2017 Business paper 2

1.(a).Explain five ways in which the internl environment may contribute to the success of a business enterprise. (10 marks)

- A functional business structure. Formal arrangement of functions and the relationships of people that is directed towards achievement of organizational goals.

- Employment of qualified, skilled and experienced personnel.

- Vlfllen the correct labour force is acquired and correctly matched to their jobs, then performance is enhanced.

- Proportionate allocation of financial resources.

- The business finances are allocated to activities based on percentage contribution to the organization’s success.

- Access to relevant physical resources like buildings, machinery, furniture and other equipment to complement human effort.

- Appropriate technology.

- Effective methods of production boosts the quantity and quality of output.

- Positive business culture.

- Productivity is enhanced when culture matches the expectations, beliefs and values of the staff. Realistic objectives.

- Setting objectives that are simple, measurable, achievable and specific(b).Describe five channels of distribution that a Kenyan manufacturer would use to ensure her goods reach consumers in another country. (10 marks)

(i)Kenyan Manufacturer —> Wholesaler(Foreign) —> Retailer(Foreign) —> Consumer (Foreign) .

(II). Kenyan Manufacturer —> Import Agent —> Retailer —-> Consumer —> Manufacturer’s —> Consumer Agent in the foreign country

(III). Kenyan Manufacturer —> Manufacturer’s Agent in the foreign country —> Consumer —>

(IV). Kenyan Manufacturer —> Manufacturer Representatives —> Consumer —> Retailer

(V). Kenyan Manufacturer —> Foreign Consumer

(VI). Kenyan -—> Manufacturer’s —>Wholesaler —> Retailer —> Consumer Manufacturer Representative

VII. Kenyan Manufacturer —> Retailer (Foreign) -—> Consumer (Foreign)

2.(a).Explain five differences between chain stores and departmental stores. (l0 marks)

Chain Stores

(i). Have many branches in different towns.

(ii). Purchases are centralized.

(iii). Have standardized prices in all branches.

(iv). Has uniform outward appearance and interior layout in all branches.

(v). Management of the stores is centralized.

(vi). Slow moving goods in one branch (vi). can be moved to another where demand for them is higher.

(Vii). A customer can pay for goods in vii. one branch and collect than from another branch.

Departmental Stores

(i) Have different departments within the same building.

(ii) Purchases are made per department.

(iii) Every department sets its own prices.

(iv) Each department is different from the other in terms of outward appearance and interior layout.

(v) Each department has its own management.

(vi) Slow moving goods in one department cannot be moved to another department.

(vii) Goods paid for in a department can only be collected from that department.

(b).The following Trial Balance was extracted from the books of Ojwang Limited on 31 December 2013.

Additional Information: Closing stock was valued at Ksh 80,000.Required: Prepare a Trading, Profit and Loss account. (10 marks)

- 3.(a).Explain five benefits that a private limited company would get by converting to a public limited company. (l0 marks)

- Ability to raise larger amounts of capital – Converting to a public limited company will enable the firm to access more funds by sell shares to members of the public through the stock exchange.

- Enjoy permanency of capital – Shareholders cannot easily withdraw be sold to other investors.

- lncreased transparency and accountability – The shareholders must scrutinize and approve the company‘s annual audited accounts which must also be published.

- Increased public confidence in the company – This is due to increased exposure to the public and control by the stock exchange Freedom from interference by owners as it operates as a separate legal entity in which owners have no direct managerial control.

- Increased professionalism and specialization in management.

- It is mandatory to have professional managers and staff to run the company on behalf of the shareholders.

- Perpetual succession – The firm is assured of continuity since share can be transferred and membership changed without affecting the business.(b). Explain five disadvantages of using direct taxes to raise government revenue. (10 marks)

- The burden of paying this tax is borne directly by the individual taxpayer and is paid at once or even in advance.

- Gives the taxpayer motivation to evade tax payment- The tax paye may come up with ways of concealing their income in order to avoid paying the tax or reduce the amount to be paid.

- Non-consultation of taxpayers in the determination of the tax rate – The determination of the rate and amount of tax to be paid is at the discretion of the tax authorities.

- Not an adequate source of government revenue – Most people in developing countries are low income earners hence limiting the amount of tax revenue from this source.

- Reduced ability to save and invest – Direct taxes take away money from the citizens hence reducing their purchasing power causing low investments.

- Tax payers are not involved in the expenditure of the tax revenue.

- There is low civic involvement and call for government accountability since tax payers do not make decisions on government expenditure.

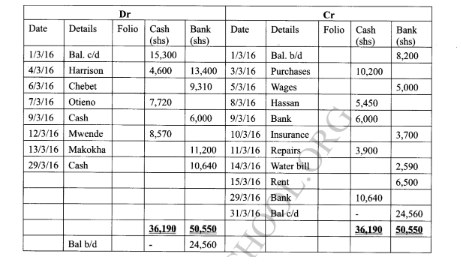

- May encourage capital flight – Foreign investors may conceal their profits in order to transfer such earnings to other countries.4.(a).The following transactions relate to Dagoreti Enterprises for the month of March 2016.

March l:Started business with Ksh 15,300 in cash and a bank overdraft of Ksh 8,200

March 3:Made cash purchases of Ksh 10,200 in cash

March 4:Harrison, a debtor settled his account of Ksh 18,000 by issuing a cheque of Ksh 13,400 and the rest by cash

March 5:Paid wages by cheque, Ksh 5,000

March 6:Received a cheque of Ksh 9,310 from Chebet

March 7:Received cash, Ksh 7,720 from Otieno

March 8:Paid Hassan Ksh 5,450 in cash

March 9:Deposited Ksh 6.000 from the ofiice into the business bank account

March 10:Paid insurance Ksh 3,700 by cheque

March l1:Paid Ksh3,90O for repairs in cash

March l2:Received Ksh 8,570 in cash from Mwende

March l3:Received a cheque of Ksh 1 1,200 from Makokha

March l4:Paid water bill Ksh 2,590 by cheque

March l5:Paid rent Ksh6,500 by cheque

March 29:Took all the cash that was in the office and deposited it into the business bank account

Required: Prepare a two column cash book for the month of March 2016. (10 marks)

- (b).Explain five factors that one may consider when selecting a means for communicating. (10 marks)

- Confidentiality of the message -The means should safeguard the content of the message from being accessed by unauthorized people.

- Accuracy of the means – Should be able to deliver the message in its original form without distortions.

- Urgency of the message – The means should be fast enough to ensure timely delivery of the message.

- Need for feedback – The means should allow for response/action where necessary.

- Affordability of the means – The sender must be able to meet the cost of the means so chosen.

- Nature of the message – A combination of means could be chosen if the message is very complex.

- Need for future reference – The means must be able to provide evidence if fixture reference will be required.

- Availability of the means – The means should be readily available

- Capacity of the means – The means should allow the required volume of information to be passed at an agreeable speed.

- Reliability of the means – The means should be able to deliver the Information to the receiver as intended

- Type/nature of audience/Recipients – The means chosen should be appropriately available to the needs of the audience5.(a).Explain five demerits of the output approach in measuring national income. (10 marks)

- It excludes crucial services that contribute to national income but not paid for like government services, and self-employment.

- It is difficult to make a decision about the goods and services to include in this measure.

- Problem of subsistence sector/output – It is difficult to value subsistence output.

- Some activities considered illegal generate a lot of income but are not included in the measure of national income – These activities inject a lot of money into the economy.

- Difficulty in valuing stock at the end of the accounting year as this differs with their value at production.

- Difficulty in determining the increase in value as a result of increasing volumes of output. Final price is usually affected by market forces.

- Difficulty in deciding on the value to use when making records – The values keep changing in line with market forces.

- It is difficult to determine the value of depreciation hence failure to record accurately the value of capital goods.(b).Explain five circumstances under which a country may realise surplus in its balance of payments. (10 marks)

- When the country exports highly valued finished products – The demand for such products is high and they fetch higher prices in the international market.

- When the country mainly imports lowly valued primary goods – These cheap imports are converted into finished goods hence earning profits from international trade.

- When the country aggressively promotes its exports – This will create more market for exporting goods thus increasing the count1y’s earnings.

- When the country devalues its currency – This makes imports more expensive forcing local consumers to by locally produced goods while exports become cheaper and are sold in large volumes.

- When the country enjoys favourable economic order – The country may be able to influence the World market prices to favour its exports

- When the country diversifies its exports – The country increases the range of its exports hence becoming more competitive

- When the country has access to adequate capital and technology – This makes the country to have a highly developed manufacturing and processing sector.6.(a).Explain five methods that the government may use to increase supply of goods in the market.( 10 marks)

- Reduce the taxes levied on producers – This causes a reduction in the cost of production hence motivating producers to increase production.

- Increase subsidies – The govermnent meets part of the production cost hence making production more affordable.

- Eliminating quotas on production – By not limiting the quantity of goods to be produced, the producers are free to supply as much as they can to the market.

- Setting favourable producer prices – The government fixes the prices at a high level which encourages emergence of new producers/ expansion of existing ones.

- Improving access to credit – The government extends loans to producers through bodies like K.I.E., IDB and ICDC to boost investment in production.

- Facilitating marketing – The government may form agencies that buy produce to cushion producers and stabilize selling prices e.g. through NCPB

- Availing new research findings and technology to producers – New methods of production from government research bodies like KARI(b).Explain five factors that may promote the growth of entrepreneurship in Kenya. (10 marks)

- Development of a positive culture that values individuals who are successful entrepreneurs,recognizes and holds them highly.

- Relevant education curriculum – The training in business is made part of the curriculum hence preparing the youth at an early age to become entrepreneurs.

- Presence of role models – Successful businessmen are an encouragement and a motivation to the youth and would-be entrepreneurs to also go into business.

- Government support – Policies passed by the government that put in place institutions that support entrepreneurship like the youth fund.

- Diminishing jobs in the formal sector – Since formal employment is becoming difficult to secure, entrepreneurship becomes the only viable alternative.

- Availability of finances – The financial institutions support businesses and provide loans to the entrepreneurs hence supporting the growth of entrepreneurship.

- Positive peer influence – When people see their peers succeeding in business, they get motivated and also try their hands at it.

- Availability of security that ensures the safety of business owners/property.

- Availability of market – Ready market where they can sell their produce is a motivating factor to venture into business.

- Good infrastructure – This facilitates the conduct of business, access to markets, raw materials and movement of factor inputs.