A partnership has minimum membership of two (2) maximum of fifty (50) except for professional firms (e.g.) lawyers, doctors, accountants etc. whose maximum membership is twenty (20) persons.

Where two or more persons wish to form a partnership, then it is recommended that they agree on the terms upon which the partnership will be run and the relationship between each other. This is done in writing and signed off as agreed by all the partners and therefore it becomes a partnership deed or agreement.

Contents of partnership agreement

- Name(s) and address(s) of both the firm and the partners

- Capital to be contributed by each partner

- The profit sharing ratios that may be expressed as a fraction or as a percentage.

- Salaries to be paid to any partners who will be involved in the active management of the business

- Any interest to be charged on drawings made by the partners.

- Interests to be given to the partners on their capital balances.

- Procedures to be taken on the retirement or admission of a partner.

ACCOUNTING FOR PARTNERSHIPS

The interest of the partners in the business is either long term or short-term. The long-term interest is the capital contributed by each partner and the balance is expected to remain fixed. It will only change when the partners agree or incase of any changes in the partnership like admission of or retirement of a partner.

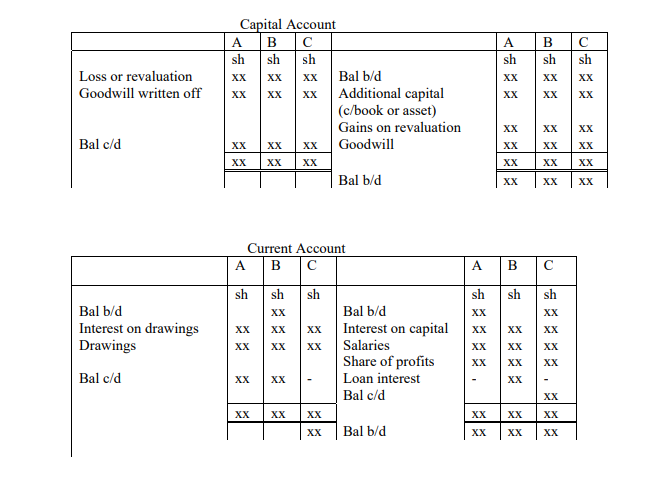

The short-term interest is reflected in form of a current account which is affected by the trading activities of the partnership (i.e.) the profits or losses and any drawings made by the partners. In most partnerships, both a capital and a current account are maintained and therefore the capital account becomes a fixed capital account. When there is no distinction between a capital account and a current account then any short- term changes are passed through the capital account therefore the capital account becomes a fluctuating capital account. Some of the transactions to be passed through the capital account and the current account are

shown in the following formats.

(Assume a firm of 3 partners A, B and C)