WEDNESDAY: 6 April 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Cost accounting uses information provided by financial accounting together with other details of internal operations of an organisation. With reference to the above statement, describe three similarities between cost accounting and financial accounting. (6 marks)

2. Rengo ltd. has provided the following data for the financial year 2022:

- Budgeted output for the year 9,800 units

- Standard details for one unit:

- Direct materials 40 square metres at Sh.530 per square metre.

- Direct labour costs:

– Bonding cost centre 48 hours at Sh.250 per hour

– Finishing cost centre 30 hours at Sh.190 per hour

- Budgeted costs and hours per annum:

- Variable overhead: Hours Sh.

Bonding cost centre 500,000 3,750,000

Finishing cost centre 300,000 1,500,000

- Fixed overhead:

Production 39,200,000

Selling and distribution 19,600,000

Administration 9,800,000

Required:

Prepare a standard cost statement of a unit cost showing:

Prime cost. (2 marks)

Variable production cost. (2 marks)

Total cost. (2 marks)

Selling price per unit at a notion profit of 15% on cost. (2 marks)

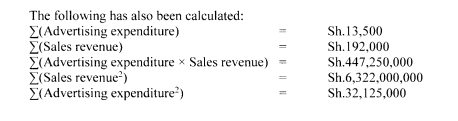

3. Jambo Ltd. manufactures bracelets for export trade. The sales revenue is dependent on level of advertising expenditure per month. The company has recorded the following sales information for the past six months:

Month Advertising expenditure Sales revenue

Sh.”000″ Sh. “000”

1 1.5 30

2 2 27

3 1.75 25

4 3 40

5 2.5 32

6 2.75 38

Required:

Estimate fixed and variable elements of the sales revenue using the least squares regression analysis. (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Discuss four circumstances under which time-based labour remuneration system is deemed to be more appropriate than the output based system. (8 marks)

2. The following data relate to a particular stock item of Magala Ltd. The company’s management is in the process of setting its stock levels as a way to address the escalating stock handling costs.

The following information is provided:

Normal usage per day 1,100 units

Minimum usage per day 500 units

Maximum usage per day 1,400 units

Lead time 25 – 30 days

Economic order quantity (previously calculated) 50,000 units

Required:

Compute the following:

Re-order level. (2 marks)

Maximum stock level. (4 marks)

Minimum stock level. (4 marks)

Average stock level. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Discuss four challenges that you are likely to encounter when installing a costing management system. (8 marks),

2. The following information is provided in relation to Baridi Kuu Ltd. The annual demand of its product branded `D’ is 30,000 units. The ordering cost per order is Sh.2,500. The holding cost is expressed as a percentage of purchase price at 20%.

The following price ranges are given with their respective quantities:

Range Quantities Price (Sh.)

(Units)

1 1-3,000 21

2 3,001-5,000 19

3 5,001-7,000 17

4 7,001-9,000 15.50

5 9,001-10,000 13

Required:

Advise the company on the quantity to purchase. (6 marks)

3. Seek Plastics Ltd. manufactures plastic components for water pumps.

The following budgeted information is available for three of their key plastic components:

W X Y

Sh. per unit Sh. Per unit Sh. Per unit

Selling price 200 183 175

Direct materials 50 40 35

Direct labour 30 35 30

Units produced and sold 10,000 15,000 18,000

Additional information:

- The total number of activities for each of the three products for the period is as follows:

Product

W X Y

Number of purchase requisitions 1,200 1,800 2,000

Number of set ups 240 260 300

- Overhead costs have been analysed as follows:

Receiving/ inspecting quality assurance Sh.1,400,000

Production scheduling/ machine set up Sh.1,200,000

Required:

Determine the budgeted profit per unit of each of the three products using Activity Based Costing (ABC) method.

(6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Distinguish between “marginal costing” and “absorption costing” techniques. (4 marks)

2. Bahati Limited operates a chemical process which produces four different products namely C, F, T and S from the input of raw materials plus water.

Budget information for the forthcoming financial year is as follows:

Sh. “000”

Raw materials cost 268

Initial processing cost 264

Conversion cost 200

Product Output Sales Additional processing cost

(litres) (Sh.000) (Sh.000)

C 400,000 768 160

F 90,000 232 128

T 5,000 32

S 9,000 240 8

Additional information:

- The company’s policy is to apportion the costs prior to the split-off point on a method based on net realisable value (NRV).

- Currently, the intention is to sell product T without further processing, but to process the other three products after the split-off point.

- An alternative strategy is being proposed so as to sell all the four products at the split-off point without further processing. If this were done, the selling prices obtainable would be as follows:

Product Selling price per

litre (Sh.)

C 1.28

F 1.60

6.40

S 20

Required:

Budgeted profit statement showing the profit or loss for each product assuming the current processing policy is adopted. (8 marks)

The profit or loss by product, and in total, assuming the alternative strategy was to be adopted. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Smart products Ltd. operates standard costing and budgetary control system.

The following is the company’s standard cost card:

Sh.

Direct materials 120

Direct labour 60

Variable overheads 20

Fixed overheads 30

Standard cost per unit 230

Standard profit per unit 20

Standard selling price per unit 250

Additional information:

- Each unit requires 3 kgs of material which cost Sh.40 per kg and 45 minutes of direct labour at a rate of Sh.80 per hour.

- Variable overheads are recovered on direct labour hour basis.

- Fixed overhead are absorbed on annual production budget of 180,000 units.

- For the year to 31 March 2022, 120,000 units had been manufactured and sold. Contrary to the managements expectation, the company’s profit and loss statement reflected a loss of Sh.1,380,000 instead of the expected profit of Sh.3,6000,000 as provided below:

(Sh.000) (Sh.000)

Sales (120,000 units) 22,800

Production cost:

Direct materials (100,000kgs) 12,000

Direct labour (52,000 hours) 3,900

Variable overheads 2,880

Fixed overheads 5,400 24,180

Profit (loss) (1,380)

Required:

Budgeted profit and loss account for the year ended 31 March 2022. (6 marks)

Flexible budget for the production achieved. (6 marks)

Wasiri Ltd. produces 10,000 units per annum by employing 50% of the total factory capacity.

The selling price per unit is Sh.500 and the total costs are as follows:

Sh.”000″

Materials 1,000

Wages 2,000

Fixed overheads 1,000

Fixed Overheads 400

Total costs 4,400

Additional information:

- Variable overheads maintains a constant ratio to the number of units produced.

- The production manager is evaluating acceptance of a special offer of additional 10,000 units at a selling price of Sh.387.50 each.

- The increased volume of purchases will reduce the material price by 2.5%.

- The wage rates will remain constant but due to employment of new workers, there will be a drop in labour efficiency by 5% on all production.

Required:

Prepare a statement showing the variation of net profits resulting from the acceptance of the order. (6 marks)

Advise the management of Wasiri Ltd. on whether to accept the offer. (2 marks)

(Total: 20 marks)