4.1 Difference between inflation and economic growth

Inflation refers to general rise in the level of prices in the economy while economic growth refers to increase in quantity and variety of things available for consumption and is result of the technological advances and increases in the pool of productive resources e.g. the size of the workforce.

4.2 The price level and real output

4.2.1 Measuring the price level

The price level is a measure of the average prices of goods and services in the economy. It serves as a gauge of the general purchasing power of money. The consumer price index (CPI) is the measure of price level that is must familiar. Consumer price index measures the cost of the basket of goods and service purchased by the average urban household. The items in the basket are determined from a survey conducted in the base year. Thus the CPI reports how much more or less expensive the fixed base year basket of goods and services would be in different years. If the CPI is higher today than it did in base year, it costs more to buy the basket of goods and services today than it did in base year.

4.2.2 Measuring nominal and real output

Nominal output refers to the current dollar/shilling value of the final goods and services produced in the economy. Gross domestic product GDP, the most common used measure of nominal output, is the total dollar value of all final goods and services produced in the economy in one year. GDP measures the current dollar value of final output, i.e. it measures only the output of goods and services sold to final consumers of the products.

Since nominal output is the current dollar value of all final sales of newly produced goods and services in the economy, it is the summation of the quantities of final goods and services (P) multiplied by the products prices (Y) i.e. nominal output=PxY

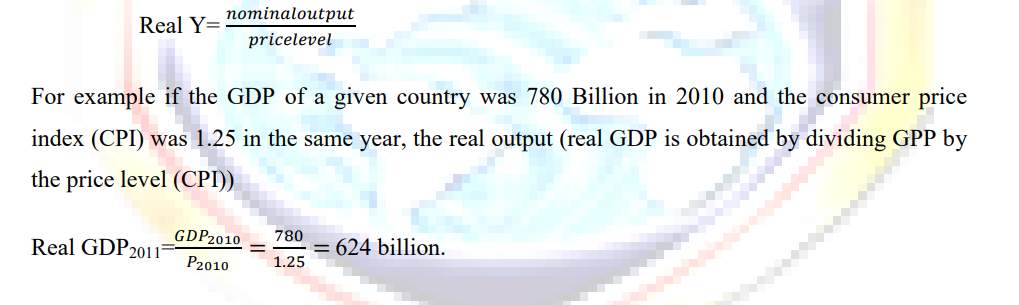

Notice that if the price level (P) doubled but the level of output (Y) remained the same, nominal output would double even though no additional goods and services are available. Real output is a measure of the physical quantity of goods and services available to the final consumers of the items. When the price level increases, nominal output will increase even if real output remains constant. To avoid confounding/confusing growth and inflation, we normally use real output to measure the output of the economy. Real output is obtained by dividing nominal output by the price level:

4.3 Inflation and economic growth

Now that you have a basic understanding of the price level and real output, we will show how to use these measures to calculate the rate of inflation and the rate of economic growth.

Inflation

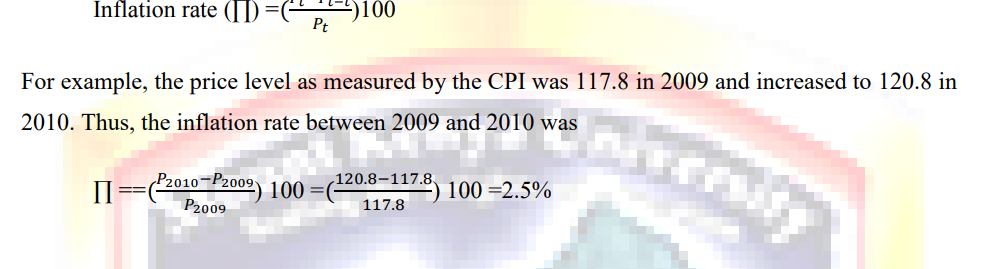

The inflation rate is the rate of change in the price level. Inflation rates are stated as a percentage change on an annual basis. For instance, if the price level is Pt in year t and Pt-1in year t-1, the inflation rate ( ) between year t and t-1 is defined as

Average prices in the economy increased by 2.5 percent between 2009 and 2010.

4.3.2 Economic growth

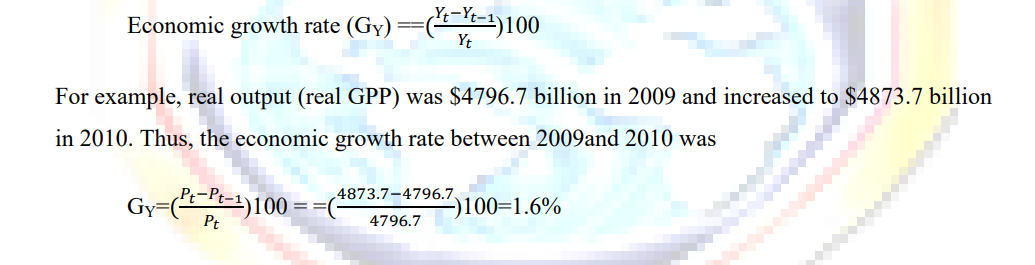

Economic growth is change in real output. The economic growth rate is usually stated as a percentage change on an annual basis. If real output was Yt in year t and Yt-1in year t-1, the economic growth rate between years t and t-1 is defined as

Between 2009 and 2010, the real quantity of final goods and services produced in the economy increased by 1.6 percent.

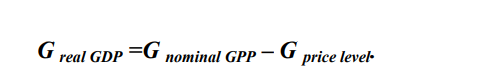

The relationship between inflation and economic growth We can use a very simple formula to relate the rate of economic growth, growth in nominal output, and inflation. The growth rate of GDP equals the growth rate of real GDP plus the growth rate of prices (the inflation rate). Thus, using G to represent growth rates, we can calculate the growth rate of real GPP as

Where the subscripts (like real GDP) refers to what is growing.

This formula reveals that the growth rate in real GDP (the rate of economic growth) equals the growth rate in nominal GDP (called the nominal growth rate) minus the growth in the price level (inflation)

For instance, if prices increases by 5 percent per year and nominal GDP increases by 7 percent per year, real output increases by only 2 percent per year, since 7%-5%=2%

4.5 Causes of inflation

Anything that cause the growth rate of money supply to increase, the growth rate of velocity to increase or the growth rate of output to decrease causes inflation.

4.5.1 Growth in the money stock

The increase in money stock leads to an increase in prices and nominal output but no increase in the real amount of goods available in the economy. In this sense, increase in the money stock leads to a higher price level.

To understand this imagine that an economy with one commodity (1 litre of soda) and one consumer. The total money stock in the pocket of consumer is $1. Clearly, then, the maximum price the consumer could pay for the soda is $1. Since the money in your pocket you cannot consume it, all you can consume is the one litre of the soda. Now suppose that by some miracle, another dollar appears to the consumer’s pocket. The money stock is now $ 2, but only 1 litre of soda is still available. The consumer would be willing to pay a price of $2 for the litre of soda. Since the money stock doubled, the price of soda doubled, and thus nominal output doubled as well. But since there is still only one litre of soda in the economy, real output is constant and the consumer is not better off than before the extra dollar appeared.

4.5.2 Velocity and economic growth

In an economy with many individuals and many goods and services, to explain the relationship between the money stock and the price level, we have to take into account the velocity of money.

Velocity of money measures the number of times the average dollar/shilling changes hands in the economy.

Why does velocity matter?

With many people and goods but only a single dollar in money, something remarkable happens. People can make more than $1 in purchases. You can use the $ 1 to buy something; the person you pay can in turn use the same $1 to buy from someone else and so on. If velocity is 2, the average dollar bill changes hands two times. $ 1 in money leads to $2 worth of purchases. If velocity is 10, $1 in money leads to 10 transactions, or $10 worth of purchases.

More generally, if the money stock is M and velocity is V, the total dollar value of transactions in the economy is MV. Similarly, if P is the price level and Y is real output, the dollar value of this output (nominal output) is PY. Since the dollar value of transactions equals the dollar value of the goods and services in the economy, it follows that;

MV=PY

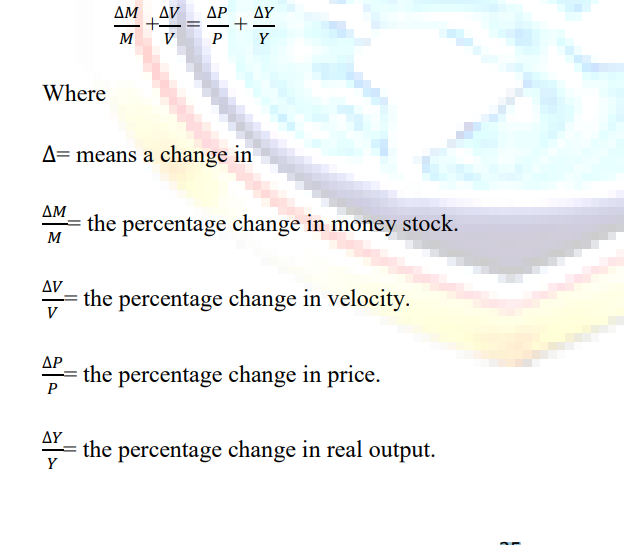

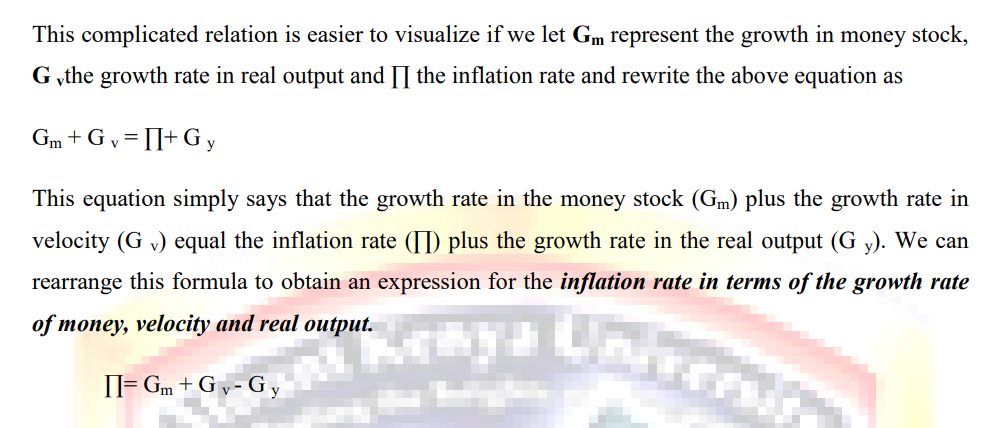

This fundamental relationship between the dollar value of exchanges (transactions) and nominal output is known as the equation of exchange. The equation of exchange can be used to obtain a detailed picture of the cause of inflation. In particular, it implies that

The inflation rate thus equals the growth rate of the money stock, plus the growth rate of velocity, minus the growth of rate in real output. Changes in any of the three growth rates on the right-hand side of the equation can lead to change in the inflation rate.