WEDNESDAY: 6 December 2023. Morning Paper. Time Allowed: 2 hours.

This paper is made up of fifty (50) Multiple Choice Questions. Answer ALL questions by indicating the letter (A, B, C or D) that represents the correct answer. Each question is allocated two (2) marks. Do NOT write anything on this paper.

1. When preparing the statement of profit or loss, why is carriage inwards included in the cost of sales?

A. Carriage outwards is included in other revenue expenses

B. It should decrease the value of purchases

C. It is an expense connected with selling goods

D. It is an expense connected with buying goods (2 marks)

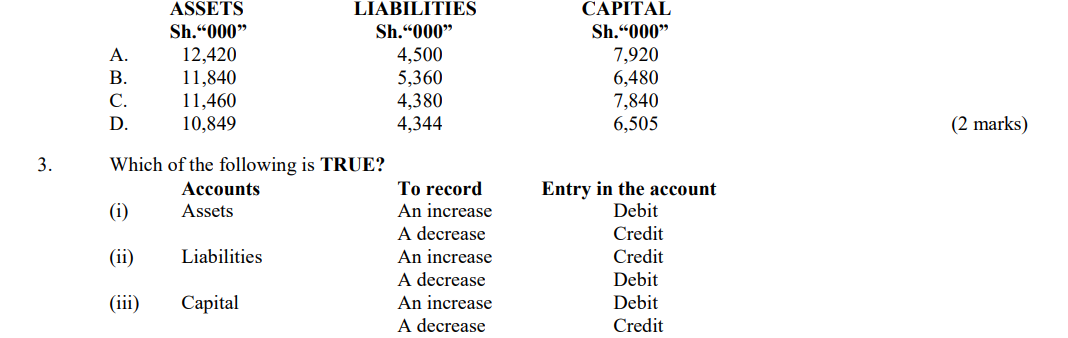

2. Which of the following is FALSE?

A. (i) and (ii)

B. (ii) and (iii)

C. (i) and (iii)

D. (i), (ii) and (iii) (2 marks)

4. What is an allowance for doubtful debts?

A. Money set aside in case of future bad debts

B. Money set aside to replace bad debts

C. Money set aside to pay for debtors who fail to pay

D. Money set aside to adjust the net profit (2 marks)

5. Which of the following errors could be disclosed by the trial balance?

A. Receipt from Kipepeo recorded in Kikapu’s account

B. Distribution expenses recorded in cash book only

C. Purchases of Sh.250,000 was omitted from the books of account

D. Credit sales of Sh.300,000 recorded as Sh.30,000 in the books of account (2 marks)

6. When the owner of a business takes goods for their own use, the double entry is _______________________.

A. Debit drawings account, Credit purchases account

B. Debit purchases account, Credit drawing account

C. Debit drawing account, Credit inventory account

D. Debit sales account, Credit inventory account (2 marks)

7. Which of the following statements explain why a bank statement shows a different balance from cash book bank column?

A. Recording too many transactions in a day

B. Customers paying money direct to the bank

C. Withdrawing any time during working hours

D. Failing to balance both bank statement and cash book (2 marks)

8. A cheque paid by the business, but not yet passed through the banking system is _________________.

A. Direct deposit cheque

B. A dishonoured cheque

C. An uncredited cheque

D. An unpresented cheque (2 marks)

9. Which one of the following should be accounted for as capital expenditure?

A. Repair of windows

B. Purchase of furniture for resale

C. Legal fees incurred on the purchase of a building

D. The cost of repainting a building (2 marks)

10. Preference shareholders have______________________.

A. Preferential right as to dividend only

B. Preferential right in the management

C. Preferential right as to repayment of capital at the time of liquidation of the company only

D. Preferential right as to dividend and repayment of capital at the time of liquidation of the company

(2 marks)

11. The accountant of Sama Limited debited rent with Sh.1,000,000 instead of Sh.1,500,000 but, credited sales with Sh.1,500,000 instead of Sh.2,000,000. What type of error was committed by these entries?

A. Error of original entry

B. Compensating error

C. Error of principle

D. Error of reversal of entries (2 marks)

12. Which of the following items will NOT appear on the same side of the trial balance?

A. Drawings and accrued expenses

B. Carriage outwards and prepaid expenses

C. Carriage inwards and rental income

D. Opening inventory and purchases (2 marks)

13. The partnership agreement contains the following items EXCEPT ____________________.

A. Partner’s capital

B. Profit and loss sharing ratios

C. Partners ages

D. Partners salaries (2 marks)

14. How are the profits divided among partners in the absence of a partnership deed?

A. Depending on the capital invested

B. Depending on the work experience

C. Unequal

D. Equally (2 marks)

15. Why do creditors require accounting information?

A. To ascertain the assets the business has

B. To ascertain the profit the business makes

C. To ascertain the amount a business can borrow

D. To ascertain the money the business has in the bank (2 marks)

16. In the sales ledger control account, bad debts written off should be recorded ____________________.

A. As a debit

B. As a credit

C. Both debit and credit

D. As a balance carried down (2 marks)

17. What is a “source document”?

A. A document that provides information about the business

B. A document that provides the accounting information

C. A document that provides information concerning the debtors

D. A document that provides information concerning the creditors (2 marks)

18. Define books of original entry.

A. These are books in which prime entries are recorded

B. These are books where credit sales are recorded first

C. These are books where credit purchases are recorded first

D. These are books which double entries of transactions are entered (2 marks)

19. Where is the information to prepare control accounts obtained from?

A. Source documents

B. Books of original entry

C. Invoices and receipts

D. Trade receivable and payables (2 marks)

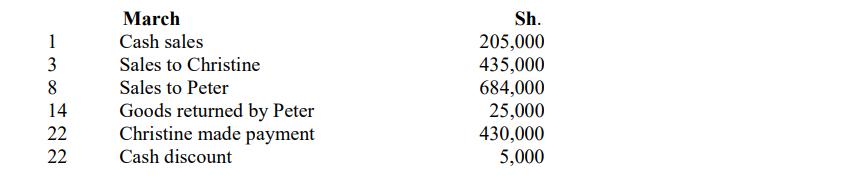

20. During the month ended 31 October 2023, the following transactions took place in the business of Harry Oliwa:

Calculate the net sales for the month of October 2023.

A. Sh.1,324,000

B. Sh.1,299,000

C. Sh.1,119,000

D. Sh.1,324,500

(2 marks)

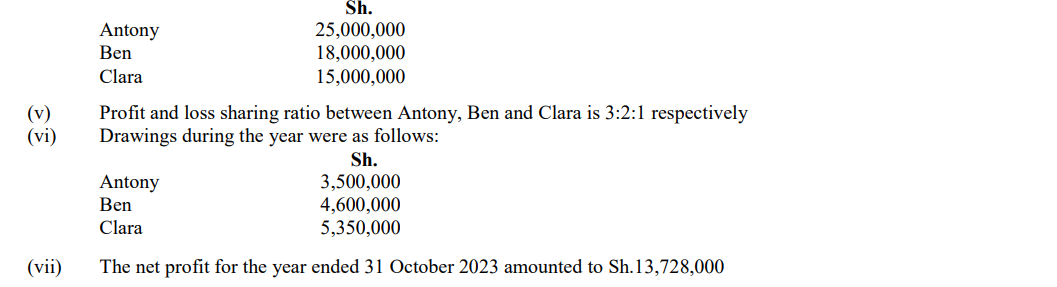

Use the following information to answer question 21, 22 and 23.

Antony, Ben, and Clara are in a partnership. The following information was extracted from their partnership accounts:

(i) Interest on capital is charged at 5% per annum

(ii) Interest on drawings is charged at 10% per annum

(iii) Ben is entitled to a salary of Sh. 4,800,000 per annum

(iv) Capital contributed by partners is as follows

21. Calculate the total interest on drawings from the partnership.

A. Sh.998,000

B. Sh.810,000

C. Sh.1,345,000

D. Sh.885,000 (2 marks)

22. Calculate the total interest on capital contributed by partners.

A. Sh.2,900,000

B. Sh.2,150,000

C. Sh.2,000,000

D. Sh.1,650,000 (2 marks)

23. Calculate the profit shared amongst the partners.

A. Sh.4,683,000

B. Sh.13,728,000

C. Sh.9,483,000

D. Sh.6,028,000 (2 marks)

Use the following information to answer Question 24 and Question 25.

On 1 July 2022 Yusuf Ali had an allowance for doubtful debts amounting to Sh.486,000. During the year ended 30 June 2023, bad debts totaled Sh. 1,600,000 debtors outstanding totaled Sh.13,500,000. It is his usual practice to provide for doubtful debts at the rate of 5% of outstanding debtors.

24. Calculate the allowance for doubtful debts for the year ended 30 June 2023.

A. Sh.486,000

B. Sh.755,000

C. Sh.595,000

D. Sh.675,000 (2 marks)

25. Calculate the allowance for doubtful debts charged in the statement of profit or loss for the year ended 30 June 2023.

A. Sh.189,000

B. Sh.269,000

C. Sh.595,000

D. Sh.109,000 (2 marks)

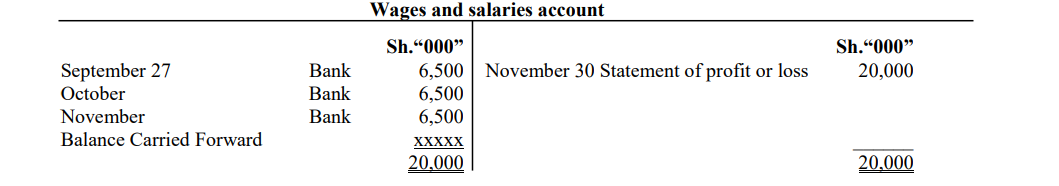

26. What is the balance on the following account on 30 November 2023?

A. A debit balance of Sh.500

B. A credit balance of Sh.500

C. A debit balance of Sh.500,000

D. A credit balance of Sh.500,000 (2 marks)

27. On 1 December 2022, Benjamin Wino had Sh.6,580,000 capital invested in his business. As at 30 November 2023, he had non-current assets valued at Sh.4,300,000, current assets valued at Sh.2,800,000, trade payables worth Sh.3,500,000 and a bank loan of Sh.3,000,000. Drawings during the year amounted to Sh.5,300,000.

Calculate the profit or loss for the year ended 30 November 2023.

A. Sh.5,820,000 loss

B. Sh.680,000 loss

C. Sh.680,000 profit

D. Sh.5,820,000 profit (2 marks)

28. During the month of November, the petty cashier was given a desired cash float of Sh.250,000. This money was used for the monthly expenses as follows; transport Sh.56,000, stationery Sh.42,900, meals Sh.69,500, phone airtime Sh.36,000 and cleaning Sh.26,500.

How much will be reimbursed at the end of the period?

A. Sh.194,000

B. Sh.250,000

C. Sh.19,100

D. Sh.230,900 (2 marks)

Use the information below to answer question 29, 30 and 31.

The details of the motor vehicle accounts of Mali Traders are given below:

(i) The balances on the following accounts at 1 July 2022 were:

• Motor vehicle account at cost Sh.3,162,000.

• Allowance for depreciation of motor vehicle is provided at the rate of Sh. 25% per annum on straight line.

• Accumulated depreciation on motor vehicle at the start of the year Sh.2,831,500.

(ii) During the year ended 30 June 2023, a motor vehicle which originally cost Sh.1,413,000 was sold for Sh.330,000.

The accumulated depreciation on the vehicle was Sh. 924,000.

(iii) During the year ended 30 June 2023, a new motor vehicle was purchased for Sh.1,914,000.

29. Calculate the depreciation charge for the year ended 30 June 2023.

A. Sh.790,500

B. Sh.924,000

C. Sh.915,750

D. Sh.437,250 (2 marks)

30. Calculate the profit or loss on the motor vehicle disposed for the year ended 30 June 2023.

A. Profit Sh.159,000

B. Loss Sh.159,000

C. Loss Sh.330,000

D. Profit Sh.330,000 (2 marks)

31. Calculate the net book value of motor vehicles as at 30 June 2023.

A. Sh.3,663,000

B. Sh.831,500

C. Sh.5,076,000

D. Sh.839,750 (2 marks)

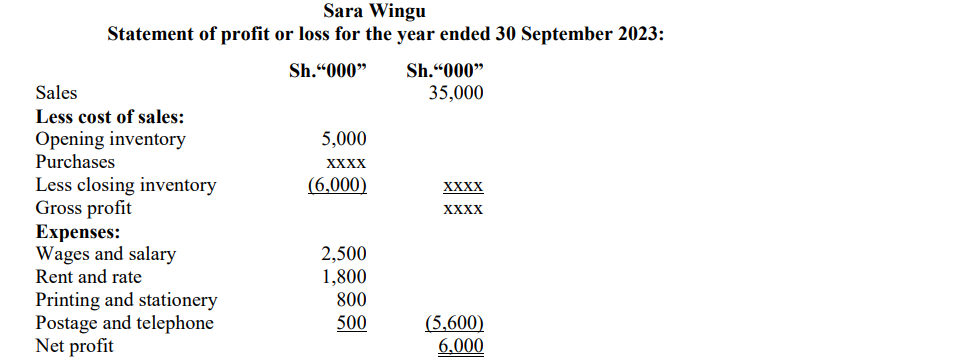

Use the following information to answer question 32 and 33:

Sara Wingu, a sole proprietor extracted her statement of profit or loss for the year ended 30 September 2023, but she was unable to reconcile all the balances.

32. Calculate the value of purchases.

A. Sh.24,400

B. Sh.23,400

C. Sh.29,400

D. Sh.35,000 (2 marks)

33. Calculate gross profit.

A. Sh.34,000

B. Sh.23,400

C. Sh.11,600

D. Sh.11,000 (2 marks)

34. In the year ended 30 September 2023, subscriptions received by Boots Club amounted to Sh.2,750,000, of which an amount of Sh.1,020,000 was for the year ending 30 September 2024. Boots Club’s books of account show that during the year ended 30 September 2022, there were subscriptions amounting to Sh.360,000 which were not yet received.

Calculate the subscriptions for the year ended 30 September 2023.

A. Sh.1,370,000

B. Sh.2,750,000

C. Sh.1,730,000

D. Sh.2,090,000 (2 marks)

35. On 1 November 2023, the accounts receivable account had a balance of Sh.1,200,000. Total credit sales during the month of November amounted to Sh.2,100,000 and returned goods during the month were valued at Sh.750,000. Payments amounting to Sh.960,000 were received.

What is the outstanding accounts receivable balance as at 30 November 2023?

A. Sh.1,590,000 Debit

B. Sh.1,590,000 Credit

C. Sh.810,000 Debit

D. Sh.810,000 Credit (2 marks)

36. Jumatatu Ltd.’s statement of profit or loss for the year ended 30 September 2023 showed a net profit of Sh.4,180,000. It was later discovered that Sh.900,000 paid for the purchase of office printer had been debited to the stationery expense account. It is the company’s policy to depreciate computers and related equipment at 25% per annum on a straight-line basis, with a full year’s charge in the year of acquisition.

What would the net profit be after adjusting for this error?

A. Sh.5,305,000

B. Sh.3,505,000

C. Sh.4,855,000

D. Sh.5,080,000 (2 marks)

37. Trisha Traders recorded revenue of Sh.1,458,000, opening inventory of Sh.217,500 and closing inventories of Sh.480,000. The purchase for the period amounted to Sh.792,000. How much is the gross profit or loss?

A. Sh.1,860,000 profit

B. Sh.402,000 profit

C. Sh.402,000 loss

D. Sh.928,500 profit (2 marks)

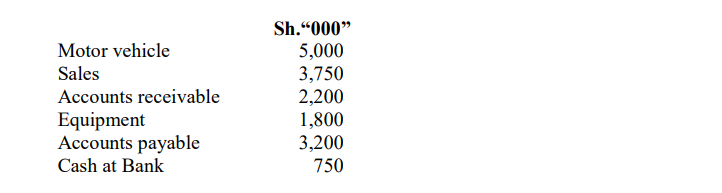

38. Prepare Obed Juma’s trial balance as at 30 June 2023 from the following balances and close the difference to the suspense account

How much is the amount to be reported in the suspense account?

A. Sh.4,400,000

B. Sh.2,800,000

C. Sh.3,000,000

D. Sh.3,600,000 (2 marks)

39. Lucy Lulu’s cash book shows a balance of Sh.100,000 and from review you have noted that a cheque of Sh. 10,000 deposited in her business bank account has not been recorded in the cash book and a standing order amounting to Sh.1,000 has recently been undertaken by the bank. This has not yet been recorded in the cash book.

Calculate the cash book balance after correction.

A. Sh.110,000 credit balance

B. Sh.109,000 credit Balance

C. Sh.91,000 debit balance

D. Sh.91,000 credit balance (2 marks)

40. In preparing a company’s bank reconciliation statement on 31 October 2023, the following items were causing the difference between the cash book balance and the bank statement balance:

(i) Bank charges Sh.760,000

(ii) Error by bank Sh.2,000,000 (cheque incorrectly debited to the account)

(iii) Uncredited cheques Sh.9,160,000

(iv) Unpresented cheques Sh.2,950,000

(v) Direct debit Sh.700,000

(vi) Cheque paid in by the company and dishonoured Sh.800,000

Which of these items will require an entry in the cash book?

A. (ii), iv and (vi)

B. (i), (v) and (vi)

C. (iii) and (iv)

D. (iii) and (v) (2 marks)

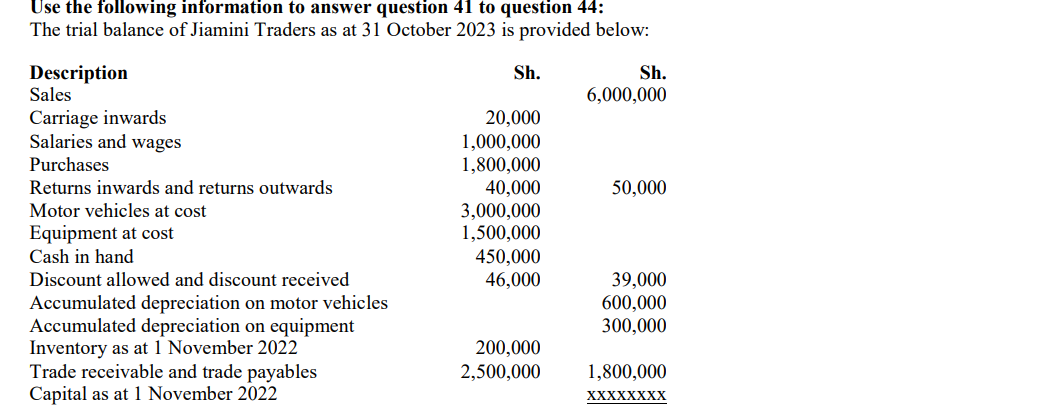

41. How much was the capital as at 1 November 2022?

A. Sh.3,000,000

B. Sh.2,500,000

C. Sh.2,000,000

D. Sh.1,767,000 (2 marks)

42. Compute the gross profit for the period ended 31 October 2023 if the closing inventory was valued at Sh.300,000.

A. Sh.4,230,000

B. Sh.4,290,000

C. Sh.4,280,000

D. Sh.1,770,000 (2 marks)

43. Depreciation on motor vehicles is charged at 20% per annum on a straight line basis and 10% per annum on equipment on a straight line basis. Calculate the net profit for the year ending 31 October 2023.

A. Sh.2,494,000

B. Sh.2,533,000

C. Sh.2,433,000

D. Sh.2,484,000 (2 marks)

44. Compute the value of non-current assets to be shown in the statement of financial position as at 31 October 2023.

A. Sh. 4,500,000

B. Sh. 3,600,000

C. Sh. 3,750,000

D. Sh. 2,850,000 (2 marks)

Use the following information to answer question 45 and question 46:

A company disposed of an old motor vehicle on 1 July 2023. The motor vehicle had been acquired on 1 January 2019 at a cost of Sh.4,000,000. The company charges depreciation on motor vehicles at 20% per annum on reducing balance. A full year’s depreciation is charged on the date of acquisition and pro-rated in the year of disposal. Cash receipt from the disposal was Sh.600,000. Determine the loss or gain from the disposal.

45. Determine the total depreciation on the motor vehicle.

A. Sh.4,000,000

B. Sh.3,600,000

C. Sh.2,525,440

D. Sh.1,474,560 (2 marks)

46. Determine the loss or gain from the disposal.

A. Sh.600,000 gain

B. Sh.200,000 gain

C. Sh.874,560 loss

D. Sh.1,925,440 loss (2 marks)

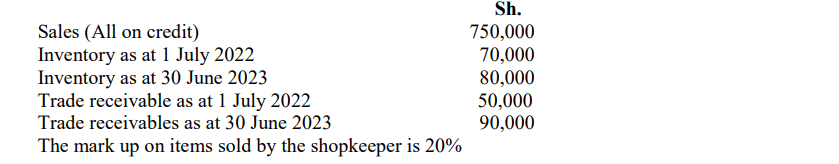

47. The following information was availed by a shopkeeper who does not maintain a complete set of accounts:

What is the figure for purchases to be included in the statement of profit or loss for the year ended 30 June 2023?

A. Sh.590,000

B. Sh.630,500

C. Sh.615,000

D. Sh.610,000 (2 marks)

48. The net profit of a firm was reported as Sh.825,400 and it was later discovered that rent income was undercast by Sh.74,000 and bad debts written off amounting to Sh.25,400 were not recorded. How much was the corrected net profit?

A. Sh.899,400

B. Sh.776,800

C. Sh.874,000

D. Sh.924,800 (2 marks)

49. The following information relates to Dixor Ltd for the year ended 30 September 2023:

Net profit after tax Sh.2,178,200. Dividends were paid at 80 cents per share. There were Sh.1,000,000 issued ordinary shares at the end of 30 September 2023. Determine the retained profit as at 30 September 2023.

A. Sh.1,378,200

B. Sh.1,742,560

C. Sh.435,650

D. Sh.2,793,200 (2 marks)

50. The profit earned by a business in the year ended 30 June 2023 was Sh.72,500,000. The proprietor injected new capital of Sh.8,000,000 during the year and withdrew goods for his private use which had cost Sh.2,200,000. If net assets as at 1 July 2022 amounted Sh.101,700,000, what were the net assets on 30 June 2023?

A. Sh.35,000,000

B. Sh.39,400,000

C. Sh.168,400,000

D. Sh.180,000,000 (2 marks)