Marginal costing is a technique where only the variable costs are considered while computing the cost of a product. The fixed costs are met against the total fund arising out of excess of selling price over total variable cost. This fund is known as ‘contribution’ in marginal costing. According to the Institute of Cost and Management Accountants, London, marginal costing is a technique where “only the variable costs are charged to cost units, the fixed cost attributable being written off in full against the contribution for that period.” Thus marginal costing considers only the variable costs while computing the cost of the product. As a matter of fact, it is not a system of cost finding such as job, process or operating costing, but it is a special technique concerned particularly with the effect affixed overheads on running the business. This is being explained in the following pages while explaining the difference between Marginal Costing and Absorption Costing.

16.2 THE CONCEPT OF MARGINAL COST

The technique of Marginal Costing is concerned with “Marginal Cost”. It is, therefore, very necessary that the term “Marginal Cost” is correctly understood. According to the Institute of Cost and Management Accountants, London, the term “Marginal Cost” means

‘the amounts at any given volume of output by which aggregate costs are changed if the volume of output is increased/decreased by one unit’. On analyzing this definition we can conclude that the term “Marginal Cost” refers to increase or decrease in the amount of cost on account of increase or decrease of production by a single unit.

SEGREGATION OF SEMI-VARIABLE COSTS

Marginal costing requires segregation of all costs between two parts fixed and variable. This means that the semi-variable cost will have to be segregated into fixed and variable elements. This may be done by any one of the following methods:

- Levels of output compared to levels of expenses method,

- Range method,

- Degree of variability method,

- Scatter graph method,

- Least squared method.

Levels of output compared to levels of expenses method: According to this method, the output at two different levels is compared with corresponding level of expenses. Since the fixed expenses remain constant, the variable overheads are arrived at by the ratio of change in expense to change in output.

Range method: This method is similar to the previous method except that only the highest and lowest points of output are considered out of various levels. This method is also designated as ‘high and low’ method.

Degree of variability method: In this method, degree of variability is noted for each item of semi-variable expense. Some semivariable items may have 30% variability while others may have 70% variability. The method is easy to apply but difficulty is faced in determining the degree of variability.

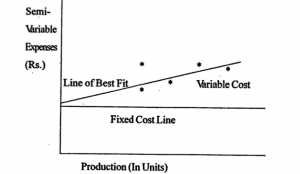

Scattered-graph method: In this method the given data are plotted on a graph paper and line of best fit is drawn. The method is explained below:

-

- The volume of production is plotted on the horizontal axis and the costs are plotted on the vertical axis.

- Corresponding to each volume of production are then plotted on the paper, thus, several point are shown on it.

- A straight line of best fit is then drawn through the point plotted. This is the total cost line. The point where this line interests the vertical axis is taken to be amount of fixed element.

- A line parallel to the horizontal axis is drawn from the point where the line of best fit intersects the vertical axis. This is the fixed cost time.

- The variable cost at any level can be known by noting difference between fixed cost and total cost lines.

Solution

CONTRIBUTION

As stated earlier, the difference between selling price and variable cost (i.e., the marginal cost) is known as ‘Contribution’ or ‘Gross Margin’. In other words, fixed costs plus the amount of profit is equivalent to contribution. It can be expressed by the following formula:

Contribution = Selling Price – Variable Cost

Or

Fixed Cost + Profit

We can derive from it that profit cannot result unless contribution exceeds fixed costs. In other words, the point of no profit no loss shall be arrived at where contribution is equal to fixed costs.

PROFIT/VOLUME RATIO (P/V RATIO)

This term is important for studying the profitability of operations of a business. Profit-volume ratio establishes is relationship between the contribution and the sale value. The ratio can be shown in the form of a percentage also. The formula can be expressed thus:

KEY FACTOR

Key factor is that factor which limits the volume of output in the activities of an undertaking at a particular point of time or over a period. The extent of its influence must be assessed first so as to maximize the profits. Generally on the basis of contribution, the decision regarding product mix is taken. It is not the maximization of total contribution that matters, but the contribution in terms of the key factor that is to be compared for relative profitability. Thus, it is the limiting factor or the governing factor or principal budget factor. If sales cannot exceed a given quantity, sales is regarded as the key factor; if production capacity is limited, contribution per unit i.e., in terms of output, has to be compared. If raw material is in short supply, contribution has to be expressed in relation to per unit of raw material required. There may be labour shortage and in such a case contribution per labour is to be known. If machine capacity is a limitation, contribution per machine hour is to be considered for appropriate decision making.

PROFIT PLANNING

The basic objective of running any business organization is to earn profits. Profits determine the financial position, liquidity and solvency of the company. Profits serve as a yardstick for judging the competence and efficiency of the management. Profit planning is, therefore, a fundamental part of the overall management function and is a vital part of the total budgeting process. The management determines the profit goals and prepares budgets that will lead them to the realization of these goals. Profit planning can be done only when the management has the information about the cost of the product, both fixed and variable, and the selling price at which it will be in a position to sell the products of the company. The management extensively applies the concept of Marginal Costing as explained in the preceding pages in profit planning.

The profit is affected by the several factors. Some of the important factors are as follows:

- Selling price of the products.

- Volume of sales.

- Variable costs per unit.

- Total fixed costs.

- Sales makes (or mix) of the different products.

The management can achieve their target profit goal by varying one or more or the above variables. This will be clear with the help of the following illustration:

BREAK-EVEN ANALYSIS

The narrower interpretation of the term break-even analysis refers to a system of determination of that level of activity where total cost equals total selling price. The broader interpretation refers to that system of analysis which determines the probable profit at any level of activity. The relationship among cost of production, volume of production, the profit and the sales value is established by break-even analysis. Hence, this analysis is also designated as ‘Cost-volume-profit’ analysis.

Such an analysis is useful to the management accountant in the following respects:

- It helps him in forecasting the profit fairly accurately.

- It is helpful in setting up flexible budgets, since on the basis of this relationship, he can ascertain the costs, sales and profits at different levels of activity.

- It also assists him in performance evaluation for purposes of management control.

- It helps in formulating price policy by projecting the effect, which different price structures will have on cost and profits.

- It helps in determining the amount of overhead cost to be charged at various levels of operations, since overhead rates are generally pre-determined on the basis of a selected volume of production.

Thus, cost volume-profit analysis is an important media through which the management can have an insight into effects on profit on account of variations in costs (both fixed and variable) and sales (both volume and value) and take appropriate decisions.

Break-even point

The point, which breaks the total cost and the selling price evenly to show the level of output or sales at which there shall be neither profit nor loss, is regarded as break-even point. At this point, the income of the business exactly equals its expenditure. If production is enhanced beyond this level, profit shall accrue to the business, and if it is decreased from this level, loss shall be suffered by the business.

It will be proper here to understand different concepts regarding marginal cost and break-even point before proceeding further. This has been explained below:

| Marginal cost | = | Total variable cost | |

| Or | = | Total cost – Fixed cost | |

| Or | = | Direct Material + Direct labour | |

| + Direct Expenses (Variable) | |||

| + Variable overheads | |||

| Contribution | = | Selling Price – Variable cost | |

| Profit | = | Contribution – Fixed cost | |

| Fixed cost | = | Contribution – Profit | |

| Contribution | = | Fixed cost + Profit | |

| Profit/Volume Ratio | = | Contribution per unit

Selling price per unit |

|

| Or | = | Total contribution

Total sales |

|

CONCEPT OF DECISION-MAKING

Decision-making is the essence of management since it may make the success of the business as a whole. In general, it means taking the final step in deliberations before acting. In management terms it has a specific meaning. It means the process of choosing among alternative courses of action, since if there is no choice; there is no decision to make. Moreover, since business takes place in a probabilistic world, every management decision deals with the future-whether it be ten seconds ahead (the decision to adjust a dial), or eighty years ahead (the decision to locate the factory). A decision always involves a prediction.

The function of decision maker is, therefore, to select courses of action for the future. There is no opportunity to alter the past.

Future is risky: Of course, routine decisions do not involve much of risk. However, most of the top management decisions are not of a routine nature. They are generally of a crucial and critical nature on account of their requiring huge investments and involving many uncertainties. But they cannot be avoided. The Executive has taken them. It has been correctly observed: “Uncertainty is his (executive’s) opponent, overcoming it his mission. Whether the outcome is a consequence of luck or wisdom, the moment of decision is without doubt the most creative event in the life of the executive”.

Concept of Relevant Costs

It has already been stated that for managerial decision-making the decision-maker must make use of relevant costs. The term’ relevant’ mean pertinent to decision at hand. Costs are relevant if they guide the executive towards the decision that harmonies with top management’s objectives. It will be ideal if the costs are not only relevant or pertinent but also accurate or precise.

It may be noted that ‘relevance’ and ‘accuracy’ are not identical concepts. Costs may be accurate but irrelevant or inaccurate but relevant. For example, the sales manager’s salary may be precisely Rs.60,500 per annum, however, this fact has no relevance in deciding whether to add or drop a production line.

The following are the two fundamental characteristics of relevant cost.

- They are future costs: Of course, all future costs are not relevant to alternative choice decisions but all costs are not relevant unless they are future. This is because past costs are the result of past decisions and no current or future decision can change what has already happened. For example, a company has to decide whether or not to accept an order for a particular product. In calculating the cost of this product to see if the order would benefit the company financially, the company uses the expected cost at the time when intends to produce the product. This could be quite different from the latest historical cost or standard cost. Thus, in forward decision-making, data regarding historical or standard cost is useful only as a basis for estimating future costs.

- They differ between alternatives: As stated above all future costs are not relevant for decision-making. Only such future costs are relevant which may be expected to differ between alternatives. Those costs, which will not change between different alternatives, are to be ignored. For example a company is considering the substitution of an automatic process in place of a slow manual process. The material consumption per unit would be Rs. 2 under both the processes but the conversion cost would be Rs. 3 per unit under the new process in place of Rs. 5 under the present process. In this case relevant cost for decision-making is not the material cost, which will not change, but the conversion cost, which will change. The cost of material should, therefore, be ignored. Conversion cost should only be considered. The proposal for automatic process should therefore be accepted since it will result in saving of Rs. 2 per unit.

Concept of Differential Costs

The term differential cost means difference in cost between alternatives. It satisfies both the conditions necessary for relevant costs, i.e., it is a future cost as well as it changes between alternatives.

Mr. J.M. Clark has described the concept of differential costs as follows:

“When a decision has to be made involving an increase or decrease of n-units of output, the difference in costs between two policies may be considered to be the cost really incurred on account of these n units of business, or of any similar units. This may be called the differential cost of a given amount of business. It represents the cost that must be incurred if that business is taken and which need not be incurred if that business is not taken”.

Since the management’s objective is to maximize the profit (or minimize the loss) of the firm, a comparison is made of differential costs with differential revenue under the available alternatives, to find out the most favourable alternative that will give the maximum possible return of the incremental capital employed in the business.

16.10 STEPS IN DECISION-MAKING

Rational decision-making requires the taking of the following steps:

- Defining the problem: The problem must be clearly and precisely defined so that quantitative amounts that are relevant to its solution can be determined.

- Identifying alternatives: The possible alternative solutions to the problem should be identified. Sometimes consideration of more alternative solutions may make the matters more complex. In order to do away with this difficulty, after having identifies all alternatives, the analysts should eliminate on a judgment basis those that are clearly unattractive. A detailed analysis of the remaining alternatives should then be done.

- Evaluating quantitative factors: Each alternative is usually associated with a number of advantages (relevant revenues) and disadvantages (relevant costs). The decision-maker should evaluate each of the relevant factors in quantitative terms to determine the largest net advantage.

- Evaluating qualitative factors: In most cases the advantages and disadvantages associated with each alternative are capable of being easily expressed in quantitative terms. However, in certain cases there may be qualitative factors associated with certain alternatives, which may not be capable of being expressed easily and correctly in quantitative terms. Evaluating such qualitative factors against the quantitative factors depends on the judgment of the decision-maker. Sometimes on account of a single qualitative factor, which though cannot be measured exactly and easily in monetary terms, the decision may just be reverse than what it was generally expected to be. For example, it is a known fact that many persons can meet their transportation needs less expensively by using public conveyances rather than by operating their own automobiles. In spite of this people own and use their own automobiles for reasons of prestige, convenience, or other factors, which cannot be measured in quantitative terms.

- Obtaining additional information: In case the decisionmaker feels necessary, he may ask for additional information. As a matter of fact many decisions could be improved by obtaining additional information and it is usually possible to obtain such information.

- Selection of an alternative: After having identifying, evaluating, weighing and obtaining additional information (if necessary), the decision-maker can select the alternative and act on it.

- Appraisal of the results: Having implemented his decision, the decision-maker should also from time to time carry out an appraisal of the results. This will help him in correcting his mistakes, revising his targets and making better predictions in the times to come.

In the following pages we shall explain how the above steps/rules are taken/applied in making decisions relating to each of the following matters.

- Determination of sales mix;

- Exploring new markets;

- Discontinuance of a production line;

- Maker buy decisions;

- Equipment replacement decision;

- Investment in asset;

- Change versus status quo; (viii) Expand or contract.

Determination of sales mix

Presuming that fixed costs will remain unaffected decision regarding sales/production mix decision is taken on the basis of the contribution per unit of each product. The product which gives the highest contribution should be given the highest priority and the product whose contribution is the least, should be given the least priority. A product giving a negative contribution should be discontinued or given up unless there are other reasons to continue its production.

Exploring new markets

Decision regarding selling goods in a new market (whether Indian or foreign) should be taken after considering the following factors:

- Whether the firm has surplus capacity to meet the new demand?

- What price is being offered by the new market? In any case, it should be higher than the variable cost of the product plus any additional expenditure to be incurred to meet the specific requirements of the new market.

- Whether the sale of goods in the new market will affect the present market for the goods? It is particularly true in case of sale of goods in a foreign market at a price lower than the domestic market price. Before accepting such an order from a foreign buyer, must be seen that the goods sold are not dumped in the domestic market itself.

Discontinuance of a product line

The following factors should be considered before taking a decision about the discontinuance of a product line:

- The contribution given by the product. The contribution is different from profit. Profit is arrived at after deducting fixed cost from contribution. Fixed costs are apportioned over different products on some reasonable basis, which may not be very much correct. Hence contribution gives a better idea about the profitability of a product as compared to profit.

- The capacity utilization, i.e., whether the firm is working to full capacity or below normal capacity. In case a firm is having idle capacity, the production of any product, which can contribute towards the recovery of fixed costs, can be justified.

- The availability of product to replace the product, which the firm wants to discontinue, and which is already accounting for a significant proportion of total capacity.

- The long-term prospects in the market for the product.

- The effect on sale of other products. In some cases the discontinuance of one product may result in heavy decline in sales of other products affecting the overall profitability of the firm.

Make or Buy Decision

A firm may be manufacturing a product by itself. It may receive an offer from an outside supplier to supply that product. Comparing the price that has to be paid will make the decision in such a case and the saving that can be effected on cost. The saving will be only terms of marginal cost of the product since generally no savings can be affected in fixed costs.

Similarly, a firm may be buying a product from outside, it may be considering to manufacture that product in the firm itself. Comparing the price being paid to outsiders and all additional costs that will have to be incurred for manufacturing the product will make the decision in such a case. Such additional costs will comprise not only direct materials and direct labour but also salaries of additional supervisors engaged, rent for premises if required and interest on additional capital employed. Besides that the firm must also take into account the fact that the firm will be losing the opportunity of using surplus capacity for any other purpose in case it decides to manufacture the product by itself.

In case a firm decides to get a product manufactured from outside, besides the savings in cost, it must also take into account the following factors:

- Whether the outside supplier would be in a position to maintain quality of the product?

- Whether the supplier would be regular in his supplies?

- Whether the supplier is reliable? In other words, he is financially and technically sound.

In case the answer in “No” to any to these questions it will not be advisable for the firm to buy the product from outside.

Equipment Replacement Decision

While deciding about replacement of capital equipment, the firm should take into consideration the resultant savings in operating costs and the incremental investment in the new equipment. In case the savings is more than the cost of raising additional funds for the new equipment, the proposal may be accepted. Besides this the firm must take into account the benefits the firm is likely to derive in the long run by replacing old and obsolete equipment. The underpreciated book value of the old equipment should be taken as irrelevant cost for this purpose. Many accountants disapprove replacement of obsolete equipment by a new one by pointing out ‘loss on disposal of old assets’. Such a tendency is unfortunate since the past costs are sunk costs and they should not be allowed to affect adversely the future decisions and firm’s goal of maximizing long-term profits.

The items of differential costs and benefits to be considered while deciding about the replacement of capital equipment call brief1y be enumerated as follows:

Terms of differential costs

- Capital equipment and associated costs, viz., interest, deprecation, etc.

- Loss on sale of old equipment.

- Increase in fixed overhead costs.

Items of differential benefits

- Saving in operating costs.

- Increased volume and value of production.

- Realizable value of old machine.

- Tax benefits, if any.

SUMMARY

Marginal costing which is otherwise known as variable costing is used as a tool for decision-making by the management. Marginal costing is also known as direct costing and this new concept is gaining wide popularity in the field of accounting. Marginal costing is a technique through which variable costs are taken into account for the purpose of product costing, inventory valuation and other important management decisions. The fixed cost, variable costs, contribution, key factor, profit volume ratio and break-even analysis are quite important concepts in marginal costing.

Break-even analysis is one of the important tools in marginal costing with the help of which we calculate the operating profits at a given sales volume, sales volume at a desired level of profit, effects of fixed cost and variable costs for the purpose of financial analysis of a company/organization.

In decision-making analysis, we may make various types of decisions with the help of marginal costing. These decisions mainly include -Determination of sates mix; Exploring new markets, Discontinuance of a production line, Make or buy decisions, Equipment replacement decision, Investment in asset, Change versus status quo and Expand or contract. Such a large number of decisions reveal the vital significance of marginal costing with reference to break-even analysis and decision-making alternative choices.

16.12 KEYWORDS

Marginal Cost: The cost incurred in producing an additional unit of product is known as marginal cost.

Marginal costing: It is a technique of ascertaining cost of production of goods or services manufactured.

Semi-variable cost: It is defined as a cost containing both fixed and variable elements.

Break-even point: The point, which breaks the total cost and the selling price evenly to show the level of output or sales at which there shall be neither profit nor loss, is regarded as break-even point.

Differential cost: Differential cost means difference in cost between alternatives.

16.13 SELF ASSESSMENT QUESTIONS

- Discuss the importance of marginal costing for managerial decision-making. State briefly the difference between contribution and profit volume ratio.

- “Marginal costing is the presentation of accounting information in such a way as to assist the management in the creation of policy and in day to day operation of the undertaking”. Elucidate.

- Explain the tools of marginal costing. Discuss the methods of segregating the fixed and variable costs.

- How does marginal costing help in decision-making? Discuss the different kind of decisions made through marginal costing.

Give suitable examples.

- Write short notes on the following:

- Break-even analysis

- Key factor.

- Differential costing.

- By taking some imaginary figures, calculate contribution, key factor, profit volume ratio, break-even point and margin of safety.

- Illustrate how decisions are made with help of marginal costing. Take suitable examples. Give working notes.