MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS 2013/2014 ACADEMIC YEAR

THIRD YEAR FIRST SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

DIPLOMA OF HUMAN RESOURCE MANAGEMENT

COURSE CODE: HRD 004

COURSE TITLE: FINANCIAL MANAGEMENT

DATE:23RD APRIL 2014 TIME: 9.00AM – 11.30AM

INSTRUCTIONS TO CANDIDATES

Question ONE is compulsory

Answer any other THREE questions

This paper consists of 5 printed pages. Please turn over.

QUESTION ONE.

Communications Company Ltd. has the following capital structure:-

The equity share of the company sells for 20/-. It is expected that the company will pay a current dividend of 2/- per share with a growth rate of 8% per annum. The corporation tax is 40%.

Required:-

a) Compute the weighted average cost of capital based on the existing capital structure.

(10mks)

b) The company raises an additional debt by issuing 10% debentures. 500,000/-. This would result in increasing the expected dividend to 3/-. The growth rate remaining unchanged, but the price of share will reduce to 15/-. Compute the new weighted average cost of capital. (15mks)

QUESTION TWO.

(a) (a) Explain three main functions of a finance controller in any established business organization. (3mks)

(b) Explain the following:

I. Bank overdraft (3mks)

II. Trade credit (3mks)

III. Leasing (3mks)

IV. Mortgage (3mks)

QUESTION THREE.

a) A large scale manufacturing industry is considering investing in a project that cost 500,000/-. The estimated salvage value is zero, tax rate is 20%.the company uses straight line depreciation and expected rate of discount and interest are 10%.

Proposed cash flow of the project is; 150,000/-, 50,000/-, 135,000/-, 165,000/-and 25,000/- respectively for the next five years.

Required:-

Determine the accounting rate of return of the project. (5mks)

b) Briefly discuss reasons why the following parties may be interested in the financial statements of an organization.

(a) The creditors

(b) The government

(c) The shareholders

(d) The employees

(e) The investors (10mks)

QUESTION FOUR.

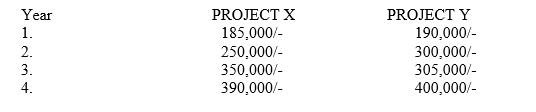

A large scale manufacturing industry is considering investing in Two Projects X and Y. The projects cost 500,000/- each. The company’s proposed cash inflows for the next four years were as follows:-

Required:-

i. Time- adjusted rate of return at 20%

ii. Benefit cost (BC) at 20%

iii. Net present value at 20% (15mks)

QUESTION FIVE.

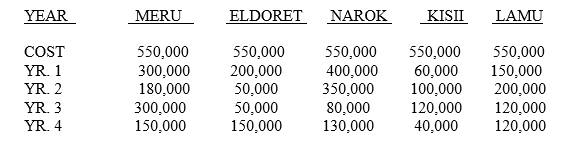

Naivas supermarket has four selling branches all over the country. Managers of each branch have filed the following reports for the last four years:

Required:

You have been appointed to advice the management on which branch is to be ranked the best and why? Explain your answer. (15mks)

QUESTION SIX.

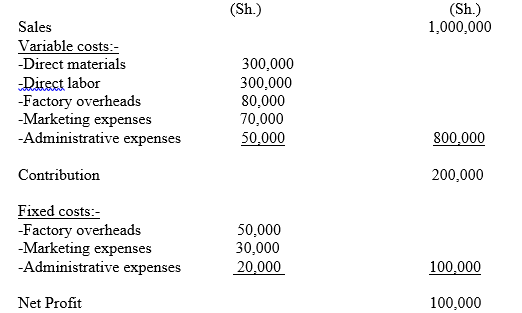

Mumias sugar company ltd has provided the following information for the year end 31st December 2013:

Required:-

a) Compute p/v ratio (3mks)

.

b) Break even point. (3mks)

c) Assuming the proposal has been made to increase fixed cost by 10,000/- sales and variable cost remaining unchanged. Compute the new break even point

(3mks)