TUESDAY: 26 November 2019. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Define the term “cash book”. (2 marks)

2. Explain the use of the following source documents:

Debit note. (2 marks)

Local purchase order. (2 marks)

3. Distinguish between “single entry system” and “double entry system” as used in accounting. (4 marks)

4. Describe how the following errors might be corrected:

Single entry error. (2 marks)

Complete reversal of entry. (2 marks)

5. Highlight six users of accounting information. (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Ann Wakesho runs a small business. On 1 September 2019, Anne had petty cash of Sh.16,400. She withdrew Sh.33,600 from her bank account to cater for the week’s expenses. The following were her expenses for the week:

September 2019:

Sh.

1 Bus fare 300

2 Postage stamps 4,250

2 ‘Tea for customers 1,100

3 Cartridge 2,150

4 Purchase of pens and printing paper 500

4 Telephone airtime 3,800

4 Refreshments 2,600

5 Repair of office furniture 5,000

5 Taxi charges 4,350

6 Post cards 4,500

7 Tea for customers 1,000

8 Telephone airtime 3,700

Required:

A petty cash book with analytical columns for transport, postage and telephone, refreshments, office stationery and sundry expenses. (11 marks)

2. The following balances were extracted from the records of Tony Mwema as at 30 September 2019:

Sh.

Cash in hand 60,000

Cash at bank 550,000

Trade receivables 400,000

Trade payables 500,000

Inventory (1 October 2018) 1,050,000

Sales returns 25,000

Sales 2,800,000

Purchases 1,025,000

Capital 745,000

Salaries 200,000

Water and electricity 30,000

Administrative expenses 10,000

Drawings 45,000

Rent and rates 85,000

Inventory (30 September 2019) 675,000

Furniture and fittings 375,000

Motor vehicle 1,750,000

Bank loan 1,500,000

Rent received 60,000

Required:

Trial balance as at 30 September 2019. (9 marks)

(Total: 20 marks)

QUESTION THREE

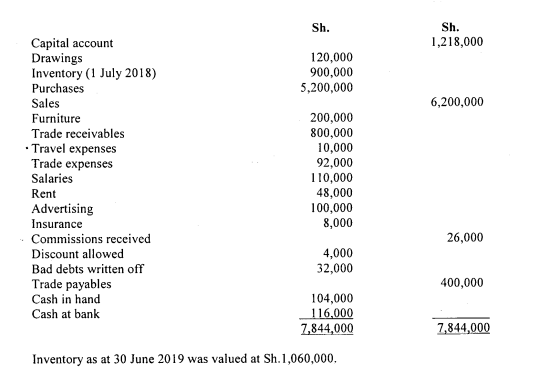

The following is the trial balance for Maji Mazuri Traders as at 30 June 2019:

Required:

1. Income statement for the year ended 30 June 2019. (12 marks)

2. Statement of financial position as at 30 June 2019. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. Highlight five benefits that could be derived from using computer assisted audit techniques (CAATs). (5 marks)

2. Outline five techniques that an auditor could use to gather audit evidence. (5 marks)

3. Explain five key stages of an audit. (10 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain five reasons why it is necessary for a limited liability company to be audited. (10 marks)

2. Discuss five purposes of an internal control system. (10 marks)

(Total: 20 marks)