Interest rate is the price that a borrower of funds must pay to the lender to secure use of funds for a specified period. An interest rate is a predetermined or negotiated payment made or received for the temporary use of money. A financial institution will charge interest when it lends money to a consumer and a consumer will receive interest when he or she deposits money with a financial institution. It is useful to think of interest as the rental charge on money.

The nominal interest rate is the interest rate you hear about at your bank. If you have a savings account for instance, the nominal interest rate tells you how fast the number of shillings in your account will raise over time. This nominal interest is composed of the real interest rate plus inflation, among other factors. The real interest rate corrects the nominal interest rate for the effect of inflation in order to tell you how fast the purchasing power of your savings account will rise over time.

A simple formula for the nominal interest is: , Where i is the nominal interest, r is the real interest and π is inflation. This relationship between nominal interest rate, real interest rate and inflation is known as the fisher hypothesis, fisher parity or fisher effect. Fisher effect is a proposition by Irving Fisher that the real interest rate is independent of monetary measures, especially the nominal interest rate. The Fisher equation is represented as follows for compounded interest rate

This equation implies that the real interest rate (r) equals the nominal interest rate (R ) minus expected inflation rate (πЄ). In the case of simple rates, the Fisher equation takes a different form as shown below:

If r is assumed to be constant, R must rise when πЄ rises. Thus, the Fisher Effect states that there will be a one for one adjustment of the nominal interest rate to the expected inflation rate. From the equation it can be deduced that:

Real interest rate = Nominal Interest Rate – Expected Inflation Rate

Nominal Interest Rate = Real interest Rate + Expected Inflation Rate

THEORIES OF INTEREST RATES DETERMINATION

Interest rates, refers to payment, normally expressed as a percentage of the sum lent which is paid over a year, for the loan of money. There are many rates of interest depending on the degree or risk involved, the term of the loan, and the costs of administration, namely, real, nominal and pure rate of interest.

Pure rate of interest is one from which factors like risk involved, the term of the loan and the cost of administration has been removed. All rates of interest are related to each other and if one rate changes so will others.

There are two theories as to how the rate of interest is determined – the loanable funds and the liquidity preference theories.

- The Loanable Funds Theory

Also called the classical theory of interest, was developed at the time of classical economists like

Adam Smith, David Ricardo and Thomas Malthus, who held the view that economic activities were guided by some kind of invisible hand i.e. through the self-interest motive and the price mechanism, and that Government interference was unnecessary and should be kept at minimum.

They therefore explained the rate of interest in terms of the demand for money and supply of loanable funds. The demand comes from firms wishing to invest. The lower the rate of interest the larger the number of projects which will be profitable. Thus, the demand curve for funds will slope downwards from left to right.

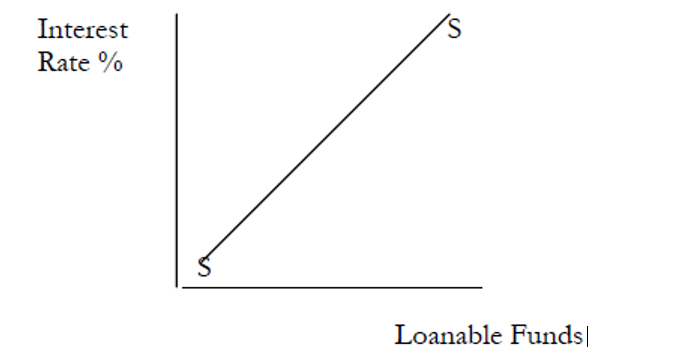

The supply of loanable funds comes from savings. If people are to save they will require a reward-interest – to compensate them for forgoing present consumption. If the interest rate is high, people will be encouraged to save and lend. If the interest rate is low, people will be discouraged from saving and lending. Hence, the supply curve of loanable funds slopes upwards.

REPLICA OF THE ABOVE DIAGRAM

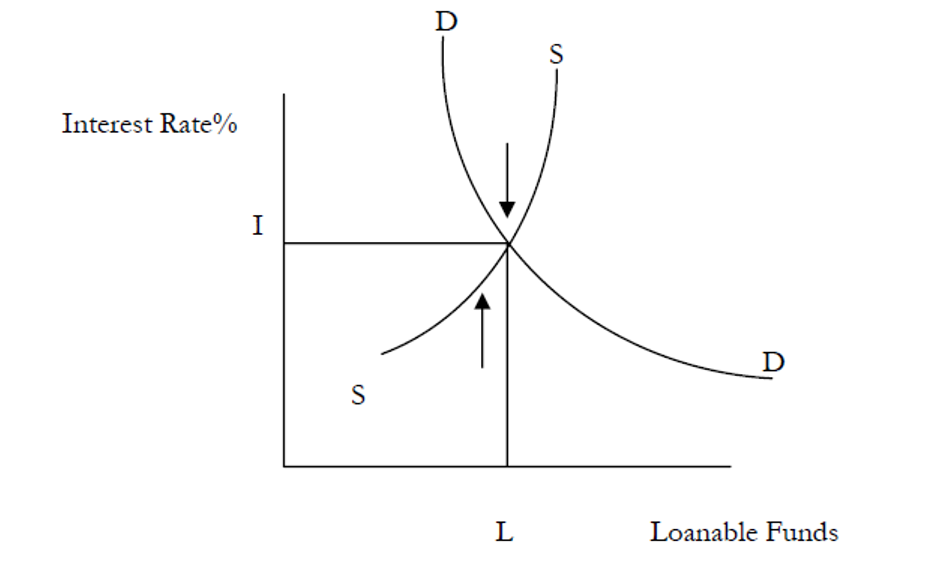

The market rate of interest is therefore determined where the demand for and supply of loanable funds are equal. Geometrically this corresponds to the point of intersection between the supply curve and the demand curve for loanable funds.

i is the equilibrium market rate of interest and L the equilibrium level of loanable funds. Above i, there is excess of supply over demand, and interest rates will be forced downwards.

Below i there is excess of demand over supply and interest rates will be forced upwards. Changes in demand or supply will cause shifts in the relevant curves and changes in the equilibrium rate of interest.

Although this theory has a certain amount of validity, it has been criticized on the following grounds:

- It assumes that money is borrowed entirely for the purchase of capital assets. This is not true because money can be borrowed for the purchase of consumer goods (e.g. cars or houses)

- It assumes that the decision to borrow and invest depends entirely on interest. This is not the case, for business expectations play more important role in the decision to invest.

Thus if business expectations are high, investors will borrow and invest, even if the rate of interest is high and if business expectations are low investors will not borrow and invest even if the rate of interest is low.

3. It assumes that the decision to save depends entirely on the rate of interest. This is not true for people can save for purposes other than earning interest, e.g. as precaution against expected future events like illness or in order to meet a certain target (this is called target savings) or simply out of habit.

- The Keynesian Theory

Also called the Monetary Theory of Interest, was put forward by the Lord John Maynard Keynes in 1936. In the theory, he stated that the rate of interest is determined by the supply of money and the desire to hold money. He thus viewed money as a liquid asset, interest being the payment for the loss of that liquidity.

Keynes formulated derived from three motives for holding money, namely:

Transactions; Precautionary; and Speculative.

Thus Keynes contended that an individual’s aggregate demand for money in any given period will be the result of a single decision that would be a composite of those three motives.

- Transactions demand for money

Keynes argued that holding money is a cost and the cost is equal to the interest rate foregone. People holding money as assets could also buy Government bonds to earn interest. But money’s most important function is as medium of exchange. Consumers need money to purchase goods and services and firms need money to purchase raw materials and hire factor services. People therefore hold money because income and expenditure do not perfectly synchronize in time. People receive income either on monthly, weekly, or yearly basis but spend daily, therefore money is needed to bridge the time interval between receipt of income and its disbursement over time.

The amount of money that consumers need for transactions will depend on their spending habits, time interval after which income is received and Income. Therefore holding habit and Interval Constant, the higher the income level the more the money you hold for transactions. Keynes thus concluded that transactions demand for money is Interest Inelastic.

Precautionary Demand for Money

Precautionary Demand for Money

Individuals and businessmen require money for unseen contingencies, Keynes hypothesized that individuals’ demand and institutional factors in society to be considered in the short run.

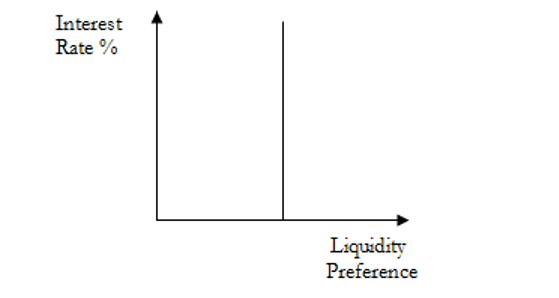

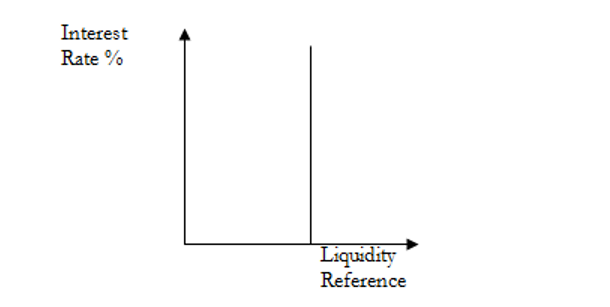

Money demanded for these two motives is called active balances, because it is demanded to be put to specific purposes. The demand for active balances is independent of the rate of interest. Hence the demand curve for active balances is perfectly inelastic.

Speculative Demand for Money

Speculative Demand for Money

Finally, money is demanded for speculative motives. This looks at money as a store of value i.e. money is held as an asset in preference to an income yielding asset such as government bond.

Keynes thus explained the Speculative motive in terms of the buying and selling of Government Securities or Treasury Bills on which the government pays a fixed rate of interest.

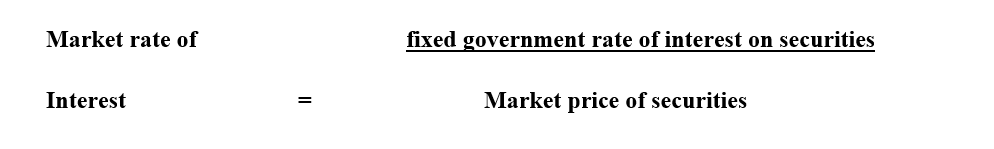

According to Keynes, securities can be bought and sold on the free market before the government redeems them, and the price at which they are sold does not have to be equal to their face value. It can be higher or lower than the face value depending on the level of demand for securities. He defined the market rate of interest as

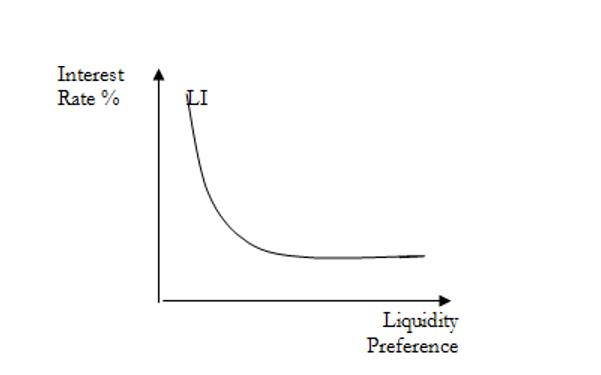

It follows therefore, that when the market price of securities is high the market interest rate will be low. Also if the market price of securities (high holders of securities) will sell them now and hold money. Hence the demand for money is high when the interest rate is low. On the other hand when the market price of securities is low, the market rate of interest will be high. Also if the market price of securities is low, it can be expected to rise. Hence people will buy securities at a low price, hoping to sell them at higher prices. In buying securities, people part with money. Hence the demand for money is low when interest rate is high. It follows, therefore, that the demand curve for money for the speculative motive slopes downwards as shown on the next page.

It flattens out at the lower end because there must be a minimum rate of interest payable to the people to persuade them to part with money. This perfectly elastic part is called LIQUIDITY TRAP.

Interest Rate Levels and Spread/pattern

This is the difference between lending and deposit rates. This spread is taken to reflect the profitability and efficiency of the intermediation process in the banking sector. However, before that is done, we provide some background information to the problem.

In Kenya interest rates were liberalized in July 1991. Financial repression theory predicts that after liberalization positive real interest rates should be realized as nominal interest rates increase from the government set low levels when price stability is achieved. The financial system also gains efficiency in the intermediation process such that the interest rate spread between the lending and deposit rate narrows. In Kenya, however, nominal interest rates increased minimally immediately after liberalization, and as inflation accelerated very high negative real rates were recorded.

Interest rate spread widened, indicating either inefficiency in the intermediation process with weak institutional infrastructure, and/or macroeconomic instability, and/or a non-competitive structure in the banking sector. Deposit rates remained at low and almost constant levels, while lending rates began moving upwards.

This may be explained by several factors:

Determinants of Interest Rate Spread

- Market structure of the banking sector,

- The policy environment,

- Interest rate levels, interest rate spread,

- Volatility of the interest rates.

These factors serve as indicators of the underlying processes acting in the financial sector.