Incoterms- which is an abbreviation for International Commercial Terms entail a set of rules for interpreting trade terms in international trade. They were first published in the international chamber of commerce (ICC) in 1936. They have been updated many times over the years. The new incoterms 2010 became effective January 2011. The basic function of Incoterms is to clarify how the functions, costs and risks are divided between the buyer and the seller in connection with delivery of the goods as required under a contract of sale. The key issues relate to delivery, risks and costs. Each Incoterm clearly stipulates the responsibilities of the seller and the buyer.

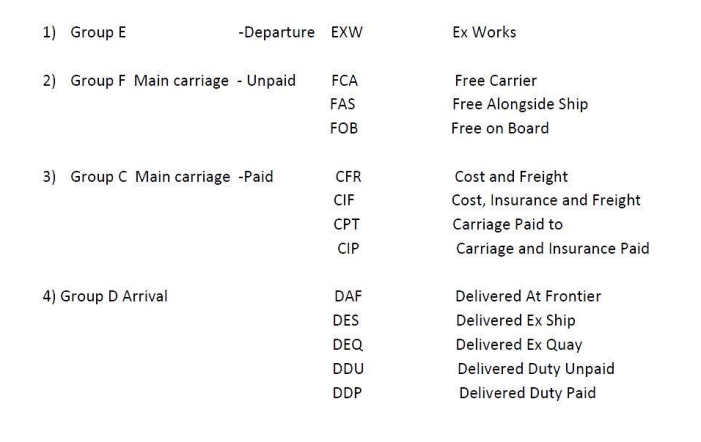

Incoterms cover all types of transport systems, including intermodal and multimodal. They only apply legally when both parties to the contract agree. Incoterms are divided into four distinct groups, which are:

Group E – Departure

EXW. Ex Works (named place): the seller makes the goods available at his premises.

Group F – Main Carriage Unpaid

FCA. Free Carrier (named place): the seller hands over the goods, cleared for export, into the custody of the first carrier (named by the buyer) at the named place. This term is suitable for all modes of transport, including carriage by air, rail, road, and containerized / multi-modal transport.

FAS. Free Alongside Ship (named loading port): free Alongside Ship: the seller must place the goods alongside the ship at the named port. The seller must clear the goods for export; this changed in the 2000 version of the Incoterms. Suitable for maritime transport only.

FOB. Free On Board (named loading port): the classic maritime trade term, Free On Board: seller must load the goods on board the ship nominated by the buyer, cost and risk being divided at ship’s rail. The seller must clear the goods for export. Maritime transport only.

C – Main Carriage Paid

CFR. Cost and Freight (named destination port): seller must pay the costs and freight to bring the goods to the port of destination. However, risk is transferred to the buyer once the goods have crossed the ship’s rail. Maritime transport only.

CIF. Cost, Insurance and Freight (named destination port): exactly the same as CFR except that the seller must in addition procure and pay for insurance for the buyer. Maritime transport only.

CPT. Carriage Paid To (named place of destination): the general/containerised/multimodal equivalent of CFR. The seller pays for carriage to the named point of destination, but risk passes when the goods are handed over to the first carrier.

CIP. Carriage and Insurance Paid to (named place of destination): the containerised transport/multimodal equivalent of CIF. Seller pays for carriage and insurance to the named destination point, but risk passes when the goods are handed over to the first carrier.

Group D – Arrival

DAF. Delivered At Frontier (named place): It can be used when the goods are transported by rail and road. The seller pays for transportation to the named place of delivery at the frontier. The buyer arranges for customs clearance and pays for transportation from the frontier to his factory. The passing of risk occurs at the frontier.

DES. Delivered Ex Ship (named port):Where goods are delivered ex ship, the passing of risk does not occur until the ship has arrived at the named port of destination and the goods made available for unloading to the buyer. The seller pays the same freight and insurance costs as he would under a CIF arrangement. Unlike CFR and CIF terms, the seller has agreed to bear not just

cost, but also Risk and Title up to the arrival of the vessel at the named port. Costs for unloading the goods and any duties, taxes, etc… are for the Buyer. A commonly used term in shipping bulk commodities, such as coal, grain, dry chemicals and where the seller either owns or has chartered, their own vessel.

DEQ. Delivered Ex Quay (named port): It means the same as DES, but the passing of risk does not occur until the goods have been unloaded at the port of destination.

DDU. Delivered Duty Unpaid (named destination place): It means that the seller delivers the goods to the buyer to the named place of destination in the contract of sale. The goods are not cleared for import or unloaded from any form of transport at the place of destination. The buyer is responsible for the costs and risks for the unloading, duty and any subsequent delivery beyond the place of destination. However, if the buyer wishes the seller to bear cost and risks associated with the import clearance, duty, unloading and subsequent delivery beyond the place of destination, then this all needs to be explicitly agreed upon in the contract of sale.

DDP. Delivered Duty Paid (named destination place): It means that the seller pays for all transportation costs and bears all risk until the goods have been delivered and pays the duty. Also used interchangeably with the term “Free Domicile”

The Correct use of Incoterms goes a long way to providing the legal certainty upon which mutual confidence between business partners must be based. To be sure of using them correctly, trade practitioners need to consult the full ICC texts, and to beware of the many unauthorized summaries and approximate versions that abound on the web.

The main purpose of Incoterms is to provide a set of international rules for the interpretation of the most commonly used trade terms in foreign trade. Incoterms have facilitated international purchasing in the following ways: Defines responsibilities regarding title, risks and costs, and eliminates possibilities of misunderstandings and disputes. Incoterms deal with a number of identified obligations imposed on the parties—such as the seller‘s obligation to place the goods at the disposal of the buyer or hand them over for carriage or deliver them at destination—and with the distribution of risk between the parties in these cases. They deal with the obligations to

clear the goods for export and import, the packing of the goods, the buyer‘s obligation to take delivery as well as the obligation to provide proof that the respective obligations have been duly fulfilled.