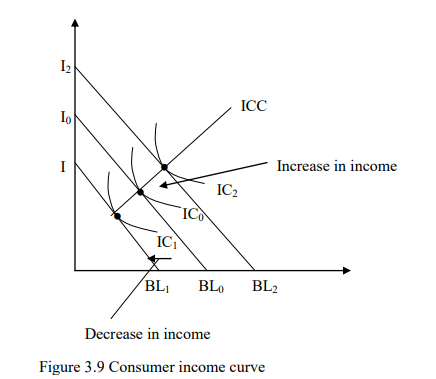

Increase in consumer income leads to an upward shift in the budget line such that it remains parallel to the original one and vice versa. Income consumption curve is a locus of points of consumer equilibrium resulting when only the consumer income is varied or

the consumer income change. It is also referred to as effects on an income change. The income consumption curve can be used to derive the Engel curve which illustrates the amount of a good a consumer will purchase per unit of time at various leave of income

holding the price constant.

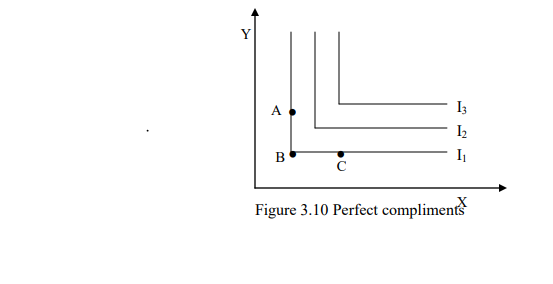

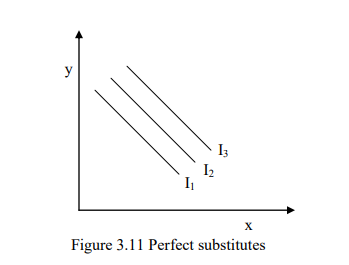

Illustration of indifferent curve for perfect substitute and perfect complimentary goods

The assumption that indifference curves are convex to the original implies that the goods are substitute but not perfect substances. In case goods are perfect substances the indifference curve is represented by a strait line with negative s lopes parallel to one another. For perfect substitutes goods the marginal rate of substitution is constant complimentary goods have indifference curves that are L shape if only they are perfect compliments as illustrated in Figures 3.10 and 3.11

Point A, B and C are o the same indifference curve yet at point C it involves the same amount of commodity Y but more of commodity X than at point B. This implies that the customer is saturated with commodity Y and therefore the MRS=0 for both X and Y. Similar case applies at point A involving same amount of X and more of commodity of Y indicating that the consumer is saturated with commodities X and therefore the Marginal Rate of Substitution (MRS) of X and Y =0

Application of Indifference Curves

1) It provides an explanation of the underlying reasons why change in price led to change in quality demand by distinguishing between substitution and income effects of price change.

2) It enables the derivation of normal and abnormal demand curve through price consumption curve

3) It is applied in labor economics to measure the trade off between income and leisure

4) It is used to examine the welfare affect of different Government Policy like taxes, subsidies for comparative welfare effects of direct and indirect taxes.

5) It enables assessment of the impact of change in the cost of living on welfare E.g.., the effect of change in money income and price of the welfare can be analyzed.