The adequate help of cost and stores accounting by way of providing up to-date, reliable and required data to the materials control department enables it to base it forecasts on the data so supplied. The cost and stores accounting are both to supply the required information. Both of them are complementary to each other in this respect. To watch the performance and to suggest corrective measures, the help of accounting has to be taken. Hence accounting and materials budgeting together for achieving the set objectives of the organization.

Materials’ budgeting helps in controlling the cost and thus makes the organization cost conscious. Cost consciousness in turn makes the organization productivity conscious. Every material requisition is considered according to its necessity, every man-hour is utilized to its fullest capacity and every shilling spent is made to prove its worth. This is achieving through cost and result analysis which is possible only through accounting. Since materials budgeting aims at cost reduction, accounting again comes to the fore for making the budget result, producing.

Techniques of drawing up materials budgets

One of the following positively correlated techniques is generally made use of for drawing up a materials budget

- Budget summaries

- Manufacturing and trading account

- Savings on investments in materials

Budget summaries

Budget summaries are summaries of various individual budgets of the organizations. They placed in proper relationship with one another. They are viewed and analyzed and help is taken from them in arriving at a certain conclusion for the purpose of incorporation of a figure in a budget estimate. A material budget is grown up in relation to production, sales and purchase budgets. Budgets

summaries help in correlating each one of them in broader perspective as budget summaries, usually accompanied by reports, which at a greater length, deal with the variances and their reactions, and are helpful in drawing conclusion for the next budget estimates.

The merits of the technique

- Budget summaries are concrete numerical standards which provide a good base for the next budget estimates

- Budget summaries describe the position briefly and are arranged in such and analytical and comparable from that they help in drawing conclusions correctly.

- Budget summaries throw light on the activities of various departments. This makes planning effective. Also objectives get correct definition. Thus implementations part of the budget estimates becomes an easy task.

The limitations of the technique

- Budget variations are always there. The variations may be of minor as well as of major nature. Budget summaries may give equal importance to both types of variations which ought not to have been treated on equal terms. The conclusions and consequently, next budget estimates may give a picture which may not be a true one.

- Budget figures are often manipulated so as to balance the requirements and funds available. This may result in faulty conclusions and thus the next budget estimate may also become faulty. In such cases, budgetary control may also be a troublesome and irksome job.

- Budget summaries are merely numerical standards. They speak only about estimates and a little bit of performance, but they do not ensure profitable operations. No clear picture thus emerges from budget summaries so far as the profitable operation the business is concerned.

Manufacturing and trading account

This technique is comparatively result-oriented as it is based on the performance of the budget viss-vis the results. This account reveals in detail various items relating to the opening stock purchases expenses on purchases, production, closing stock, working –in-progress, etc, and finally the cost of production and profit made out of manufacturing and trading process. This account is a good base, rather a good applied technique for budget estimates. Of course, budget summaries cannot be done away with. The positive help such summaries are of immense value for the framers of materials budget.

The merits of the technique

- This technique is result-oriented and thus a good base for budget estimates

- It stresses profitability aspect on each of the correlated budgets of the various departments.

Thus efficiency and performance become the keynote of various budgets.

3.Pro rata analysis of the result is possible. Thus periodical and flexible budgets become a possibility.

The limitations of the technique

- It involves much paper work and thus becomes too heavy a burden for an organization of relatively small size.

- There may be cases in which proper allocation of expenses to one or other of the items may not be feasible. Wrong inferences, thus may be drawn.

- The result-oriented budget framing technique may result in interdepartmental rivalry which ultimately may not prove to be good for the organization as a whole.

Savings on investments in materials

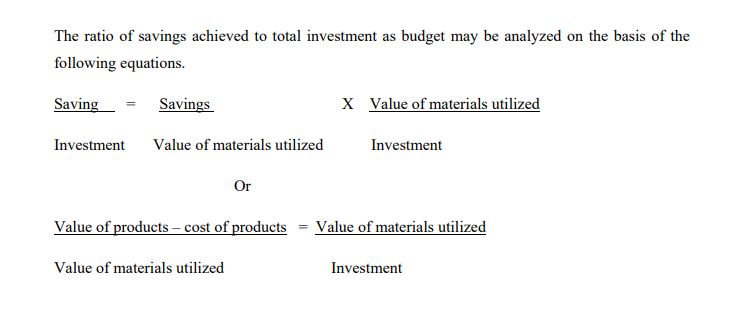

The overall performance of an organization can be judged by the profit it has made during a specified period and a budget is a means to setting the objective of profit-making in a right perspective through its estimates based on returns on investment. The materials budget consumes the major portion of funds available in the organization; hence it is appropriate to measure the performance of materials budget by finding out the savings on the investments made in the past and possible expected savings in future. The amount of savings achieved by any materials budget effectively is the success of any materials budget and this can be better judged by the ratio of savings and investment in materials.

The merits of technique

- Objectives are clearly defined, which give a realistic approach in materials budgeting.

- It can also be effectively used in other inter-related departments

- As detailed analysis is possible, a remedial action for disturbing trends may be taken.

- It makes possible the effective use of scarce means available to the organization.

The limitations of the technique

- It lays too much emphasis on the financial aspects. Other important factors which may curtail the investment and achieve savings are not taken care of.

- The savings so arrived at are based on past performances. Future budgeting is based on calculations. But the circumstances in which the savings are achieved may not be present in the budget year in question. The result, thus, may be misleading.

- Much paper work, labour and calculations are required, but they may not worthwhile for a small-sized business.

Before choosing any one of the techniques discussed above, the framers of materials budget should take into consideration the points enumerated below.

- The objective and policies of the organization. Budget is a means and not an end in itself, hence a well defined objective and policy will ensure effective materials budgets, otherwise, it will simply be a waste of time, money and energy.

- The period of budget: budget, whether material or any other, may be of short term or long term. Generally, a materials budget is of short term. The short term may also be of three months, six months or even one year. This makes a materials budget more effective and result producing.

- The data available. As has been discussed in the foregoing pages, the data, if available as required, may make or mar the success and the effectiveness of a budget. In all the three techniques discussed above the availability of reliable, perfect, up-to-date and analytical data is very essential.

- Flexibility of budget. The flexibility of budget, particularly materials budget, is one of the important points to be taken note of. The materials are subject to various kinds of losses during the storage process, their demand may increase or decrease according to changes in the production schedule. This requires flexibility so as to make adjustments according to circumstances.

- Repetition of past targets. Business is a growing and going venture. Repetition of past targets in any budgetary provision is always in bad taste. It reflects the unconcerned attitude of those who are responsible for running the organization. A change towards betterment should always be the motto of the framers of any kind of budget.

Purchasing Plan and Materials Budget can only be fixed to the accuracy of Sales and Production Forecasts – normally not accurate to annual basis but requirement adjustment throughout the production year

Materials Budget contains information concerning:

• Estimated materials prices for the period

• Timing of purchases to establish obligation rates for the period .

Forward buying can be arranged commensurate with planning levels and accuracy.

• Forward buying attempts to purchase quantities to levels approximating foreseeable requirements.

• “Hand to Mouth” buying is buying material to satisfy current operating requirements, oftentimes at less than optimum economic quantities.

Forward buying consists of advanced arrangements such as:

• Blanket Purchase Agreements

• Contract Purchases (IDIQ, Requirements, etc.)

Long term forward buying arrangements should include provisions to mitigate risks associated with market volatility (swings either upward, to protect supplier, or downward, to protect buyer)

Market Stability influences purchase timing

• Stable markets may allow orderly purchases of uniform quantities

• Unstable markets may provide opportunities to be either seized or avoided

• Proper market timing can be a hedge against rising prices of commodities

Volume purchased can influence prices (and also the cost of capital) while avoiding the negative impact of numerous small purchases. Acquisition strategy and contract type are important here.

It is important to emphasize that Strategic Materials Planning considers long-term material requirements and market projections

• In strategic materials planning, the focus is on the corporate position over the long haul, not short term gratification

• Potentially critical materials for future needs are identified and sources developed

• Consumer demand and product/materials innovation must be considered

• Political and economic environments in source countries must be assessed

• Competitor demands for like commodities must be considered

• Strategic materials planning should maximize benefits derived from second or alternative sourcing agreements by injecting competition, ensuring product availability

• Materials projected in short supply should be considered for substitution/replacement and vice versa

• Make or buy decisions should be included where outsourcing of components is a concern or potentially risky