This is a persistent and generalized increase in price levels making the consumers to have a low purchasing power. It is a process in which price levels are rising at a rapid rate and money is losing value. It is also defined as general level of prices in a basket of goods(consumed by every one e.g. sugar, milk, unga, kerosene etc).The problem of inflation is that it reduces the value of money. Inflation is measured using consumer price index. CPI.

Deflation on the other hand refers to a situation where there is a trend for general prices of goods and services to fall.

TYPES OF INFLATION.

- Creeping /mild/moderate inflation-prices rise at a rate of less than 10% per annum. This inflation is not harmful to economy and it is desirable to induce more investment thus promoting growth and it is of benefit to debtors-ie they buy goods at current price and pay for them in future at the same old price and not the high price commodity would be selling at that time, and business people i.e entrepreneurs are encouraged in economic times when prices are high since they will supply more goods and profit margins will be high, and still they buy goods when prices are low and sell them later when prices have risen.

- Rapid inflation- This is inflation rate around 6%.It is harmful to the economy

- Galloping inflation-General price levels are increasing rapidly.it is in tens or hundreds.

- Run away/hyper inflation-Prices are extremely high .people usually lose confidence in money as a medium of exchange and store of value ie consumers use a lot of money to buy few goods and services. In such a situation consumers use a lot of money to buy few goods and services. This type of inflation would appear unlikely to happen. It however happened in Germany in 1923 and the country had to do away with its currency system to restore its monetary confidence.

- Stagflation-this is derived from stagnation and inflation ie it combines elements of stagnation and inflation in an economy.it is a condition of high inflation in a period of high unemployment/recession.it arises due to an increase in production costs e.g. wages causing firms to reduce employment of labour and other resources which in turn lower production reducing goods supply in economy.

THE MEASUREMENT OF INFLATION.

1.Consumer price index-This is an index number of the prices of commodities.it measures the realative changes in the prices of a specified set of consumer goods which would be bought by the average house hold on a regular basis. the basket may consist of commodities e.g. food and beverages, housing, transportation, medical care and so on. The weights in the index are based on the survey by government of family expenditure to ensure that it relates to present day buying patterns. commodities representing a larger proportion of expenditure will be given more significant weights in the index.

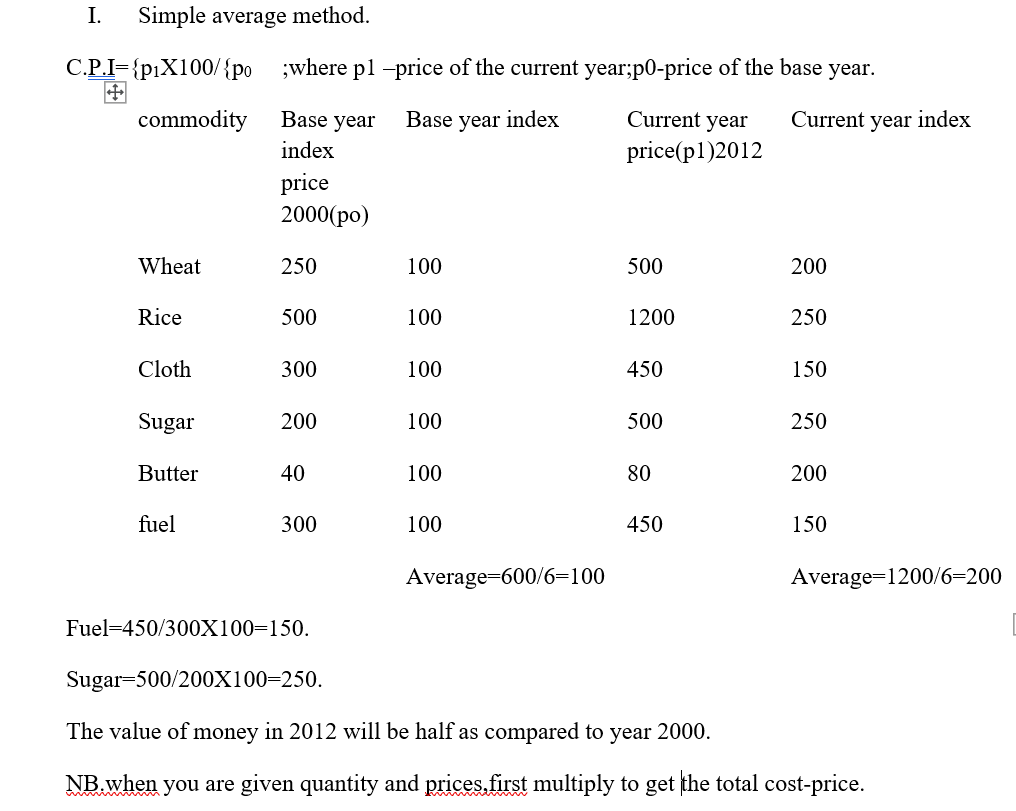

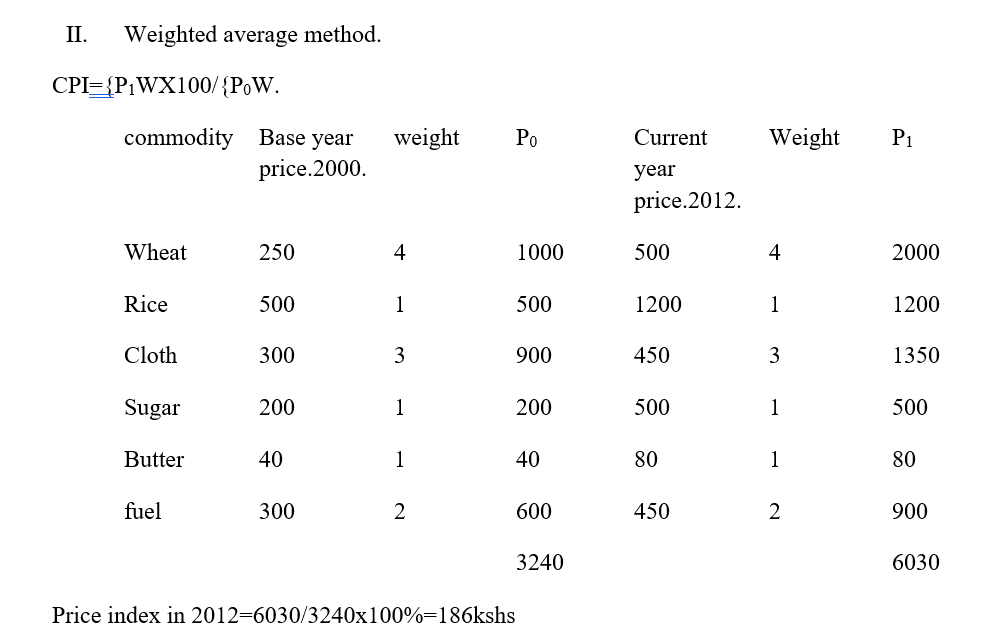

in Kenya inflation is considered by income groups and by categories of goods and services. the CPI is a fairly reliable measure of the cost of living. however since it is a fixed weight index it does not allow for substitution effects whereby consumers may for example select a substitute good whose price has experienced a relatively smaller increase. quality of goods changes such that a price increase may reflect improved quality rather than inflation. the CPI may sometimes overstate price increases. the CPI is measured using two methods;

This means that purchasing power in year 2012 is 186 kshs and in year 2000 it was 100 kshs.the value of money in year 2000 is 100ksh while in 2012 it is 188 kshs thus the value of money is worsening.

MEASURES OF INFLATION IN KENYA.

- Month-on-month inflation-this is inflation over a period of 12 months.

- Average –annual inflation-this refers to the average of the month-on month inflation over the last 12 months.

- Three months annualized inflation-this refers to month-on month inflation that would be generated if generation in last 3 months were to be maintained throughout the year.

- Underlying inflation-this refers to change in the general price level that includes changes in prices of food and any other once and for all price change.

CATEGORIZATION OF INFLATION.(BEHAVIOURAL ASPECTS).

The types of inflation forms a basis of categorizing inflation in an economy.

- Suppressed inflation-this inflation has been prevented from taking effect using deliberate measures taken by government e.g. price controls and it is not measurable

- Inertial/built-in inflation- this is a condition of rising prices at a steady rate over time.

- Balanced inflation-it has no effect on output, employment or income distribution because prices remain relatively the same even though high.

- Unbalanced inflation-it causes changes in the relative prices of commodities in economy.

- Anticipated inflation-people expect and are prepared for it.

- Unanticipated inflation-people did not expect it and hence were unprepared for it.

CAUSES OF INFLATION.

They are two main causes of inflation ie;

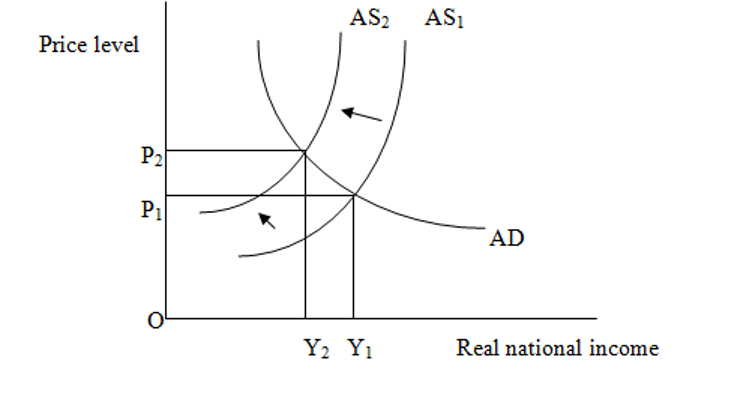

Cost push inflation-this refers to increase in cost of production of goods and services. This reduces supply ie higher costs reduces the aggregate supply. Diagramatically, x axis we have the income/output and y axis the price levels and the supply curve is contractionally.

Types of cost-push inflation.

- Wage push inflation-this results from an increase in labour costs/wages as a result of labour unions demanding higher wages without a corresponding increase in productivity. the business will reduce the amount of labour employed causing production to fall. the fall in supply causes prices to rise since demand has remained at the same level

- Profit push inflation-it develops when firms exercise their market influence to raise prices to higher levels than necessary and retain their profit margin.

- Supply-shock inflation-this arises as a result of impact of unforeseen disturbances called supply shocks. Ie extreme crop failure will cause prices of agricultural produce to rise rapidly because the buffer stocks may not be enough to take care of resulting shortage. if crude oil rises abruptly in international market, the impact is that there is an increase in the cost of production of firms that use oil as fuel.

CAUSES OF COST PUSH INFLATION.

- Rise in wages and salaries-this may increase the cost of labour ie brought about by pressure from workers and trade unions for better pay. the increased cost of labour may be reflected in the increased prices of commodities which in turn would cause inflation.

- Increase in taxes-increase in direct taxes e.g. VAT can increase costs of production and cause firm to raise their prices.

- Drive for higher profit margins-this increase in prices will increase the general price level in economy causing inflationary conditions.

- Unforeseen disturbances-they arise and the country can do little to stop them. when such things as the rapid increase in crude oil prices/crop failure occur prices in domestic economy rise, creating inflationary conditions.

- Increase in prices of inputs-this includes raw materials e.g. fuel, electricity and transport costs. this pushes costs of production up pushing up goods and services costs.

- Reduction in subsides-the producer will therefore meet part of cost which government was paying through subsidisation and this would be eventually be reflected in increase in price of commodity.

- Imported inflation-this results from trading with foreigners. the overall domestic price level is composed of average prices of domestically produced goods and domestic prices of imported goods. this arises due to rise in prices of foreign goods as well as well as dependence on imported goods.

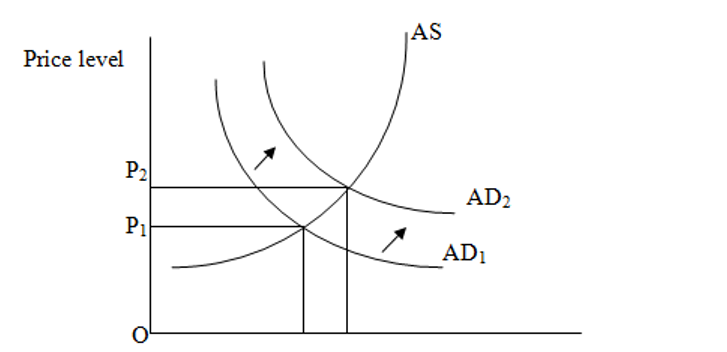

2. DEMAND PULL INFLATION.

This type of inflation comes about where there is excessive demand for goods and services in the economy causing a rise in prices. The rise in demand pulls prices upwards, hence the term “demand pull:. In this situation, there is: too much money chasing too few goods: diagramatically, x axis we have GDP and on y axis we have prices, and it is a contractionally one.

The following are some of the factors that cause demand pull

1. Increase in government expenditure

The government finances its activities from the revenue it collects mainly from taxes, levies and fines. In situation where the government is not able to raise enough money from its main sources, it can resort to borrowing from the central Bank or in the very extreme cases, it may print more money.When the government spends the money, it in effect makes more money available to people thus increasing aggregate demand, which in turn may lead to upward pressure on the prices of goods and services.ie current debt stands at 900 billion

2. Effects of credit creation by the commercial banks

Credit creation is the process through which banks lend out money to individuals and businesses. Through this process, commercial banks can lend out more money that the deposits they hold. This process increases the money supply, which in turn leads to an increase in consumers purchasing ability. The increased consumer’s ability to purchase more goods and services increases the aggregate demand which eventually leads to inflation.

3. Increase in money incomes

If money incomes increase due to reasons such an increase in export earnings, or increase in wage earnings, the people’s purchasing power will increase. This will have upward pressure on prices as demands for goods and services increase.

4. General shortages of goods and services

Shortages of commodities supplied may bring about demand pull inflation in that the demand would be higher than supply. The high demand hence pulls the prices of the commodities upwards. Shortages may be caused by factors such as, adverse climatic conditions, hoarding-introduce goodswhen prices are high, and smuggling-no taxes are paid, withdrawal of firms from the industry and decline in levels of technology.

- Increase in population

- Changesin tastes and preferences of consumerswich is positive.

- A fall in the level of savings.

- Expectations of price increases.

- Decreased taxation on personal salary

- Long gestation period.

- Inadequate infrastructural facilities-goods don’t reach market.

Effects of Inflation in an Economy

Inflation has a number of have on businesses, demand and consumer confidence. These effects can either be positive or negative as discussed below:

Positive effects of inflation

1. Benefit to debtors

Inflation may benefit debtors’ in that they end up paying less in real terms. This is because the debtors pay for the commodities in the future at the old low prices and not at the high prices which the commodity would be selling.

2. Benefit to the sellers

Sellers may benefit from inflation in that they buy commodities when prices are low and sell them later when prices are high thereby making more profits.

3. Motivation to work

Inflation may have some motivating effect to work as people try to cope with effects of inflation by working harder. As prices of commodities go up people may find that they are not able to buy the amount of commodities they were buying before the inflation set in. In an effort to maintain their standards of living, they may work harder in order to earn more.

Using the Philips curve concept it reduces unemployment at a considerable level.

Negative effects of Inflation

1. Reduction in profits

A rise in prices of commodities may lead to reduced sales volume for firms. This in turn may reduce the firm’s profits.

2. One uses more of time

Inflation can be wasteful in that individuals and firms may waste a lot of time shopping around for reasonable prices. The time so wasted can be an extra cost to the individual or firm. Similarly, firms may waster a lot of time adjusting their price list to reflect new prices.

3. Increases in wages and salaries

During inflation, firms are usually pressurized by employees and trade unions to raise employees’ wages and salaries to cope with inflation. A conflict may arise between the parties concerned, regarding the level of increase that is adequate and may result to strikes.

4. Decline in standards of living

During inflation, consumers’ purchasing power decreases. This is so especially for people who earn fixed incomes such as pensioners. The reduction in purchasing power brings about a decrease in standard of living.

5. Loss to creditors

Creditors lend out when the value of money is high. At the time of payment, the creditors receive less in real money terms. Since its value has been eroded by inflation.

6. Retardation of economic growth

Inflation may create a situation where business people are not willing to take risks, invest in new ventures, expand production or hire more workers. This would be more than the exports resulting into unfavorable balance of payment.

7. Adverse effects on the balance of payments

Inflation may have adverse effects on the balance of payments. If inflation is high in the domestic economy, exports become more expensive leading to a fall in their demand.

On the other hand, the imports from countries not experiencing inflation become relatively cheap thus increasing their demand. This implies that the imports would be more than the exports resulting into unfavorable balance of payment.

8. Loss of confidence in the monetary system

High levels of inflation may lead to loss of confidence in money both as a medium of exchange and a store of value. This may lead to a collapse of the monetary system.

- A rise in unemployment will engineer.

- Reduced savings and investments-more money is spent on purchasing items.

- Social and political instability prevails due to strikes and unbearable life to citizens.

- Widens the gap between the poor and the rich.

- Leads to unfair distribution of incomes

Controlling Inflation (Anti-inflationary measures)

Inflation is not desirable and for this reason the government may adopt policies meant to reduce or control it to a manageable level. The anti- inflationary policies are divided into three categories:

- Monetary policies

- Fiscal policies.

- Non- monetary policies

Monetary policies (Control of Money Supply)

In most cases inflation will occur when the amount of money in circulation is greater that the available goods and services. The government should ensure that increase in money supply is matched with increase in goods and services. Monetary policy influences the economy through changes in the money supply and available credit. The central bank uses the following monetary policy instruments to control money supply/ to remove inflation:

- Bank rate policy. During inflation, the bank rate is raised. In view of this commercial banks also increase the interest rates/lending rates thus discouraging borrowing hence a reduction in the amount of money in circulation.

- Open market operation. During inflation, the central bank sells government securities such as treasury bills and government bonds through open market operations (OMO). This reduces the excess money in circulation.

- Reserve requirements. During inflation, the central bank increases the reserve requirements. This reduces the amount of money at the disposal of commercial banks for lending purposes. This helps to control the amount of money in circulation

- Rationing of credit. All commercial banks get loans from the central bank up to aspecific limit. During inflation, this limit is reduced.

- Margin requirements. Margin requirement is the difference between the value of the security and the amount of the loan advanced against that security. During inflation, the margin requirement is raised.

- Consumers selective credit control. Here the central bank discourages the purchase of commodities on instalment basis to check inflation.

- Restricting terms of hire purchase agreement and credit sales in order to reduce demand for commodities sold. This can be done by:

- Increasing the rate of interest.

- Reducing the repayment period.

- Increasing the amount required as down payment.

Moral persuasions.

Selective credit control-the central bank here discourages offering credit to certain sectors that are likely to spur inflation and offer to those sectors that do not transmit inflation.

Fiscal policies.

Fiscal policy refers to the deliberate change in either government spending or taxes to stimulate or slow down the economy. It is the budgetary of the government relating to taxes, public expenditure, public borrowing and deficit financing. Fiscal policy is based on demand management i.e raising or lowering the level of aggregate demand by controlling government expenditure, consumption expenditure and investment expenditure. The main fiscal policy measures are:

- Public expenditure. During inflation the government reduces its expenditure leading to a reduction in the amount of money in circulation and a fall in prices.

- Changes in taxation. Changes in tax rates can help in the stabilization of the economy. For example, a decrease in tax rates increases disposable income in relation to national income. Hence consumption rises at every level of national income. With increase in aggregate demand for goods, employment increases. A rise in tax rates causes a decrease in disposable income, creates a larger budget deficit and reduces inflation. Also high inflation reduces individual’s purchasing power and a fall in prices.

- Changes in government expenditure. If inflation is at or above the level of full employment in the economy, the government can reduce prices by restricting its own unproductive expenditure.

- Public borrowing. Public borrowing reduces aggregate demand for goods hence reducing the price level. If the government borrows money from individuals and spends it on more productive purposes, the production of goods increases and prices tend to fall.

- Balanced budget changes. A balanced budget decrease has a mild contractionary effect on national income and hence bringing down the price level.

- Control of deficit financing. If the government resorts to deficit financing e.g bank borrowing and printing of notes to finance the budget deficit, money supply in the country increases and this pushes prices upwards. Deficit financing should be avoided.

Non-monetary measures

- Wage Adjustment. Wages must be raised at regular intervals to enable the individuals to maintain their purchasing power at the same level.

- Output Adjustment. The government must take steps to increase the production of goods, so that the rise in price level is checked.

- Price control. The government fixes prices or imposes direct controls on prices of essential/basic commodities.

- Rationing. Here the purchase of specific commodities is controlled. The individuals can purchase a specific quantity only during a specific period.

There other methodologies that can be used to control the level of inflation ie;

Control of the Level of demand

The solution to demand-pull inflation is to reduce the level of demand in the economy as whole. The government can achieve this by using the following two fiscal policies:

- Changing in taxation-An increase in tax such a income tax would reduce consumer demands for goods and services.

- Reducing government spending-Government spending is an injection into the economy. If it is restricted the amount of money in circulation would reduce thereby reducing demand to commodities.

Cost controls

Cost push inflation can be controlled by controlling the factors that contribute to rise in cost. These factors include:

- Increase in wages and salaries-To curb inflation brought by increase in wages and salaries the government may restrict such increase. Alternatively, if unions are believed to be pushing for excessive pay increase, then direct attempts can be made to curb their powers.

- Reducing taxes- taxes such as VAT are believed to be behind the cost-push inflation, the government cab reduce such taxes in order to control inflation.

- Restricting imports-Where inflation is caused by increase in prices of imports, the importing country can control the inflation by reducing the quantities of such imports. This can be done by looking for alternative sources of supply.

- Bureaucratic obstacles/complicated procedures.

DEFLATION

Deflation is a situation where there is a fall in the general level of prices and as a result thereof, the value of money increases. It is that state of the economy where the value of money is rising or prices are falling. Deflation, in fact is a situation where falling prices are accompanied by falling levels of employment, output and income.

Causes of deflation

- A fall in private investment

- A persistent unfavourable balance of payments

- Continued government budgetary surpluses

- A sudden increase in total output

- Action of the central bank to raise the interest rate.

- Action of the central bank by selling securities such as treasury bills and government bonds

Effect of deflation on different sections of the society

- Over production. When prices are falling, the producers buy materials and other inputs at higher prices and are forced to sell the products at lower prices. This results in over production of commodities.

- Traders lose. During deflation, the traders purchase their goods at higher prices and have to sell them later at lower prices due to the deflationary trend.

- Investing class. During deflation, the equity holders lose and debenture holders gain when prices fall.

- Fixed income groups. During deflation, the pensioners, wage earners gain as the wages and pensions do not decrease with the fall in prices.

- Consumers. When prices of commodities fall, the consumers whose income is fixed, gain.

- Creditors and debtors. During deflation, the creditors to gain and the debtors tend to lose.

- Tax payers. The tax payers lose during deflation as the value of money rises.

- Private sector units. The private sector units when the prices of their goods fall.

- Industrial unrest. During deflation, there are industrial disputes and unrests in the industrial sector.

- Pace of economic growth. During deflation, the pace of economic growth slows down. The reduction in output and increase in unemployment retards economic growth.