FRIDAY: 17 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. For a long time, profit maximisation has been considered as the main goal of a firm. However, shareholder’s wealth maximisation goal has recently gained acceptance amongst most companies as the key goal of a firm.

Required:

In relation to the above statement:

Distinguish between “profit maximisation goal” and “shareholder wealth maximisation goal”. (4 marks)

Explain three limitations of profit maximisation goal. (6 marks)

2. Discuss three types of Eurocurrency loans as a source of finance for enterprises. (6 marks)

3. Edwin Malenya is considering to borrow Sh.100,000 from his employer to buy a motor cycle for his personal use. His employer has agreed to lend him the total amount repayable in three years at an interest rate of 9% per annum

Required:

The annual instalments payable by the borrower. (2 marks)

Determine the amount that an investor should deposit in an account today that pays an interest rate of 12% per annum compounded quarterly so that he can have a balance of Sh.2,000,000 in the account at the end of 10 years. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Describe four types of derivatives contract. (8 marks)

2. Outline four contents of a bond indenture. (4 marks)

3. Explain four purposes of valuation of securities by investors. (4 marks)

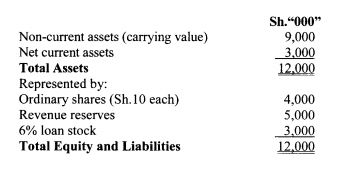

4. The following information was extracted from the financial statements of Twiga Investments Ltd. as at 30 September 2021:

Additional information:

- The 6% loan stock is redeemable at 3% premium.

- The current market value of freehold property exceeds the book value by Sh.600,000.

- All the assets other than freehold property are estimated to be realisable at market value.

Required:

The value of 75% holding of ordinary shares in the company as at 30 September 2021 using the net assets basis valuation method. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Highlight four principles underlying Islamic finance. (4 marks)

2. Faustin Onyango was faced with a choice of receiving Sh.1,000,000 today or Sh.1,050,000 in six months’ time. An analyst has advised him to take Sh.1,000,000 because of time value of money.

Required:

Explain to Faustin Onyango, who is a layman in finance:

The meaning of the term “time value of money”. (1 mark)

Three key factors that makes time value of money important. (3 marks)

3. The finance manager of Mambo Mazuri Limited has complied the following information regarding the company’s capital structure:

Ordinary shares

The company’s equity shares are currently selling at Sh.100 per share. Over the past five years, the company’s dividend pay-outs which have been approximately 60% of the earnings per share (EPS) were as follows:

Year ended 31 October 2021 Dividend per share (DPS)

Sh.

2017 5.23

2018 5.50

2019 5.85

2020 6.25

2021 6.60

The dividend for the year ended 31 October 2021 was recently paid.

The average growth rate of dividend is 6% per annum.

To issue additional ordinary shares, the company would have to give a discount of Sh.3 per share and it would cost Sh.5 in floatation cost per share.

The company can issue unlimited number of shares under the above terms.

Preference shares

The company can issue an unlimited number of 8% preference shares of Sh.10 par value at a floatation cost of 5% of the face value per share.

Debt

The company can raise funds by selling Sh.100, 8% coupon interest rate, 20 year bonds, on which annual interest will be made.

The bonds will be issued at a discount of Sh.3 per bond and a floatation cost of an equal amount per bond will be incurred.

Capital structure

The company’s current capital structure, which is considered optimal, is as follows:

The company is in the 30% tax bracket.

Required:

The cost of ordinary shares. (3 marks)

The cost of preference shares. (2 marks)

The cost of debt. (3 marks)

The cost of retained earnings. (2 marks)

The weighted average cost of capital (WACC) using book values. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Discuss three features of a good capital investment appraisal technique. (6 marks)

2. Mageuzi Limited has approached you to advice on an equipment to be purchased for use in the production line.

The investment will involve an initial outlay of Sh.2 million and the expected cash flows are as follows:

Year Cash inflows Cash out flows

Sh. “000” Sh. “000”

1 1,750 175

2 900 80

3 1,200 50

4 1,100 70

Additional information:

- The equipment’s economic life is 4 years with a residual value of Sh.400,000.

- It is the company policy to depreciate its assets on a straight line basis.

- The cost of capital is 12%.

- The corporate tax rate is 30%.

Required:

The net present value (NPV) of the investment. (12 marks)

Advise the management on whether to invest in the project. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. A Certified Investment and Financial Analyst graduate has forecasted that the market returns in the securities exchange in the next seven years will be as follows:

Year Market return (%) Probability

1 -30 0.05

2 -10 0.10

3 10 0.20

4 20 0.25

5 25 0.20

6 30 0.15

7 40 0.05

Required:

The expected rate of the market returns. (3 marks)

The standard deviation of the market returns. (5 marks)

2. Waigizaji Limited is an advisory and capital investments firm. The firm is in the process of preparing a bulletin to present to potential clients in their upcoming road shows. They have approached you to prepare a presentation on the various investments processes that the new investors will be taken through.

Required:

Discuss four investment processes that will feature as part of your presentation to Waigizaji Limited. (8 marks)

3. Summarise two functions of foreign exchange market. (4 marks)

(Total: 20 marks)