endorsed the central bank approach. According to this committee, “the similarity between currency and other realizable assets or means of purchasing to the point of rejecting money in favor of some broader concept, measurable or immeasurable.”

In other words, money can be any form through which the borrowers receive credit. On the basis of monetary policy and policy targets, the central bank implements different measures to control money supply.

There are three broad motives on the basis of which money is required by people, which are as follows:

- Transaction Motive:

Refers to the demand for money to fulfill the present needs of individuals and businesses. Individuals require money to fulfill their current requirements, which is termed as income motive. On the other hand, businesses need money for carrying out their business activities, which is known as business motive.

These two motives of money are discussed as follows:

- Income Motive:

Refers to the motive of individuals who demand money for fulfilling the needs of themselves as well as their family. Generally, individuals hold cash for bridging the gap between the receipt of income and its expenditure.

The income is received once in a month but the expenditure takes place every day. Therefore, it is required to hold some part of income to make current payments. The holding amount depends on the amount of an individual’s income and interval of receiving income.

5. Business Motive:

Refers to the requirement of money by businesses in liquid form to meet the current requirements. Businesses require money for procuring raw material and paying transport charges, wages, salaries, and other expenses. The money demanded by businesses depends on their turnover. The higher turnover indicates the requirement of higher amount of money to cover up expenses.

6. Precautionary Motive:

Refers to the longing of individuals to hold money for various contingencies that may take place in future. These contingencies can include unemployment, sickness, and accidents. The amount of money need to be held for the precautionary motive depends on the nature of a person and his/her living conditions.

7. Speculative Motive:

Refers to the motive of individuals for holding cash to make out benefit from the movements of market regarding the change in interest rate in future. The precautionary and speculative motive acts as the store of value with different purposes.

Development of money Stages of Evolution of Money

Some of the major stages through which money has evolved are as follows:

- Commodity Money

- Metallic Money

- Paper Money

- Credit Money

- Plastic Money.

Money has evolved through different stages according to the time, place and circumstances.

1. Commodity Money:

In the earliest period of human civilization, any commodity that was generally demanded and chosen by common consent was used as money.

Goods like furs, skins, salt, rice, wheat, utensils, weapons etc. were commonly used as money. Such exchange of goods for goods was known as ‘Barter Exchange’.

2. Metallic Money:

With progress of human civilization, commodity money changed into metallic money. Metals like gold, silver, copper, etc. were used as they could be easily handled and their quantity can be easily ascertained. It was the main form of money throughout the major portion of recorded history.

3. Paper Money:

It was found inconvenient as well as dangerous to carry gold and silver coins from place to place. So, invention of paper money marked a very important stage in the development of money. Paper money is regulated and controlled by Central bank of the country (RBI in India). At present, a very large part of money consists mainly of currency notes or paper money issued by the central bank.

4. Credit Money:

Emergence of credit money took place almost side by side with that of paper money.

People keep a part of their cash as deposits with banks, which they can withdraw at their convenience through cheques. The cheque (known as credit money or bank money), itself, is not money, but it performs the same functions as money.

5. Plastic Money:

The latest type of money is plastic money in the form of Credit cards and Debit cards. They aim at removing the need for carrying cash to make transactions.

The development of money has passed through various stages in accordance with time, place and circumstances with the progress of economic civilsation of mankind.

Economists have recognized five such stages in the evolution of money:

- Animal Money

- Commodity Money

- Metallic Money

- Paper Money

- Credit Money

1. Animal Money:

Animals were being used as a common medium of exchange in the primitive hunting stage. History records that cattle occupied a place of pride as money in the earliest period of human civilization.

In temperate regions of Europe, Asia and Africa cattle was regarded as the most standard unit of barter for quite a long time in the primitive era.

In the ancient Indian civilization, the concept of Go-Dhan (cattle wealth) as a form of money is also referred to in Arth-Veda. In the fourth century B.C., the Roman State had officially recognized cows and sheep as money to collect fines and taxes.

2. Commodity Money:

In certain communities, early primitive money, in its crudest sense, also took the form of commodity money. A large number of commodities from axes to yarn have been adopted as money.

The particular commodity chosen to serve as money depended upon various factors like location of the community, climatic environment of the ‘region, cultural and economic standard of society, etc.

For example, people living by the seashore adopted shells and dried fish as money. People of the cold regions in Alaska and Siberia preferred skins and furs as a medium of exchange.

African people used ivory and tiger jaws as money. Besides, commodities such as precious stones, rice, tea, tobacco, etc. also served as money during the primitive days of human civilization. Professor Paul Einzig has recorded some 17 commodities in the list of primitive money.

Animal and commodity money, however, suffered from such drawbacks as:

- Lack of uniformity and standardization;

- Inefficient store of value due to the problem of storing and loss of value with the lapse of time;

- Lack of easy transferability due to difficulties of portability; and

3. Metallic Money:

Commodity money gradually transformed into metallic money when precious metals like gold, silver, copper, bronze, etc. were discovered and used as a medium of exchange with the growth of economic civilization from the pastoral to the commercial stage of society.

Use of metals as money in the course of time paved the way for the development of coinage system in the economy.

As historian Toynbee narrates, the coin age began around 700 B.C. in Lylia, a Greek city state. Imperfections of the metallic money in size, shape and weight, etc. have been removed with the minting of coins by states.

Metallic money had, however, the following drawbacks:

- On account of its bulkiness, a large sum of money in terms of coins was not easily

- It was unsafe to carry and could be easily lost or

- Rapid transactions were not feasible by using coins as a mode of

- The coin era, however, lasted till the 17th

4. Paper Money:

In the 17th and 18th centuries, paper currency emerged as “token money.” In modern era, paper money has become popular. It originally came as paper receipts against metallic money which was found unsafe to carry by itinerant merchants.

Then with the shortage of metals, state authorities thought of introducing paper currency a representative paper money which was convertible.

In the later stages, however, it became “fiat money”, i.e., inconvertible legal tender. Being representative money, paper currencies, thus, economies the use of standard coins or metals.

5. Bank Money:

In the final stage, along with paper money, another form of convertible money developed in the form of credit money or bank money, owing to the growth of banking institutions and credit creation activities and cheque system of payments in modern era.

In modern commerce large transactions are carried on through cheques and only small transactions are managed through currency money.

In modern economy, coins, paper notes and bank money, i.e., cheques issued against demand deposit, all serve as money. But even today, sometimes other things have also served as money.

In Germany, for example, in the post-war period (1945-46), cigarettes and cognac were used as money when its financial and economic condition had greatly deteriorated.

Sometime ago, due to shortage of token coins in India, coupons and stamps were used as money.

In short, anything and everything can serve and has served as money provided it is generally recognized and accepted as means of payment. But all things cannot serve as good money.

Good money should possess the attributes of general acceptability, recognisability, portability, divisibility, malleability, durability, uniformity, adequacy and stability of value.

Functions of money

- A Medium of Exchange:

The only alternative to using money is to go back to the barter system. However, as a system of exchange the barter system would be highly impracticable today.

For example, if the baker who supplied the green-grocer with bread had to take payment in onions and carrots, he may either not like these foodstuffs or he may have sufficient stocks of them.

The baker would, therefore, have to re-sell the product which would take time and be very inconvenient. By replacing these complicated sales by the use of money it is possible to save a lot of trouble. If the baker accepts payment in money this can be spent in whatever way the baker wishes. The use of money as a medium of exchange overcomes the drawbacks of barter.

Thus, money provides the most efficient means of satisfying wants. Each consumer has a different set of wants. Money enables him (her) to decide which wants to satisfy, rank the wants in order of urgency and capacity (income) and act accordingly.

This type of system also enables specialization to extend. Take, for example, a person who performs only a single task in a shoe factory. He has not actually produced anything himself. So what could he exchange if a barter system were in operation? With money system the problem is removed. He can be paid in terms of money and can use that money to buy what he wants.

2. A Measure of Value:

Under the barter system, it is very difficult to measure the value of goods. For example, a horse may be valued as worth five cows or 100 quintals of wheat, or a Maruti car may be equivalent to 10 two- wheelers. Thus one of the disadvantages of the barter system is that any commodity or service has a series of exchange values.

Money is the measuring rod of everything. By acting as a common denominator it permits everything to be priced, that is, valued in terms of money. Thus, people are enabled to compare different prices and thus see the relative values of different goods and services.

This serves two basic purposes:

- Households (consumers) can plan their expenditure and

- Business people can keep records of income and costs in order to work out their profit and loss

3. A Store of Value (Purchasing Power):

A major disadvantage of using commodities — such as wheat or salt or even animals like horses or cows — as money is that after a time they deteriorate and lose economic value. They are, thus, not at all satisfactory as a means of storing wealth. To realise the problems of saving in a barter economy let us consider a farmer. He wanted to save some wheat each week for future consumption. But this would be of no use to him in his old age because the ‘savings’ would have gone off.

Again, if a coal miner wanted to set aside a certain amount of coal each week for the same purpose, he would have problems of finding enough storage space for all his coal.

By using money, such problems can be overcome and people are able to save for the future. Modern form of money (such as coins, notes and bank deposits) permit people to save their surplus income.

Thus money is used as a store of purchasing power. It can be held over a period of time and used to finance future payments. Moreover, when people save money, they get the assurance that the money saved will have value when they wish to spend it in the future. However, this statement holds only if there is no severe inflation (or deflation) in the country.

In other words, it is quite obvious that money can only act effectively as a store of value if its own value is stable. If, for example, most people feel that their savings would become worthless very soon, they would spend them at once and save nothing. For the last few years the value (or the purchasing power) of money has been falling in India.

Yet in the short run—for day-to-day purposes—money has sufficient stability of value to serve quite well as a store of value.

4. The Basis of Credit:

Money facilitates loans. Borrowers can use money to obtain goods and services when they are needed most. A newly married couple, for example, would need a lot of money to completely furnish a house at once. They are not required to wait for, say ten years, so as to be able to save enough money to buy costly items like cars, refrigerators, T.V. sets, etc.

5. A Unit of Account:

An attribute of money is that it is used as a unit of account. The implication is that money is used to measure and record financial transactions as also the value of goods or services produced in a country over time. The money value of goods and services produced in an economy in an accounting year is called gross national product.

According to J. R. Hicks, gross national product is a collection of goods and services reduced to a common basis by being measured in terms of money.

6. A Standard of Postponed Payment:

This is an extension of the first function. Here again money is used as a medium of exchange, but this time the payment is spread over a period of time. Thus, when goods are bought on hire-purchase, they are given to the buyer upon payment of a deposit, and he then pays the remaining amount in a number of installments.

Under the barter system this type of transaction could involve problems. Imagine a farmer buying a video-recorder and agreeing to pay for it in terms of a fixed amount of wheat each week for a certain number of weeks. After a few weeks the seller of the video recorder might have more than enough wheat.

Yet he will have to receive more wheat in the coming weeks. If money had been used, the seller could then use it to buy whatever he wanted, whether it is wheat or something else—now or in future. In other words, the use of money permits postponement of spending from the present to some future occasion.

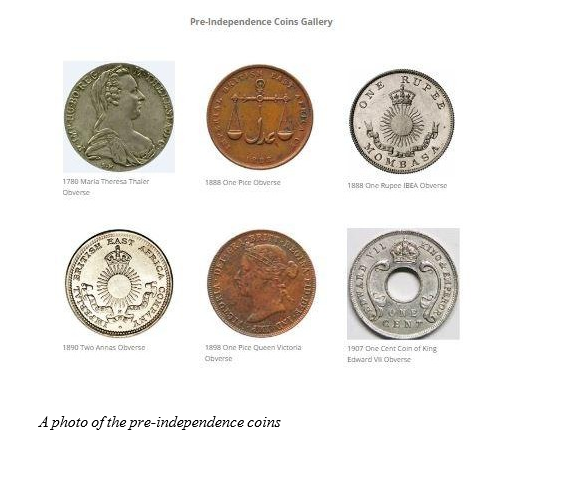

History of the kenya currency Kenyan Currency Through the Years

- After the launch of the new currency in Kenya by president Uhuru Kenyatta at the

Narok stadium on Saturday we look back at the history of money in Kenya and its evolution.

Early use of currency in Kenya commenced with the Arab influence who were among the first to use currency as we know it.

In Muscat, they used a silver coin called the Maria Theresa Thaler (MT$), first minted in Austria in 1741 and, not surprisingly, they continued using it when the Sultanate moved to Zanzibar in 1832.

The different approaches of money can broadly be grouped into two categories, which are shown in Figure-2:

Around the same period, the silver rupee minted by the British East India Company (1600-1858) was increasingly being used along the Indian Ocean coast as the monsoon-dependent dhow trade with India expanded.

The British chartered company, the Imperial British East Africa Company (IBEA), got the concession to trade in the area referred to as Kenya today. They then issued the Pice, Rupees and Annas as the currency of the region.

After IBEA went bankrupt a single coin, the copper Pice was minted and was the only piece of currency to bear the name East Africa Protectorate and unlike the Imperial British East Africa (IBEA) coinage which used Latin on the face.

Penetration of coins and notes only started when construction of the railway commenced in Mombasa in May 1896, to reach Port Florence – present day Kisumu – in December 1901.

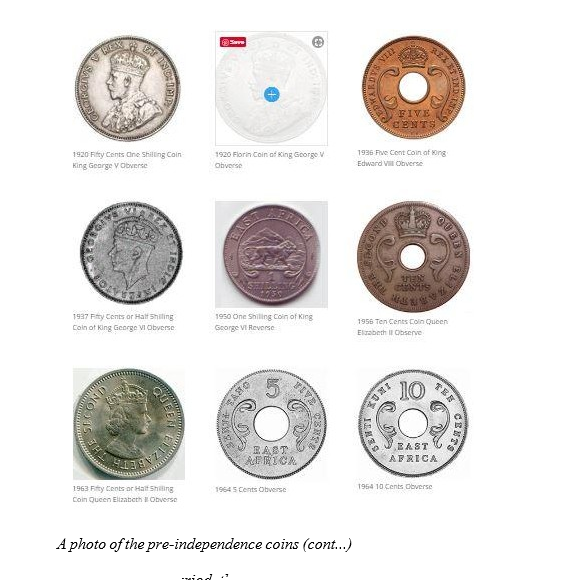

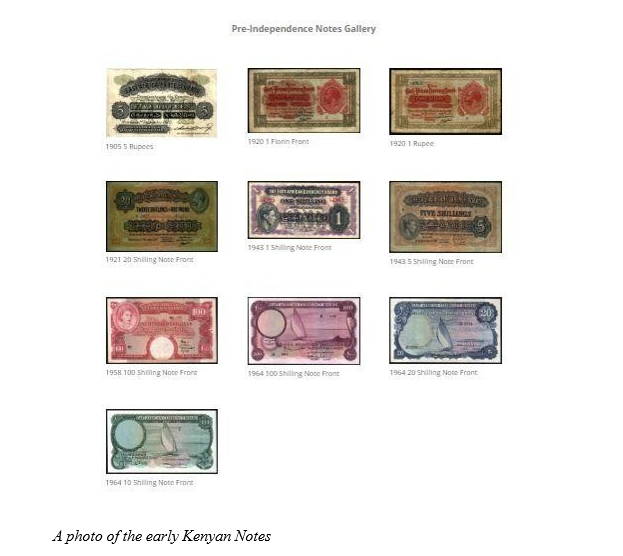

After world war one a decision was made in 1919 to replace the Mombasa Currency Board with a London based East African Currency Board (EACB) which would cater for the existing Protectorates as well as the newly acquired responsibility of providing currency to the Tanganyika Trust Territory.

The newly established EACB introduced an intermediate currency based on the English Florin with the thought that it would ease the transformation from Rupee to Shilling.

This then became the advent of the shilling in Kenya.

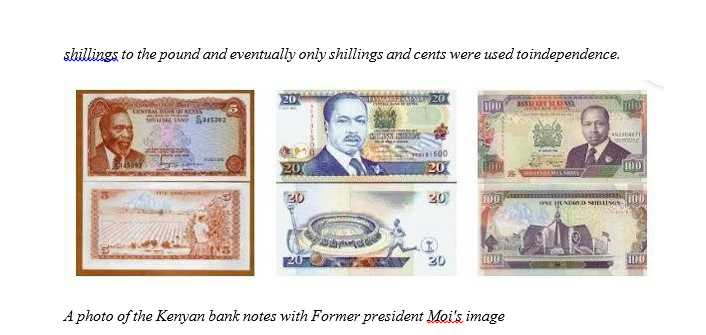

The shilling was however interchangeably used with the pound at a rate of twenty

As the East African territories became independent in sequence from 1962 the EACB ceased to issue notes with the image of the monarch and removed her name from the coinage.

For the banknotes, the interim currency was commonly known as the “Lake Issue” currency because of the background of Lake Victoria on the notes.

The Lake Victoria designed notes were in the denominations of 5,10, 20 and 100 shillings.

Kenya began printing and minting its own currency under the mandate given to the Central Bank of Kenya in the Central Bank of Kenya Act cap 491.

Banknotes for the Central Bank of Kenya, although not yet issued, were legalized under Legal Notice number 252 of 1966 dated July 1, 1966. Coins were issued in April 1967. EACB banknotes ceased to be legal tender in September 1967 while the EACB coins were demonetized in April 1969.

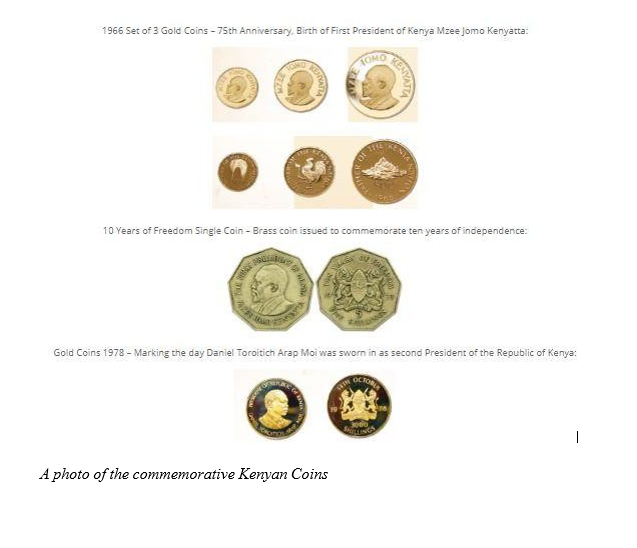

The initial issue of Kenya shilling notes were in the denominations of Ksh 5, Ksh 10, Ksh 20, Ksh 50 and Ksh 100, all bearing the portrait of the first President of Kenya, Mzee Jomo Kenyatta, in the front, and diverse scenes of economic activities in Kenya at the back. These notes were the first using the double title of Banki Kuu ya Kenya and Central Bank of Kenya

On April 10, 1967, new Kenya shilling coins were issued in the denominations of 5 cents, 10 cents, 25 cents, 50 cents and Ksh 1.

The coins were minted by the Royal Mint of U.K. and made from cupro-nickel. Like the notes, the obverse featured the portrait of Kenya’s founding father, Mzee Jomo Kenyatta.

The reverse, however, featured the Kenyan coat of arms, a theme that has remained a dominant feature to the present series of coins.

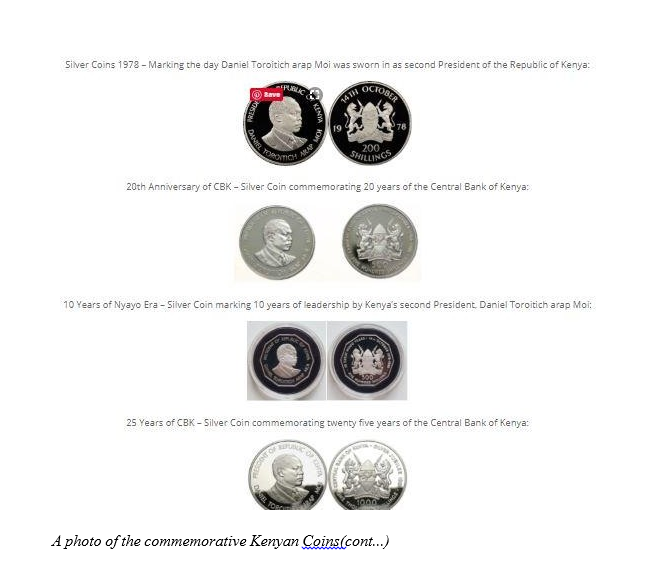

To mark some national and central banking events, the Central Bank of Kenya has and continues to issue special commemorative currencies.

These special currencies are limited in number and are specifically printed or minted to celebrate an event or in honour of a person.

They form a historical reference point and memento for the country.

Due to their specialty and use of precious materials like gold or silver, these currencies become very unique attracting demand from numismatic collectors or other individuals.

In 1980, a portrait of Daniel Arap Moi replaced Kenyatta until 2005, when the central bank introduced a new coin series that restored the portrait of Kenyatta. The coins are 50 cents and Ksh 1 in stainless steel and bi-metallic of Ksh 5, Ksh 10 and Ksh 20.

Ksh 5 notes were replaced by coins in 1985, with the same happening to Ksh 10 and Ksh 20 in 1994 and 1998. In 1986, Ksh 200 notes were introduced, followed

by Ksh 500 in 1988 and Ksh 1000 in 1994.

The banknotes are printed in Nairobi by British security printer De La Rue.

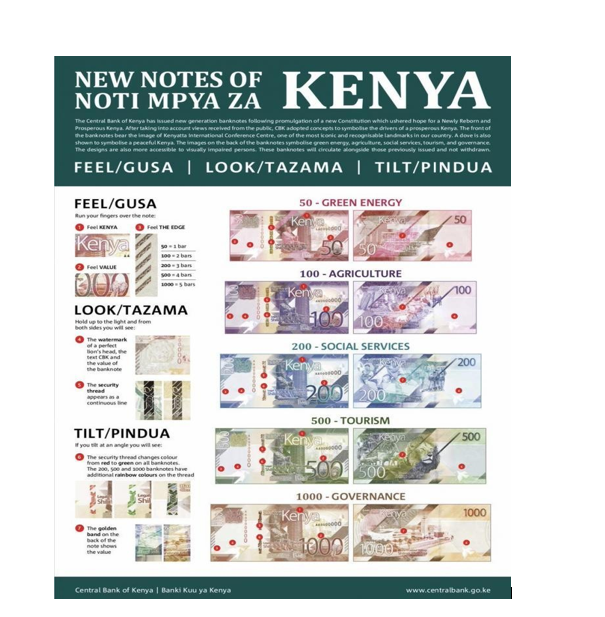

On December 11, 2018, Central Bank governor Patrick Njoroge and President Uhuru Kenyatta launched the new generation coins that were in line with the 2010 constitution of the Republic of Kenya dropping the images of the former presidents and embracing wildlife.

They launched the Ksh 1, Ksh 5, Ksh 10 and Ksh 20 coins

New generation coins launched on December 11, 2018

The new generation notes to replace the ones with presidential photos were launched on June 1, 2019, at the Narok stadium by the duo also abolishing the old Ksh 1000 notes.

Denominations of the launched currencies were between Ksh 50 and Ksh 1000.

Forms of money in the Kenya context

- Money of Account:

Money of account is the monetary unit in terms of which the accounts of country are kept and transactions settled, i.e., in which general purchasing power, debts and prices are expressed. The rupee is, for instance, our money of account; sterling is the money of account of Great Britain and marks that of Germany. Money of account need not however be actually circulating in the country.

During 1922-24 the mark in Germany depreciated to such an extent that it ceased to be money of account. The paisa in India has not in circulation and yet it is money of account. In the circulation and yet it is money of account. In the words of Keynes, “Money of account is the description of little title money is the thing which answers to the description.”

2. Limited and Unlimited Legal Tender:

Coins may be limited legal tender or unlimited legal tender. A legal tender currency is one in terms of which debts can be legally paid. It is an offence to refuse to accept payment in legal tender money. A currency is unlimited legal tender when debts up to any amount can be paid through it.

It is limited legal tender when payments only up to a given limit can be made by means of it. For instance, rupee coins and rupee notes are unlimited legal tender in India. And so is the half-rupee coin. But coins of lower denominations are only limited legal tender. They are legal tender only up to ten rupees.

When a coin is worn out and become light beyond a certain limit, then it ceases to be a legal tender. When one rupee and half-rupee coins are more than 20% below the standard weight they are not long in legal tender. A Government may take away the legal tender quality of a currency.

For instance, the old rupee coins of one hundred and eighty grains 11/12 fine are no longer legal tender in India. In 1978 the Government declared currency notes of rupees one thousand denomination and above as no longer legal tender, it is usually done to bring such currency out of the hoards. However, recently notes of Rs. 1000 have again been issued by Reserve Bank of India and have unlimited legal tender status.

3. Standard Money:

Standard money is that in which the value of goods as well as all other forms of money are measured. Thus, in India all prices of goods are measured in terms of rupees.

Moreover, the other forms of money such as two-rupee notes, ten rupee notes, hundred rupee notes and one half rupee coin are expressed in terms of rupees. Thus rupee is the standard money of India. Standard money is always made the unlimited legal tender money.

In old days the standard money was & full- bodied money, i.e., its face value was equal to the real or intrinsic worth of the metal it contained. But now-a-days in almost all countries of the world, even the standard money is only a token money i.e., the material contained in it is very much less than the face value written on it.

Thus, the rupee in India is available in the form of paper notes which have no intrinsic worth. Even the rupee coin has a metallic value much less than its face value. Rupee coin has been called a ‘note printed on nickel’ (Rupee coin these days is made of nickel).

4. Token Money:

The token money is that the metallic value of which is much less than the real or intrinsic worth of the metal it contains. Rupee and all other coins in India are all token money.

5. Bank Money:

Demand deposits of banks are usually called bank money. Bank deposits are created when somebody deposits money with them. Banks also create deposits when they advance loans to the businessmen and traders. Today these demand deposits are the important constituent of the money supply in the country.

It is important to note that bank deposits are generally divided in two categories: demand deposits and time deposits. Demand deposits are those deposits which are payable on demand through cheques and without any serving prior notice to the banks. On the other hand, time deposits are those deposits which have a fixed term of maturity and are not withdraw able on demand and also cheques cannot be drawn on them.

Clearly, it is only the demand deposits which serve as a medium of exchange, for they can be transferred from one person to another through drawing a cheque on them as and when desired by them. However, since even time or fixed deposits can be withdrawn by foregoing some interest and can be used for making payments, they are included in the concept of broad money, generally called M3. It may be noted that latest addition to the forms of money are credit cards issued by the banks which are these days extensively used for making purchases.

The characteristics of money are

- Durability

Durability of money is such that it can be used over and over again; hence it must survive wear and tear for long periods. In business you cannot always rely on paper money coming in so branch out and allow for online transactions. In other words the fact that we cannot always deal with paper money is an opportunity to expand your business beyond the paper and achieve greater durability through online transactions.

2. Portability

Portability is that money must be able to go wherever such that it is easy to transport as people travel. Why not ensure that your business products can be accessed wherever money is portable. Enable pay pal, visa transactions and any other transaction platforms that are possible in your country that encourage the portability of money. So make your goods available to the extent of the portability of money.

3. Divisibility

This aspect deals with the fact that money must be easily divided to enable a person to buy different products. When you own a shop make sure that the shop offers different products which allow for different denominations. So if a person walks in wanting something for a dollar there should be something in it for them. So let your goods and services allow or encourage customers to spend different denominations. Think little extras which have different values.

4. Uniformity

Uniformity of money calls for a standardization of money so that it looks the same. Ensure that your products have a specific branding standard which is recognized in different parts. Let you products be uniform so that they are easily recognizable.

5. Limited supply

Limited supply states that money is only valuable if it is in limited supply. Once in a while in business provide products that allow for high demand. This will improve sales for some sections of your products. Produce some goods in limited quantities so that they become more valuable to people.

6. Generally Acceptable

This deals with the fact that the form of currency must be acceptable. If we are to do business, then we must ensure that the business enables that the exchange that occurs is acceptable in terms of the value that we are to receive. Only sell a product or service that is going to return to you a currency whose value is acceptable to the survival of the business. If the currency is not acceptable to what you need to achieve then branch out to a new market with an acceptable currency.