MONDAY: 1 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain four advantages of preparing financial statements. (4 marks)

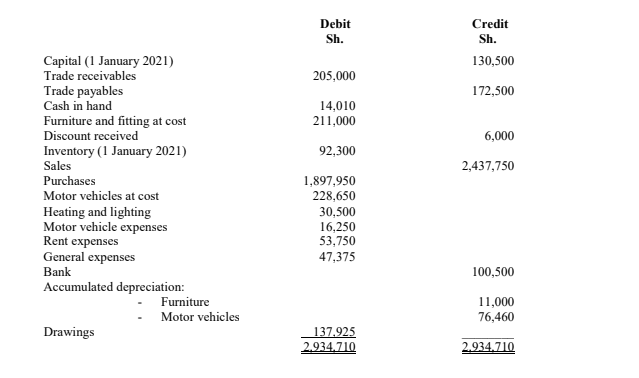

2. Jane Mutisya, a sole trader, extracted the following trial balance as at 31 December 2021:

Additional information as at 31 December 2021:

- Accrued motor vehicle running expenses amounts to Sh.26,000.

- Prepaid rent expenses and prepaid general expenses amounted to Sh.22,500 and Sh.12,500 respectively.

- Depreciation is to be provided as follows:

Asset Rate per annum Method

Motor vehicle 20% On cost

Furniture and fittings 10% On reducing balance

- Inventory was valued at Sh.102,500.

- During the financial year ended 31 December 2021, Jane took some goods costing Sh.40,000 for personal consumption and some cash amounting to Sh.2,500 for personal expenses. These transactions had not been recorded in the books.

- An allowance for doubtful debts is to be maintained at 5% of the trade receivables balance at the end of the year.

Required:

1. Statement of profit or loss for the year ended 31 December 2021. (8 marks)

2. Statement of financial position as at 31 December 2021. (8 marks)

(Total: 20 marks)

QUESTION TWO

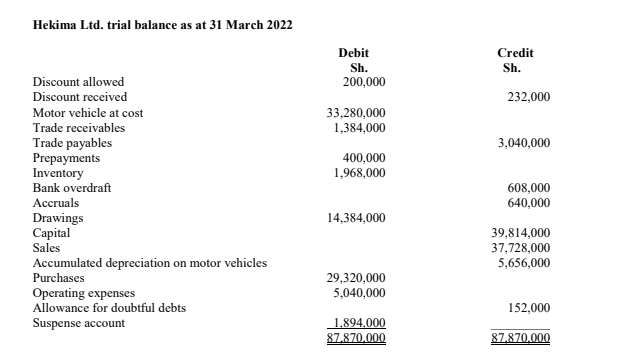

The newly employed accountant of Hekima Ltd. extracted a trial balance which failed to balance. He placed the difference in a suspense account as shown below:

On further investigation the following were discovered:

- Purchases day book for January 2002 was undercast by Sh.1,120,000.

- A payment to a creditor by cheque of Sh.340,000 was erroneously credited to the creditors account, but was correctly posted in the bank.

- The sales for the month of March 2022 were overcast by Sh.992,000.

- An amount of discount received of Sh.100,000 was debited to discount allowed account.

- A payment of Sh.162,000 for operating expenses was debited to the operating expenses account as Sh.216,000.

- An amount of Sh.644,000 from a debtor was only recorded in the cashbook and no other entry was made.

- On 1 April 2021, a motor vehicle was purchased at a cost of Sh.1,600,000. This was debited to purchases account.

- Depreciation on the motor vehicles is charged at a rate of 10% per annum.

Required:

1. Journal entries to correct the above errors. (8 marks)

(Narrations not required)

2. Suspense account duly balanced. (6 marks)

3. A corrected trial balance as at 31 March 2022. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Describe the term “bank reconciliation”. (2 marks)

Identify four items that may cause the balance as per bank statement and the cashbook (bank column) at a given date to differ. (4 marks)

2. Explain three books of prime entry. (6 marks)

3. The following information relates to the business of Beshy Enterprises for the month of March 2022:

1: Opening cash balance was Sh.675,000 and the bank had an overdraft of Sh.1,875,000.

2: Paid for stationery Sh.85,000 cash.

4: Received cheque from Jessica Wambui Sh.2,275,000 after allowing a discount of Sh.12,500.

5: Settled in full Linet Achieng’s account of Sh.71,500 by cheque after being granted a 10% cash discount.

9: Deposited Sh.500,000 to the bank account from the business.

12: Withdrew Sh.81,250 for personal use from cash account.

19: Bought a printer worth Sh.750,000 on account and paid half the amount by cheque.

22: Paid Asili Sacco loan of Sh.187,500 by cheque.

23: Withdrew Sh.200,000 for office use.

31: Paid salaries of Sh.150,000 in cash and Sh.437,500 by cheque.

31: Sold some equipment and received Sh.293,750 in cash.

Required:

Three column cashbook duly balanced as at 31 March 2022. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. Currently, many business organisations are operating computerised accounting systems.

Required:

Evaluate four benefits of a computerised accounting system. (4 marks)

Outline four challenges of a computerised accounting system. (4 marks)

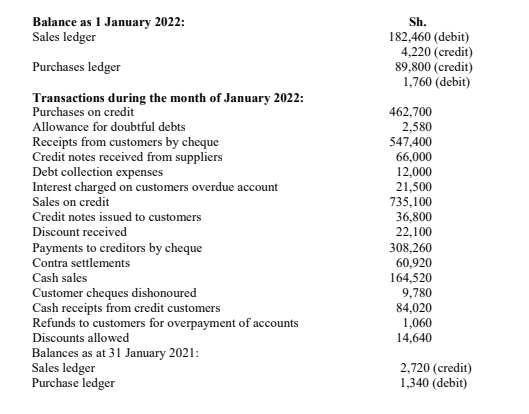

2. The following information was extracted from the books of Miradi Enterprises for the month of January 2022:

Required:

Sales ledger control account as at 31 January 2022. (6 marks)

Purchases ledger control account as at 31 January 2022. (6 marks)

(Total: 20 marks)

QUESTION FIVE

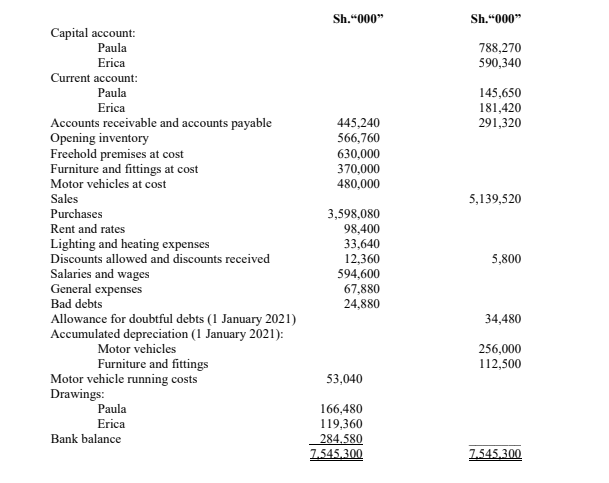

Paula and Erica are in a partnership under the following agreements:

- Interest on partners’ capital be provided at the rate of 10% per annum.

- Paula to be paid an annual salary of Sh.102,000,000

- Paula and Erica to share profits and losses equally.

The following trial balance was extracted from their books as at 31 December 2021:

Additional information:

- As at 31 December 2021, inventory was valued at Sh.600,880,000.

- As at 31 December 2021, rates paid in advance amounted to Sh.6,400,000.

- As at 31 December 2021, lighting and heating due amounted to Sh.7,640,000.

- Allowance for doubtful debts is to be increased to Sh.39,240,000.

- Depreciation is to be provided on non-current assets as follows:

Non-current asset Rate per annum

Motor vehicles 15% on cost

Furniture and fittings 10% on cost

- Erica ordered goods for her personal use at a cost of Sh.4,880,000 and this amount was paid by the firm and debited to purchases account.

- After the above trial balance was prepared, an advice was received from the firm’s bank stating that Sh.2,240,000 charges had been debited to the firm’s current account.

Required:

1. Statement of profit or loss and appropriation account for the year ended 31 December 2021. (8 marks)

2. Partners’ current accounts as at 31 December 2021. (4 marks)

3. Statement of financial position as at 31 December 2021. (8 marks)

(Total: 20 marks)