TUESDAY: 25 April 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain THREE benefits of maintaining a cost (6 marks)

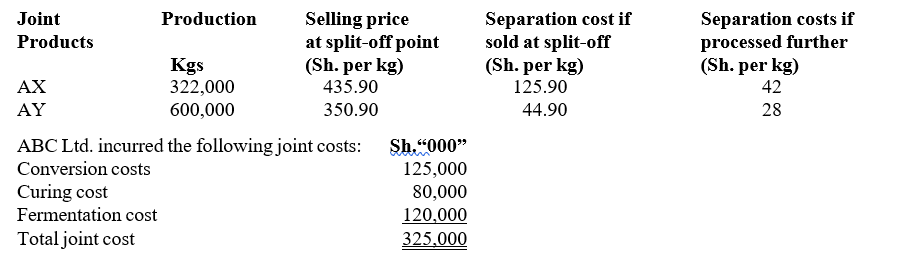

2. ABC applies joint process costing in the production process of two joint products; AX and AY. The following information was gathered for the two joint products:

Required:

Calculate the total profit or loss per product if joint costs are allocated to product AX and AY on the basis of:

- Sales value at split-off (4 marks)

- Net realisable value at split-off (4 marks)

3. Digital Television Ltd. manufactures digital televisions. The main component used in making digital televisions is the fluorescent bulbs. For each digital television manufactured, 12 bulbs are required. The company manufactures 15,000 digital televisions per It costs Sh.200 each time the bulbs are ordered and the carrying cost are Sh.8 per bulb per year.

Required:

- Determine the economic order quantity of (3 marks)

- Calculate the number of times per year the bulbs will be ordered assuming 360 days in a (3 marks)

(Total: 20 marks)

QUESTION TWO

1. In the context of labour remuneration, highlight FOUR causes of labour (4 marks)

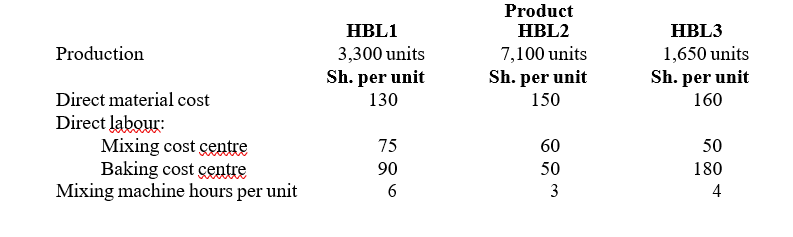

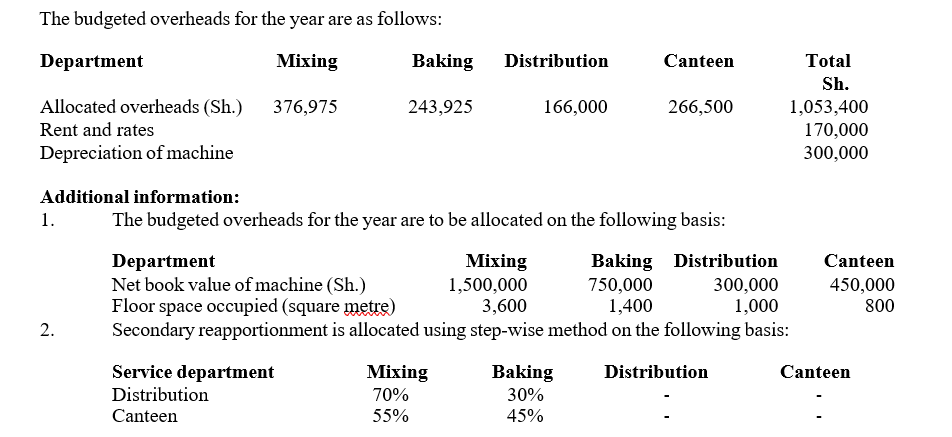

2. Ezekiel Mutinda, a sole trader, prepares three types of cakes branded HBL1, HBL2 and HBL3 in two production cost centres and two service centres. The production centres are mixing cost centre and baking cost centre while the service centres are distribution department and canteen

The following is the budgeted production data and production cost for the year ending 31 December 2023:

Required:

- An overhead analysis sheet (OAS) showing both primary and secondary (4 marks)

- Total machine hours for mixing cost (2 marks)

- A machine hour overhead absorption rate (OAR) for mixing cost (2 marks)

- A rate expressed as a percentage of direct labour cost for the baking cost (4 marks)

- Calculate the budgeted total cost per unit of product HBL1 (4 marks)

(Total: 20 marks)

MASOMO MSINGI PUBLISHERS APP – Click to download and access past paper answers in PDF

QUESTION THREE

1. Outline FOUR factors influencing stock levels in inventory (4 marks)

2. Highlight FOUR purposes of cost estimation to a service company such as a (4 marks)

3. Relei is currently following a centralised material storage system. The company is in the process of preparing its cash budget for the second-quarter of the year 2023 and has availed the following data:

Additional information:

- Cash sales are 60% of the total The remaining sales are collected equally during the following two months.

- Assets are to be acquired in the month of April 2023 and May Therefore, provisions should be made for payment of Sh.16,000,000 and Sh.65,000,000 for the same.

- An application has been made to the bank for the grant of a loan of Sh.45,000,000 and it is hoped that the loan will be received in the month of May

- Creditors for materials purchased are granted one-month credit after month of

- Monthly production overheads include depreciation of 5,000,000 per month.

- Selling overheads are paid one month after the month in which the overhead

- Salaries commission at 3% on sales is paid to the salesmen each

- Salaries and wages are paid monthly at the end of the

- An advance tax of 20,000,000 is due in April 2023.

- The cash balance as at 1 April 2023 is estimated as 144,500,000.

Required:

A cash budget for the second quarter of the year commencing 1 April 2022 to 30 June 2023. (12 marks)

(Total: 20 marks)

QUESTION FOUR

1. Discuss FOUR limitations that a firm might encounter when operating a marginal costing (8 marks)

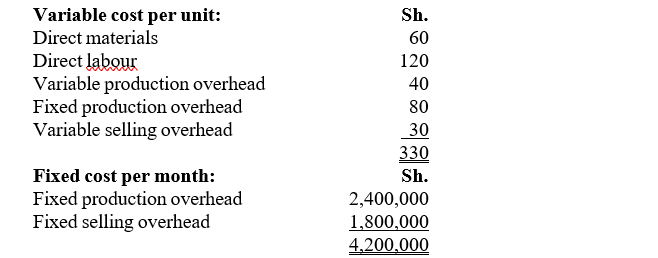

2. Grate manufactures and sells a single product branded “GL”. The cost data for the product is as follows:

Additional information:

- The product is sold for 400 per unit.

- Grate budgeted to produce and sell 30,000 units per month.

- Actual production and sales units for the months of January 2023 and February 2023 are as follows:

4. There was no opening inventory or work-in-progress as at the start of January

Required:

Prepare profit or loss statements based on:

- Marginal costing (6 marks)

- Absorption costing (6 marks)

(Total: 20 marks)

QUESTION FIVE

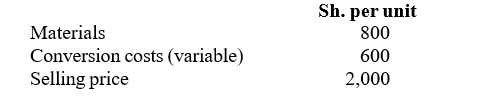

1. Quivo manufactures and sells a single product branded “QV”. The following information relates to product “QV” for the month of March 2023:

Additional Information:

- The dealer’s margin is equivalent to 10% of the selling

- The total fixed cost during the period was 25,000,000.

- The sales department indicates that the current sales during the period amounted to 90,000

- The production capacity utilisation is at 60%.

The company has in the recent past faced an acute competition that has negatively affected the sales targets. The Marketing Manager has presented the following two options for increasing sales:

Option A: Reducing sales price by 5%.

Option B: Increasing dealers’ margin by 25% over the existing rate.

Required:

Recommended the option the company should adopt if the company desires to maintain the present profit. (8 marks)

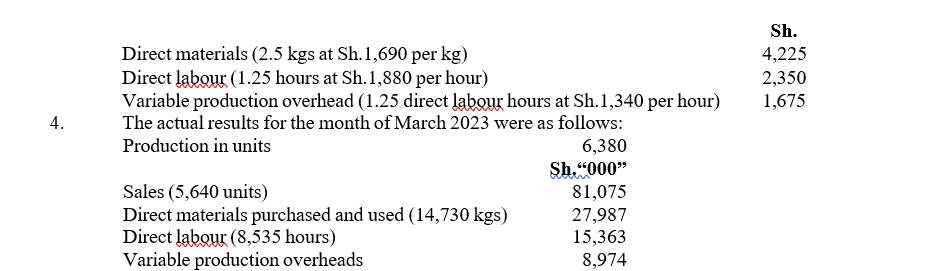

2. Dex manufactures a single product branded “XV”. The company operates a standard marginal costing system.

The following information for the month of March 2023 is availed to you:

- The budgeted production and sales for the month amounted to 6,000

- The standard selling price of product “XV” per unit is 13,200.

- The variable standard manufacturing costs per unit are as follows:

5. The variable production overheads are absorbed on the basis of direct labour

6. The opening and closing inventories of finished goods are valued at the standard variable manufacturing cost per unit

Required:

Compute the following variances:

- Sales (2 marks)

- Sales volume (2 marks)

- Direct material (2 marks)

- Direct material (2 marks)

- Direct labour (2 marks)

- Direct labour (2 marks)